Published on May 5, 2025 by Aashima Gupta

In recent times, environmental, social and governance (ESG) reporting has evolved from a peripheral concern to a central part of corporate strategy. As the importance of sustainability practices grows among stakeholders, demand for greater transparency and accountability is increasing. This is where ESG reporting can play a critical role for companies aiming to build long-term trust and value.

Through ESG reporting, businesses make ESG disclosures. This information is crucial for investors using ESG criteria to assess long-term risks and performance of their portfolios.

Current trends in ESG reporting are as follows:

-

ESG reporting mandate has grown by 74% in the last four years.

-

Around 400 reporting provisions exist in 80 countries.

-

For private companies, the average submission rate for ESG metrics rose to 70% in 2024 from 67% in 2023.

-

Approximately 90% of S&P 500 firms publish ESG reports

With increasing regulations, frameworks and stakeholder expectations, companies are bound to provide transparent, reliable and comprehensive disclosures on their ESG practices. Companies commonly adopt various reporting frameworks including ESG Data Convergence Initiative (EDCI), Sustainable Finance Disclosure Regulation (SFDR) Global Reporting Initiative (GRI) and Corporate Sustainability Reporting Directive (CSRD). These frameworks guide companies on how they can communicate their ESG performance to stakeholders effectively.

Challenges faced by companies in traditional ESG data and reporting

Challenges companies face in traditional ESG reporting include difficulties in collecting data accurately, ensuring data quality across industries, integrating data from different sources and keeping pace with evolving regulatory requirements.

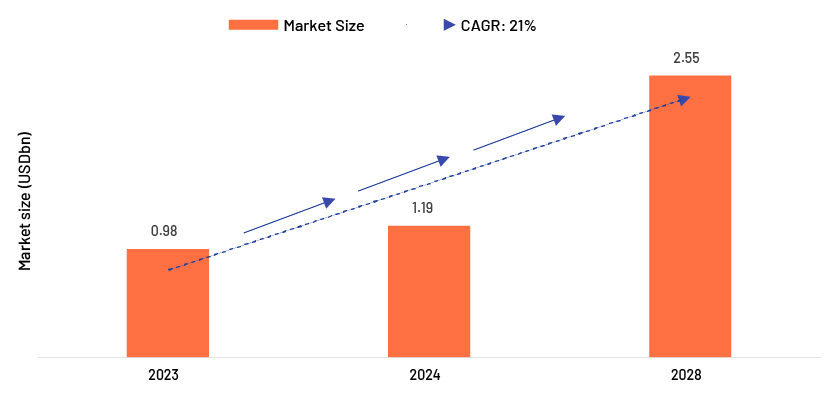

Global ESG reporting software market forecast

As businesses strive to enhance their sustainability efforts and stakeholders’ demands for transparency and accountability grow, technology has emerged as a transformative force helping organisations streamline the processes and enhance data accuracy to meet the sustainability standards effectively.

The ESG reporting software market has grown from $0.98bn in 2023 to $1.19bn in 2024, clocking a 20.8% compound annual growth rate (CAGR). It is forecast to reach $2.55bn by 2028, posting a five-year CAGR of 21%.

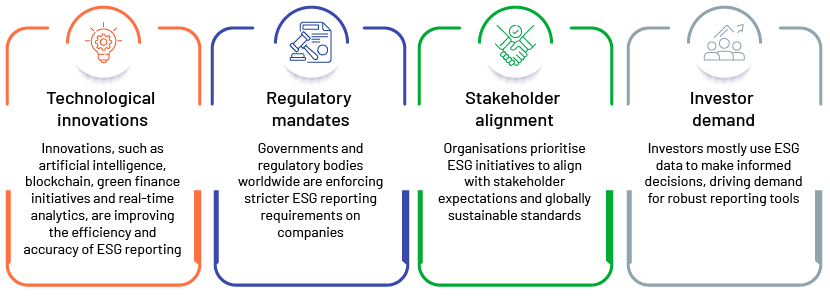

Key growth drivers of software market

The global software market is experiencing rapid growth, due to digital transition and technological advancements. In addition, evolving regulations, stakeholder expectations and strong investor demand are shaping the future, as illustrated in the graphic below.

Future implications on software market

The projected growth in the software market signifies that companies are likely to adopt advanced ESG reporting solutions to stay competitive and compliant. This trend suggests increasing opportunities for software providers to innovate and expand their offerings in the ESG space.

Technologies shaping future of ESG reporting

Emerging technologies are transforming the way organisations collect, analyse and disclose ESG data for greater transparency and accuracy. These technological advancements not only streamline reporting processes but also help in decision-making and stakeholder engagement. Such technologies include:

-

Blockchain for transparency: It ensures secure and immutable records for ESG data, enhancing trust and transparency. For example, Fishcoin uses blockchain to incentivise data sharing and improve traceability in the seafood industry.

-

Artificial intelligence (AI) and data analytics: AI tools process vast data sets, uncovering meaningful insights and trends. Machine learning algorithms help refine ESG strategies while ensuring compliance with global standards. For example, Sia Partners relies on AI to study various outcomes, including the deployment of carbon tax and use of renewable energy sources.

-

Internet of things (IoT): These devices monitor real-time environmental metrics such as energy use, waste generation and water quality. Data allow proactive risk management and regulatory compliance. For example, Zenatix integrates IoT to streamline ESG reporting processes.

-

Cloud computing: These cloud platforms automate ESG data collection, standardise reporting metrics and enhance transparency across organisations. For example, Bain & Company uses Persefoni’s Climate Management & Accounting Platform (CMAP) to streamline carbon accounting and ESG reporting.

-

XBRL for standardised reporting: The eXtensible Business Reporting Language (XBRL) streamlines ESG disclosures by making reports machine-readable and understandable by computers.

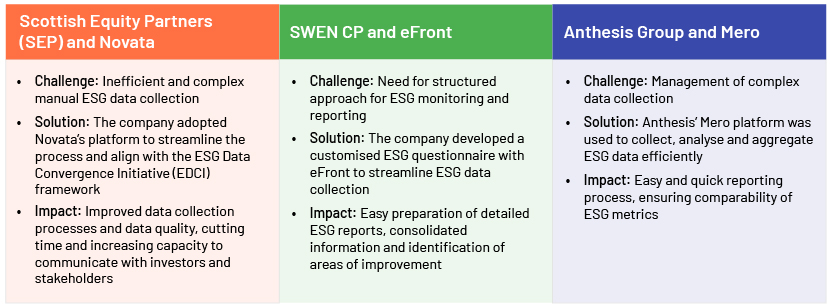

Case studies

Technology plays a pivotal role in enhancing ESG data management and reporting in private markets.

Benefits of technology-enabled ESG data and reporting

Technology helps in transforming ESG reporting, offering businesses significant advantages in efficiency, accuracy and transparency:

-

Enhanced data collection: Digital tools help in collecting ESG data from multiple sources, reducing errors and inconsistencies. Centralised platforms, such as Nossa Data, ensure data accuracy and save time and resources.

-

Higher accuracy: Automation reduces human errors in handling data.

-

Greater transparency: Digital tools make ESG disclosures accessible and comprehensible.

-

Data-driven insights: Predictive analytics identify risks and opportunities for sustainable growth.

Conclusion

Technology is not just changing how we collect and report ESG data. It is also fundamentally transforming how organisations understand and address their environmental and social impacts. ESG remains key to business decisions, and technology adoption will likely help businesses gain a competitive edge and satisfy stakeholders. Technology, which ensures data accuracy and streamlines reporting processes, among others, is transforming the way organisations approach ESG, driving progress towards a more sustainable and responsible future.

How Acuity Knowledge Partners can help

Acuity is a leading provider of ESG data and reporting services to private markets. We tackle complex ESG data challenges by cleaning, validating and standardising diverse and unstructured ESG data from myriad sources. Our in-house digital platform streamlines the overall data journey, from automated data collection to report generation. We also help clients efficiently manage and make better investment decisions.

Sources

-

Latest Global Market Insights- 2024 ESG Reporting Software Market Overview

-

Fishcoin- Blockchain based traceability for the seafood industry

What's your view?

About the Author

Aashima Gupta has been working at Acuity Knowledge Partners for 3 years as an Associate, where her primary focus is delivering comprehensive ESG solutions to clients. She is responsible for providing end-to-end services around ESG research, analysis, and reporting. Aashima holds a post-graduate diploma in Management from Institute of Management Studies, Ghaziabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox