Published on April 29, 2025 by Rabin Thakur

The ESG Data Convergence Initiative (EDCI) is a partnership of private markets investors that aims to streamline fragmented environment, social and governance (ESG) data and use it for reporting purposes. The initiative was launched in September 2021 and has grown to more than 475 general- and limited- partner members that command close to USD40tn of assets under management (AuM).

ESG data and metrics have historically been fragmented. The earliest known frameworks and guidance revolved around the basic parameters of ESG, responsible investment or impact metrics. The challenge of obtaining data in private markets was even bigger considering there has been no single standard framework used consistently by private investors.

The ESG Data Convergence project addresses critical gaps in data collection and reporting in multiple ways. Established by founding members CalPERS and Carlyle, the ESG Data Convergence Initiative software enables tracking of standard KPIs that govern data collection and reporting. It should be noted that the KPIs included in the framework are quite straightforward and not complex. At the same time, the EDCI provides comparable data from multiple asset managers, helping the sector benchmark portfolio performance versus peers’.

Key Benefits of the ESG Data Convergence Initiative for Private Markets

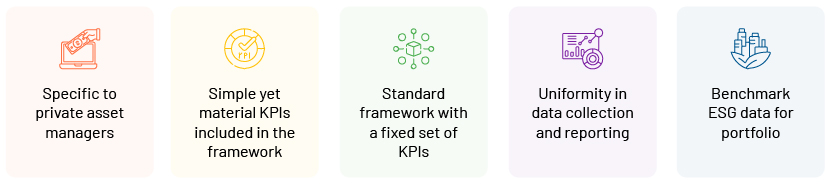

Specificity to private markets: The EDCI is a coalition of private asset managers including limited partners (LPs) and general partners (GPs). Data collection and reporting are governed by data availability and reporting needs relevant to private markets.

Choice of KPIs: The EDCI includes KPIs that are usually the most tracked and the most material to a wide range of businesses. Regardless of the sector an investor is invested in, there would always be a significant amount of uniformity in the data an asset manager reports under the EDCI.

Standard framework for all purposes: The KPIs included are standard across the different themes of investment. There is a mandatory requirement to collect and report data on the KPIs.

Uniform data collection and reporting: Since the EDCI makes it mandatory for members to collect data and report annually on the fixed set of KPIs, all data available under the initiative is uniform in terms of the nature of the KPIs on which data is reported.

Benchmarking your portfolio: The biggest advantage members of the initiative enjoy is the benchmark report that the EDCI allows its users to pull in. Using the substantial amount of data, uniform in nature and specific to private markets, the benchmark reports provide a very good understanding of how the overall portfolio is performing versus peers’ in terms of sustainability.

Standard Metrics in the ESG Data Convergence Project

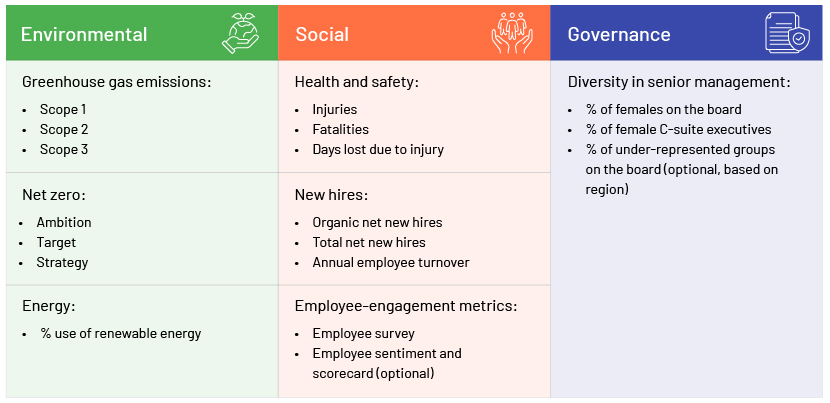

The metrics included in the reporting framework are those widely accepted as part of most frameworks, such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Sustainable Finance Disclosure Regulation (SFDR) and International Sustainability Standards Board (ISSB). This ensures increased coherence for asset managers interested in additional reporting on any of these globally accepted frameworks along with their mandatory disclosures on the EDCI.

Key metrics of the EDCI:

Best Practices in ESG Data Convergence Initiative Reporting

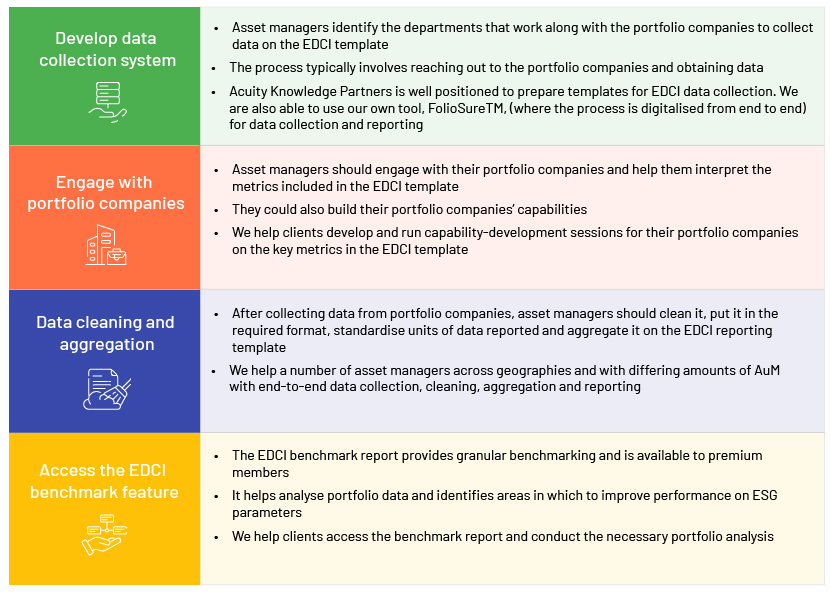

As part of the initiative, asset managers must report on the EDCI template. Best practices in data collection and reporting include the following:

How Acuity Knowledge Partners can help

We are the leading provider of ESG services to the private markets. Our capabilities are developed around ESG data collection, aggregation, analysis and reporting. We support clients with ESG data convergence initiative software and systems for ESG reporting on regulatory requirements of the SFDR and EU Taxonomy. We support clients on either side of the maturity continuum to set up ESG reporting processes.

Sources:

Tags:

What's your view?

About the Author

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Like the way we think?

Next time we post something new, we'll send it to your inbox