Published on May 12, 2025 by Investment and Fund Commentaries Team

Unlocking new frontiers in investment research

The global generative artificial intelligence (GenAI) market was valued at c.USD43.87bn in 2023 and is projected to grow from USD67.18bn in 2024 to USD967.65bn by 2032, at a compound annual growth rate of 39.6%, according to Fortune Business Insights.[1] Whether in learning, reasoning, or problem-solving, AI has carved out a niche for itself in every sector, including in financial markets.[2]and particularly in AI in fund research.

Banks and financial technology companies alike have greater expectations because of the increasing prevalence of AI in financial services. All net new investments that the financial institutions, especially banks, have undertaken in their technology stack are being reassessed. With the help of AI in financial services and AI in fund research customers can enhance their personal banking experiences, make appropriate decisions to mitigate risk, manage fraudulent activity, improve accuracy in services and leverage human-AI partnerships.[3]

In addition to other factors, the stock market is influenced by politics, economic conditions, market fluctuations and investment behaviour. Using traditional investment models to establish a multivariate relationship between stock prices and these factors would be an uphill task and often unsatisfactory. In such situations, AI in fund research is advantageous owing to its attributes of self-organisation, non-linearity and self-adaptation.[4]

Revolutionising investment strategy: the role of AI in fund research and commentary

A major transformation has occurred in traditional investment analysis with the emergence of AI in investment commentary and AI in fund research as developing investment ideas, decision-making and market reporting facilitated new ways of using natural language processing (NLP) and GenAI. While NLP allows machines to process unstructured data into structured forms, AI in investment commentary further enhances its capabilities by producing creative and sophisticated outputs, such as generating new datasets, scenarios or highly tailored reports that improve decision-making across investment processes.[5]

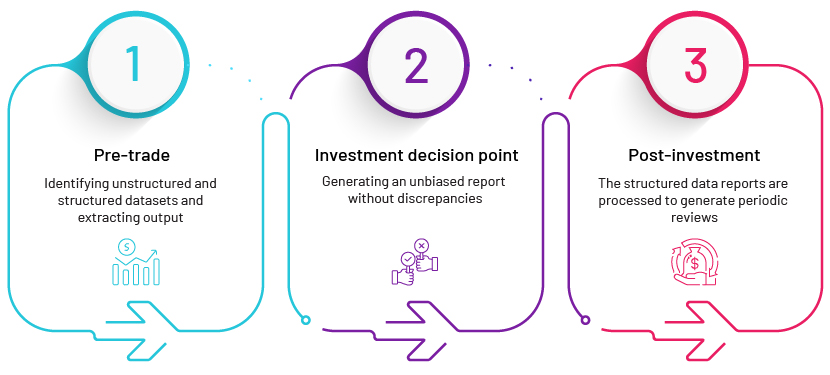

Technology can make use of such datasets to extract investment decision processes in three separate phases:

-

Pre-trade: AI adoption of AI in fund research, including GenAI, can reduce analysts' time spent identifying and evaluating investment ideas by leveraging structured and unstructured datasets.[6] GenAI, with its advanced contextual understanding, can stimulate multiple trading scenarios and generate targeted insights, aiding in investment ideation and risk assessment.[7]

-

Investment decisions: NLP can process decision-making-related data to generate an unbiased report describing the decision, including constraining factors. GenAI builds on this by identifying subtle data patterns and creating predictive analytics models that empower portfolio managers to make forward-looking, optimised decisions with the aid of AI in fund research.

-

Post-investment: Index performance can be easily picked up by AI in investment commentary to generate performance attribution reports and periodic investor reviews, improving accuracy and reducing production costs of reports based on the performance and strategy of investment portfolios.[8] GenAI can automate the creation of sophisticated visualisations and tailored reviews, delivering higher engagement and a competitive edge in client reporting.

The following chart explains the different phases:

Assessing the degree of AI integration in asset management

The Appen State of AI 2020 Report reflects that nearly 41% of global companies started integrating AI into most of their processes after the pandemic. Investment in setting up automation via AI has picked up pace to accelerate the adoption of remote working, augment the user and customer experience and reduce labour costs.[9]

The use of algorithms in asset management to devise novel trading signals and execute trades at a lower cost is a significant advantage of AI adoption. The technology can also improve risk modelling and forecasting by generating insights from new data sources.

AI/machine learning (ML) was also found to have a significant impact on data-driven business strategies, as reflected in several subdomains of asset management.[10]

The biggest asset management conglomerates, such as BlackRock, outsource AI tools including Aladdin Wealth, Future Advisor, iRetire, and Advisor Center to improve the user experience and interfaces.[11] Goldman Sachs, an American multinational investment bank, collaborates with H2o.ai by leveraging AI to provide optimal trading and investment opportunities.[12] JP Morgan has a dedicated AI research team to explore and advance cutting-edge research to smooth the client experience in dealing with their assets.

