Published on June 20, 2025 by Sneh Srivastava and Muskan Goel

On 19 March 2025, the US Securities and Exchange Commission's (SEC’s) Division of Investment Management updated its Marketing Compliance Frequently Asked Questions (FAQs) to provide further clarification on the recently amended Marketing Rule (rule 206(4)-1 of the Investment Advisers Act of 1940). This revision aims to address uncertainties faced by investment advisors, particularly those managing private funds, regarding the presentation of specific performance data, portfolio characteristics and risk measurements. These updated responses replace previous guidance from the SEC staff concerning adherence to the Marketing Rule.

What exactly has changed? A breadown…

Recent guidance has focused on elucidating the reporting of extracted performance (the performance of a selection of investments) and specific portfolio characteristics.

| Title | Previous stance | New guidance | Example |

|---|---|---|---|

| 1. Extracted Performance: Gross vs. Net Requirements | When an advisor showed the gross performance of what's termed "extracted performance" – meaning the performance of a specific investment or a group of investments within a portfolio – they also needed to present the net performance of that exact subset with equal visual weight. This often-posed challenges in accurately calculating net performance at such a granular level. | The SEC staff now indicate that they would not recommend enforcement action if an advisor displays gross extracted performance without the corresponding net extracted performance with the conditions criteria. | If an advisor highlights the gross performance of a successful individual stock within a fund, under the new guidance, they can do so without showing that specific stock's net performance, as long as they prominently display the overall fund's gross and net returns for a comparable period. |

| 2. Portfolio Characteristics | There was ambiguity regarding whether certain portfolio characteristics, such as yield, volatility, attribution analysis and Sharpe ratio, should be considered "performance" under the Marketing Rule, which would then trigger the requirement to show net figures. Calculating these characteristics net of fees could be impractical or potentially misleading. | Calculating these characteristics net of fees could be impractical or potentially misleading. It was clarified by the SEC staff that no recommendation for enforcement action would be given if an advisor presents one or more gross characteristics of an investment or portfolio without including the subsequent net characteristics. | An advisor wants to showcase a fund's gross yield. According to the new guidance, they can present this on a gross-only basis if they also prominently feature the fund's overall gross and net performance for a comparable time frame and clearly disclose that the yield is presented before deducting fees. |

What’s the significance of the new rule?

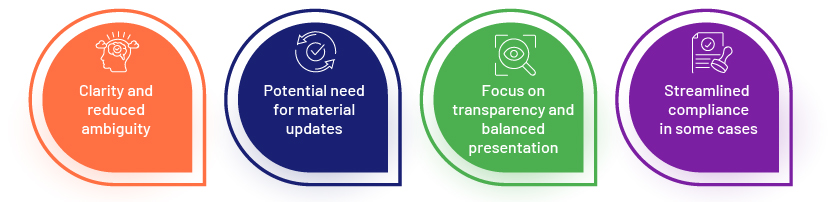

SEC new marketing rule carries significant implications for investment advisors:

-

Clarity and reduced ambiguity: The clarifications resolve long-standing uncertainties, especially regarding extracted performance and portfolio characteristics, simplifying advisors’ understanding of SEC expectations.

-

Potential need for material updates: To ensure compliance, advisors must revise their marketing material (websites, brochures, pitchbooks, social media), which may involve incorporating net performance, modifying performance metric emphasis and adding new disclosures.

-

Focus on transparency and balanced presentation: The SEC remains committed to fair and balanced investor information, reinforcing the need to avoid misleading presentations. This aims to provide investors with clearer, more comparable performance data, ensuring better-informed decisions.

-

Streamlined compliance in some cases: Flexible presentation of total and gross portfolio performance could simplify compliance for some firms. This aims to ease the burden on issuers while maintaining investor protection, potentially boosting private capital formation.

Concluding and forward-looking insights

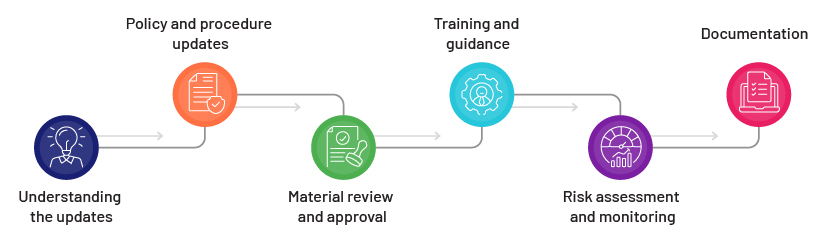

The marketing compliance team plays a crucial role in ensuring adherence to the SEC's updated guidance on extracted performance and portfolio characteristics. Their responsibilities include the following:

-

Understanding the updates: Thoroughly analysing the new FAQs to grasp the nuances of presenting gross-only extracted performance and portfolio characteristics under specific conditions, including the prominent display of total portfolio gross and net performance.

-

Policy and procedure updates: Revising internal marketing policies and procedures to align with the new SEC marketing rule for investment advisors, ensuring all marketing material reflects the new requirements for disclosure and comparison.

-

Material review and approval: Implementing a robust review process for all marketing content to verify that presentations of extracted performance and portfolio characteristics meet the stipulated conditions, such as clearly stating the gross performance and making sure that the total portfolio performance receives equal prominence.

-

Training and guidance: To ensure consistent adherence, the marketing compliance team will educate marketing personnel and advisors on the revised regulations. This includes comprehensive training on the new marketing rule for investment advisers, along with clear guidelines to support its proper application across all marketing communications.

-

Risk assessment and monitoring: Continuously monitoring marketing material to ensure adherence to the new guidance and assessing potential risks associated with non-compliance to proactively address any issues.

-

Documentation: Maintaining detailed records of how compliance with the updated guidance is achieved in marketing material, including review processes and approvals.

By effectively fulfilling these responsibilities, the marketing compliance team acts as a vital gatekeeper, enabling a firm to leverage the flexibility offered by the SEC's updates while maintaining regulatory compliance and making sure that communication with clients is clear and transparent.

How Acuity Knowledge Partners can help

As a leading player in the global financial services sector, Acuity Knowledge Partners provide comprehensive compliance expertise and a range of related services. Our methodology centres on building an adaptable, strong and capable control framework to manage organisational risk comprehensively. We pinpoint and resolve weaknesses in compliance programmes, satisfy regulatory obligations and develop customised solutions leveraging cutting-edge technology.Our specialised offerings encompass corporate compliance, forensic accounting, compliance assessments, ongoing monitoring, risk-trend evaluation and risk-reduction strategies. We create and tailor reviews to reduce a company's exposures, aligning with current regulatory benchmarks. From initial assessment through to final documentation and recommendations, our thorough approach delivers a complete understanding of business risks, strengthening a firm’s ability to withstand threats.

Sources:

-

https://www.morganlewis.com/pubs/2025/03/sec-staff-issues-updated-marketing-rule-faqs

-

SEC’s Latest Marketing Rule Guidance: Key Takeaways for Advisers | Akerman LLP – JDSupra

-

SEC Releases New Guidance on Marketing Rules: Important Points for Advisers

Tags:

What's your view?

About the Authors

Sneh Srivastava currently works in the Corporate Compliance team at Acuity Knowledge Partners and has over 11 years of experience in Regulatory Compliance industry and is responsible for compliance monitoring tasks for a client.. She has a master’s degree in business administration with a specialization in Finance and international business from GL Bajaj, Greater Noida.

Muskan Goel is part of the Corporate and Forensic Compliance team at Acuity Knowledge Partners, bringing over seven years of experience in the Regulatory Compliance industry. She oversees compliance monitoring tasks for a client. Muskan holds a master's degree in Business Administration with a specialization in Finance and Operations from IMT Ghaziabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox