Published on October 27, 2025 by Shikha Singh

Conversations with banking clients over the past year have seldom ended without a discussion on AI. As the technology landscape evolves rapidly and creates headlines across industries, the sell-side research business is also experiencing its share of buzz. There is no denying technology’s potential in making a research analyst’s role more efficient, enabling them to cater to clients better.

As a team of supervisory analysts and editors who work as gatekeepers of research, our role in the regulatory review of content requires judgement, coordination and, equally importantly, an understanding of the big picture, tone and the ever-important clear attribution to the source or basis for statements or opinions. The human filter is crucial for these tasks. That said, we recognise the low-hanging fruits that AI tools present – for instance, language checks and consistency with style guides – that make our work more efficient as technology continues to become a greater enabler over time.

In the write-up below, we throw light on responsibilities where subject expertise and ability to offer relevant solutions in grey areas (such as M&A and politics) make SAs indispensable in the research review process.

Safeguarding research integrity

-

We act as gatekeepers for management, raising alerts for further review in the event of a change in coverage, rating or target-price estimate; controversial subjects/opinions; conflicts of interest with analysts; and stale or mismatched recommendations on securities.

Example:

The board lacks long-term vision, as it has prioritised a stock-buyback plan over strategic investments, leaving the firm with no growth potential.

This statement can be considered offensive. Opinions on company management/board and political figures should be balanced.

-

We also ensure the content is free from language that could be construed as front-running.

Example:

We will look to upgrade the stock once the FY24 results are out of the way and the market focuses on the impending benefits of the cost-rationalisation process and the strategic sale of non-core assets.

This hints a future rating change tied to a known event – a classic example of front-running. The intent to change rating, price target or forecasts, even if conditional, is material non-public information, and trading on that information violates rules on fair disclosure, as clients could benefit from being in a position to trade on market-moving information that the broader market is unaware of.

Analytical consistency and data validation

SAs play a crucial role in validating valuation methodologies, ensuring that the investment thesis stands on solid ground and logically supports the target price and rating. For this, they work closely with research management. They meticulously review every figure, cross-checking data with charts and tables to ensure accuracy and consistency.

Example:

An analyst revised the EPS forecasts for ABC Technologies upwards by an average of 15% for the next three fiscal years, driven by strong FY results, an improved demand outlook and cost initiatives. However, the DCF valuation-based target price (TP) increase was only 2%.

Upon review, the SA found the DCF valuation table was not rolled forward to account for the reported results. Once the analyst rectified the error, the new TP reflected the updated forecasts, necessitating a rating change.

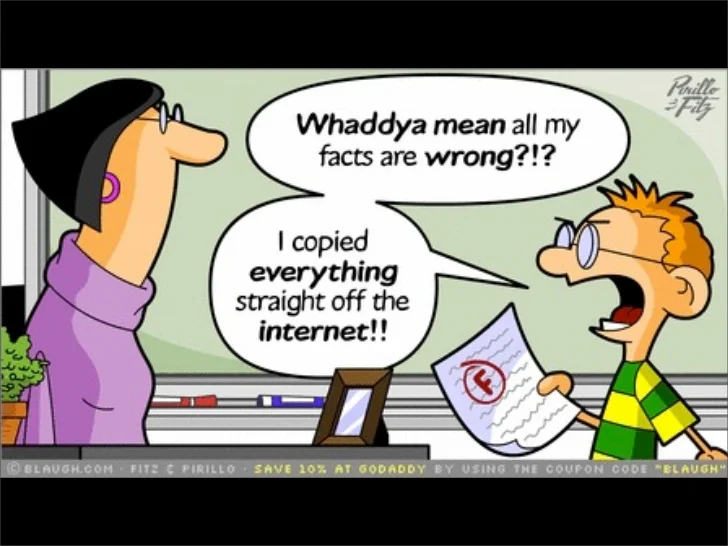

Ensuring proper information sourcing

SAs meticulously track every source and ensure clear attribution, giving credit where it is due – keeping content ethical and copyright-compliant. They also ensure analysts avoid starting or (inadvertently) spreading rumours and/or inaccurate information and base their research only on confirmed information and trusted sources.

Example 1:

We believe ABC Ltd could be looking to buy OMN to become the leading telecom player. Management has previously indicated that it could look at M&A to drive growth, and we believe OMN presents the perfect opportunity given its recent spectrum win.

Analysts cannot bring companies into M&A play unless there are confirmed reports from reputed sources or the companies themselves have released statements on the matter.

Example 2:

Market rumours suggest XYZ is about to launch a drug that could change the landscape of weight-loss treatment. Given the estimated size of the market, we expect a significant re-rating of the stock.

Analysts cannot base their views on unsubstantiated news. They cannot change ratings, target prices or estimates based on unconfirmed news, even if the news is from reputed sources.

Working with research management and compliance teams

SAs play a key role in ensuring reports are published only after appropriate approval is obtained from an investment review committee and/or the compliance team. SAs liaise with compliance teams for approval on restricted stocks and on research involving government-owned entities. At certain banks, SAs are required to apply the research guidelines to restricted stocks and take a decision on permissible content. They also coordinate with legal and compliance teams for inclusion of appropriate disclosures in research reports.

Secondary responsibilities

In addition to their primary responsibilities, SAs review content for logic, structure and commerciality. They also review and approve research marketing material including presentations, podcasts and video scripts.

How Acuity Knowledge Partners can help

We offer

-

Top-tier SA services to sell-side firms. Our SAs have experience across geographies and domain areas (equity, fixed income, credit, economics and strategy). They recognise the importance of time to market amid high submission volumes, expertly balancing speed with quality of output.

-

Senior editors ready to sit for the Series 16 exam within three months of joining. This is a cost-effective alternative, where editors transition seamlessly to an SA role in line with client requirements. To fast-track the process, we identify senior editors with relevant experience and rigorously prepare them for the role, guided by seasoned SAs in-house.

-

Pre-SA review by senior editors. This is especially helpful for firms that do not require licensed individuals but want the same level of review rigor.

Our Agentic AI editing tool is poised to augment our support, increasing efficiency and reducing turnaround time and costs as technology steadily enhances our capabilities over time.

Committed to excellence, we tailor our services to meet client needs, delivering flexible, reliable and cost-effective solutions. We offer full-time, part-time and ad hoc support, including 12-hour coverage and peak-period assistance during earnings.

What's your view?

About the Author

Shikha heads Acuity Knowledge Partners’ (Acuity) editing, formatting & publishing and design services, managing all client accounts in this vertical. She has 16 years of experience in working with financial research content. Before joining Acuity, she worked with Goldman Sachs as a Series 16-qualified Supervisory Analyst and Editor. She also set up and managed its 10-member content management team in Bangalore. Her previous work at JPMorgan included reviewing equity research reports, and she focused on credit and industry and company research reports during her stint at Crisil Research (an S&P company). Shikha holds an MBA in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox