Published on July 11, 2025 by Mauricio Rivera Soto and Shirley Canedo Rivas

With the UEFA Champions League (UCL) and FIFA Club World Cup 2025 finals still playing in our minds, we decided to collect some key insights about investing in football teams. Clubs and fans have strong emotional ties, and the decision to go public can attract mixed sentiments. While some fans would appreciate an opportunity to own part of their beloved club, others may worry about commercialisation and erosion of traditional values.

The UCL is an annual football competition featuring the top clubs from Europe. While the English Premier League, Serie A in Italy, Spanish La Liga and Germany’s Bundesliga each have their unique flavour, the UCL’s diverse styles have contributed to unpredictable outcomes, making the championship exciting, which resonates with the audience in virtually every country the matches are telecast live.

While most of these clubs are private, some have launched IPOs, listing their stock on different exchanges.

In what follows, we discuss some of the most popular publicly traded clubs.

Manchester United (NYSE: MANU)

Based in Manchester in England, it is one of the most famous publicly traded football teams. The club has been listed on the NYSE since August 2012. Once the top revenue earner, it ranks 4th globally, with FY24[1] revenue at EUR770.6m (+3.0% y/y).

Borussia Dortmund (ETR: BVB)

Based in Dortmund in Germany, the club (often referred to as BVB) is listed on the Frankfurt Stock Exchange. Borussia Dortmund went public in October 2000. It has achieved significant success in the Bundesliga and UEFA competitions. The club ranks 11th, with FY24 revenue of EUR513.7m (+22.0% y/y).

Juventus FC (BIT: JUVE)

Based in Turin in Italy, Juventus (commonly known as Juve), at 36 wins, is the most coveted team in local league championships, also called scudettos. It is listed on the Borsa Italiana – the Italian Stock Exchange. The club has been publicly traded since December 2001. Juve ranks 16th, with FY24 revenue at EUR355.7m (-18.0% y/y).

AFC Ajax (AMS: AJAX)

Amsterdamsche Football Club Ajax, commonly known as Ajax, is based in Amsterdam. It enjoyed material success in the last century. The club’s shares have been traded on the Euronext Amsterdam Stock Exchange since 17 May 1998. It generated EUR152.0m revenue in FY24.

It is worth noting that the 2024-2025 UCL season has not been kind to the above-mentioned clubs. Manchester and Ajax did not qualify for the tournament. Juventus lost to PSV in the knockout phase play-offs, while Borussia Dortmund was sent home by FC Barcelona in the quarter-final.

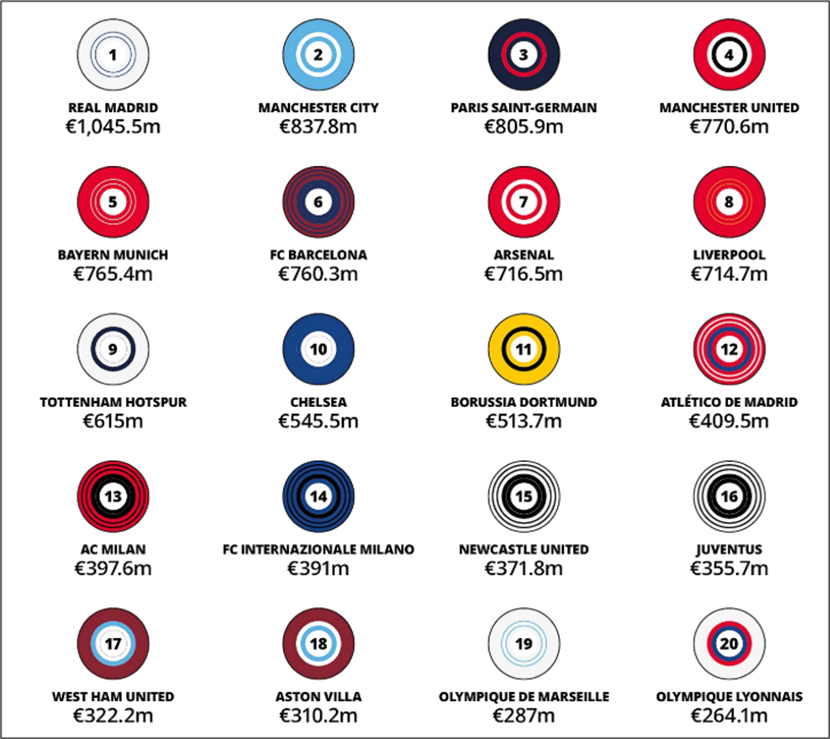

Top football clubs by FY24 revenue

Source: Deloitte

2025 football team valuations

| RANK | Team | Country | League | Value | Revenue | EBITDA | Debt as % of value | Owner(s) |

| 1 | Real Madrid | Spain | La Liga | $6.7B | $1.13B | $125M | 19% | Club members |

| 2 | Manchester United | England | Premier League | $6B | $834M | $186M | 11% | The Glazer family, Sir Jim Ratcliffe |

| 3 | Barcelona | Spain | La Liga | $5.65B | $822M | $66M | 32% | Club members |

| 4 | Liverpool | England | Premier League | $5.4B | $774M | $76M | 3% | John Henry, Tom Werner |

| 5 | Manchester City | England | Premier League | $5.2B | $902M | $148M | 0% | Sheikh Mansour bin Zayed Al Nahyan |

| 6 | Bayern Munich | Germany | Bundesliga | $5.1B | $828M | $68M | 0% | Club members |

| 7 | Paris Saint-Germain | France | Ligue 1 | $4.55B | $873M | $35M | 1% | Qatar Sports Investments, Arctos Partners |

| 8 | Arsenal | England | Premier League | $4B | $772M | $174M | 1% | Stan Kroenke |

| 9 | Tottenham Hotspur | England | Premier League | $3.55B | $665M | $184M | 31% | Joseph Lewis Family Trust, Daniel Levy |

| 10 | Chelsea | England | Premier League | $3.5B | $591M | -$29M | 0% | Todd Boehly, Clearlake Capital, Mark Walter |

| 11 | Borussia Dortmund | Germany | Bundesliga | $2.3B | $551M | $45M | 2% | Borussia Dortmund KGaA |

| 12 | Atlético de Madrid | Spain | La Liga | $2.1B | $442M | $46M | 17% | Miguel Gil, Ares Management, Idan Ofer |

| 13 | Juventus | Italy | Serie A | $2B | $390M | -$43M | 1% | The Agnelli family |

| 14 | Newcastle United | England | Premier League | $1.3B | $400M | $39M | 5% | Saudi Arabia Public Investment Fund, RB Sports & Media |

| 15 | Inter Milan | Italy | Serie A | $1.25B | $423M | $44M | 33% | Oaktree Capital Management |

| 16 | AC Milan | Italy | Serie A | $1.2B | $430M | $71M | 2% | Redbird Capital Partners, Yankee Global Enterprises |

| 17 | West Ham United | England | Premier League | $1.1B | $349M | $70M | 0% | David Sullivan, Daniel Křetínský, Gold family trust |

| 18 | Aston Villa | England | Premier League | $1.09B | $335M | -$60M | 0% | Nassef Sawiris, Wes Edens, Michael Angelakis |

| 19 | Fulham FC | England | Premier League | $1.08B | $229M | -$13M | 15% | Shahid Khan |

| 20 | Los Angeles FC | United States | Major League Soccer | $1.05B | $155M | $13M | 17% | Bennett Rosenthal, Brandon Beck, Larry Berg |

| 21 | Los Angeles Galaxy | United States | Major League Soccer | $1.03B | $107M | $3M | 0% | Philip Anschutz |

| 22 | Inter Miami | United States | Major League Soccer | $1B | $185M | $50M | 20% | David Beckham, Jorge Mas, Jose Mas |

| 23 | Eintracht Frankfurt | Germany | Bundesliga | $930M | $267M | -$60M | 5% | Club members |

| 24 | Brighton and Hove Albion | England | Premier League | $920M | $279M | $12M | 0% | Tony Bloom |

| 25 | Napoli | Italy | Serie A | $910M | $276M | $93M | 4% | Aurelio De Laurentiis |

Source: CNBC

Note: For the 22 European teams, data pertains to the 2023-2024 season. For the three US teams, data refers to the 2024 Major League Soccer season.

Most valuable football teams remain privately held, as high costs and IPO complexities may not outweigh the potential gains from significant revenue, strong global brand appeal and broad fan base. Private ownership allows team owners to maintain control over their clubs’ operations and strategic decisions without the pressure of meeting shareholders’ expectations. Also, public companies must follow strict financial disclosure rules, which may compel them to divulge sensitive strategies. The lack of convergence between fans’ and shareholders’ interests also keep teams away from going public. Fans want an owner willing to spend money to bring the top players and improve sport facilities. Shareholders, in many cases, do not want to spend too much money on the business if they do not see short-term returns. But if they do not, fans will not be happy. This also explains why the vast majority of clubs remain private.

On the flip side, being a fan and an investor can be bittersweet. While the team may improve its position in the standings, the share price may not reflect this success. Additionally, the thrill of a fan when their investment is finally paying off can be dampened if their team is eliminated early from the tournament.

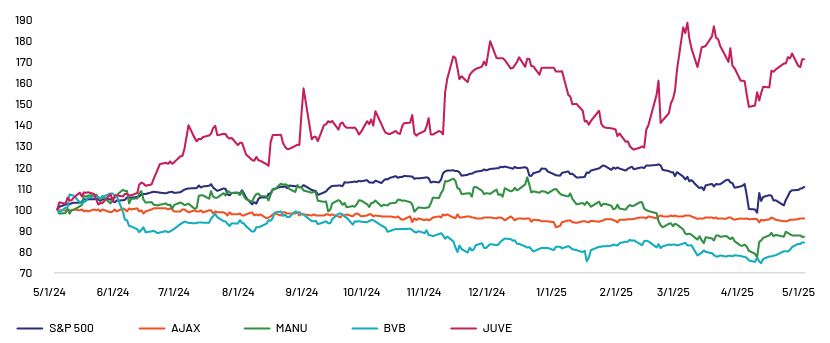

Emotions and loyalty are capitalised in a volatile industry, contributing to price hedging. However, we observe that loyalty does not always translate into profit, evident in the 2024 Sharpe ratio – Juventus (JUVE IM): 1.50; Borussia Dortmund (BVB GY): -0.51; AJAX (AJAX NA): -0.53 and Manchester United (MANU US): -0.70 (source: Bloomberg).

Football club stock prices vs S&P 500 evolution (index base 100)

Source: Investing.com (compiled by the authors)

To analyse the risk correlation with the rest of the market, we considered the Yahoo Beta index (5Y Monthly), which represents a stock’s volatility relative to S&P 500 over a five-year period, calculated on a monthly basis. Only Borussia Dortmund (1.21) showed greater volatility compared to the market, while the other listed teams tended to be less volatile – Juventus (JUVE IM), 0.69, Manchester United (MANU US), 0.63 and AJAX (AJAX NA), 0.19. while the other listed teams tended to be less volatile – Juventus (JUVE IM), 0.69, Manchester United (MANU US), 0.63 and AJAX (AJAX NA), 0.19. Despite these numbers, negative stock price movements are not unusual. Many can be attributed to governance issues. Examples include a 27.7% sale of the voting rights in Manchester United by the Gazer family (in 1Q25), which was accused of limiting other investors’ decision-making power over the team’s activities. Another instance is Juventus’s stock price crash after the 2023 ‘plusvalenza’ scandal, which entailed the inflation of the values of outgoing players to create artificial capital gains. A third case in point is the 2004 Calciopoli incident, where Juventus executives, among others, manipulated referee appointments to favour certain clubs, including Juventus. The scandal came to light in 2006.

Football has multiple channels to attract funds including private market strategies, such as MCOs (multi-club ownership), where investors (including City Football [UAE], Silverlake [US], 777 Partners [US] and Red Bull [Austria]) diversify their investment in different geographies and clubs of varying sizes. In addition, naming rights sales in sports venues have become a popular practice in recent years. Sponsorship deals and loans are also common, such as ‘The Spotify Camp Nou’s redevelopment’ – one of the most relevant ones – for which FC Barcelona secured a financing of USD1.45bn. The conditions are expected to be re-negotiated during 2025 given its improved financial results.

Moreover, according to the UEFA’s Intelligence Centre 2024 report, football clubs that accepted the infrastructure challenge (e.g., Paris Saint-Germain, FC Bayern, Liverpool and Manchester City, as well as smaller clubs including Turkey’s Galatasaray) are more likely to double gate revenue across a 15-year window. In contrast, Chelsea and Manchester United, without major stadium changes, will likely see a drop in their gate revenue.

Football clubs now compete beyond the football pitch, locking horns with the broader entertainment industry, which adds to uncertainty in a business exposed to valuation and risk-assessment challenges. According to the FIFA 2024 report, 83% football fans use a smartphone while watching the sport on TV. Younger generations are interested in not only the game, but also behind-the-scenes developments, which explains why new audiences are following more than one team while others remain loyal to a single team.

Talent scouting has also changed. Teams, such as Real Madrid, are not interested in acquiring the current Golden Ball winner, but in investing in the development and integration of its first team of young players, which has borne fruit in the form of successful players such as Vini Junior and Rodrygo. A different strategy characterises teams (including Inter Miami CF) and even nations with substantial financial muscle, including Saudi Arabia. Both are inducting world-class, highly admired players (Lionel Messi and Cristiano Ronaldo, among others) to their line-up to enhance their global appeal, culminating in record-breaking Google searches by fans as they familiarise themselves to the leagues where their idols play.

Since results in football are unpredictable, different value management strategies are used by football teams to achieve more resilient revenue. For example, despite not holding ‘the Cup’, Benfica and Ajax excel at player-trading, according to McKinsey. Also, teams (such as Liverpool) use cross-cutting technology to excel at squad-building. For instance, Salah (Liverpool), Mané (Al-Nassr F.C.) and Firmino (Al-Ahli F.C.) had earlier signed for a combined total of c. GBP100m before becoming ‘Liverpool’s legendary front three’. This strategy contrasts with other top teams’ approaches to use the same amount to secure only one player. In the coming months, the FIFA World Cup 2026 and all related businesses will likely define most of the returns for many sport investors. Although this will be only one layer, reflecting ‘who’s who’ in adapting to new scenarios and in the implementation of AI tools, since there are strategies whose results may last longer in time but are not immediately seen.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific expertise to rapidly increase internal analyst bandwidth and expand coverage. We have set up dedicated teams of analysts (CAs, MBAs and CFAs, among others) to support our clients on a wide range of activities including idea generation, financial analysis, thematic research, database-building and regular sector coverage. Each output is tailor-made to suit clients’ requirements and made available for clients’ exclusive use. This provides clients a unique, competitive and sustainable edge.

Sources

-

https://www.cnbc.com/2025/05/05/cnbcs-official-global-soccer-team-valuations-2025.html

-

https://www.sportsowls.com/2024/04/why-uefa-champions-league-is-so-popular.html

-

https://www.aranca.com/assets/docs/Investment-Landscape-of-European-Football.pdf

-

https://inside.fifa.com/official-documents/annual-report/2024

-

https://medium.com/@trym.sorum/how-liverpool-made-data-their-competitive-advantage-c1ff8bd84e69

-

Bloomberg

-

Yahoo finance

Tags:

What's your view?

About the Authors

Mauricio Rivera holds a Business Administration degree with a major in Finance. He has been with Acuity Knowledge Partners since 2015 and has experience in both sell- and buy-side equity and fixed income research. Mauricio has covered industries including bank and non-banking financial institution, auto, petrochemical, utility and investment holding for US and Latam markets.

Shirley Canedo holds an MBA from INCAE Business School and has been part of Acuity Knowledge Partners’ investment research team since 2022. She has primarily covered buy-side fixed income instruments across Latin America, with a focus on the banking and utility industries, among others. Outside work, Shirley is a passionate Bayern Munich fan.

Like the way we think?

Next time we post something new, we'll send it to your inbox