How AI is transforming the asset management sector

The use of different models is having a significant impact in the asset management sector, according to a CFA Institute study on the use of AI in asset management. The NLP approach can extract economically meaningful information from different sources (such as articles, annual reports and blogs) and interpret context and sentence structure. Another widely used model is LASSO regression, which automatically picks the highest explanatory future returns from a large set of return-predictive signals; this is also used to identify lead-lag relationships between asset groups and markets [13] a key aspect of AI in fund research.

| Type of AI tool | Functionality/objective | Business use case |

| Conversational AI | Customer support – improves response time to 24x7; e-commerce – product recommendation, order and payment assistance; education – subject-specific queries/language learning | Intercom’s Fin can automate and streamline customer interactions Babylon Health provides AI-driven preliminary consultations; Duolingo leverages interactive learning. |

| Stock-picking AI (random forests, support vector machines, and neural networks) |

|

Sia Partners has helped fund managers absorb more information at a lower cost. [14] |

| Proprietary metrics development | The model analyses over 6,000 broker reports per day and over 5,000 earnings call receipts each quarter. | BlackRock leverages this process by following a rigorous testing and approval process.[15] |

| Anomaly-detection API | The tool predicts the anomaly status of the last data input | IBM incorporates this for univariate and multivariate time series data[16] |

| Generative text AI | The tool enables the automation of up to 80% of tedious and repetitive tasks, especially in commentaries. | It saw an average rate of interest of 209% over three years and reduced the time taken by 60%[17] |

As AI/ML has the potential to revolutionise sectors by automating multiple processes, improving decision-making and enhancing customer experience, we expect several areas to be enhanced in the future.

Advancements in using AI to predict fluctuations in science and technology have been revolutionary. However, there are still questions about integrating AI in fund research. Automating commentaries and formulating datasets using AI is making progress in adapting AI and ML in market research. This helps generate investment commentaries based on market and human behaviour. It is important to handle AI research properly, to avoid potential consequences.

How Acuity Knowledge Partners can help

We have been the leading provider of customised research, analytics, and technology solutions to the financial services sector for over 20 years. Our Data Analytics team offers defined automation processes for investment banks, advisories, and private equity firms. The team’s expertise ranges from digital engineering services to data engineering, data science, and AI and enterprise platform services. Our robust data management framework acquires and processes datasets through exploratory data analysis and feature engineering. The team also employs deep learning, NLP, and stochastic/statistical modelling to analyse unstructured datasets, delivering valuable insights, proprietary outputs, and customised reporting. The team has significantly improved retention and acquired new clients by developing and implementing in-house AI commentary-generating tools.

Our pragmatic RoI-driven approach has identified key client challenges and formulated a milestone-based framework with clear timelines. The team plays a pivotal role in guiding and supporting our clients to effectively implement emerging technologies in their financial operations.

Source-

[1] Generative AI Market Size, Share | Research Report [2032]

-

[2] Artificial intelligence (AI) | Definition, Examples, Types, Applications, Companies, & Facts | Britannica

-

[3] Artificial Intelligence Opens Up The World Of Financial Services (forbes.com)

-

[4] Open Access proceedings Journal of Physics: Conference series (iop.org)

-

[5] Generative AI Market Size, Share | Research Report [2032] Artificial intelligence (AI) | Definition, Examples, Types, Applications, Companies, & Facts | Britannica

-

[7] Artificial Intelligence Opens Up The World Of Financial Services

-

[9] COVID-19 increased use of AI. Here's why it's here to stay | World Economic Forum (weforum.org)

-

[11] Artificial Intelligence and Machine Learning in Asset Management (blackrock.com) Page: 5

-

[12] Artificial Intelligence at Goldman Sachs – Current Initiatives | Emerj Artificial Intelligence Research

-

[13] Bartram, S., Branke, J., & Motahari, M. (2020, August 28). Artificial Intelligence in Asset Management. CFA Research Foundation Literature Reviews, 15-17.

-

[14] The Role of Artificial Intelligence in the Asset Management Industry (sia-partners.com)

-

[15] Artificial Intelligence and Machine Learning in Asset Management (blackrock.com) Page 7

What's your view?

About the Author

The investment commentary production team at Acuity Knowledge Partners is a meticulously selected group of CFA-level writers dedicated to creating high-quality, research-focused, and curated content. This team supports over 20 global asset managers, generating more than 2,000 write-ups across major asset classes. Over the past two decades, Acuity's investment and fund commentaries team has also served as the primary intelligence unit, producing regular economic and capital market analyses for both internal and external publications and distributions.

Like the way we think?

Next time we post something new, we'll send it to your inbox