Published on by Shreya

Recent events, including the pandemic and the Russia-Ukraine war, have presented significant challenges for the global economy, with several countries grappling with the repercussions of a widespread recession. Germany, renowned for its robust economic performance, was not immune to these adverse effects. The 2023 recession has had a profound impact, affecting a number of aspects of its economy.

-

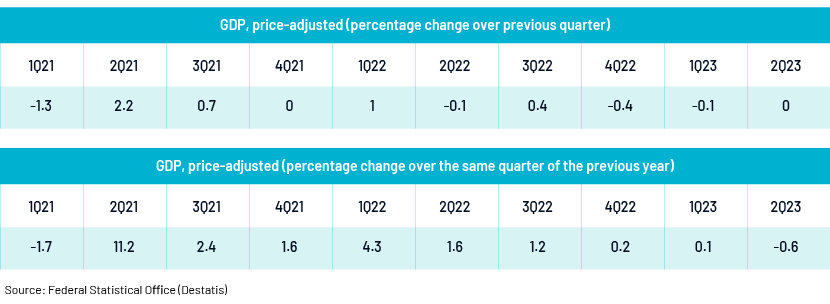

Germany’s GDP fell by 0.1% in the first quarter of 2023, after a decline of 0.4% in the fourth quarter of 2022. A recession is commonly defined as two successive quarters of contraction.

-

The second quarter was flat compared to the first, showing no signs of recovery from the winter recession and establishing Germany’s place as one of the world’s weakest major economies.

Germany’s GDP growth in the first half of 2023 was much less than anticipated, with consumer spending affected by real wages dropping and exports restrained by external demand. The European Commission has significantly reduced its former growth estimates and now expects the German economy to decline by 0.4% in 2023.

A variety of factors contributed to this downturn, including global economic trends, geopolitical tensions and domestic challenges.

This article explores some of the reasons for the economic downfall of Europe’s largest and the world's fourth-largest economy and what the future likely holds.

Factors contributing to the recession in Germany

a. Impact of inflation: Severe inflation has had a negative impact on German consumers, reducing their purchasing power and expenditure.

-

-

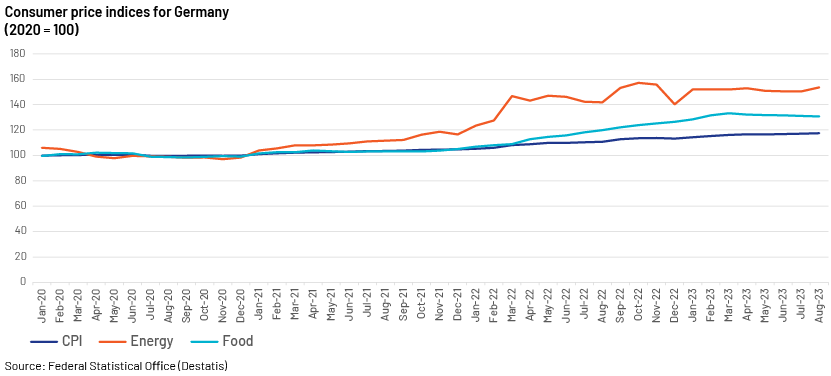

Germany's inflation rate, calculated as the change in the consumer price index (CPI) from one year to the next, was 6.1% in August 2023. The inflation rate was 6.2% in July 2023.

-

Food prices increased by 9.0% y/y i n August 2023. Although the increase in food costs moderated considerably (July 2023: +11.0%), certain food groups continued to see price increases that were noticeably more than the increase in general inflation.

-

b. Decline in consumer spending: Despite a slight slowdown in inflation, German customers are still exceedingly cautious and hesitant to pay too much for goods they have had access to at far lower pricing for years because of discount merchants.

-

-

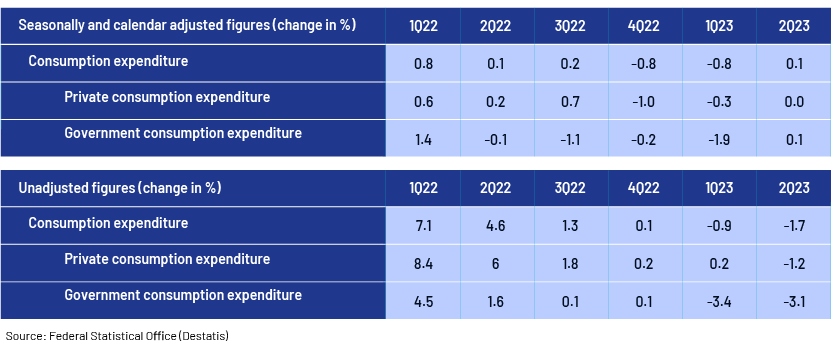

After adjustments, private consumption spending fell for two straight quarters – by 1.0% in 4Q22 and 0.3% in 1Q23, pointing to a decline in consumer activity. Private consumption remained stagnant in 2Q23.

-

The fundamental cause of the decline, according to Germany's Minister for Economic Affairs Robert Habeck, is the country's long-standing reliance on Russian energy and the abrupt halting of this supply following Russia’s invasion of Ukraine.

-

c. Reduction in government spending: Government spending decreased by 0.2% in 4Q22 and 1.9% in 1Q23, primarily due to the phasing-out of state-financed pandemic-related initiatives, such as testing and vaccines, which reached a record high at the start of 2022 amid efforts to combat the spread of the Omicron virus

d. Insufficient recovery factors: Despite developments, including an uptick in industrial output and China's reopening, the economy continued to experience supply-chain disruptions that kept it in a recessionary danger zone.

-

-

Germany had a trade deficit of c.EUR4.53bn in May 2023 as a result of importing c.EUR13.2bn worth of goods from China while exporting c.EUR8.72bn worth of goods to China. Germany's exports fell by c.EUR492m (-5.34%) – from c.EUR9.21bn to c.EUR8.72bn from May 2022 to May 2023 – while its imports fell by c.EUR-4.19bn (-24%) – from c.EUR17.4bn to c.EUR13.2bn.

-

e. Increase in energy prices: The German economy suffered as a result of the large increase in energy prices during the winter half-year, driven by Germany’s heavy reliance on Russian energy.

-

-

In August 2022, Germany's primary source of Russian gas, the Nord Stream 1 pipeline, was shut down by Russia.

-

f. Impact of recession in other Eurozone countries: The economic prognosis for the Eurozone has been impacted negatively by the recession in Germany and the ongoing inflationary pressures. The general picture for the Eurozone indicates a difficult route ahead, necessitating cautious economic management and policy measures to encourage growth and handle inflation-related concerns; certain nations, such as France and Spain, are expected to perform better than predicted.

Factors supporting Germany‘s economic recovery

a. Investment growth: Increasing investment is critical for economic growth. This would help the country attract international funds, create new employment opportunities, strengthen domestic capability and optimise economic operations.

-

-

Chancellor Olaf Scholz encourages faith in the economy, saying, "The prospects for the German economy are really positive.” He emphasised that substantial growth in clean energy would "unleash the strengths of the economy", specifically mentioning the significant investment in semiconductor and battery manufacturers.

-

Investments in machinery and equipment (gross fixed capital formation) climbed by 0.6% y/y in 2Q23, following 2.1% y/y growth in 1Q23, suggesting the possibility of corporate growth and economic recovery.

-

Investment in the construction sector increased 0.2% q/q in 2Q23, indicating an increase in infrastructure projects and construction activity, versus 2.7% q/q in 1Q23.

-

b. Supportive government initiatives: The German government is implementing a number of initiatives in an effort to pull the economy out of recession. More is needed to accelerate recovery.

-

-

Chief Economist of German bank Berenberg, Holger Schmieding, says, "the government is already addressing some key issues," highlighting measures proposed to speed up the clearance process for priority investments and draw in more highly qualified foreign workers.

-

Intel and Taiwan Semiconductor Manufacturing Company announced their plans in 1H23 to build large plants in Germany due to the c.EUR15bn worth of subsidies provided by the German government.

-

c. Tackling inflation and high energy prices: High energy prices, caused by discontinued supply from Russia, are the primary cause of Germany’s high inflation. Addressing this issue is key to reducing inflation and increasing consumer spending on non-energy products.

-

-

Increased government spending in 2Q23 was mostly due to comprehensive economic relief measures, such as a gas and heating price brake, as a "reaction to high inflation and energy prices", according to Destatis.

-

d. Long-term optimism: Despite the current difficulties, there is hope as the economy adjusts to the new conditions. Certain aspects of the 2Q23 economic analysis showed positive signs:

-

-

As the number of employees increased, total gross pay and compensation increased by 7.6% y/y. The annual increase in household final consumption spending at current prices was 5.7%, significantly less than in the preceding quarters. Discretionary income increased by 6.9%. The savings ratio increased significantly, to 11.1% from 10.3% in 2Q22.

-

Germany’s real GDP is expected to grow by 1.1% in 2024, driven by a rebound in spending. Additionally, the steady decline in the cost of commodities, including energy, is expected to reduce overall inflation.

-

Germany shows signs of promise – with an increase in investments and construction and stable commercial activity –despite going into a recession in the initial months of 2023.

How Acuity Knowledge Partners can help

We provide research related to a range of economic factors through a variety of consulting services, backed by the latest thinking and knowledge of industry best practices. Our services include strategic research and consulting services, corporate advisory, data analytics and business intelligence in areas relating to the adoption of emerging technologies, such as market and competitive intelligence, strategy research, financial modelling, M&A support, valuations and supplier management research support.

References:

-

https://www.reuters.com/markets/europe/germany-enters-recession-2023-05-25/

-

https://www.indiatimes.com/worth/news/europes-largest-economy-germany-slips-into

-

https://edition.cnn.com/2023/05/25/economy/germany-recession-q1-2023/index.html

-

https://www.indiatimes.com/worth/news/europes-largest-economy-germany-slips-into-

-

https://www.destatis.de/EN/Themes/Economy/Prices/Consumer-Price-Index/_node.html#266062

-

https://www.reuters.com/markets/europe/spend-recession-away-not-thrifty-germans-2023-06-05/

-

https://www.ft.com/content/28d22761-d81f-4402-bd56-7329fd6d18b0

-

https://english.news.cn/20230826/6944c3664f04497b9cd7e9a8db14b3a9/c.html

-

https://oec.world/en/profile/bilateral-country/deu/partner/chn

Tags:

What's your view?

About the Author

Shreya is a Delivery Manager in Acuity Knowledge Partners supporting consulting & corporate clients, across sectors. She has over 11 years of experience in working with global clients, being single point of contact (SPOC) on a variety of engagements for business consulting, corporate strategy, and deal advisory, across multiple verticals.

She specializes in market research, strategy development, commercial & financial due diligence, benchmarking (operational, financial, technology, pricing, among others), go-to-market strategy, competitive intelligence, market/opportunity assessment, among other related services. Her responsibilities cover client handling/management, project management, team management, sales enablement, and quality assurance.

She also attended several technology oriented international conferences including Cloud Expo Asia, RSA Conference, DevOps India Summit,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox