Published on January 29, 2020 by Jayraj Gohil and Preeti Rai

The increased incidence of insider trading makes it critical that public companies and their employees be aware of compliance systems in place to keep a check on this illegal practice. Insider trading can be explained as the buying or selling of a publicly traded company’s stock by someone who has access to non-public material information about that stock. In this article, we discuss the laws/sanctions and recent trends relating to insider trading, and potential solutions to minimise risk, specifically in the US.

Insider trading has a significant negative impact on stock markets and companies. It is, therefore, vital to regulate this practice, for the following reasons:

To prevent individuals and organisations from making misappropriations and deriving unfair advantage

To stabilise markets

It is also important to look at the consequences of insider trading. Allegations of insider trading against an officer, director or other employee of a company may cause significant damage to the company’s reputation, and subsequently trying to defend the company could be expensive and distract the workforce.

Insider trading, if proved, attracts the following penalties:

-

Individuals: Civil penalties ranging from three times the profits made/loss avoided and criminal fines up to USD5,000,000 (including a prison sentence of up to 20 years)</p

-

Companies: Criminal fines up to USD25,000,000 and civil penalties</p

It is widely agreed that the effect of insider trading is worse than that of any other crime related to securities transactions. Insider trading could also lead to macro risks, such as crashing the respective stock market.

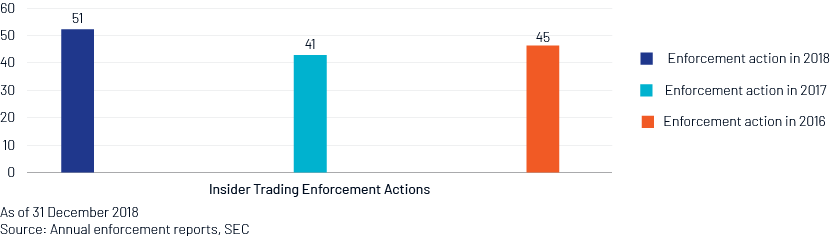

The following chart illustrates the number of SEC enforcement actions relating to insider trading:

We see that the SEC’s standalone enforcement actions have risen in the past three years. Total enforcement actions have grown by more than 13% from 2016 to 2018. This has likely led to increased urgency to meet compliance requirements.

Most companies are looking to reduce the incidence of insider trading. We believe the following measures have proven to be effective:

-

Imposing criminal, prophylactic and civil/administrative penalties

-

Placing trade restrictions for a stipulated period of time; for example, prior to corporate announcements or buybacks

-

Placing special trade restrictions on individuals with access to insider information

-

Requiring trade pre-clearance for making a trade; this can be used to determine and restrict any unfair trade practice on the basis of frequency and regulations

-

Conducting insider trading awareness programmes

-

Creating information barriers and access controls

Acuity Knowledge Partners is an influential player in the global market, providing compliance expertise and a wide scope of other services. We have a pool of subject-matter experts in the compliance function. In line with US federal laws, we help clients prevent insider trading through services such as the following:

-

Broker statement review, to obtain a holistic view of an employee’s trades and trading pattern

-

Email surveillance, including checking for inappropriate exchanges of the firm’s confidential and key information

-

Post-trade surveillance to examine each trade according to a set of rules, to monitor any incongruous trading or trading configuration

The following is a checklist for those with access to insider information to consider before making an investment decision or proceeding with a trade:

-

Is the information substantial?

-

Is this information something an investor would consider important in making an investment decision?

-

Would you, as an investor, take this information into account when determining whether to buy or sell?

-

If generally disclosed, would this information affect the security’s market price?

-

To whom has this information been provided, and is the information non-public?

-

Has the information been effectively converted to the marketplace?

It is, therefore, important to encourage employees to approach the compliance and legal departments before they embark on activity where such information is involved. In conclusion, insider trading is an activity that could lead to a loss of investor confidence, unrealistic stock prices, and high rates of inflation, and it is an avoidable one.

References:

https://www.supermicro.com/about/policies/Insider_Trading_Policy.pdf

https://www.sec.gov/files/enforcement-annual-report-2018.pdf

https://www.sec.gov/files/enforcement-annual-report-2017.pdf

Tags:

What's your view?

About the Authors

Jayraj Gohil has over 14+ years of experience in compliance, having worked for various firms including State Street Global Advisors and Goldman Sachs. His expertise spans across the risk and compliance sector, focusing on compliance reviews of marketing/advertising materials. At Acuity Knowledge Partners he is part of the central compliance team and specializing in marketing material review. Jayraj is an MBA from Global Academy of Technology, Bengaluru (VTU).

Preeti Rai has overall 4 years of experience in compliance & banking operations, having worked for various firms including State Street Global Advisors and Northern Trust her expertise spans across Compliance, Policy monitoring and Risk surveillance . At Acuity she is responsible for monitoring Code of Ethics for a client. Preeti has completed her Masters in Commerce from Christ University, Bengaluru

Like the way we think?

Next time we post something new, we'll send it to your inbox