Published on May 5, 2025 by Avishek Suman

Executive summary

Independent research firms play a vital role in the investment research space by offering unbiased and objective insights to institutional investors. However, despite several positive changes in the industry, these firms have largely remained relatively small and niche compared with sell-side research firms. They command a meagre portion of the buy-side wallet, and with the advent of new technology, competition is becoming increasingly fierce. As research budgets continue to be tightened, independent research firms must scale up their research coverage to stay relevant. Partnering with specialised research providers offers a cost-effective solution that not only enhances value but also supports long-term sustainability.

The evolution of independent research firms

Independent research firms have been around for many years. One of the first independent research firms – Value Line – dates back to 1931.

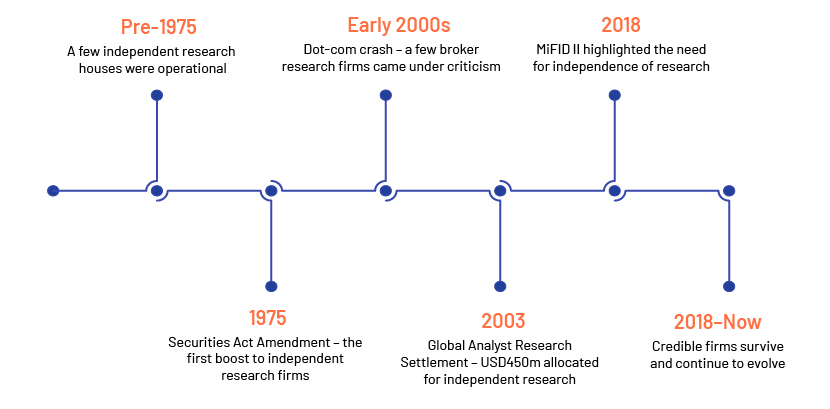

In the US, the Securities Act Amendment of 1975, which aimed at regularising financial markets, spurred the growth of independent research firms for the first time. In the following couple of decades, the industry saw the rise of independent research firms such as Morningstar, which was founded in 1984. The dot-com crash of the early 2000s brought a few brokerage research firms under criticism and further highlighted the need for “independent” research.

A major shot in the arm for independent research firms came in 2003 when the US enforced the Global Analyst Research Settlement, which mandated 10 large broker research firms to set aside US450m to fund independent research for the next five years.

In 2018, the Markets in Financial Instruments Directive II (MiFID II) implemented the “unbundling” provision, which reinforced that research needed to be independent.

Today, the advent of generative and agentic AI is changing the research space rapidly, with independent research firms evolving from niche research boutiques to full-fledged research providers.

Independent research firms: Facing challenges, but are they insurmountable?

Independent research firms solely rely on selling research for revenue. Unlike sell-side firms, they lack investment banking or trading operations. With limited income streams, most independent research firms remain small, niche players focused on a few sectors.

They compete against sell-side firms with large research teams, access to expensive market data and the financial wherewithal to invest in advanced technology. Sell-side firms typically have enormous research coverage of multiple sectors and companies. Bulge bracket sell-side firms also have the resources to develop or acquire tech stacks that provide a distinct competitive edge over their smaller competitors.

Scalability remains the biggest hurdle independent research firms face currently. Excluding market leaders, most independent research firms are small and typically cover only a few sectors and a handful of companies. If these sectors go out of favour due to market vagaries, the research firms risk losing buy-side attention completely.

The limited research coverage of these firms is directly reflected in their share of the buy-side research budget. According to a 2024 survey by Substantive Research, brokerage firms received 85% of the buy-side’s research budget, while independent research firms accounted for a much lower 8%.

Why independent research firms should partner with specialised research providers to attain scalability

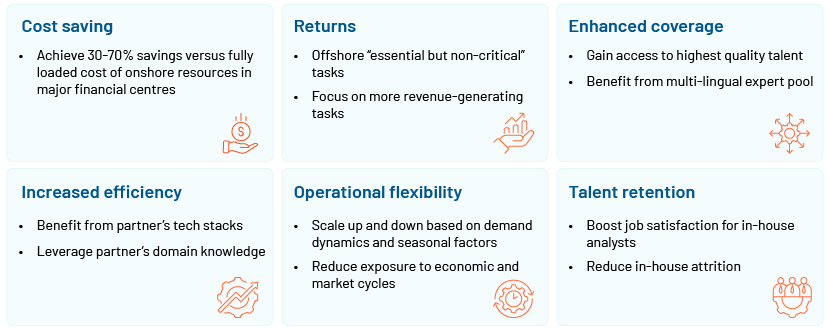

Collaborating with reliable third-party research and analytics firms such as Acuity Knowledge Partners (Acuity) is a workable solution for independent research firms to scale operations and maintain their research coverage. Offshoring a major portion of research tasks ensures cost-effective coverage expansion, while in-house analysts may focus on deeper analysis, strategic decision-making and client management. Additionally, firms such as Acuity come with deep domain knowledge and top-tier talent, enabling research firms to obtain impactful, meaningful insights. Such specialised firms also have strong tech capabilities that can be deployed by independent research firms to move along the value chain.

How Acuity Knowledge Partners can help

We provide research on industry- and country-specific topics to global organisations and research houses and help them make sound decisions. We support our clients in a wide range of areas, including M&A, investment research, industry profiling, financial analysis, thematic research, and macroeconomic and FX research. Acuity also helps clients build databases and provide regular sector coverage. Each output is customised based on the client’s requirement. By leveraging dedicated teams of experienced analysts at our offshore delivery centres, our clients benefit in terms of operational efficiency and cost optimisation.

Sources:

Tags:

What's your view?

About the Author

Avishek Suman manages the Investment Research business at Acuity Knowledge Partners, Beijing. He has close to 19 years of work experience in research, including 15 years in Acuity Knowledge Partners. Prior to assuming this responsibility in Beijing, Avishek served as Delivery Manager for buy-side and sell-side clients.

Like the way we think?

Next time we post something new, we'll send it to your inbox