Published on June 27, 2025 by Vaishnavi Bhaskar and Smriti Ramkumar

Transforming RFP workflows: the impact of response management systems on team productivity

At the core of the fast-paced world of asset management lies the principle of maximising returns that drives firms to meet ambitious targets, constantly deliver exceptional results and ensure customer satisfaction. This has a cascading effect, especially on teams central to client acquisition and retention such as RFP teams, to deliver accurate, detailed and timely responses. Stress among RFP/ DDQ specialists is becoming an increasingly prevalent issue in RFP response management just as compounding returns can magnify wealth, compounding stress can intensify burnout, making it harder for RFP teams to sustain their productivity and morale.

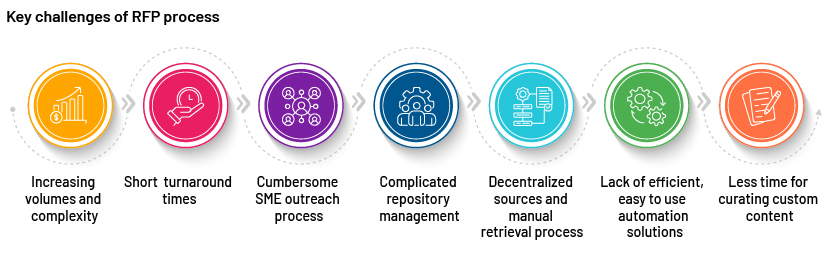

One of the primary causes of burnout for RFP/DDQ specialists is the volume of work they are required to handle. Increasing competition among the growing number of asset managers, demand for tailored investment strategies, the popularity of ESG and DEI themes and a tightening regulatory environment contribute to the increase in number and complexity of RFIs, RFPs and DDQs. Adding to the never-ending woes, when teams are stretched thin, difficult decisions must be made within a short span of time. This is not merely a missed chance to secure new business but also a potential loss of revenue in terms of expanding the firm’s AuM, which can hinder growth prospects and market positioning.

To mitigate burnout, a common solution that managers propose is delegation of tasks. But what happens when all avenues of delegation – downward, upward and lateral – are exhausted and everyone around you is equally overwhelmed with their own workload? In such cases, the traditional approach to task distribution becomes ineffective. The modern approach to solving this conundrum is to leverage artificial intelligence (AI) to assist with sophisticated tasks and automate repetitive and low-complex tasks.

Automation: a game-changer for the proposal process

“Automation” has become an integral part of today’s world, trickling down to almost all industries and our daily lives. From smart devices, driverless vehicles and AI used in healthcare to detect diseases in the early stages to entire industries, automation is everywhere. Within the asset management sector, proposal automation is revolutionising the way RFP teams function.

But first, what is proposal ?

Proposal automation is the process of using software to streamline the creation, management and submission of responses to questionnaires. Essentially, it can help automate repetitive tasks (such as populating recurring responses, proposing new responses and formatting the document), enabling proposal teams to focus more on the bespoke and strategic components, ultimately improving overall productivity and client satisfaction.

It is no surprise then that most RFP managers are prioritising proposal automation and diverting more of their budgets towards AI-related initiatives. Automation boosts team efficiency, helps teams submit more proposals and win more deals by maximising resources and enabling RFP writers to focus on high-priority tasks.

The following are ways in which delegating work to AI and automation in response management system (RMS) platforms can effectively combat burnout in RFP teams:

1. Streamlining repetitive questions:

The time commitment required to complete a single DDQ is staggering: a 100-question DDQ can take 10-13 hours just for the initial draft. Besides this alarming statistic, there is the realisation that most investors are chasing the same data and information. All DDQs typically have the same ask, while the questions are simply worded differently. This, along with their recurring nature, makes DDQs prime candidates for automation.

Response Management System can quickly auto-populate information from previous submissions or suggest best-fit responses from content and document libraries, reducing search time significantly. Depending on the type of questionnaire, anywhere between 40% and 70% of the questions can be answered at the click of a button, enabling specialists to focus on validating and fine-tuning responses to meet client expectations.

2. Automating response generation:

The most time-consuming part of any RFP/DDQ is answering non-standard questions; specialists need to source information from outside content libraries using external sources such as annual reports, prospectuses and other legal documents.

Response Management System platforms now offer a short cut and are able to generate a first draft of responses after sifting through lengthy legal documents. Specialists can also input data files and use AI to craft first-draft commentaries that can then be sent to subject-matter experts (SMEs) for further edits. This reduces the initial time spent on drafting, and instead of starting from scratch, SMEs can focus on refining and adding value.

3. Enhancing SME collaboration:

RFPs/DDQs often require contributions from various departments and SMEs, each with their own priorities, timelines and levels of urgency. Coordinating with these diverse individuals and perspectives can be challenging and sometimes mentally taxing. Specialists spend valuable time carefully crafting SME outreach emails and then following up.

To ease this, Response Management System platforms can draft emails to SMEs, automate approval workflows and send timely notifications. This way, SMEs are more likely to meet deadlines, and RFP teams can avoid tedious manual follow-ups. A few platforms are also able to auto-identify email replies from SMEs and insert responses directly into the questionnaire.

4. Improved quality control:

In the competitive world of asset management, a single inaccurate response can jeopardise the chance of securing a mandate. RFP teams invest countless hours in multiple layers of reviews to ensure only the most polished, accurate and compelling version is delivered to the client.

AI-powered Response Management System platforms can automatically check grammar, flag inconsistencies and provide real-time suggestions to improve clarity, brevity and readability. Features include making text more readable, trimming word count, changing tone, switching voice from active to passive, enabling teams to quickly modify responses to match internal guidelines and client expectations. Some platforms also insert automated annotations, helping teams with audit trails.

5. Faster formatting:

First impressions are crucial, and a well-formatted document can greatly enhance a client’s perception of a firm’s professionalism. This is why RFP specialists invest significant time in meticulously formatting each document.

AI can streamline this process through the use of templates. Specialists can create branded templates with preset font styles, sizes and other formatting elements. With these templates, questionnaires can be quickly converted into branded documents, saving valuable time and ensuring consistency without the need for manual formatting.

6. Content management:

The quality of a DDQ depends heavily on the integrity of the content stored in the repository. High content integrity means ensuring all data is up to date, accurate and error-free; this requires regular reviews and updates. However, RFP teams are often stretched thin, leading to stale and duplicate records due to oversight.

Modern RFP response management platforms help with tracking user-engagement metrics such as usage and download count and provide RFP managers with actionable insights for optimising future content-management strategies. AI also helps with auto-tagging and categorising content based on topics. It also performs sanitisation checks and identifies duplicate records in a repository.

It is now clear more than ever that adopting AI for RFP response is the only way forward. Automation is not a replacement for human intervention but a tool that helps asset managers. They are two sides of the same coin: while AI RFP response automation accelerates the process and handles tactical tasks, human expertise ensures personalisation, builds trust and ensures proposals are strategically sound. The success of next-generation RFP teams will be defined by how well they strike a balance between these two inseparable halves.

How Acuity Knowledge Partners can help

We have consistently been at the forefront of technology implementation and innovation, driving significant advancements in the financial services sector. This commitment is exemplified by our AI-powered solutions, including our Business Excellence and Automation Tools (BEAT) and our Agentic AI platform, which enhance efficiency and accuracy across financial processes. Within the fund marketing space, we offer two notable AI-enabled tools: BEAT Edge, an award-winning solution that helps asset managers streamline their consultant database updates, and BEAT RFP Pulse, an AI RFP response automation tool which automates responses to significantly reduce the time and effort required for RFPs.

BEAT RFP Pulse has been developed in collaboration with our Centre of Excellence that comprises a number of seasoned RFP writers. The tool is specifically tailored for RFP writers and adopts a streamlined, no-frills approach, focusing only on the essential features to produce standout, high-quality output. The key strengths of RFP Pulse include its robust response-generation capabilities, the ability to work seamlessly with Word and Excel files in their native formats within the tool and its smart annotation features.

To explore how AI and GenAI streamline the RFP process, watch our explainer video on BEAT RFP Pulse in action.

Tags:

What's your view?

About the Authors

Vaishnavi Bhaskar is an Assistant Director within the Financial Marketing Services (FMS) line of business at Acuity Knowledge Partners (Acuity). In this role, she is responsible for managing multiple client engagements supporting the RFP teams of leading US-based asset management firms. She also plays an active role in various business development initiatives supporting the growth of the FMS line of business.

Vaishnavi brings close to ten years of experience in the asset management domain. Prior to joining Acuity, she worked at Goldman Sachs as an Analyst, where she gained foundational experience in financial services and client support.

Smriti Ramkumar is a Senior Associate within the Financial Marketing Services line of business at Acuity Knowledge Partners (Acuity). In this role, she is primarily responsible for completing request for proposals and due diligence questionnaires for Acuity’s global asset management clients.

Prior to joining Acuity, Smriti worked as a senior Associate at Morgan Stanley in Mumbai, India. She also worked as an Underwriter for TATA AIG, prior to Morgan Stanley.

Smriti holds an MBA in Banking and Finance (Major in Capital Markets) from T.A. Pai Management Institute, Manipal, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox