Published on May 16, 2025 by Aayushi Bhardwaj

Introduction

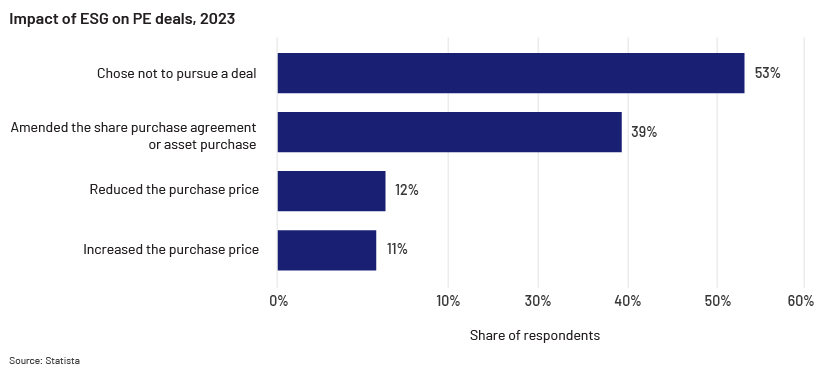

Several countries worldwide have mandated compulsory environmental, social and governance (ESG) disclosures following burgeoning awareness and demand from stakeholders. The investment space, including private market, has not been untouched in this context. According to the latest data available, since 2023, ESG has influenced investment decisions in public and private markets alike. While 40% private equity (PE) firms globally have confirmed that original purchase deals were edited in 2023 to better suit their ESG needs, 53% deals were dismissed, due to unsatisfactory ESG performance.

As regulatory frameworks tighten, stakeholders are demanding greater transparency because of which the need for ESG know-how is growing rapidly. Private market has come under increasing pressure to integrate ESG considerations into their investment decisions, not only to ensure compliance but also to drive long-term value and resilience. Investors, consumers and policymakers expect businesses to disclose climate risks, social impact and governance practices accurately. This shift has created strong demand for ESG professionals who can navigate complex reporting requirements, implement sustainable strategies and align corporate goals with global sustainability standards. One of the models that satisfy this growing need which are witnessing innovation incessantly.

This blog dives deep into the possible future of such outsourcing initiatives.

ESG outsourcing empowering ESG goals

Outsourced ESG management is driving ESG success by assisting private market investors and other significant stakeholders with expert guidance, technology-driven solutions and efficient compliance management. Additionally, outsourcing partners shoulder the entire responsibility of bringing industry-specific knowledge. By leveraging third-party providers, private companies can enhance their sustainability journey through ESG administration outsourcing, cost-effectively without overburdening internal teams.

Third-party service providers are excelling in providing innovative sustainability-related solutions, at the investment and operational levels. These solutions include artificial intelligence–driven analytical tools, end-to-end data management, streamlining of complex regulatory responses and regular updates on relevant reporting frameworks’ norms. This allows stakeholders to focus on their core investment decisions while accelerating their ESG commitments and driving long-term value creation.

In what follows, we discuss the extent to which the assortment of ESG services offered by third-party providers can be expanded.

Evolving ESG outsourcing services

In 2024, . This outsourced support helps firms develop and implement ESG strategies, conduct due diligence, create value, monitor portfolios, plan exits and meet reporting requirements of limited partners and regulators. In addition to ESG directors, chief sustainability officers are amongst other important positions which are being outsourced to third party.

This is a strategic and timely solution for PE and PC firms navigating the growing complexity of ESG compliance and integration. Furthermore, outsourced ESG director service also provides businesses with sustainability leadership on a flexible, cost-effective basis, helping them steer through the evolving ESG landscape. This move will likely revolutionise the availability of ESG expertise for general partners, especially for investment firms undertaking governing roles in their investee companies.

Below, we discuss the differences between independent directors and outsourced ESG directors.

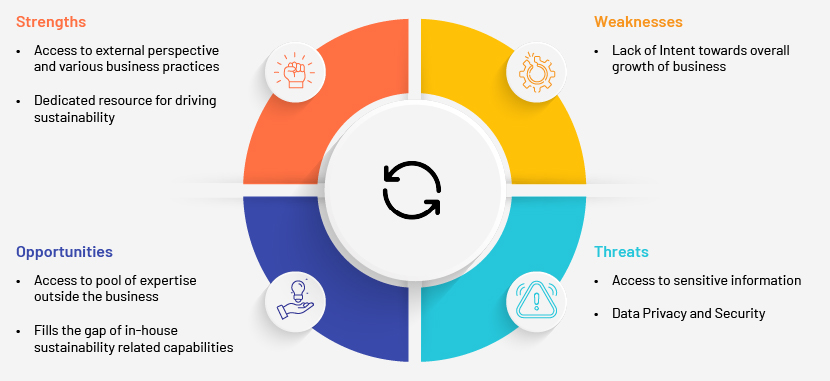

Let us conduct a analysis of this groundbreaking innovation to improve sustainability while delivering business goals. Unlike independent directors in an organisation, the engagement of outsourced ESG directors benefits from flexibility, allowing private market firms to access deep sustainability knowledge without hiring a full-time executive. In addition, these professionals are expected to be highly responsible for bringing external perspectives, industry best practices and scalable solutions, making them integral to firms that lack in-house capabilities. While independent directors will likely be more mindful of their legal obligation to act in the best interest of their clients and stakeholders, the role of an outsourced ESG director is advisory- and operations-centric, which enhances the efficient implementation of ESG frameworks and alignment with regulatory requirements. Therefore, it is safe to say that the growing need for seniority in ESG demands that more organisations replicate the model, which can transform the organisational structure compared to the establishment of an in-house sustainability team inclusive of board oversight. Although, such an engagement also stands at the risk of lack of intent which can pile up as a roadblock in ESG considerations of the firm.

However, outsourcing an executive position to a third party introduces several risks for private market firms. Data privacy and security is one major concern, as ESG directors often manage sensitive company information, including ESG performance metrics, regulatory filings and sustainability strategies. Sharing such data with third-party providers increases the risk of breaches, unauthorised access or mishandling, which could lead to compliance violations and reputational damage

How Acuity Knowledge Partners can help

Acuity Knowledge Partners help companies devise strategies around corporate responsibility. Our research and analysis support helps develop the right policies and procedures to comply with applicable sustainability frameworks. Key tasks within this space include data collection from portfolio investments, template design for internal and external reporting, preliminary and deep-dive analysis of ESG policies, initiatives and procedures relating to target portfolio investments, ESG due diligence and thematic research.

Sources

-

https://www.rsm.global/service/esg-and-sustainability-services/esg-outsourcing

-

https://www.directors-institute.com/post/independent-directors-evolving-role-in-facilitating-esg

-

https://www.directors-institute.com/post/independent-directors-as-catalysts-for-esg-innovation

-

https://www.iodglobal.com/blog/details/independent-directors-and-furthering-board-esg-agendas

-

https://thelegalschool.in/blog/appointment-of-independent-director

Tags:

What's your view?

About the Author

Associated with Acuity KP for past 8 months, Aayushi have an overall experience of ~8 years which spreads over a spectrum of services related to ESG and sustainability. At Acuity, Aayushi is responsible for shouldering clients with various ESG-related responsibilities such as ESG Due Diligence and streamlining regulatory reporting for frameworks such as SFDR, EDCI and PRI for the clients inclusive of other ad-hoc requests.

Like the way we think?

Next time we post something new, we'll send it to your inbox