Published on June 11, 2025 by Nikita Sushil and Kavya Venati

Uncertainty around trade policies is already creating headwinds for global economic momentum, but there are several other dynamics at play that asset managers should keep an eye on. For starters, even with trade talks alleviating concerns about full-blown trade wars, US tariffs are still likely to be higher than before.[1] The implications could be higher inflation and – amid stubborn unemployment – lower demand, a dreaded combo termed stagflation, which could potentially tip the US into recession.

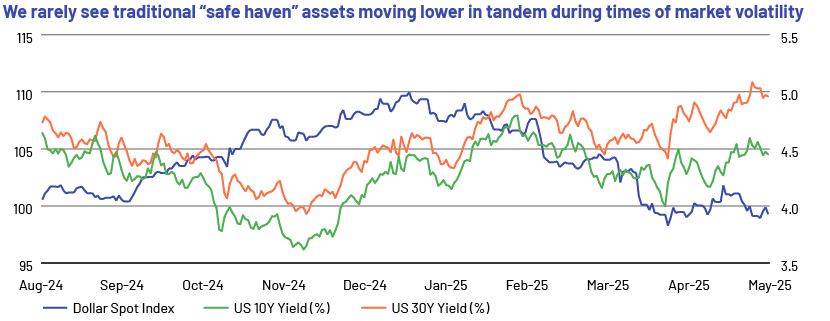

The 12% drop (2-8 April) in the S&P 500 index (within a week of baseline and reciprocal tariff announcements) and the significant surge in “safe-haven” US bond yields that followed suggest that the unprecedented panic and volatility were all-pervasive and agnostic to asset classes.

In this blog, we also discuss how markets are digesting (1) outsized fiscal deficits, (2) visible disruptions to correlations between US equities, bonds and the USD after tariff announcements, (3) rising term premiums and (4) the revival of global inflation risks, which are influencing investment strategies. We also explore how gold and bitcoin are shining brighter amid growing uncertainty and try to find opportunities in adversity that could drive alpha for investors.

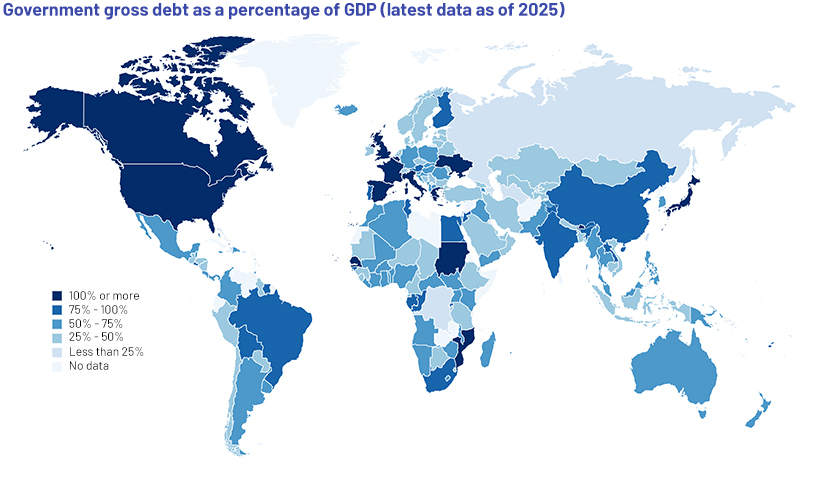

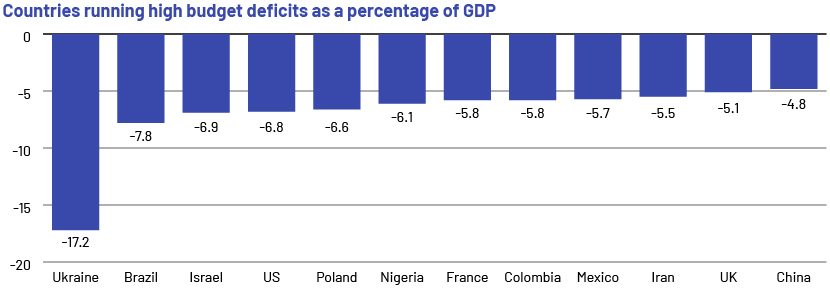

Growing budget deficits remain a pressing issue

Budget deficits are set to rise in 2025 and beyond, due to elevated spending on defence and debt repayments. Almost USD9.2tn worth of debt is set to mature in 2025 for the US alone, against estimated 2025 federal revenue of USD5.49tn.[2]

Sovereign debt issuance is set to rise further globally. The value of issuance by OECD countries is projected to reach USD17tn in 2025 (vs USD15.7tn in 2024).[3]

Furthermore, increased defence expenditure is poised to drive greater deficit spending across major economies this year. Notably, once a staunch defender of fiscal conservatism, the famously prudent German government has joined the bandwagon, easing its long-standing debt brake (Schuldenbremse[4]) to finance defence spending in the face of a weakening transatlantic alliance since the start of the Russia-Ukraine conflict. After the announcement, the once-stable Bunds saw increased volatility, leading to a 30bps spike in the 10-year yield. [5]

Source: www.imf.org

Source: tradingeconomics.com, Bloomberg

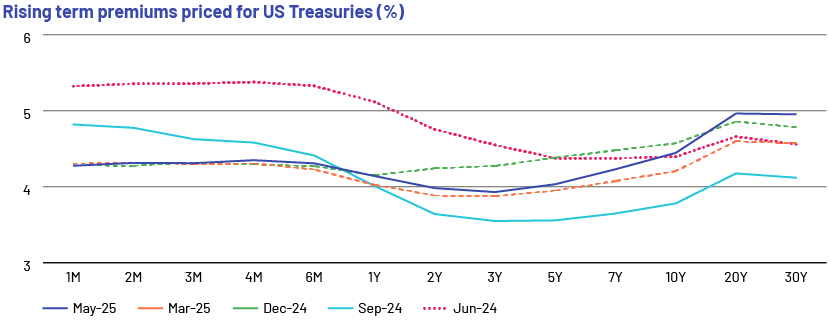

Term premiums are being closely watched by bond vigilantes

Given this context, investment firms may need to re-assess long-duration plays, with rising term premiums becoming the overarching theme in bond markets.

The US benchmark yield curve is less inverted today than it was a year ago, indicating a shift in demand from the long end to the short end of the curve. Heightened policy uncertainty, rising debt and inflation concerns have driven yields higher for longer-dated maturities. President Trump's proposed "One, Big, Beautiful Bill" legislation, which extends many provisions of the 2017 Tax Cuts and Jobs Act (TCJA), in addition to other proposals from Trump's campaign, would exacerbate this already-burgeoning deficit – Moody's Ratings thinks the new bill could add USD4tn to the federal primary deficit, which excludes interest payments, over the next decade. [6]

Source: Bloomberg

Weak demand for long-dated bonds has also extended to JGBs, with the BoJ’s tapering bond purchases weighing heavily on securities against the backdrop of high public debt and other macroeconomic and demographic challenges. The rout witnessed on 20 May 2025 was the worst seen in recent times – a disappointing Treasury auction sent the 40-year JGB to a record high of 3.445%.[7]

Resurgence of inflation on the horizon

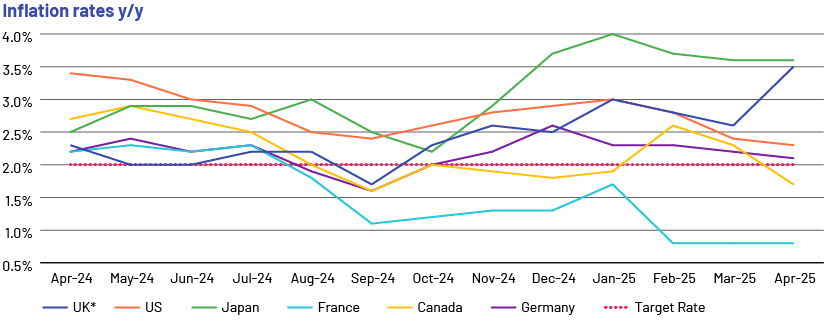

While inflation in several key economies remains above central-bank targets, it has cooled off since the beginning of the year.

*The spike in UK inflation is transitory in nature – it is due to an increase in the Ofgem energy price cap introduced in April 2025, which will be revised down from July 2025[8]

Source: tradingeconomics.com, countryeconomy.com

Yet, we may now see an extended pause in interest rate changes, thanks to President Trump’s tariffs, which are bound to be inflationary in nature.

Stimulus packages – adding demand-side inflation

Some governments are resorting to stimulus packages to absorb exogenous tariff shocks by loosening purse strings. Whether these will further stoke inflation and attract bond vigilantes remains to be seen.

Countries that announced stimulus packages in April 2025 in response to tariffs:

| Spain | Unveiled a EUR14.1bn (USD15.66bn) stimulus package |

| South Korea | Unveiled a supplementary budget, with a stimulus package of KRW12tn (USD8.4bn) |

| Portugal | Announced a USD11bn stimulus package |

Changes emerging in asset-price correlations

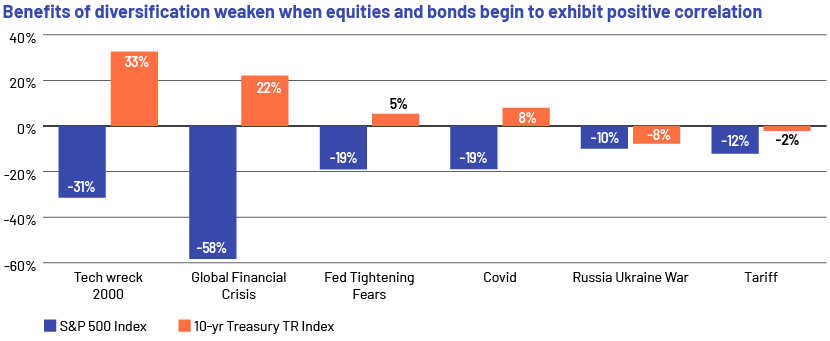

Interestingly, some asset classes have broken away from conventional correlations observed during black-swan episodes; investment firms may need to rethink their tactical strategy of parking funds in bonds during high volatility; previously, bonds shielded investors from the effects of equity drawdowns.

Source: Bloomberg

Concerns of de-dollarisation grow as US exceptionalism loses steam

If USD weakness continues, investment firms are likely to increase currency hedges for US equity portfolios.

Source: https://www.investing.com

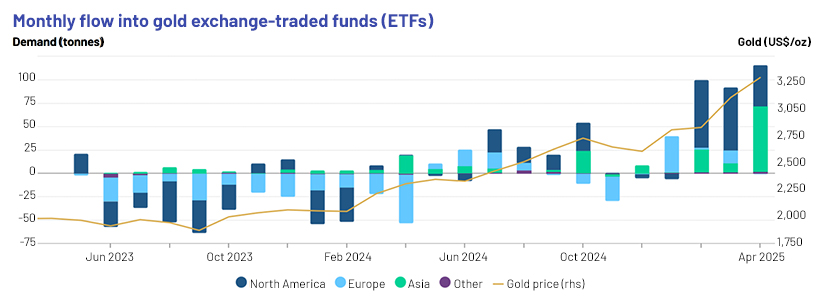

Gold may continue to gain in a widening bid to diversify central-bank reserves

Often seen as a strategic asset, gold has found favour with central banks as an effective alternative to diversify forex holdings beyond the USD – this also mitigates the risk of sanctions and asset freezes.

Demand for gold has surged, with central banks expanding their gold reserves for the 16th consecutive year – they now hold c.35,500 tonnes of gold, representing c.17% of all the gold ever mined.[9]

Supply-side factors have also helped buoy prices – global mining output has remained relatively flat since 2018 due to higher extraction costs.[10]

Source: https://www.gold.org/

Allocations to gold ETFs are expected to remain high, with entities such as the SPDR Gold Shares, the world's largest gold-backed ETF, seeing net inflows of USD8.65bn[11], with most of it coming from institutional investors increasing allocations to gold as an effective hedge, owing to low correlation with assets such as stocks and bonds.

A watershed period for bitcoin as big asset managers line up

Bitcoin’s appeal as a non-sovereign asset has grown amid tariff-related uncertainties, buoyed by investor interest, including the Trump administration’s move to create a strategic bitcoin reserve and digital-asset stockpile – it had clocked gains of more than 12% this year as of 31 May 2025.[12]

In 2024, prominent asset managers such as BlackRock (iShares Bitcoin Trust ETF) and Fidelity (Wise Origin Bitcoin Fund) launched bitcoin ETFs that also drew investments from Goldman Sachs and Morgan Stanley.[13] These funds have delivered returns of c.53% (on a yearly basis as of 31 May), reflecting a stellar performance.[14]

Oil markets being tested by supply glut

OPEC+ has gone on the offensive to defend market share by raising oil production for a third consecutive month, adding output of 411,000 barrels per day (bpd) in July. Additionally, renewed uncertainty over the US-Iran nuclear deal, along with a dim global growth outlook, could test oil markets further in the coming quarters. At the time of writing, Brent crude was down roughly 16% on a YTD basis as of 31 May.

Lastly, emerging markets present opportunities

While the near-term outlook remains fluid, there will be pockets of opportunity within the emerging-market basket that stand to gain from a weak USD, attractive valuations (or yields on the debt side), greater long-term growth prospects and better-controlled deficits, presenting a compelling case. Some of these are also poised to see further rate cuts. The MSCI Emerging Market Index has remained resilient with a +7.6% YTD return as of 31 May, much higher than its developed-market counterpart, which rose +4.2%.

Final thoughts

Systemic shifts in trade relations are set to emerge as market decoupling gathers pace. Investment houses need to brace for higher volatility this year, as President Trump’s playbook is difficult to gauge. The Chinese economy’s response to fiscal and monetary stimulus measures, and its trade dynamics with the US, will be closely watched for clues regarding its growth narrative in the coming quarters. Segments of the market previously considered to be bastions of stability – JGBs, Bunds and US Treasuries – are witnessing significant volatility, anchoring yields in a higher range. This shift has implications for conventional trading strategies. Geopolitics and ongoing military conflicts – be it in Ukraine and Russia or areas in the Middle East – continue to pose risks to regional economic stability. Given the current landscape, policymakers are going back to the drawing board to recalibrate monetary policies to tackle the growth/inflation trade-off. Investment houses may need to rethink their strategies to build portfolios that can absorb volatility, cushion the downside or exploit tactical opportunities, based on what their mandates dictate.

How Acuity Knowledge Partners can help

With our expansive experience in the asset management space over the past 20 years, our SMEs in the Investment Operations and Risk Services (IORS) function have successfully serviced portfolio managers to fortify their portfolios by providing bespoke solutions to actively track their investments. We also enable them to stay ahead of markets and better prepared by offering customised support to determine potential future risks.

Sources:

-

[1] https://www.statista.com/statistics/1557485/average-tariff-rate-all-imports-us/

-

[4] Schuldenbremse is a German constitutional rule introduced during the GFC in 2009 to ensure the country's financial stability. Under this mechanism, the annual federal deficit cannot exceed 0.35% of GDP, while federal states are entirely prohibited from taking on new net debt.

-

[5]https://www.cnbc.com/2025/03/06/bond-yields-rise-globally-german-bunds-continue-selloff.html

-

[7]https://www.reuters.com/business/japans-fiscal-woes-put-boj-bond-taper-plans-test-2025-05-15/

-

[9] Central Banks Rapidly Boosting Gold Reserves: Key Insights

-

[13]https://finance.yahoo.com/news/goldman-sachs-morgan-stanley-buy-101717417.html

What's your view?

About the Authors

Nikita Sushil has 11 years of experience in performance models and risk analytics for fixed-income portfolios. At Acuity Knowledge Partners, she leads client engagements focused on analysing risk and performance parameters for bond markets. Additionally, she contributes through her domain expertise and collaborates with the Technology and Data Science teams on various projects. She commenced her career as an analyst with Northern Trust in the regulatory reporting space and worked briefly with Societe Generale in its Fund Accounting division prior to joining Acuity.

Nikita has been a CFA charterholder since 2018 and has completed her Bachelor of Commerce from Jain University, Bangalore, India.

Kavya Venati has more than 4 years of experience servicing several asset management firms on the performance and risk side for their equity and credit portfolios. At Acuity, she supports clients with investment risk analytics requirement & has undertaken multiple performance and analytics automations to enable process efficiency, was also part of cost cutting efforts for several clients. She exhibits good understanding of various products, performance and risk metrics. Prior to joining Acuity she worked as an Engagement Financial Analyst at Deloitte Consulting USI for a brief period.

Like the way we think?

Next time we post something new, we'll send it to your inbox