Published on February 3, 2022 by Gunjan Upadhyay

French author François de La Rochefoucauld said, “To eat is a necessity, but to eat intelligently is an art.” This maxim has been guiding the global food industry, with consumers becoming increasingly conscious about the health and environmental implications of the food they eat.

What is safe food?

A study by the University of Michigan on 5,800 food items discovered that 0.45 minutes of healthy life are lost per gram of processed meat consumed, while 0.1 minutes are gained per gram of fruit intake. This is based on the Health Nutritional Index (HENI) and calculated factoring in 15 dietary risk factors associated with the food items in question. The research considers the environmental and health impacts of each food item, and foods contributing to global warming are not considered to be a healthy choice. The study ranks food items based on their HENI scores and asserts that food such as fruits, legumes and candy add positive health minutes. Meanwhile, other food items, including poultry, dairy, grilled chicken and sugar, have negative HENI scores.

The study advocates increasing consumption of food with positive HENI scores (or positive healthy minutes) and avoiding ones with negative HENI scores. A simple way to do this is by replacing processed meats with greens. Meat alternatives, such as plant-based meats, also present a viable choice, with significant market opportunities for food tech and consumer packaged goods (CPG) companies.

Plant-based meats – a necessary trend for a sustainable food system

We rarely stop to think about the environmental costs associated with common foods such as meatballs and burgers. Here are some quick facts:

-

Meat consumption doubles greenhouse emissions compared with vegetarian diets. Emissions rise 2.5x vis-à-vis vegan diets, according to a study by the University of Oxford

-

Animal agriculture accounts for less than 20% of global food supply but 77% of global agricultural land

-

The conventional meat industry ranks higher than the entire transportation sector in terms of greenhouse gas emissions

-

Cattle ranching for beef supply is responsible for 80% of the depletion of Amazon rain forests, according to the Yale School of Forestry & Environmental Studies

-

Apart from environmental impacts, conventional meats also increase the risk of heart disease, cancer and diabetes, according to studies by the University of Oxford. Processed meat, in particular, has been found to be dangerous to health due to concerns over food safety and the presence of genetically modified organisms (GMOs)

The UN admits the conventional meat industry is the major cause of global deforestation, water contamination and soil depletion. Furthermore, with the global population expected to reach an estimated 10bn by 2050, meeting meat demand of this scale would be highly challenging for the food industry.

These issues have put conventional meats in a grey area in the eyes of climate- and health-conscious consumers. The rationale of remaining invested in the conventional meat market now seems skewed. Alternative meats could help mitigate this situation.

Meat alternatives such as plant-based meats use 47-99% less land than conventional meat, with negligible water and nutrient pollution, according to the Good Food Institute. The manufacturing process is also far less taxing on the environment in terms of water and land usage as well as greenhouse gas emissions.

Consumers are increasingly perceiving plant-based meats as a safe, healthy and tasty food choice that works around the adverse environmental impacts of livestock farming. The plant-based meats industry is showing promising growth and rapid consumer acceptance.

Exploding market expectations

The meat-free movement is taking off at an impressive pace. A Bloomberg study expects the plant-based food market to exceed USD162bn by 2030 from USD29.4bn in 2020, a 451% jump. The growing preference for sustainable and healthier diets is even attracting the sizeable global meat industry (worth over USD1.4tn) to plant-based meats.

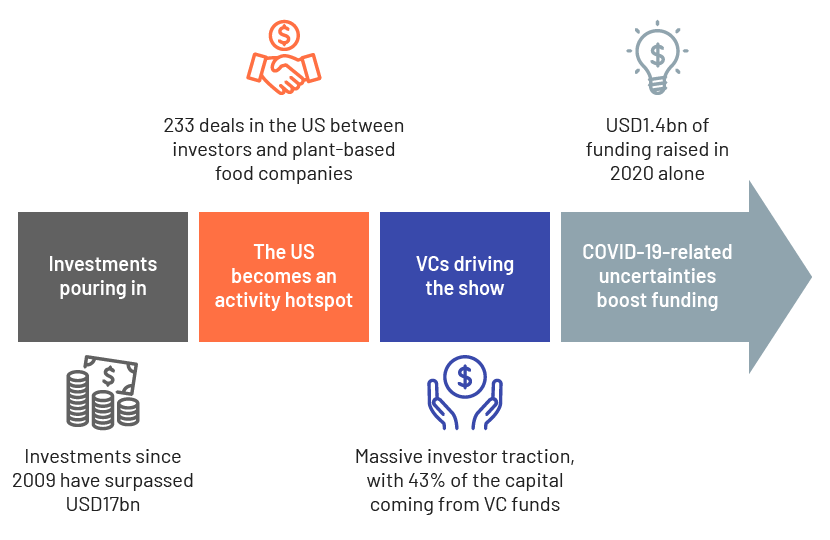

The COVID-19 crisis also accelerated the pace of market growth. The meat market was marred by significant supply-chain disruptions due to processing plant closures. During the pandemic, people made healthier food choices, shifting from conventional meat to alternatives. Consequently, 2020 witnessed an abundance of investment in and big wins for the alternative meat industry.

