Published on April 11, 2023 by Mahesh Agrawal

"Bank confidence is a fragile reed, and a troubled bank is damaged by any rumours, true or not." – Irvine Sprague, former chairman of the Federal Deposit Insurance Corporation.

Silicon Valley Bank (SVB), one of the most preferred banks for startups in the US, was damaged in March when customers requested to withdraw a record USD42bn in a single day1 , nearly 20% of the bank’s balance sheet. The bank failed to honour such a large withdrawal request, pushing the federal government to take action. The Federal Deposit Insurance Corporation (FDIC) acted fast and took custody of bank assets, assuring all depositors that all their money was safe and available as and when required. This assurance was given on the entire deposit and not only for the FDIC-insured amount of USD250,000 per customer2 .

The FDIC’s quick actions helped stabilise sentiment, although concerns remain regarding the financial and banking sector as US Federal Reserve (Fed) interest rates remain high. A rate-hike cycle could have multiple adverse effects on a bank’s balance sheet, including (1) higher stressed assets, as some borrowers could face challenges in repaying loans due to higher interest costs, (2) the economic slowdown could reduce a bank’s earning potential and (3) the value of a bank’s fixed-income assets could decline.

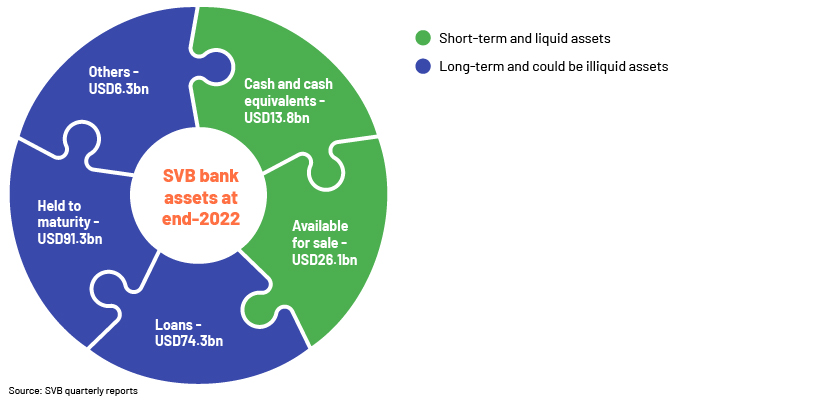

A bank’s assets can be broadly classified into four categories:

-

-

Loans – A bank uses deposits to extend long- and short-term loans to customers. Loans are usually provided at a premium to the deposit rate, a major income source for a bank. These loans are largely fixed-term in nature and not available for a bank to redeem immediately.

-

Securities – For liquidity management and other reasons, banks invest in different securities that could be short-term or long-term.

-

Available-for-sale (AFS) securities – These are largely short-term debt or financial assets readily available to a bank to meet demand for immediate cash. For accounting purposes, AFS securities are marked to market and represent the fair value of the assets in quarterly or annual reports.

-

o Held-to-maturity (HTM) securities – These are largely long-term debt assets that a bank does not intend to sell in the market. Usually, these are Treasury bonds and other safe assets where loss of principal is assumed to be relatively low. For accounting purposes, HTM securities are not marked to market and are instead amortised based on the coupon yield and time to maturity.

-

-

Cash – Cash available with a bank that can be used to meet an immediate demand. Cash is a low-yielding asset and, hence, kept at a relatively low level.

-

Bank failures are usually associated with dubious lending practices, where excessive loans are provided without proper due diligence or where investments are made in sub-standard assets. However, for SVB, the main trouble was with the highest-rated investment securities. Due to the sharp interest rate hikes, the market value of its existing HTM assets (US Treasury bonds) dropped by around USD16bn3 , although the bank continued to show them at book value, based on adopted accounting practice. If the assets were liquidated in a stressed market, the losses would have been large enough to wipe out all its equity capital. Wider dissemination of this information resulted in a run on SVB.

Impact on interest rates and economic growth

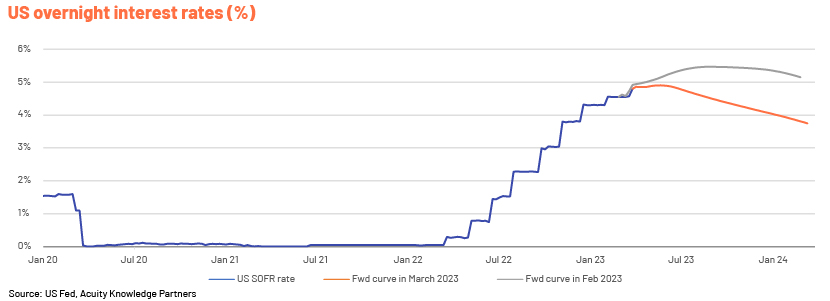

After SVB’s collapse, Signature Bank, another US bank, reported trouble over the following weekend. The FDIC took custody of this bank as well and assured depositors that their money was safe and available. These two large bank failures in the US made the US and global financial markets volatile again, with the markets focusing on the Fed’s rate-hiking decisions. For now, the Fed has opted to continue rate hikes, with a 25bps hike implemented in its March meeting taking the Fed rate to 4.75-5.00%4 . With inflation still above the comfortable range, the Fed has hinted at one more rate hike this year of around 25bps, with the peak rate at around 5.25%.

Before these recent bank troubles, the Fed was on a path to continue rate tightening in the immediate term, with the market expecting a peak rate of 5.5-6% this year; the current economic environment has made it challenging for the US to continue on that path. The market has started to price in the possibility of a rate cut towards the end of the year, although the Fed has provided no hint of a rate cut at least for this year.

Contagion risk is defined as the risk to the financial system due to the failure of one or more institutions owing to business transactions, collateral arrangements and other factors. With the FDIC taking control of both banks, contagion risk in this particular case is limited, although it cannot be ruled out completely. The major risk for the financial system comes from the fact that many other banks could be in a position similar to that of SVB or Signature Bank; the market should be more cautious moving forward.

Across the Atlantic, Switzerland averted or at least delayed a major catastrophe earlier in March, when it asked UBS to take over Credit Suisse, as Credit Suisse’s credit profile had deteriorated sharply, resulting in large bank withdrawals. The European Central Bank, too, continued to focus on inflation for now and raised interest rates by 50bps to 3.5%5 , although it refrained from providing forward guidance. Decisions on further rate hikes are likely to be data-driven, although one or two more rate hikes of 25bps are possible unless financial risk accelerates sharply.

Our expectations for the different assets in 2023 and beyond

-

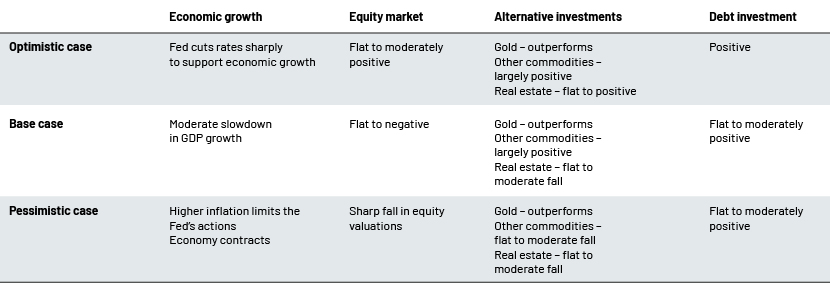

Equity market – The global equity market has performed under pressure since the start of 2022 as geopolitical risks and increasing cost of capital weighed on sentiment. The landscape looks even more challenging going forward, as the financial sector faces the most uncertainty since the global financial crisis of 2008-09. On the positive side, central banks globally are better equipped to handle the situation, and risk of complete chaos is limited. We believe value investing could be a better strategy in the short term, with the market likely to be cautious on growth projections.

-

Debt market – 2022 was an eventful year for the debt market as a rise in interest rates weighed on bond prices; we expect this year to be calmer for debt investors. The rate-hike cycle in most countries is nearing completion, with some central banks already hinting at pausing rate hikes as inflation cools from record-high levels. Inflationary pressure is still not completely under control, but we believe economic stability and employment concerns could take precedence. As the rate-hike cycle ends, bond prices are likely to stabilise, with bonds offering decent returns in the short to medium term.

-

Gold – Gold performed relatively well in 2022, with prices staying largely flat for the year, even as central banks globally raised interest rates sharply. Investors had the option of both safety and higher returns in government securities; however, gold also acts as an inflation hedge, and this has helped investors to stay put in gold. Gold could emerge as one of the preferred investments this year as central banks battle to rein in volatility in the financial market.

-

FX – The USD peaked in 2H 2022 and has been underperforming other major currencies since as central banks globally catch up on rate hikes and the Fed hints at pausing rate hikes. The USD index is still quite high compared to historical averages, and a pause in the Fed’s rate hike could put downside pressure on the USD. However, economic uncertainty could increase demand for safe-haven assets if financial conditions deteriorate further. We believe the FX market could trade at higher volatility in the short to medium term.

How Acuity Knowledge Partners can help

We provide expert market research on sectors, economies and commodities. We have a firm grasp of macroeconomic and market concepts, and expertise in technical and quantitative analysis to provide in-depth market insights on relevant topics. We help clients manage increasing demand on their teams by providing customised managed-services solutions, based on specialised skills and technology, and by delivering operational efficiency, resilience and significant cost savings.

Sources:

2https://www.fdic.gov/news/press-releases/2023/pr23019.html

4https://www.federalreserve.gov/newsevents/pressreleases/monetary20230322a.htm

5https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.mp230316~aad5249f30.en.html

What's your view?

About the Author

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Like the way we think?

Next time we post something new, we'll send it to your inbox