Published on June 1, 2021 by Praveen Fernando

With the urgency to mitigate climate change, private institutions have shifted their financing decisions towards green lending because they are cheaper and serve a global cause. Funds directed to “green” or sustainable investments have reached USD31tn and are expected to reach USD53tn by 2030, according to reports by the Global Sustainable Investment Alliance and the International Finance Corporation. However, even though regulators face difficulty in quantifying climate risk in banks’ risk-weighted assets (RWAs), banks tend to add more green lending services to their loan portfolios to reduce their non-performing loan (NPL) ratios. This recent growth in green lending has increased the risk of “greenwashing”. In finance, greenwashing (also called green sheen) means the use of low-cost green funds for projects with minimal or no green benefits. From a lender’s perspective, greenwashing tarnishes both the integrity of a loan product and investor confidence, leading to reputational damage.

What triggered the alarm on greenwashing?

Actions and initiatives to mitigate climate change triggered the alarm on greenwashing. These include the Green Finance Study Group (GFSG) and the G20 Sustainable Finance Study Group (SFSG) encouraging green investment through green financing, and EU member states’ target of achieving net zero emissions by 2050 through the European Green Deal. Problems were likely to arise with this new “trend”, and greenwashing is one of them. In addition, policy changes by administrations such as the Trump administration that relaxed environment and climate change regulations created loopholes for greenwashing.

The lack of visibility on bank commitments to climate change and incidence of controversial green bond issuance also raised concerns over greenwashing. NGOs criticise banks’ sustainability commitments because they are unsure whether banks have set targets to reduce their exposure to fossil fuels. JP Morgan Chase and Morgan Stanley (alleged, by certain NGOs, to be the biggest financiers of fossil fuels) were criticised for minimal breakdown targets and their lack of commitment to phasing out funding for fossil fuels. HSBC’s commitment to reducing financed emissions to net zero by 2050 became controversial due to its financing commitments with East Asian mining companies.

According to the Green Bond Principles, green bonds are issued to finance new and existing projects with environmental benefits. However, some issuances have breached the core concept. The EUR2.5bn GDF Suez bond issuance financed the Jirau Dam in Brazil. Subsequent flooding submerged 362km2 of rainforest and had an adverse impact on indigenous communities, destroying habitat and violating labour rights. Part of the proceeds of the maiden green bond issuance by Export-Import Bank of India (Exim) was used to construct the Khulna-Mongla railway line, which will transport coal to the proposed 1,320MW Rampal Power Station in Bangladesh, located near Sundarbans, the world’s largest mangrove forest.

The solution: Defined frameworks and expert third-party involvement

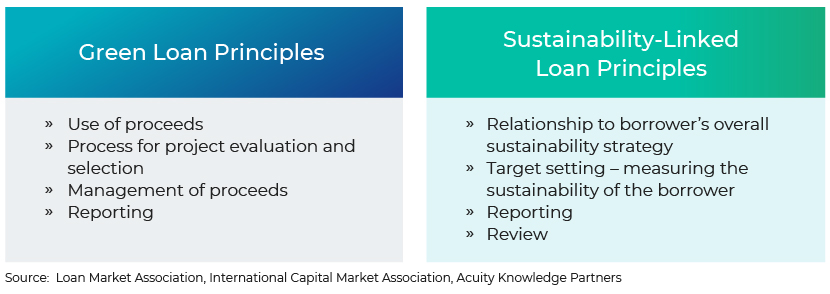

Voluntarily adopting the frameworks of the Green Loan Principles (2018) and Sustainability-Linked Loan Principles (2019) safeguards investments from greenwashing. The key distinction between the frameworks is the criterion of use of proceeds – the Green Loan Principles specify that they must be used for a particular purpose. We list the key components of the frameworks below.

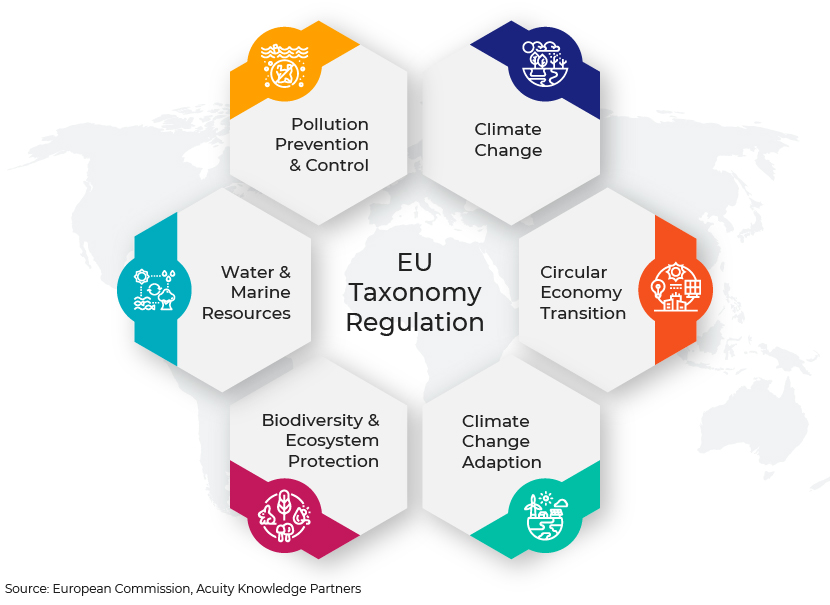

Since these frameworks apply on a voluntary basis, the EU introduced the EU Taxonomy Regulation on 22 June 2020. The EU Taxonomy, a key enabler of the EU’s Green Deal, is expected to scale up investments in environmentally sustainable economic activities by providing appropriate definitions to companies, investors, and policymakers. Even though the Taxonomy Regulation provides transparency and confidence to financial institutions, a lack of standardised and comparable data has become a challenge for the banking sector. However, the EU Taxonomy may create a sense of security for investors, enabling a smooth transition while mitigating market fragmentation. Most importantly, the Taxonomy Regulation protects private investors from greenwashing. The EU Taxonomy consists of six environmental objectives.

External frameworks and toolkits are also needed to give credibility to banks’ claims of abiding by the Paris Agreement. The Science-Based Targets initiative (SBTi) framework (which BNP Paribas uses to set environmental KPIs) and 2° Investing Initiative’s (2DII’s) Paris Agreement Capital Transition Assessment (PACTA) toolkit for banks (which ING utilised to develop the “Terra” approach to analyse the climate impact of its loan portfolio) allowed banks to set science-based targets and align their portfolios with climate-change goals.

The risk of greenwashing could also be minimised through the participation of expert third-party verifiers and by incorporating definitive provisions in documentation. Lenders could request borrowers to provide Green Project Certifications from approved verifiers (such as AECLU, BAM, BlockC, CCA, and LEED) as conditions precedent (CP) to the facility and regular renewal of certifications. Enhancing credibility through third-party verification ensures the financed green-cash will be allocated to projects with environmental value, and helps regulators during the approval process. Loan agreements could also be included with provisions and representations on the environmental benefits associated with the project as condition-subsequent (CS) covenants on the criterion vis-à-vis environmental protection – information covenants (environmental KPI disclosures, sustainability reports, compliance certificates from verifiers), disclosures on the actual benefits and hazards faced with the project, and penalties for any misrepresentation or misleading claim made by the entity.

How Acuity Knowledge Partners can help

Our experienced ESG experts assist financial institutions to align themselves with climate change, Sustainable Development Goals, and environmental, social, and governance (ESG) guidelines. Our expert services in the banking space – including analytics, scoring, rating, benchmarking, and covenant-monitoring support – help mitigate potential exposure to credit/reputational risks to lenders.

Sources:

https://www.lma.eu.com/application/files/9115/4452/5458/741_LM_Green_Loan_Principles_Booklet_V8.pdf

https://www.climate2020.org.uk/green-green-bonds/

https://www.ft.com/content/1bcbad16-f69e-47db-82fa-0419d674bb53

What's your view?

About the Author

Praveen is an Associate attached to the Commercial Lending division at Acuity Knowledge Partners. He is currently part of the Diversified Lending team undertaking covenant monitoring and validation, financial spreading and performing risk raters for a leading European based bank. Prior to joining Acuity Knowledge Partners, he was a graduate trainee attached to the Finance division of a local conglomerate. Praveen is a passed finalist of the Chartered Institute of Management Accountants (UK). He also holds a BSc. in Finance (Special) from University of Sri Jayewardenepura.

Like the way we think?

Next time we post something new, we'll send it to your inbox