Published on August 7, 2025 by Bikram Swar and Ashutosh Sarda

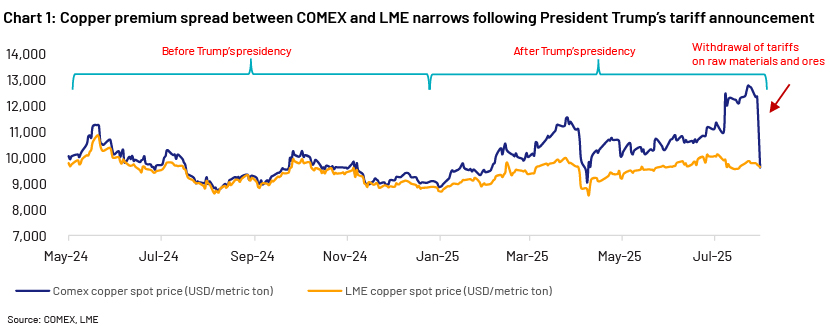

On 8 July 2025, the copper price on the COMEX surged 13.3% to USD5.65 per pound (USD12,445 per metric ton), up c.40% year to date, following President Trump’s tariff proposal for the sector as a whole. The move was implemented faster than expected, and the rate was double market expectations.

However, on 30 July 2025, President Trump narrowed the scope of the tariffs to copper pipes and wiring, leaving out raw materials such as ores, concentrates and cathodes. This unwound the COMEX premium over the London benchmark, the London Metal Exchange (LME), sending the price plummeting c.22% and bringing it to parity with the LME.

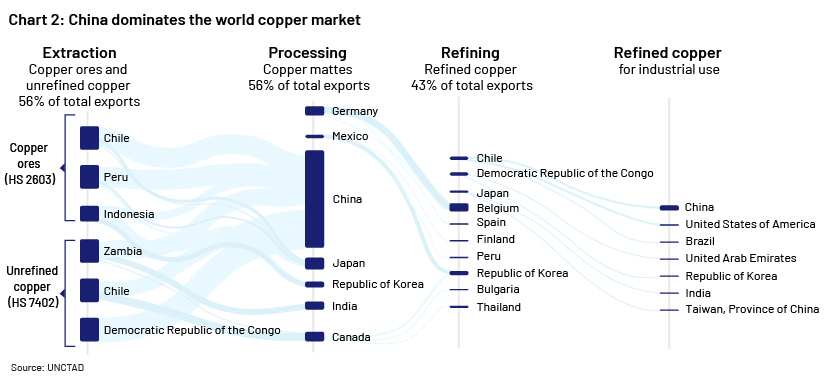

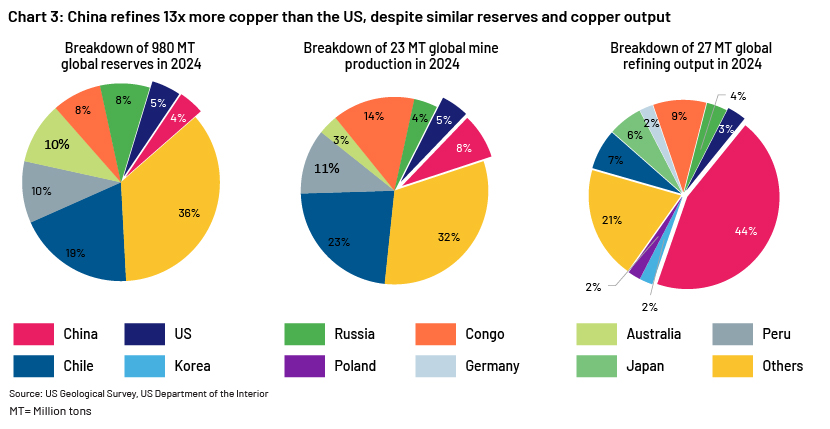

Policy decisions on US copper imports have a far-reaching impact, as almost half of the country’s annual consumption is imported; it has experienced a notable decline in its copper refining output – to 0.9MT in 2024 from 1.7MT in 2002.

-

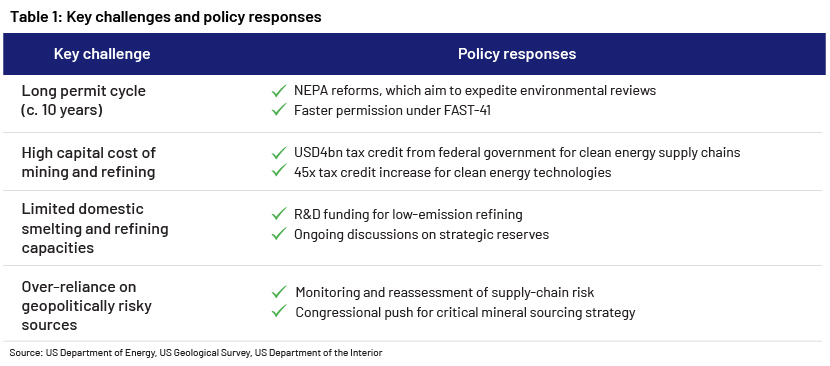

To boost domestic production, the government is rolling out reforms to grow refining and mining capacities. However, these would take five to seven years to be commissioned.

Copper price surge in the US and the impact of revised tariffs

The US copper market has witnessed significant policy-driven uncertainty over the past seven months, as illustrated in the chart below. To start with, after Trump assumed presidency, the market anticipated tariffs on copper, but the scale, timing and details were still unclear. On 8 July 2025, the US government announced a 50% tariff on copper imports, double the rate expected, for implementation on 1 August (vs market expectations of late November). This triggered a sharp reaction from the COMEX market, sending the price to a record premium (c.25%) over the LME. However, one day prior to actual implementation, there was another policy decision to narrow the scope of tariffs – only to semi-finished copper products such as pipes, wires, rods, sheets and tubes, and to copper-intensive goods such as pipe fittings, cables, connectors and electrical components, leaving out key raw materials such as ores, concentrates and cathodes. The price on the COMEX fell c.22% on the day, wiping out the entire premium.

In the weeks leading up to the decision, the prospect of sweeping tariffs had prompted a wave of emergency buying, pushing COMEX prices higher as importers rushed to secure supplies. The initial announcement was seen as a signal of strong protectionist intent – part of a broader strategy to strengthen domestic industry under the banner of national security and economic resilience. This rally was reinforced by robust demand from electric vehicles, datacentres and renewable energy projects.

US copper crunch – slow permit process and refining shortfall

Despite being home to 47m tons of copper reserves, the US faces a structural copper scarcity, as greenfield investments have been limited in recent years due to a lengthy and slow licensing process. The country takes 29 years to develop a mine – second only to Zambia (34 years) – while Chile and Congo take c.22 and 15 years, respectively.

In addition, the US’s refining capacity has shrunk over the past 25 years, with the number of refineries contracting to five from nine in 2000, reducing refining output by c.50% to 0.9m tons. Consequently, the US imports c.50% of its annual copper demand (up from c.38% in 2000), primarily from Chile (c.70% of total imports), Canada and Peru, making the country vulnerable to global supply-chain disruptions. Even in recycling, less than half of the copper is processed domestically while the rest is exported, due to capacity constraints.

Key policy changes

To address these challenges and boost domestic copper supply, the US has initiated multiple steps to rebuild the domestic copper supply chain. In March 2025, it passed an executive order – Immediate Measures to Increase American Mineral Production. This includes key provisions such as fast-tracking permits for mining, refining and smelting projects, identifying and prioritising copper-related projects for immediate approval and reducing regulatory delays under the National Environmental Policy Act (NEPA) and other federal frameworks. In addition, it offers tax incentives and is making a legislative push to classify copper as a critical mineral (which would unlock federal funding and loan guarantees for copper projects) to prop up domestic production.

Conclusion

Players in the copper market are exposed to significant risks, as frequent policy changes have brought heightened market volatility. The policy changes over the past three months have been sudden, leading to large swings in prices; this risk remains in the near to medium term, as other segments have experienced sudden policy changes as well. At the structural level, the US copper supply chain stands at a critical crossroads as it grapples with material reliance on imports and underdeveloped domestic mining and refining infrastructure. While the government’s policy response is ambitious and directionally sound, the execution time frame of five to seven years means that short-term disruptions are inevitable.

The revised 50% tariff, limited to copper pipes and wiring, is reshaping the industrial landscape more selectively. It offers a minimal advantage to domestic miners, as raw materials such as ores and cathodes remain untaxed. Instead, the policy favours scrap processors and vertically integrated manufacturers who can bypass imported semi-finished goods, gaining a cost advantage. Manufacturers relying on imported semi-finished goods now face higher costs, potentially disrupting production planning.

How Acuity Knowledge Partners can help

Through our sector specialists, we provide thematic research on industry trends and policy changes to equip asset managers, hedge funds and other financial institutions to assess how industry trends and policy changes affect credit quality of issuers. Furthermore, by leveraging cutting-edge technology, we accelerate delivery and provide insights that drive informed decision-making. For instance, using a bottom-up approach, our in-house experts help clients identify winners in global trade and tariff shifts. This ensures our clients stay ahead of the curve while navigating complexities and capitalising on emerging opportunities.

Sources

COMEX (the commodity exchange)

LME

UN Conference on Trade and Development (UNCTAD)

US Department of Energy

US Department of the Interior

US Geological Survey

https://unctad.org/publication/global-trade-update-may-2025-critical-minerals-copper

https://downloads.regulations.gov/BIS-2025-0010-0083/attachment_2.pdf

https://govfacts.org/federal/commerce/why-are-there-tariffs-on-copper/

-

Copper PRICE Today | Copper Spot Price Chart | Live Price of Copper per Ounce | Markets Insider

What's your view?

About the Authors

Bikram has close to 8 years of experience in valuations, equity research, and credit research, with a focus on the auto and oil & gas sectors. He currently works with a US-based hedge fund, where he handles credit research on high-yield and investment-grade securities across different strategies. He is also responsible for reviewing deliverables to ensure quality. Bikram is a Chartered Accountant and a Company Secretary.

Ashutosh has 4 years of experience in investment and credit research, specialising in the chemicals and oil & gas sectors. He works with a US-based hedge fund, conducting credit analysis on high-yield and investment-grade securities across multiple industries. Ashutosh is a Chartered Accountant.

Like the way we think?

Next time we post something new, we'll send it to your inbox