Published on July 16, 2025 by Amit Tikoo and Rohit Sharma

Summary

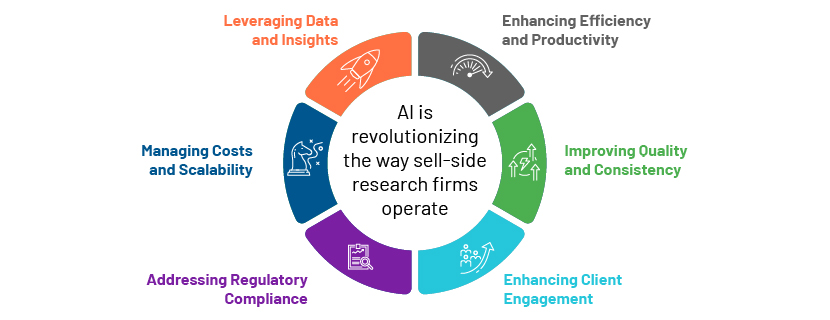

Sell-side research firms face countless challenges, including regulatory compliance, the need for increasingly broader research coverage, maintenance of quality and consistency and differentiation of services in a crowded marketplace. Despite this, the future is exciting, with the integration of artificial intelligence (AI) and outsourcing activity. AI platforms help automate data collection and collate reports with predictive analytics for improved productivity and scaling of complicated tasks. Outsourcing helps reduce research production costs while enhancing sector-specific knowledge, enabling firms to provide personalised, effective research.

Sell-side research firms’ role in transforming markets and evolving technology

Sell-side research firms – such as investment banks, brokerage firms and market makers – are called on to deliver high-quality, timely and actionable insights to clients. To stay ahead of the competition, most have resorted to outsourcing their functions or are relying on AI to enhance their research capacity in order to improve margins.

Clients do not only reward information – they reward speed, insight and relevance. By outsourcing, research firms can hone their competitive edge: publishing faster, covering deeper and changing more rapidly.

Structural shifts and revenue trends

The global research market has changed significantly in recent years. Sector revenue was projected at USD15-17bn annually from 2019 to 2021, trending downward slowly. However, 2022-24 witnessed stabilisation and slight growth, fuelled by issuer-sponsored research models, specifically for small- and mid-cap firms, coupled with outsourced research and offshore analytical services. Technology integration has also helped significantly in terms of reducing costs and improving quality. The prospects are encouraging in 2025, with 2-4% growth in global expenditure on research projected, driven by renewed institutional interest in differentiated insights and deep macro and sectoral analysis.

Challenges impacting the sell-side research sector

-

Regulatory environment: The US sell-side research sector is less regulated than that in Europe under MiFID II, where research is required to be unbundled from the execution of services, resulting in lower research budgets and consolidation among leading providers. The US sector still uses bundled payments ("soft dollar arrangements") and has not yet experienced comparable budget reductions or structural adjustments. Although the SEC's grant of temporary relief to synchronise with MiFID II ended in July 2023, there is still talk of possible regulatory reforms in the US to enhance transparency and reduce conflict of interest. It is, therefore, safe to say that the US market is less or loosely regulated compared to its European counterpart.

-

Is MiFID III a possibility? There is currently no implementation of MiFID III. If such legislation is adopted, it could cut even further into sell-side research budgets and revenue. Enforcing the unbundling of research payments could create pressure to cut costs, consolidate markets and drive revenue models further towards reliance on AI and automation for balancing margins. New research models such as issuer-sponsored research may offset revenue loss, but they introduce the issue of objectivity.

-

Current hurdles for research firms: Sell-side research faces a number of challenges. Heavy investment in human capital and technology is required to expand research coverage, and a wider coverage universe makes it more difficult to maintain consistency and quality, sometimes compromising depth for scale. The need for regulatory compliance adds to the complexity, as does pressure on research teams to ensure timely delivery of insight across sectors and geographies. Internal resources are also strained in efforts to differentiate offerings in a saturated market environment where clients expect customised and superior quality research. Integration of new technologies into existing workflows could be met with resistance, and technical hurdles could inhibit innovation and efficiency.

