Published on February 25, 2025 by Priya Vaidyanathan and Nuwan Jayawardana CFA

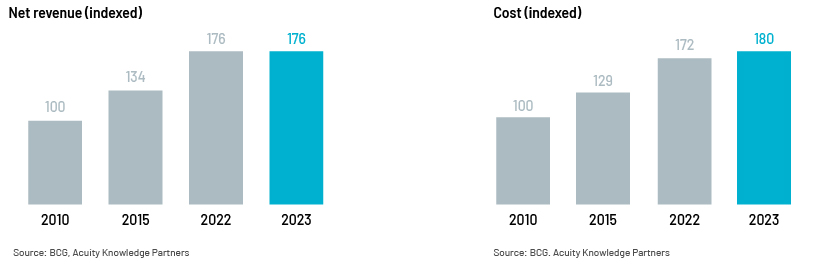

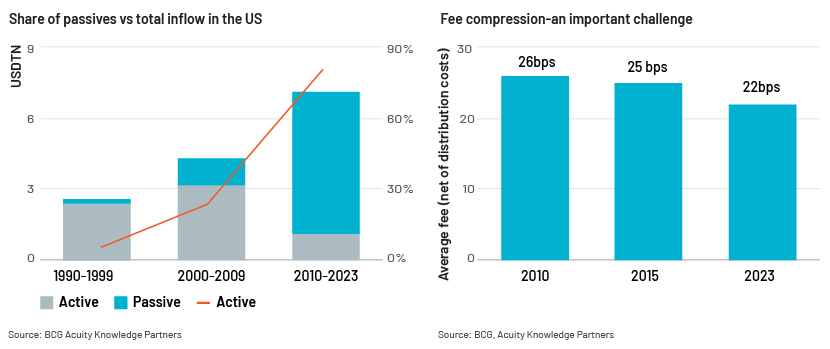

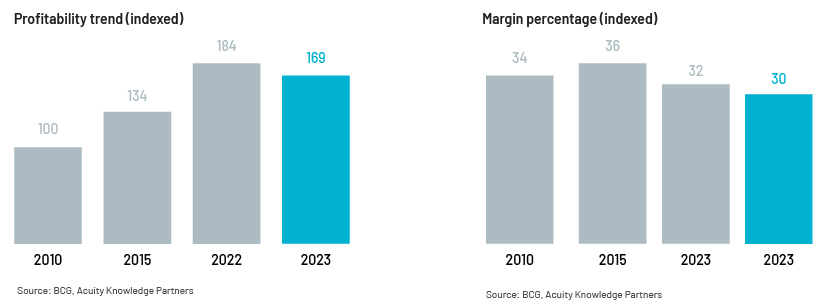

The sector saw a strong rebound in assets under management (AuM) in 2023, growing 12% y/y to USD118tn, after a 9% decline in 2022. However, this did not lead to proportionate revenue growth – while revenue increased just 0.2%, costs grew 4.3% in 2023. This growing disparity underscores the persistent pressures faced by asset managers, exacerbated by high market volatility, uncertain macroeconomic conditions and geopolitical challenges. Investors’ shift towards lower-cost products has further hurt traditional asset managers’ margins.

The asset management sector’s revenue plateaued y/y while costs escalated in 2023.

We detail the key structural challenges we foresee in 2025 below:

Structural challenge #1 - Fee Compression Moving to Passive Investing: Reshaping the Industry

The structural shift towards lower-fee passive funds, which track indices, as opposed to active investing has reshaped the asset management sector, adding to the asset management challenges faced by traditional firm. Active investing has had its own challenges in beating returns from market indices, due to higher expenses on research and portfolio management. Plagued by lack lustre performance and elevated fees, actively managed investments have seen a dip in inflows. Moreover, given investors’ increasing propensity for low cost, stable performance and long-term stability through passive investment sources, active asset managers have been pressured to justify their higher fees and show value. US passive funds represented 84% of total net flow during the decade ended 2023 vs 26% in the previous decade, according to BCG’s latest report on the asset management sector.

While investors continue to favour passive strategies, institutional investors are increasingly focused on actively managed ETFs, for better returns, product diversification and flexibility at relatively lower costs. We expect this trend to persist into 2025, translating into continued fee decline, consolidation among asset managers and a continued focus on cost efficiency. To remain competitive, active managers need to strive for product differentiation, personalisation and enhanced client services to make relationships stickier.

Structural challenge #2 – Growing cost of compliance amid increasing regulatory pressures

The global asset management sector is exposed to growing regulatory pressure, compelling firms to adapt rapidly. Regulators across the globe are increasing scrutiny on greenwashing, which in turn increases regulatory overview and reporting requirements for asset managers. The Securities and Exchange Commission (SEC) regulations in the US, aimed at protecting investor interests, call for higher scrutiny, transparency and compliance.

In Europe, the Markets in Financial Instruments Directive (MiFID II), Sustainable Finance Disclosure Regulation (SFDR), Packaged Retail and Insurance-based Investment Products (PRIIPs) and Key Investor Information Documents (KIIDs) mandate increased transparency and reporting, driving up the cost of compliance. In addition, the recently introduced Alternative Investment Fund Managers Directive II (AIFMD II) focuses on the regulatory framework for managing alternative investments within the EU. In Asia, the Hong Kong Securities and Futures Commission (SFC) has implemented tighter regulations for fund products.

While regulatory pressure is bound to increase, asset managers are expected to keep systems ready and even embed new requirements to avoid regulatory risks and penalties for non-compliance. In the coming years, we expect heavy investment in hiring, upgrading technology/infrastructure and adopting AI in the areas of monitoring, data management and risk. We expect asset managers to increasingly use KPOs to provide specialised skillsets for oversight and review in a cost-effective manner.

Key investment areas in the compliance space include the following:

Technology and partnerships to enhance data management and reporting

-

Infrastructure upgrade and employee upskilling to meet changing regulatory requirements

-

Assessment of impact of future regulations and steps to ensure compliance

-

Outsourcing to access specialised skillsets and trim operational costs

Structural challenge #3 – Navigating market volatility and offering stable returns

Navigating market volatility due to uncertain macroeconomic conditions, geopolitical issues, and policy decisions remains one of the most persistent asset management challenges. Swings in asset prices and interest rates have compelled asset managers to constantly adjust their strategies, such as increased investment in private markets, to provide superior returns.

As asset managers face top-line pressure due to the structural shift to lower-fee products, actively managing portfolios with rebalancing strategies will be crucial to achieving target returns. AI-driven risk management solutions and personalized client engagement will become vital for managing increasing client expectations and sustaining competitive advantage.

Structural challenge #4: Need for personalisation

The asset management sector is seeing increased demand for personalised services, adding another layer to the asset management challenges as firms are required to continuously augment their offerings. The drive towards personalisation requires significant investment in data collection and data analysis, using AI tools to understand client preferences and predict future requirements.

We believe that asset managers that use a combination of personal relationships and AI-driven tools to understand client needs will have a significant competitive edge. Customisable mandates aligned to client end goals and risk appetite with continuous monitoring and flexibility to adapt to changing market conditions would provide a holistic personalised experience to clients. We expect bespoke solutions to be imperative to retain and grow client assets. Key to addressing this challenge would be personalisation at scale. Asset managers are experts in providing personalisation via existing, legacy relationship teams. Firms that secure a competitive advantage would be those that use AI technology and digital technology services to provide bespoke services at scale, but at marginal costs.

Structural challenge #5 – Margin pressures continue to drive operational efficiency, consolidation and increased focus on outsourcing

The diverse and complex nature of the assets they manage, the slew of regulatory requirements and rapid technological developments pose significant challenges to asset managers. Maximising operational efficiency and evaluating their operative models is becoming critical as asset managers continue to face challenges in reducing costs.

Asset managers are investing heavily in technology, aiming for a leaner workforce over time. The sector is also experiencing consolidation to gain entry into newer markets, add on new capabilities and onboard new customer segments. There is increasing demand for outsourcing to gain access to specialised talent to handle complex workflows and gain a cost advantage, which would help ease margin pressure.

This is also increasing the trend of striking strategic partnerships with KPOs and leveraging their scale, expertise and agility to streamline not only middle-office operations but also front-office operations, such as research and sales support. We expect asset managers to continue investing in technology to improve efficiency. While transforming the way they perceive client relationships, data management and analysis through AI could help them achieve personalisation, increase client engagement and focus on long-term benefits. As a first step, automating routine and repetitive tasks would provide bandwidth so employees could handle more strategic and revenue-generating tasks.

Read the full outlook for Asset Management 2025 here.

What's your view?

About the Authors

Priya has over 20 years of experience in equity research and financial auditing. At Acuity Knowledge Partners, she currently manages client relationship and delivery for leading private banks. She has been with the company for over 19 years and has led teams in sell-side and buy-side engagements. She previously worked at Ocwen Financial Services and as an auditor at Deloitte. Priya is a Chartered Accountant and holds a Bachelor of Commerce degree from Bangalore University.

Nuwan provides global leadership to the traditional asset management segment within the Investment Research Buy-side business unit. As a senior leader in Acuity Knowledge Partners’ (Acuity’s) Sri Lanka delivery centre, he provides oversight to the Buy-side research teams, including resource management.

Nuwan also spearheads the Colombo University Outreach programme, bringing Acuity’s global expertise to Sri Lanka’s brightest minds.

His journey started over 20 years ago as Sell-side Equity Analyst covering the mortgage-backed securities sector. After seven years in the domain, he moved to fixed income research to expand Acuity’s credit research franchise in the Sri Lanka delivery centre. Subsequently, he was appointed Head of fixed income, focused on..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox