Published on May 20, 2025 by Ramesh Dharanipathy

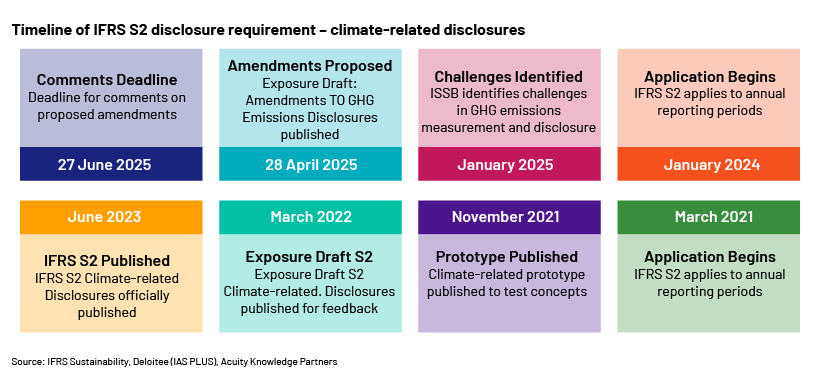

The international Sustainability Standards Board (ISSB) recently published proposed targeted amendments to International Financial Reproting Standards (IFRS) S2, standards on climate-related disclosures, favourable to asset managers and commercial banking and insurance companies. These amendments help reduce the complexity and costs associated with disclosing greenhouse gas (GHG) emissions, particularly related to financed emissions, although the data is still useful for investment decision-making. The ISSB’s consultation on these amendments to the IFRS S2 climate-related disclosures is open until 27 June 2025. After considering stakeholder feedback, the ISSB aims to finalise the amendments by end-2025, with the effective date for annual reporting likely to start on 1 January 2026.

This blog highlights the significance of IFRS S2 climate-related disclosures for asset managers and provides an overview of the IFRS S2 requirement, the timeline for disclosure requirements, a summary of the proposed amendments, a comparison of original disclosure requirements and the proposed amendments, implications for asset managers, the next steps and implementation timelines for these amendments.

Significance of IFRS S2 for asset managers

IFRS S2 mandates that entities, including asset management firms, disclose information regarding climate-related risks, opportunities and GHG emissions associated with their investments. This requirement is crucial for investors, as it offers essential insights on climate-related vulnerabilities and the sustainability performance of their investment portfolios.

The proposed amendments aim to tackle the practical challenges faced by those preparing these reports, seeking to simplify the reporting process while ensuring that transparency for users remains intact. This balance is vital for maintaining the integrity of the information provided, enabling stakeholders to make well-informed decisions based on comprehensive and accessible data.

Overview of IFRS S2 Climate-Related Disclosures

For any entity, the main objective of IFRS S2 is to disclose information about climate-related risks and opportunities; this is useful for the primary users of general-purpose financial reports in making decisions relating to providing resources to the entity. These climate risks and opportunities could reasonably be expected to affect the entity’s cashflow and its access to finance or cost of capital over the short, medium or long term.

IFRS S2 applies to

-

Climate-related risks to which the entity is exposed:

-

Climate-related physical risks

-

Climate-related transition risks

-

-

Climate-related opportunities available to the entity

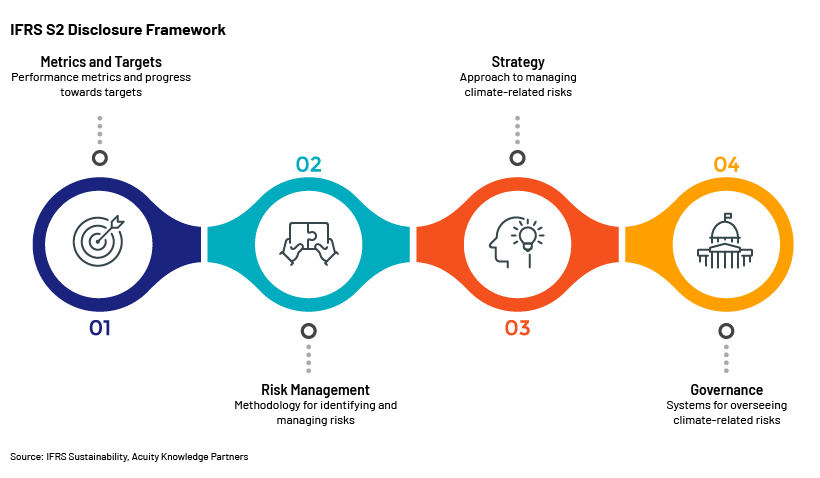

IFRS S2 requires all entities to disclose information that would enable users of general-purpose financial reports to understand the following aspects:

The proposed amendments focus on the following:

-

Measurement and disclosure of Scope 3 Category 15 GHG emissions

-

Use of the Global Industry Classification Standard in applying specific requirements related to financed emissions

-

Jurisdictional relief from using the GHG Protocol Corporate Standard

-

Applicability of jurisdictional relief for global warming potential values

-

The table below summarises the original disclosure requirement, feedback received from the market and proposed amendments:

IFRS S2: Original disclosure requirement, feedback received and proposed amendments

| Items considered for amendment | Original disclosure requirement | Feedback received | Proposed amendments |

| Measurement and disclosure of Scope 3 Category 15 GHG emissions | Disclose Scope 3 emissions associated with its loans or investments (financed emissions) | Uncertain whether to consider derivatives, underwriting activities and investment-banking activities as part of the disclosed financed emissions | Exclude derivatives from Scope 3 disclosures related to financed emissions but provide the value of the excluded derivatives |

| Use of the Global Industry Classification Standard in applying specific requirements related to financed emissions | An entity to use the Global Industry Classification Standard (GICS) six-digit industry-level code for classifying companies | This led to application challenges, as entities need to license to use the GICS | Allowed to use an alternative industry-classification system |

| Jurisdictional relief from using the GHG Protocol Corporate Standard | Measure GHG emissions according to GHG protocol or as per the jurisdictional authority | Requirement is not clear – whether this applies to the entity or to subsidiaries | The entity is allowed to adopt this alternative method instead of the GHG Protocol Corporate Standard |

| Applicability of jurisdictional relief for global warming potential values | Entities mandated by their jurisdiction to adopt different GWP values, such as those reporting under the National Greenhouse and Energy Reporting Act 2007, will need to recalculate their GHG emissions using two distinct GWP values: one for compliance with IFRS S2 and another for local regulatory requirements | Entities are authorised to apply the specified GWP values rather than those from the latest IPCC evaluation |

Implications for asset managers and investors

The proposed amendments to the IFRS S2 climate-related disclosures reduce the challenges associated with the collection and reporting of GHG emissions data, particularly by exempting emissions related to derivatives from the mandatory disclosure requirements. This exclusion helps lower compliance costs, enabling focus on financed emissions directly associated with loans and investments.

Next steps and implementation timeline

The ISSB is currently conducting a consultation on proposed amendments, which will remain open until 27 June 2025, and it aims to finalise the amendments by end-2025, with annual reporting periods likely to start on 1 January 2026. Asset managers and investors should closely track these developments to ensure their reporting, investment analysis and engagement strategies are in line with the evolving IFRS sustainability disclosure framework.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners deploy ESG and sustainability specialists through flexible engagement models to provide a vast array of capabilities to effectively assist clients in a number of critical areas. These specialists are well versed in the intricacies of ESG factors, enabling them to provide tailored insights that align with a client’s strategic objectives. With such comprehensive skillsets, they are invaluable for any organisation seeking to strengthen its ESG and sustainability research and support in investment decision-making.

-

Climate risk and opportunity assessments

-

Climate change scenario analysis and stress-testing

-

Quantifying financial impacts of climate risks

-

Evaluating the efficacy of decarbonisation plans

-

Evaluating Scope 3 emissions, particularly financed emissions

-

Preparing reports for the Task Force on Climate-Related Financial Disclosures (TCFD)

-

Support with sustainability and climate reporting

-

Assessing green, social and sustainable bond impact

-

Climate risk and vulnerability assessments, including asset impact and impairment modelling

-

Single- and double-materiality assessments

-

ESG and climate maturity assessments

-

SDG mapping and impact assessment of investee companies

-

End-to-end support with SFDR reporting

-

EU Taxonomy assessment of investee companies

References:

Tags:

What's your view?

About the Author

Ramesh Dharanipathy has been with Acuity Knowledge Partners for 13 years working in the areas of ESG, Sustainability, climate change and investment research. He has acquired extensive experience in various aspects of ESG, sustainability, and climate change, including conducting climate-related risk and opportunity assessments, performing ESG and climate maturity evaluations, and mapping Sustainable Development Goals (SDGs) alongside impact assessments for investee companies. His expertise also encompasses comprehensive support for SFDR reporting, EU Taxonomy assessments, double-maturity evaluations, ESG benchmarking and analysis, and developed ESG – related methodology documents. Additionally, he is involved in assessing the impact of green, social, and sustainable bonds while quantifying the financial implications of climate risks...Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox