Published on May 9, 2025 by Raj Kotecha

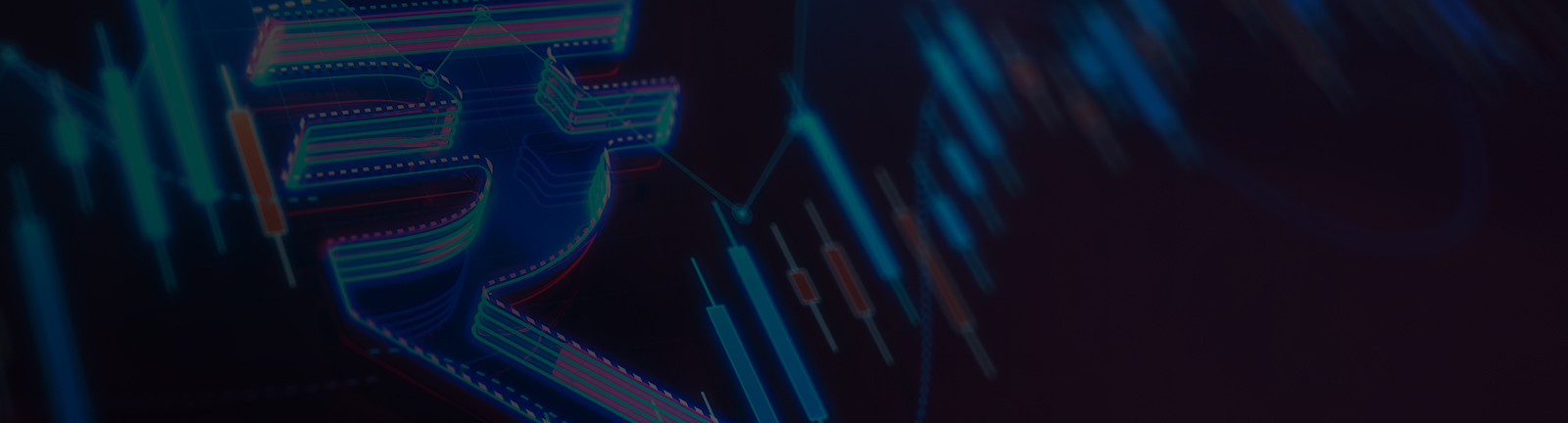

In the ever-evolving world of finance, initial public offerings (IPOs) serve as a significant milestone for companies desiring attractive valuation and investors looking for multi-bagger businesses. These global IPO trends reveal how market cycles, liquidity conditions, and geopolitical factors have shaped listing activity across both developed and emerging economies.

The pre-pandemic era (from 2015 to 2019) saw approximately 6,000 IPOs globally, raising more than USD950bn in capital; during the pandemic (from 2020 to 2023), USD1tn in capital was raised through c.6,600 listings, with a record-breaking peak in 2021, with 70%+ more capital raised than in 2020. This surge was fuelled by increased liquidity, low interest rates and government stimulus. However, following the 2021 boom, the trend seems to have normalised at the pre-pandemic level, driven by an increase in rates, market volatility and geopolitical uncertainty amid elections and trade tensions.

Source: EY, PwC

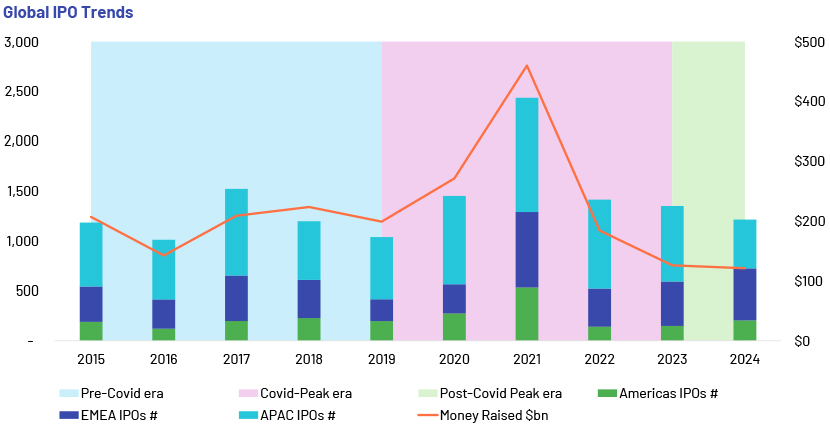

The India IPO market has evolved into a dynamic ecosystem, reflecting strong investor sentiment, robust regulatory frameworks, and a consistent pipeline of listings across sectors. Whereas IPO activity globally has declined since the pandemic, India has stood out as one of the attractive economies. According to PwC, the country was the third-largest market globally in terms of IPO proceeds in 2023, reflecting a shift in sources of capital and maturing local markets. Proceeds surged to a record USD22.8bn in 2024 owing to 337 listings, compared to USD7bn in 2023 from 242 listings. Tata Consultancy Services (TCS), the country’s first-ever billion-dollar IPO, raised INR47.13bn (c.USD1bn) in August 2004, whereas Hyundai Motors raised INR278.59bn (USD3.3bn) in October 2024 as a result of regulatory reforms, ease of doing business, improved corporate governance and economic expansion. The top mainboard IPOs accounted for 46% of the total capital raised through listings in 2024.

Source: National Stock Exchange, Bombay Stock Exchange, Chittorgarh.com

*2025 YTD is as of 6 May 2025

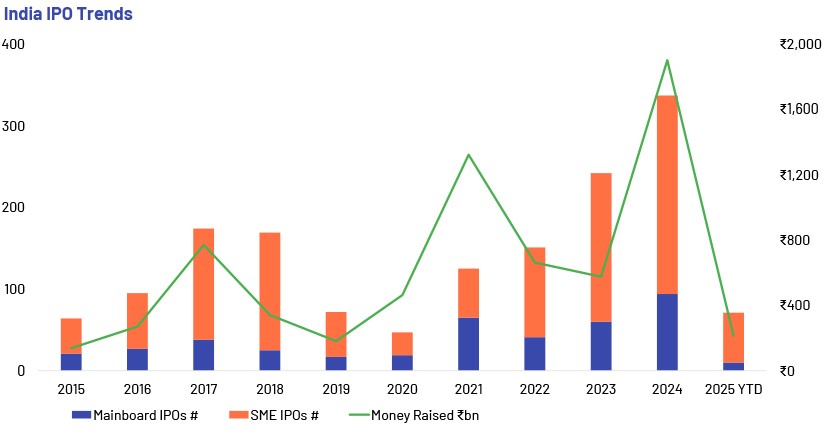

A temporary slowdown in foreign institutional investor (FII) and domestic institutional investor (DII) activity may be a short-term headwind. However, with the country being one of the fastest-growing economies driven by domestic consumption that accounts for 70% of GDP, production-linked incentive schemes, the allocation of USD134bn in capital expenditure on infrastructure, the IMF, in light of the recent tariffs, expects the Indian economy to grow by 6.3% in FY26, compared to 4.0% for China, 2.0% for Brazil, 1.5% for advanced economies and 3% for the global economy, offsetting the challenges posed by global shocks.

As the economy scales towards new heights, analysts expect the first USD10bn IPO in the next three to five years. So far in 2025, 71 listings have raised INR214bn (USD2.5bn) in proceeds; these are expected to exceed the INR20bn (USD23bn) benchmark on the back of big-ticket IPOs such as those of Reliance Jio, Lenskart, the National Stock Exchange, JSW Cement, Tata Capital, Zepto, NSDL and Flipkart.

Source: Trendlyne

*2025 YTD is as of 6 May 2025

Demographic dividends are another pivotal catalyst at play in India’s capital markets; the median age is 28 (38 for China), driven by over 65% of the population falling within the working age of 15 to 64 years, significantly boosting economic productivity and disposable income.

The rise in disposable income has, in turn, fuelled greater retail investor participation. A clear indication is growth in the number of demat accounts – an increase of more than 4x to over 175m in 2024 from 40m in 2020, signifying financial literacy and investor confidence. As India’s financial ecosystem continues to evolve as a result of innovations by fintech companies, an increase in discount brokers and a robust pipeline of IPOs, together with capital formation, the country is likely to dominate strongly in the coming decade.

Top 10 mainboard IPOs by amount raised in 2024

| Company | Ticker NSE/BSE | Listing date | Capital raised (Rs bn) | Offer Price (Rs) | Listing Gain / (Loss) | Subscription Status (Times) |

| Hyundai Motor India Limited | HYUNDAI / 544274 | 22-Oct-24 | ₹278.6 | ₹1,960 | (1%) | 2.37x |

| Swiggy Limited | SWIGGY / 544285 | 13-Nov-24 | ₹113.3 | ₹390 | 8% | 3.59x |

| NTPC Green Energy Limited | NTPCGREEN / 544289 | 27-Nov-24 | ₹100.0 | ₹108 | 3% | 2.55x |

| Vishal Mega Mart Limited | VMM / 544307 | 18-Dec-24 | ₹80.0 | ₹78 | 33% | 28.75x |

| Bajaj Housing Finance Limited | BAJAJHFL / 544252 | 16-Sep-24 | ₹65.6 | ₹70 | 114% | 67.43x |

| Ola Electric Mobility Limited | OLAELEC / 544225 | 9-Aug-24 | ₹61.5 | ₹76 | 0% | 4.45x |

| Afcons Infrastructure Limited | AFCONS / 544280 | 4-Nov-24 | ₹54.3 | ₹463 | (8%) | 2.77x |

| Waaree Energies Limited | WAAREEENER / 544277 | 28-Oct-24 | ₹43.2 | ₹1,503 | 66% | 79.44x |

| Bharti Hexacom Limited | BHARTIHEXA / 544162 | 12-Apr-24 | ₹42.8 | ₹570 | 32% | 29.88x |

| International Gemmological Institute India Limited | IGIL / 544311 | 20-Dec-24 | ₹42.3 | ₹417 | 22% | 35.48x |

Source: National Stock Exchange

Top 10 SME IPOs by amount raised in 2024

| Company | Ticker NSE | Listing date | Capital raised (Rs bn) | Offer Price (Rs) | Listing Gain / (Loss) | Subscription Status (Times) |

| Danish Power Limited | DANISH | 29-Oct-24 | ₹2.0 | ₹380 | 50% | 126.65x |

| Sahasra Electronics Solutions Limited | SAHASRA | 4-Oct-24 | ₹1.9 | ₹283 | 90% | 122.06x |

| Ganesh Green Bharat Limited | GGBL | 12-Jul-24 | ₹1.3 | ₹190 | 90% | 229.92x |

| Tunwal E-Motors Limited | TUNWAL | 23-Jul-24 | ₹1.2 | ₹59 | 8% | 12.31x |

| Petro Carbon and Chemicals Limited | PCCL | 2-Jul-24 | ₹1.1 | ₹171 | 75% | 92.01x |

| Vision Infra Equipment Solutions Limited | VIESL | 13-Sep-24 | ₹1.1 | ₹163 | 26% | 68.14x |

| C2C Advanced Systems Limited | C2C | 3-Dec-24 | ₹1.0 | ₹226 | 90% | 125.35x |

| Ganesh Infraworld Limited | GANESHIN | 6-Dec-24 | ₹1.0 | ₹83 | 90% | 369.56x |

| Usha Financial Services Limited | USHAFIN | 31-Oct-24 | ₹1.0 | ₹168 | (2%) | 19.37x |

| Baweja Studios Limited | BAWEJA | 6-Feb-24 | ₹1.0 | ₹180 | 2% | 2.62x |

Source: National Stock Exchange

Source: National Stock Exchange

JPX: Japan Exchange Group

KRX: Korea Exchange

HKEX: Hong Kong Exchanges and Clearing

SZSE: Shenzhen Stock Exchange

Tadawul: Saudi Exchange

IDX: Indonesia Stock Exchange

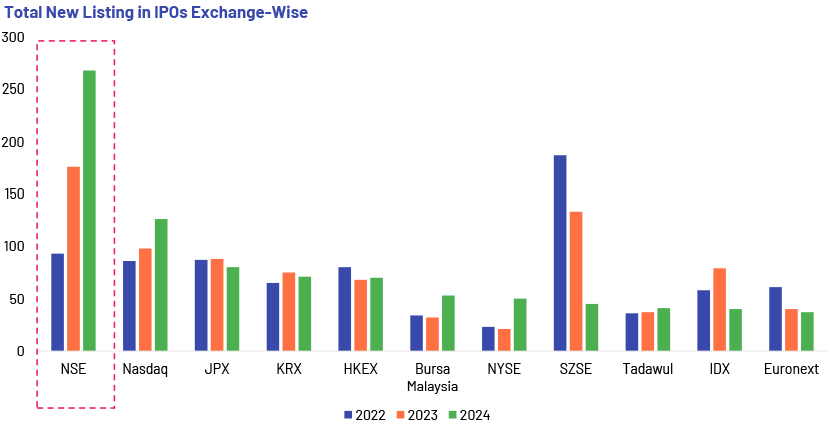

India’s National Stock Exchange stands out as the clear leader, with IPO listings surging to a whopping 268 in 2024 from 93 in 2022. This remarkable growth contrasts with trends in new listings in other regions: China’s Shenzhen Stock Exchange experienced a contraction, with the number of IPOs dropping to 45 in 2024 from 187 in 2022, reflecting the lowest activity due to market uncertainty. In the US, both the Nasdaq and the NYSE have demonstrated resilience and gradual recovery, but the JPX, KRX, HKEX, Brusa Malasia, Tadawul, IDX and Euronext exchanges have reported relatively stable activity. India’s growth prospects continue to underscore strong investor confidence, favourable regulatory policies and thriving capital markets.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners are experienced in supporting investment banks, hedge funds, brokers and analysts in the US, Europe and Asia Pacific with our equity research, investment banking, special situations, M&A, capital markets, restructuring and sustainable finance solutions. We have years of experience in providing end-to-end support to research analysts and helping onshore teams on live transactions along with regular workstreams related to IPOs, valuation and financial modelling.

Sources:

-

IPO – Latest IPO, Upcoming IPO, Recent IPO News, IPO Issue Price, Listing Details- NSE India

-

World Economic Outlook, April 2025: A Critical Juncture amid Policy Shifts

What's your view?

About the Author

With more than 7 years of experience in Equity Research, Raj is currently supporting Acuity’s leading Buy-side client covering global markets along with multiple industries. On top of this, his interests lie in integration of Big Tech, AI and Media. He holds a Master’s & Bachelor’s in Business Administration Finance with CFA Level 1 certification

Like the way we think?

Next time we post something new, we'll send it to your inbox