Published on November 26, 2024 by Nitant Kumar Arora and Mukesh Kumar Sharma

Environmental, social and governance (ESG) concerns have become paramount in all corporate actions, gaining in significance among investors, governments, customers and employees. Implementing effective measures to ensure sustainability can result in an influx of investment, boost expansion and improve business.

However, transparency, data recording and sharing, and pursuing sustainability across supply chains remain challenging for organisations seeking responsible growth and value-based investments. Entities must also search for a platform that is less energy-consuming. Blockchain in ESG meets all these criteria.

In 2020, the European Commission researched instances of greenwashing; it found that 42% of green claims were exaggerated, false or deceptive. A poll by Google Cloud in 2022 showed that 58% of C-level executives and VPs surveyed believed their companies had engaged in greenwashing; the number increased to 72% of respondents from North America. At an investment level, 85% of the asset managers say ESG is a high priority for their companies, but almost two-thirds (64%) are concerned about a lack of transparency and corporate disclosure around ESG activities. Blockchain would address these opaque areas. Integrating with blockchain is the way forward for removing scepticism around ESG and making it more transparent.

Blockchain technology is revolutionising the landscape of ESG practices by integrating measurement, reporting and verification with ESG. Measurement is critical for aggregating data, reporting is critical for meeting compliance requirements and verification is important for data integrity. Its inherent transparency and traceability are transforming ESG reporting by automating the reporting of exhaustive and disparate data points such as carbon emissions and credits, tracing products and labour conditions along the supply chain. These metrics can also be benchmarked and compared with the goals set by both the company and the regulator.

Blockchain’s unshakeable nature, facilitated by distributed ledgers, is solidifying trust among stakeholders concerned about ESG commitments. Conventional ESG reports have struggled with trust-related challenges in terms of data, a gap that blockchain bridges. When data is set into the blockchain, it stays the same, assuring stakeholders of its authenticity.

How blockchain transforms ESG

-

Transparent data recording:

Blockchain records ESG activities more precisely, making sure that data collection is not interfered with. Entities can monitor carbon emissions instantaneously and ensure they follow sustainable sourcing practices along the supply chain. By demystifying the process, this ledger enhances trust among investors, consumers and regulators.

-

Supply-chain traceability:

The decentralised nature of blockchain enables real-time tracking of materials, ensuring ethical sourcing. For example, fashion companies can verify that their raw materials are sustainably sourced, addressing both environmental and social concerns.

-

Automated ESG reporting:

Blockchain’s ability to automate data collection streamlines ESG compliance, reducing human intervention and, thus, error and fraud. By ensuring that ESG reports are accurate and auditable, blockchain strengthens governance and risk management efforts.

-

Green finance and carbon credits:

Blockchain technology provides a secure atmosphere for trading carbon credits and green bonds. Being a transparent platform, blockchain ensures that these instruments are used for the environment-related cause they are intended for.

-

Trading:

One of blockchain’s strongest points is its ability to provide a more effectual and efficacious settlement platform, as the nodes and validators certify the transaction and all the members in the network have the same record, reducing the need for reconciliation. Blockchain could in future be the technology supporting the trade of sustainable financial products such as green bonds and renewable energy credits, including renewable energy certificates (RECs). Furthermore, the tokenisation of real-world assets such as carbon credits could promote more methodical trading by shrinking the investment ticket size via fractionalisation, bringing price discovery and liquidity to the market and conducting almost-real-time settlement. The technology could also enable businesses and individuals to actively promote growth of renewable energy and sustainable production.

Potential of blockchain in ESG

Blockchain is already making strides in industries such as energy, finance and fashion, offering verifiable carbon tracking and transparent supply chains. As the technology matures, the link between blockchain and ESG goals would deepen, offering new opportunities for businesses to enhance sustainability efforts.

Striking an equilibrium between economic development, sustainability and ethical governance is the best way to generate profit. At a macroeconomic level, putting the United Nations’ Sustainable Development Goals at the centre of the world’s economic strategy is estimated to result in annual opportunities worth USD12tn by 2030 and to create 380m jobs.

Outstanding implementations of blockchain technology are already coming to light, including application by the World Bank, which uses a blockchain-based system named Chia to report reduction in emissions from projects and trading of carbon offsets.

Start-ups are also navigating new avenues to synchronise their strategies with ESG principles; in this transition, too, blockchain technology is emerging as a front runner. Moreover, innovative funding mechanisms such as initial coin offerings and security token offerings, combined with ESG considerations, are reshaping sustainable start-up financing. Blockchain, as a decentralised digital ledger technology, provides a range of benefits that can significantly improve ESG investing.

Market outlook

ESG assets under management (AuM) are on track to grow beyond USD40tn by 2030 (based on Bloomberg’s scenario analysis) and will account for 25% of the USD140tn of projected AuM across the globe.

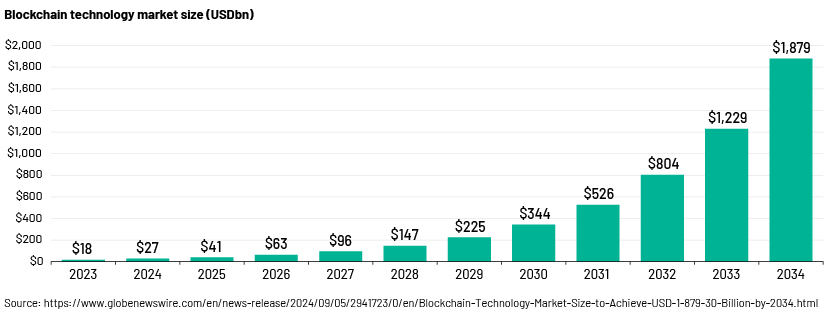

Blockchain is also set to grow from a market size of USD17.6bn in 2023 to USD26.9bn in 2024 and USD1,879.3bn by 2034.

Conclusion

With investment increasing in all areas of corporate responsibility, understanding how blockchain could revolutionise ESG reporting would become crucial. Future-oriented companies are already integrating blockchain in ESG reporting and addressing benchmarks – from tracking carbon footprints transparently to tokenising carbon credits – for streamlined trading.

How Acuity Knowledge Partners can help

Our Business Information Services (BIS) team helps with data mining and creating the data infrastructure needed for decision-making. We also help with managing blockchain-verified ESG data, offering real-time insights on regulatory requirements to support strategic decisions and ESG compliance. Our assistance extends to investor reporting, by packaging and organising data into clear and insightful reports, and improving governance risk management by tracking board decisions and internal policies over blockchain and maintaining a database of dynamic conventions governing industries. This eases and expedites access to a complete unified database that contains all the information relating to a specific industry. Click here for more details on our data engineering, data science, and AI services

Sources:

-

https://www.beaconvc.fund/knowledge/empowering-esg-with-blockchain-technology

-

https://londonpolitica.com/esg-watch-blog-list/blockchain-impact-investing

-

https://londonpolitica.com/esg-watch-blog-list/blockchain-start-ups

-

https://www.astrakode.tech/blockchain/how-blockchain-is-shaping-the-future-of-esg/

-

https://activate.fujitsu/ESG-reporting-to-accelerate-sustainability-transformation.pdf

-

https://www.linkedin.com/pulse/blockchain-esg-comprehensive-guide-data-integrity-modern-majid-salehi

-

https://medium.com/@ronaldforlee/transforming-sustainability-reporting-how-blockchain-is-elevating

-

https://www.beaconvc.fund/knowledge/empowering-esg-with-blockchain-technology

-

https://www.beaconvc.fund/knowledge/empowering-esg-with-blockchain-technology

-

https://londonpolitica.com/esg-watch-blog-list/blockchain-start-ups

-

https://www.linkedin.com/pulse/esg-investing-blockchain-technology-powerful-finance-ferreira

-

https://www.precedenceresearch.com/blockchain-technology-market

What's your view?

About the Authors

Nitant has over ten years of extensive work experience in the Investment Banking Division. He previously worked with EvalueServe. Currently he is a Delivery Lead, attached to the Financial Institutions Group (FIG) for a leading client based out of USA. He is responsible for carrying out company analysis, valuation analysis, industry analysis, and benchmarking. Nitant holds Executive MBA from ITM Ghaziabad and has completed his B.Com from University of Delhi.

Mukesh is an Associate Director within Business Information Services division at Acuity Knowledge Partners, and has over 19 years of experience in business, and secondary research and analysis. He specializes in managing complex BIS processes, ensuring seamless operations and strategic alignment. His responsibilities include overseeing stakeholder management, quality assurance, resource allocation, driving process improvements, risk mitigation and efficient workflow, as well as coaching and mentoring team members to foster a high-performance culture and resolving complex issues through effective negotiation and conflict resolution. He holds an MBA from Vinayaka Mission University and a B.Com from Andhra University.

Like the way we think?

Next time we post something new, we'll send it to your inbox