Growing investment in the plant-based market

The surge in investments has caught the attention of the global food industry, with global companies, such as Unilever, Kellogg and Nestlé offering their own plant-based meat brands for the masses. Meat companies such as Tyson, JBS and Perdue have rebranded themselves as "protein companies" and have been acquiring plant-based brands.

Leading players in the plant-based meat market, such as Beyond Meat, Impossible Foods and Oatly, are expected to profit more than conventional meat producers soon. They have started to collaborate with restaurants and fast-food chains, challenging stereotypes around plant-based foods. Brands are now investing in product innovation and launching plant-based alternatives that are convenient and healthy, appeal to children and taste exactly like real meat.

Trends promise long-term growth – changing food preferences and investor interest make a case for the alternative food industry

-

The rise of flexitarianism, a diet comprising mostly plant-based foods with moderate amounts of meat and animal products, brings opportunities for meat alternatives: One in four meat consumers is trying to limit their animal-product consumption, according to a Gallup survey. There is also an age factor at play here, as young adults seem more likely to give up animal-based food

-

Food technology and innovation: Food technology and innovation have been witnessing significant growth since 2017. Several start-ups have been launched, and the mainstream industry is investing heavily in research and innovation

-

Vegan population: The aversion to meat products due to ethical, environmental and health reasons has created an ever-growing number of vegans/vegetarians

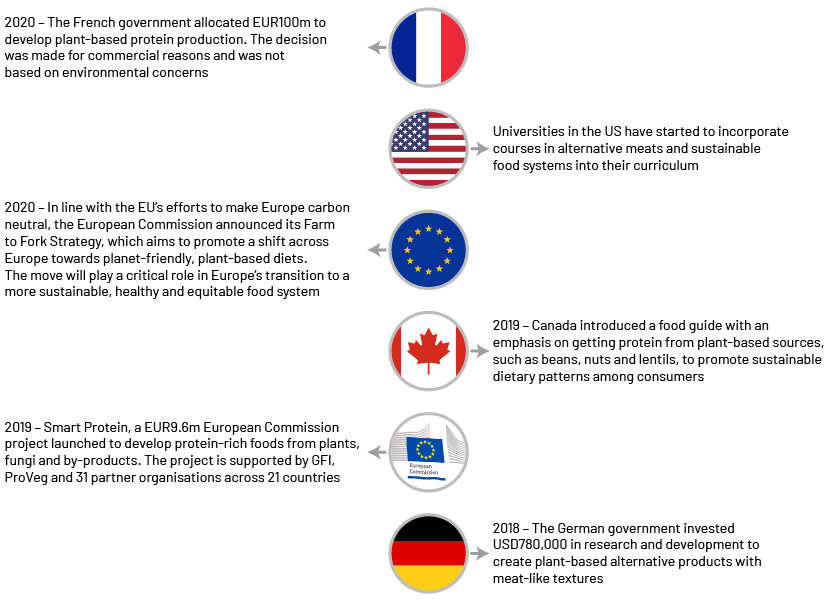

While the demographics and trends are on the producer’s side, food manufacturers are working on strategies to deal with market pushback, including fluctuations in key ingredient prices, reluctance to adopt plant-based diets due to dietary inertia, high prices, lower preference among men for plant-based diets and the convenience associated with animal-based products. However, there is hope as regulators and governing bodies make positive policy moves globally and working to accelerate growth in the segment.

Government initiatives promoting plant-based meats

Going meatless is the future, and the food tech industry is not complaining

Plant-based meat has been received positively by consumers. Effectively marketing alternative proteins and their benefits will also help bring more people aboard the plant-based meat movement. Brands are developing new products that try to meet the requirements of both conventional meat consumers and health-conscious customers. The launch of a lower-fat version of meatless ground beef by Beyond Meats in 2020 is an example.

Opportunities for stakeholders across the food tech and consumer goods industries to invest in and profit from this market are abundant. The food industry is on the verge of reinventing itself to become friendlier to the planet, pocket and palate, and the best time to invest is now.

How Acuity Knowledge Partners can help

We support clients with deep-dive research across industries, including food tech, CPG, retail, financial services and consumer goods. Our pool of professionals experienced in consumer market risk analysis, theme-based research and trend analysis help clients identify investment opportunities by analysing the latest market and consumer trends. We also provide other value-added services to help clients understand the global market landscape better and assist in designing product strategies to ensure a competitive edge.

Sources:

https://www.idtechex.com/en/research-report/plant-based-meat-2021-2031/823

https://sentientmedia.org/plant-based-meats/

Alternative and Plant based Meat Market reports

What's your view?

About the Author

Gunjan Upadhyay has over 11 years of experience in research and consulting. She works as a subject-matter expert, specialising in the consumer products, FMCG and retail markets. Gunjan assists leading private equity firms and management consulting clients with industry analysis, opportunity assessment, portfolio strategy and identifying new avenues for growth. She holds an MBA in Finance and a master’s in Economics.

Like the way we think?

Next time we post something new, we'll send it to your inbox