The EU's Listing Act (effective December 2024) offers an opportunity for smaller sell-side research firms in Europe. This enables companies to bundle payments for research and execution of services, negating the impact of MiFID II and helping smaller firms access high-quality research at more affordable rates.

Streamlining the future via innovation

The future of sell-side research depends on how fast new technologies and new business models can be embraced. AI could positively impact productivity, accuracy and quality of output. AI platforms can be used in the data-gathering processes, freeing up time for analysts to engage with clients. More importantly, technology helps with regulatory compliance, ensuring transparency in the reporting process, which is also automated with the help of AI. AI enables further scaling by helping increase research output without directly increasing either headcount or cost. Arguably, the most exciting application for client engagement is customisation – research tailored to an investor’s individual preferences in terms of goals, risk tolerance and market interest. AI, thus, turns the flood of data into insights that are more personalised, relevant and timely, helping firms align research services with the expectations of modern clients.

Amalgamation of AI and outsourcing future-proofs sell-side research

Outsourcing can help a sell-side research firm save 30-40% of its production costs, far better than building a large team in-house. Such service providers can bring perspective and research independence, enabling additional flexibility in extending operations. They improve research accuracy and sectoral expertise using global pools of specialised resources. Efficiencies are improved and better-quality output presented, as routine tasks are delegated to analysts who will focus on client engagements and strategic insights. Thus, operations are streamlined, with AI reducing manual effort on data processing, modelling and report generation, and enhancing the profit model.

Combined, AI and outsourcing improve scalability: firms can benefit from increased research coverage of 20-30% without increasing associated costs. Automated compliance checks and real-time analytics seek to improve both accuracy and delivery speed, enabling firms to better meet client demands and internal goals.

How Acuity Knowledge Partners can help

We combine human expertise with cutting-edge technology to deliver high-quality and timely insights. Our Agentic AI platform, Agent Fleet, unites two decades of experience with advanced technology. Our analysts bring deep domain expertise with customisable insights while AI automates processes such as data extraction and sentiment analysis, with significant potential for more rapid, accurate and personalised research. This enables clients to scale research without increasing costs, meet tight deadlines and deliver differentiated insights. With the inclusion of AI, we improve compliance, efficiency and impact with a new selling paradigm that enhances productivity and reduces burnout. We believe in continued client relationships and maximising the value of outsourcing.

Sources:

-

https://www.oliverwyman.com/our-expertise/insights/2017/sep/mifid-ii-research-unbundling.html

-

https://www.sec.gov/newsroom/speeches-statements/uyeda-statement-staff-no-action-letter-07-05-2023

-

MiFID II unbundling and sell-side analyst research – ScienceDirect

-

SMID-Caps Sell-Side Analysts Continue to Diminish – Alpha IR & Alpha Advisory Groups

What's your view?

About the Authors

Amit Tikoo is a Credit Research Analyst with over 18 years of experience in IG and HY credits across the US, LATAM, Europe, and APAC regions. He specializes in financial modeling, capital structure, debt maturity, liquidity analysis, and comprehensive company research. Amit attends earnings calls to provide key highlights and supports Asia-based sell-side research with Bloomberg-linked automated files and weekly deliverables. He holds a B.COM and an MBA in Finance.

Rohit is part of Acuity Knowledge Partners, a highly experienced Credit Research Analyst with over a decade of expertise in the APAC region, specializing in both investment-grade and high-yield credits. Proficient in financial modeling, liquidity and capital structure analysis, and comprehensive research on companies and industries. Skilled in using Bloomberg and other databases for peer identification and preparing comparative analyses. Currently supports sell-side research, handling various financial and macroeconomic tasks. Holds a B.COM and an MBA in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox