Published on August 10, 2022 by Pavan Kumar Ganapavarapu

Green financing refers to financial investment in sustainability projects and initiatives – projects that are socially, environmentally and economically feasible and support growth of a more sustainable economy. It consists of loans, financing instruments and investments whose main purpose is to ensure and support growth and development of environmentally sustainable projects or reduce the environmental impact of more conventional initiatives.

Commercial real estate lenders are increasingly offering loans based on sustainable performance as demand grows for green-linked financing. Real estate operations are part of a larger drive in the financial realm. Over USD700bn in sustainable and environmentally friendly debt was issued globally in 2020, according to Bloomberg, up from USD250m in 2018. Investment products designed to address environmental, social and governance (ESG) concerns are expected to expand to more than USD53tn in assets by 2025. In the US, Fannie Mae (the Federal National Mortgage Association) has adopted BREEAM Residential Plus as an acceptable means of evaluating loans under its Multifamily Green Initiative, which granted USD13bn in green loans last year.

To expedite the adoption of green construction methods, institutional investors must be mobilised. Institutional investors will help pump liquidity into the green real estate sector, enabling primary lenders to free up cash to introduce better green lending programmes. Green bonds, green debt instruments such as securities, and green lending institutions help investors and institutions increase their clientele and product offering, construct higher-value and lower-risk portfolios, and connect with new funding opportunities.

Many emerging-market banks are unable to fund green homes because of a shortage of green property pipelines. Recent market research shows that even though the number of green real estate buildings is gradually increasing, they are still very much a minority. Approximately 70% of many global cities’ building stock will likely be around in 2050, the biggest hurdle to overcome in the process of decarbonising the environment. Banks may help establish a pipeline of green property by providing incentives to builders and actively working with them to enhance knowledge of and capabilities in green building. Property owners could also benefit from green financing by renovating properties to make them eligible for green certification.

Banks offer favourable financing conditions such as reduced rates, longer tenors, longer grace periods or cheaper front-end charges to help developers stretch out or offset the large upfront costs of constructing green. To guarantee favourable financial terms for green building, a bank may begin with a conventional loan until preliminary green certification based on the proposed design is obtained. After the initial certification, the benefits of green financing kick in, with clear deadlines for the project to be finished and certified green. Another financial incentive banks may provide is paying the costs of green certification partially or fully. Banks can use their green loan programmes to offset these costs by tying them to the construction project they are funding.

Green finance is increasingly being used to accelerate the transition to a greener economy, as it offers the financial backing required to implement environmental initiatives, such as green real estate, on a worldwide scale. This shift has also influenced sectors like real estate investment banking, where institutions are tailoring solutions to finance environmentally sustainable projects. Individuals, governments and companies across the world are now working more closely to develop awareness, form “green” affiliated entities and groups, ratify legislation and offer green funding to save energy and natural resources. Given the construction sector's significant contribution to the depletion of resources and the acceleration of environmental issues, a number of property owners and users are warming to the idea of going "green", and many have implemented green technology on and in their buildings to generate energy and/or try to preserve raw materials and energy.

Green finance has several advantages for lenders and borrowers alike. There are clear environmental and reputational advantages. New frameworks have been proposed by central banks and governments throughout the world to support sustainable financing in particular, and we have witnessed continued development in sustainable lending in the commercial real estate sector. While Europe remains the market leader, other countries such as China and Canada are quickly catching up.

Green bonds have a lot of investor interest in the capital markets, which means there is significant demand lenders could take advantage of. Companies with ESG strategies are increasingly viewed as superior borrowers in terms of credit risk. US real estate investment trusts (REITs) are under pressure from investors to uphold ESG values, a trend likely to drive more REITs to invest in green properties.

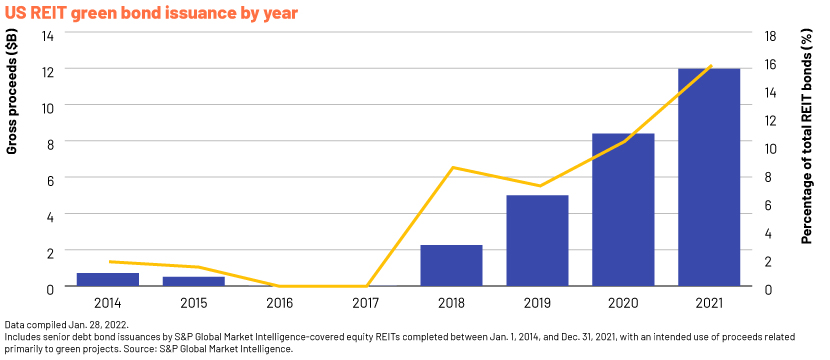

Proceeds from green bonds issued by US REITs in 2021 accounted for 15.5% of all REIT bond proceeds for the year, the highest level to date. In comparison, green bonds accounted for 10.2% of bond issuance in 2020 and 7.1% in 2019. While green bonds still represent a small percentage of capital-raising activity, they have continued to rise in popularity over the past four years, widening the potential buyer pool for REIT securities and serving as an avenue for REITs to tap into investors looking for sustainability-oriented investments.

Green funding on a large scale means that environmental or sustainable efforts take precedence over traditional economic investments that may or may not be viable. Focusing on this type of finance results in transparency and a consistent flow of money towards environmental goals. More jobs and company possibilities would be created as this sort of funding grows in popularity. All this would eventually lead to improved human life and amenities, as well as long-term development that does not degrade or damage nature.

Even the prospective tenants of upcoming green projects are keen on investing in greener and more sustainable properties. Corporate real estate (CRE) owners, for their part, must keep up with tenant demand for green features in both current and new leases. Increased tenant participation would almost certainly lead to increased satisfaction and, as a result, retention. As corporations begin to consider methods to include green elements into current leases, CRE owners may learn from best practices in other countries, such as the UK.

Tenants’ focus on lowering energy expenses may be significantly less financially meaningful and remunerative than a minor increase in production. Tenants also seek to achieve their company's environmental and social responsibility objectives. Tenants must collect, measure and provide data pertaining to utilities utilised in their rented areas in order to do this. As a result, green building elements are increasingly influencing leasing decisions, resulting in increased efficiency and investor interest that can be properly tracked and analysed.

To conclude, there are a number of suggestions and observations that can be made. Green finance has emerged as a global concern in the pursuit of long-term economic and financial growth. Environmental change and pollution are a source of worry for all nations. To achieve more sustainable growth, we must identify potential green projects and determine whether or not they are eligible for green finance. To achieve green development, green initiatives must be established, and replication of these projects must be made easier. Green buildings should be encouraged by investors and financial organisations. Finally, funding renewable-energy resources is critical. Global warming is causing a number of issues. Greenhouse gas emissions, according to scientists and environmental experts, are to blame. Green funding would sharply reduce greenhouse gas emissions. By overcoming impediments and raising awareness of more sustainable growth among corporate citizens, the world would have significant potential to establish the green infrastructure required for green financing.

How Acuity Knowledge Partners can help

We provide support across the lending value chain (origination, underwriting, portfolio monitoring and servicing) for both on-balance-sheet and off-balance-sheet CRE lending. We help our clients across a range of industries in reviewing and developing sustainable/ESG programmes and related reporting, such as GAP analysis and metric/KPI identification. We work closely with origination/underwriting teams in sourcing, validating, consolidating and presenting data in client-specified models based on their requirements.

Sources:

https://www.adb.org/sites/default/files/publication/481936/adbi-wp917.pdf

https://www.cbd.int/financial/gcf/definition-greenfinance.pdf

https://efinancemanagement.com/sources-of-finance/green-finance

https://www.worldgbc.org/news-media/what-are-green-mortgages-how-will-they-revolutionise

https://www.investopedia.com/terms/g/green-bond.asp

https://www.jll.co.in/en/trends-and-insights/investor/how-real-estate-is-starting-to-embrace-green

http://greenfinanceportal.env.go.jp/en/loan/overview/about.html

https://www.wallstreetmojo.com/green-investments/

https://www.greenfinanceplatform.org/page/explore-green-finance

What's your view?

About the Author

Pavan Kumar Ganapavarapu has been part of Acuity Knowledge Partners’ RECM team since 2014. Prior to this, he spent 4 years at Wells Fargo India Solutions Pvt Ltd. He has 12 years of experience in commercial real estate cash flow modelling, valuation analysis, lease abstraction, loan origination and detailed loan underwriting.

Like the way we think?

Next time we post something new, we'll send it to your inbox