Published on July 8, 2025 by Dilip Gurunath

Introduction

Index rebalancing is a mechanism to keep an index accurate. It is the process of periodically realigning the weights of assets to ensure reliability, accuracy and relevance of all the constituents of the index in accordance with a predefined benchmark or index. During every rebalancing or reconstitution, major rebalancing events can shift trillions of dollars in passive flows, create short-term price surges and fuel institutional trading.

Index rebalancing can lead to sector trends and a substantial shift in trading volumes and affect stock prices and broader market sentiment.

Impacts of index rebalancing

-

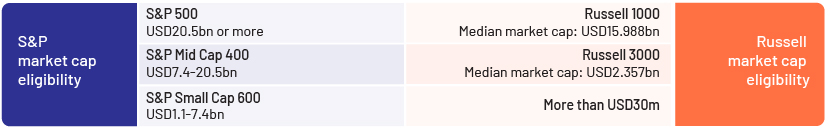

Adjusting rundowns between small-cap, mid-cap and large-cap securities to replicate deviations that have occurred over the past 12 months. Rebalancing reassesses constituents based on their investment norms to determine eligibility for inclusion in the index based on their value and growth.

-

Rebalancing adjusts index composition to ensure it is relevant and reflects accurate constituent data, leading to investment opportunities, portfolio adjustments and tax-related consequences.

Rebalancing benchmark strategies

-

Periodic rebalancing: Rebalancing occurs according to a fixed schedule (quarterly, semi-annually or annually)

-

Threshold-based rebalancing: Rebalancing is triggered only when asset weightings deviate beyond preset limits

-

Ad hoc or event-driven: Rebalancing occurs when a major event (merger, delisting, corporate action, sector classification change) forces a change

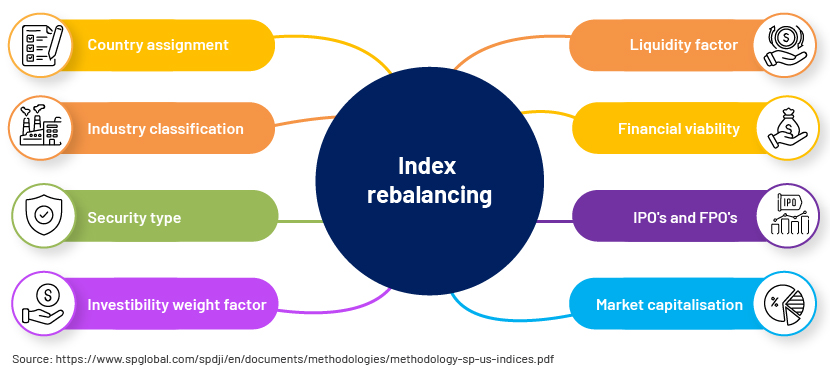

Key parameters of index rebalancing

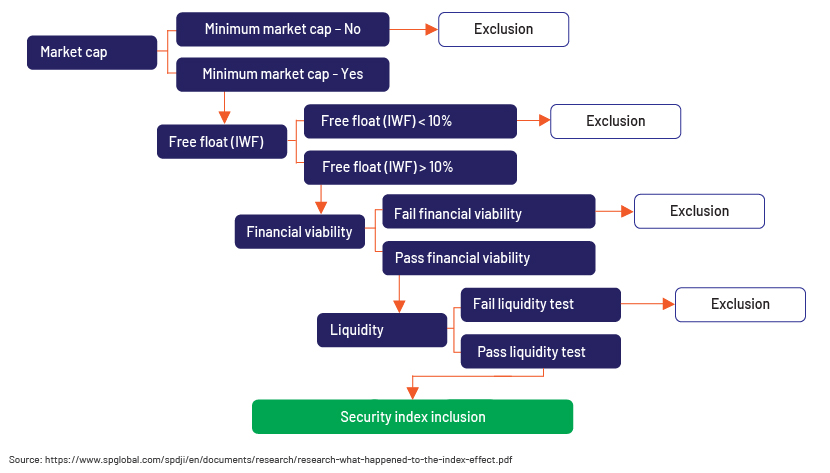

Constituents must essentially meet the following eligibility parameters to qualify for consideration for index inclusion. These key parameters determine whether all eligibility criteria are met.

Detailed explanation of key parameters of index rebalancing

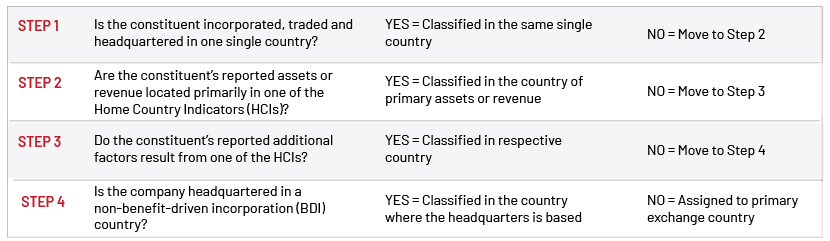

Country assignment

Domicile assignment becomes complex and challenging when constituents in frontier or emerging markets seek developed-market tax and legal systems. When a domicile is chosen based on convenience, certain additional information and procedures for domicile assignments are considered:

Industry classification

Constituents will be revised according to the Global Industry Classification Standard (GICS). Based on the GICS classification benchmark, each constituent is assigned to a sub-industry, corresponding industry, industry group and sector. At each of the four levels, a constituent can be classified only into one grouping.

Organisational structure and security type

The issuing constituent must be a “corporation”, and securities issued should be “common stock”. Common stock or ordinary stock (i.e., shares) and “corporations” (including equity and mortgage REITs) are eligible for inclusion.

Float-weighted market capitalisation

Market capitalisation (cap) signifies the “market value” of a constituent. Market cap is computed based on the total number of outstanding shares multiplied by the current market price of the share. Constituents qualifying for total company-level market cap criteria are also required to have security-level float-adjusted market cap, which must be at least 50% of the corresponding index’s total company-level “minimum market cap” threshold.

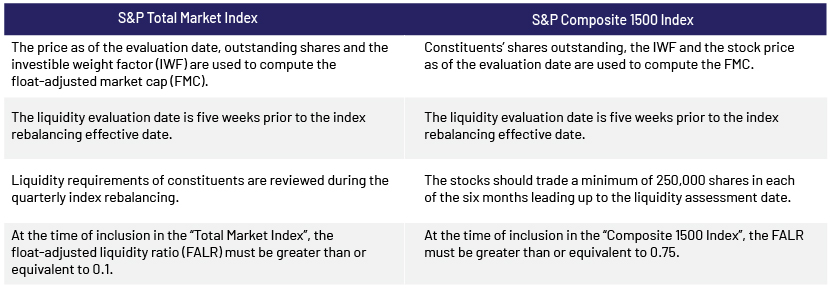

Liquidity

A float-adjusted liquidity ratio is a methodology used to measure constituents’ liquidity. The annual dollar value traded of a constituent is defined as the average closing price of the constituent multiplied by historical volume traded over the “365 calendar days” prior to evaluation date. Liquidity is analysed using composite pricing data and all publicly reported US consolidated volumes.

Financial viability

The index constituents’ financial viability test is conducted only when the sum of the most recent four consecutive quarters’ earnings (net income and excluding discontinued operations) computed based on Generally Accepted Accounting Principles (GAAP) is positive. For REITs, financial viability is computed based on funds from operations (FFO) and/or GAAP earnings.

IPO seasoning

Eligible companies should be IPO-seasoned for a minimum of 12 months.

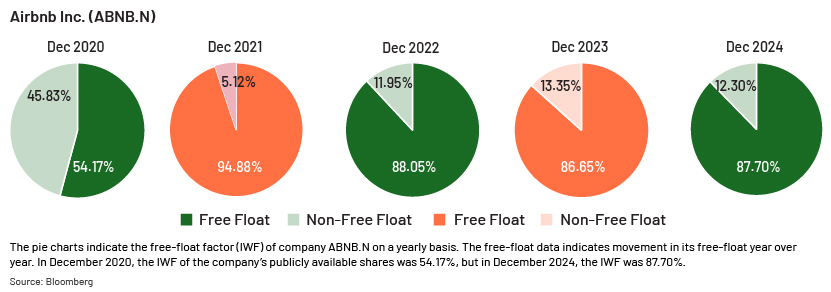

The investible weight factor (IWF)

The free-float/investible weight factor (IWF) signifies the outstanding shares of a company owned by public investors that are freely tradable in the secondary market and are not restricted [i.e., held by insiders (officers and directors), strategic investors, large private holders or government bodies]. The minimum IWF of an S&P Index constituent should be at least 10% free float (0.10).

Flowchart model of inclusion and exclusion of securities from equity indices

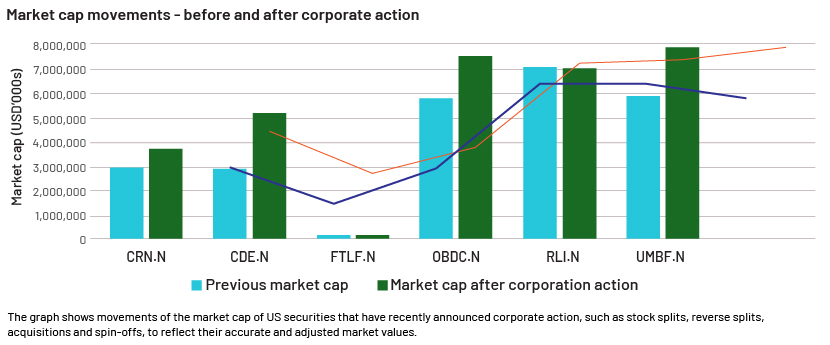

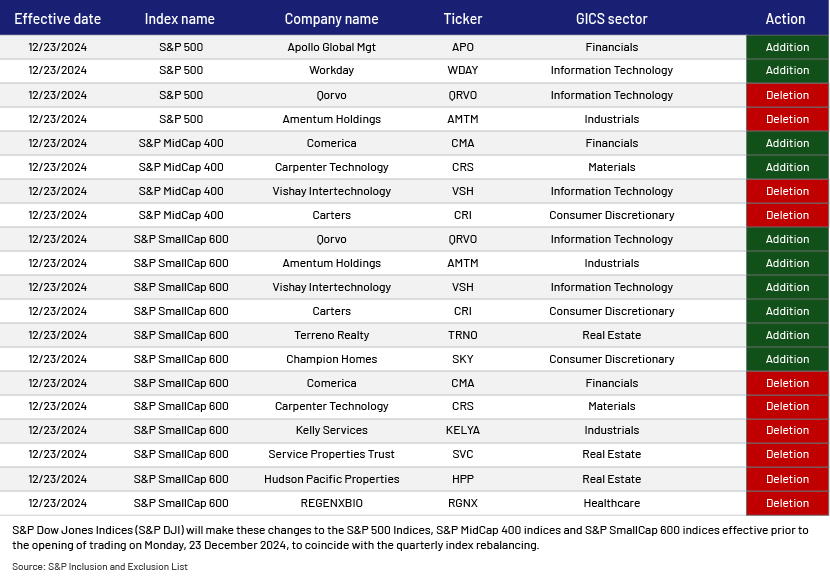

The following illustrates actual index rebalancing, showing addition and deletion of live constituents of S&P Dow Jones Indices (S&P DJI):

Consequences of inappropriate validation of index rebalancing

-

Inaccurate rebalancing can lead to shifts in different market sectors, incorrect free-float (IWF) data and illogical index weightings, impacting security performance and triggering a realignment of the index and changes in holdings.

-

Improper rebalancing can create short-term price volatility during execution, leading to higher turnover and potential transaction costs.

-

Index exclusion/inclusion can be exploited by arbitrage and forces funds to buy high and sell low in extreme cases, resulting in taxes on capital gains.

-

Affects investment strategies, portfolio performance, trading and risk management approaches. For index-tracking funds (ETFs), index rebalancing directly affects their portfolio composition.

How Acuity Knowledge Partners can help

We are one of the world’s leading third-party vendors of index support, with more than 16 years of experience in supporting some of the top benchmark index providers. We offer end-to-end index support services under one roof, providing reference and index data and analysis, index creation and index operations across strategy, benchmark and thematic indices, index marketing and client servicing.

By leveraging our broad suite of index solutions and services, our clients can move up the value chain and overcome budgetary and research-bandwidth constraints. We help our clients develop and test new and monetisable research ideas. Furthermore, our research and analytics expertise and ability to take on regular maintenance work free up their time to focus on higher-priority objectives.

Key support to buy-side and sell-side service providers:

-

Help in creating quantitative models to predict changes in index composition and stock weightings

-

End-to-end analysis of historical data, market indicators, statistical analysis

-

Assistance in identifying patterns and trends for informed decision-making

-

Applying advanced techniques including market sentiment and macroeconomic events

Sources:

-

https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-us-indices.pdf

-

https://research.ftserussell.com/Analytics/FactSheets/temp/5bcb1070-b366-4e4c-88fe-ff9970588caf.pdf

-

https://www.spglobal.com/spdji/en/documents/research/research-what-happened-to-the-index-effect.pdf

What's your view?

About the Author

Dilip has been with Acuity Knowledge Partners for past 10 years part of Investment Operations and Risk Services, supporting a global investment management firm in index data review. Prior to Acuity, he worked at Thomson Reuters, supporting Reference data team. He pursued his MBA from The Oxford College of Engineering and Management, Bangalore specializing in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox