Published on March 11, 2021 by Shamika Ramanayake

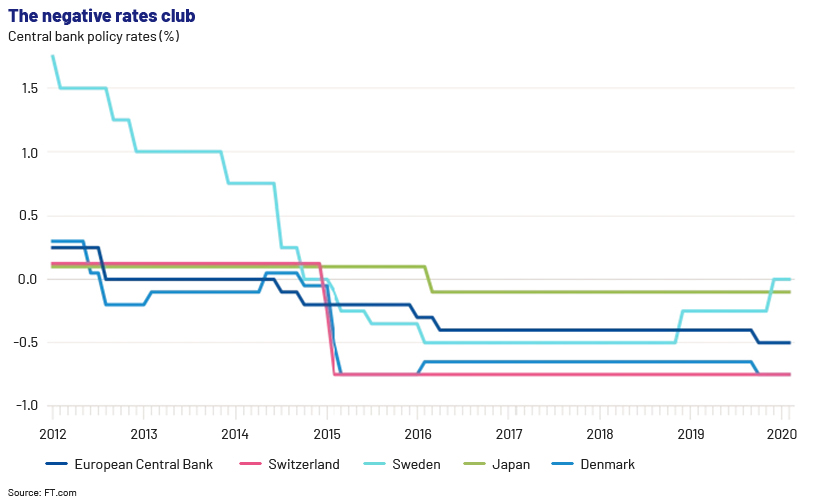

The concept of negative interest rates was hardly used in banking parlance until 2009, when Sweden’s Riksbank, regarded as the world’s oldest central bank, brought the concept into the limelight by lowering the repo rate to -0.1% to revive the country’s growth2. Although the experiment was short-lived, several advanced economies – Denmark, Switzerland, Japan and the European Central Bank (ECB) – later followed a negative interest rate policy (NIRP)3.

Conventional banks would incentivise savers for giving up the utility value of money in the interim and subsequently charge borrowers for the utility value of such money they lend. However, NIRP goes against this equilibrium.

Why a ‘negative interest rate’?

Despite broader arguments for and against an NIRP from central bankers, economists and market operators, a number of underlying factors have accelerated its adoption in advanced economies. Whether used by Japan as a last resort for reviving long-lost growth, Sweden to target inflation, Denmark to stabilise the exchange rate or the EU to stimulate stagnant growth, the potential outcomes of adopting an NIRP are many.

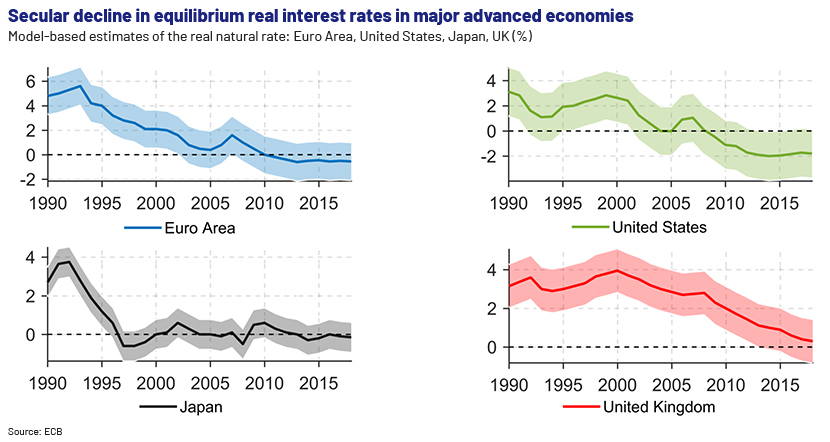

On most occasions that conventional policy tools have run out of steam and been unable to stimulate demand in a downturn, central banks have resorted to pushing near-zero short-term policy rates (real rates) below the zero bound. This has mainly resulted in increased lending by banks, anticipating better returns and simultaneously persuading borrowers (households and firms) to lock in low rates on new loans or refinance legacy debt. Real equilibrium rates have been declining in advanced economies over the past two decades, for these reasons.

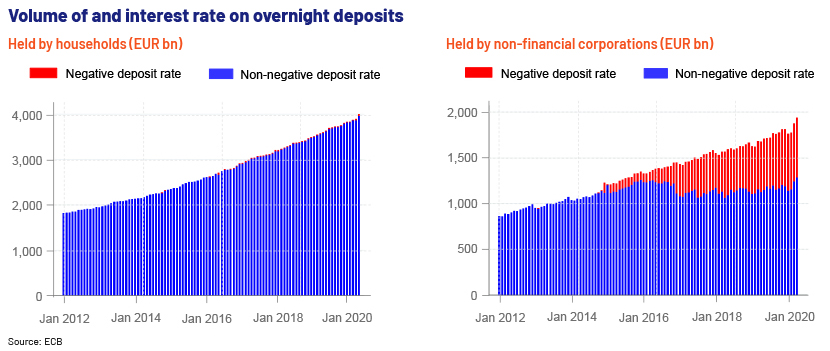

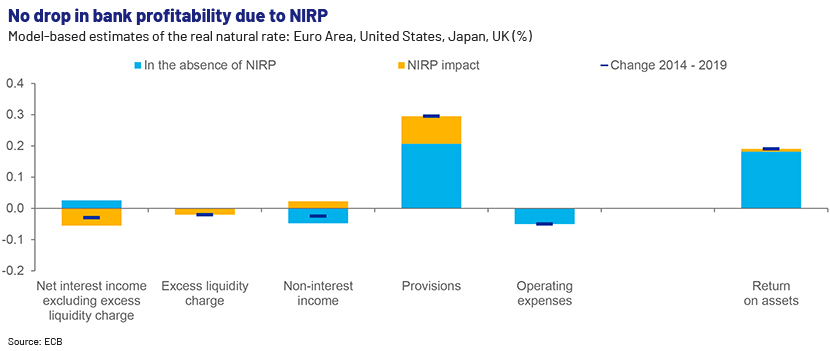

The ECB ventured into the uncharted territory of NIRP in 2014 by lowering the deposit facility rate (DFR) to -0.1%4. Its cautious approach to NIRP over the next six years saw the DFR dropping further to -0.5%5. The negative DFR essentially imposed a tax on reserve cash held by banks with their respective central banks under the Eurosystema.

NIRP effect on Euro-banking

DEPOSITS

EFFECTS |

OUTLOOK |

NEWS FROM DENMARK |

|---|---|---|

|

|

|

LOANS

|

|

|

|

|

|

The ECB’s leniency towards the current negative DFR and accommodative fiscal policy support, aggravated by the pandemic (i.e., the largest-ever EU budgetary stimulus totalling EUR1.8tn14), affirm the EU’s medium-term commitment to reviving the region’s subdued economic activity13. Amid this protracted weaker EU demand, the incentive for the Euro-banking industry to pursue business remodelling agendas to reduce conventional opex through outsourcing, automation and/or hybrid solutions is likely to remain compelling for the foreseeable future. This would eventually result in banks and other financial institutions remaining more operationally agile and lean on cost to deliver better returns for a wider range of stakeholders.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners has extensive expertise in providing services to global banks and financial institutions in Europe, the US and the Middle East.

Our Commercial Lending team is experienced in remotely managing the banks’/financial institutions’ credit portfolios, providing support with covenant monitoring, credit facility renewal, financial spreadsheets, risk rating modules, sensitised scenario modelling, tailor-made periodic reporting and presentations. These services help our clients fast-track cost-optimisation and process re-vitalisation strategies to remain flexible in the marketplace.

Glossary

a. Our Commercial Lending team is experienced in remotely managing the banks’/financial institutions’ credit portfolios, providing support with covenant monitoring, credit facility renewal, financial spreadsheets, risk rating modules, sensitised scenario modelling, tailor-made periodic reporting and presentations. These services help our clients fast-track cost-optimisation and process re-vitalisation strategies to remain flexible in the marketplace.

b. The gross savings rate of households is defined as gross savings divided by gross disposable income, with the latter including the change in the net equity of households in pension funds reserves.

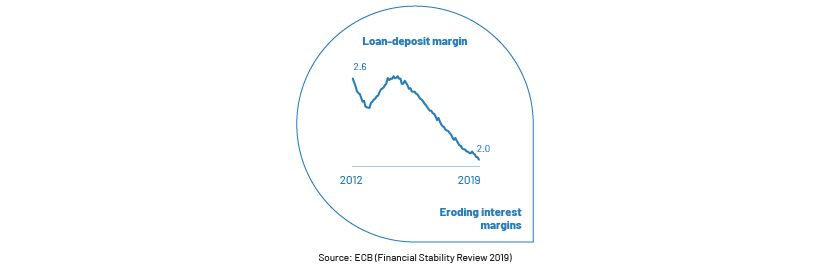

c. The loan-deposit margin is defined as the difference between the average interest rate on loans and the average interest rate on deposits.

References

1. Most popular topic in Investopedia:

10 Most Searched Financial Topics of 2019

https://www.thinkadvisor.com/2019/12/11/10-most-searched-financial-topics-of-2019-investopedia/

2. Sweden’s Riksbank (-)ve rates:

“Don’t do it again! The Swedish experience with negative central bank rates in 2015-201”’ by Economists Fredrick N G Andersson and Lars Jonung, 08 May 2020

3. Danish (-)ve rates:

Danmarks Nationalbank, Monetary review, 3rd quarter (Part 1), 14 September 2012

Danmarks Nationalbank, Monetary review, 4th quarter 2015

https://www.nationalbanken.dk/en/publications/Pages/2015/12/Monetary-review-4th-Quarter-2015.aspx

ECB (-)ve rates:

“ECB introduces a negative deposit facility interest rate”, press release, 05 June 2014

https://www.ecb.europa.eu/press/pr/date/2014/html/pr140605_3.en.html

Swiss (-)ve rates:

“Negative Interest Rate Policy in Switzerland” by Elisabeth Ziegler-Hasiba and Ernesto Turnes, 28 June 2018

https://www.researchgate.net/publication/328139630_Negative_Interest_Rate_Policy_in_Switzerland

Japan’s (-)ve rates:

“The effectiveness of Japan’s negative interest rate policy”, ADBI working paper series, January 2017

https://www.adb.org/publications/effectiveness-japan-negative-interest-rate-policy

4. “Going negative: the ECB’s experience” – speech by Isabel Schnabel, Member of the Executive Board of the ECB, 26 August 2020

https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200826~77ce66626c.en.html

5. Key ECB interest rates

https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html

6. European Banking Federation facts and figures 2020

https://www.ebf.eu/facts-and-figures/ebf-facts-figures-2020-key-documents/

7. Euro indicators, Eurostat 145/2020, 2 October 2020

8. The Euro area bank lending survey, 3Q 2019

9. Jyske Bank annual report 2019

10. The Danish mortgage model

https://www.youtube.com/watch?v=iAqdvNEpoq0

11. Top 1000 World Banks 2020 UK and Europe, press release, 07 January 2020

https://www.thebanker.com/Top-1000-World-Bank-Ranking-European-Press-Release-1593558395

12. Financial Stability Review, November 2019

https://www.ecb.europa.eu/pub/pdf/fsr/ecb.fsr201911~facad0251f.en.pdf

13. Press conference by Christine Largarde, President of the ECB, 10 December 2020

https://www.ecb.europa.eu/press/pressconf/2020/html/ecb.is201210~9b8e5f3cdd.en.html

14. “Recovery plan for Europe”, ECB

https://commission.europa.eu/strategy-and-policy/recovery-plan-europe_en

What's your view?

About the Author

Shamika is a Delivery manager attached to the Commercial Lending division at Acuity Knowledge Partners. Prior to joining Acuity Knowledge Partners, he worked as a Relationship manager/ARM attached to Corporate & MNC banking divisions of several leading banks in both Sri Lanka and UAE. He possesses over 18 years of work experience as a banker which includes 9 years of exposure in FI, MNC, Corporate & Commercial and GRE lending and credit portfolio management in UAE and Sri Lanka. Shamika is an associate member of the Institute of Certified Management Accountants (Australia) and the Chartered Institute of Marketing (UK). Also currently studying for Chartered Financial Analyst Level..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox