Published on June 5, 2019 by Xiaoyu Zhang

Generation Z – How strong are they in China

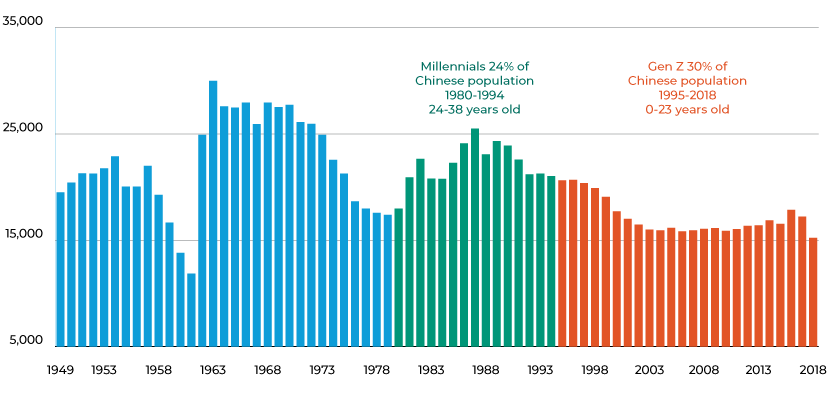

According to National Bureau of Statistics of China, the population of Generation Z (those born after 1995) has reached 421.39 million, accounting for 30% of the total population. By 2020, Generation Z will account for 40% of consumers in China. Some of this cohort may still have no independent income, but their advanced digital knowledge and ability to assess purchasing factors from a young age make them influential in family spending decisions.

However, many companies are failing to appreciate the importance of Generation Z and their predecessor, the Millennials, which could result in unexpected business failure in the following years.

New Born Population of China (1949-2018, Yearly, Thousand)

Source: NBS of China; MA Knowledge Services Analysis

Strength of Generation Z’s spending cannot be ignored

A survey by Kantar explores the income of those aged between 19 and 23 years, who are university students. Although they do not have a formal job, the average monthly disposable income stood at RMB3,501, higher than that of all the Chinese (RMB3,033) (source: NBS of China, 2017). While most of the Generation Z population are relying on their family for financial support, 35% have multiple streams of income such as part-time job, scholarship, or sale of second-hand goods (source: Kantar, 2018).

Consumption behavior of Generation Z is unique

If the millennials are considered digital pioneers, Generation Z are digital natives. Raised clutching a smartphone, they are unique in their consumption attitudes. Below are some of the key attributes of Generation Z:

Social influence plays a significant role in their buying behavior

Most of the Generation Z population are the only child in their family, due to the then prevalent one-child policy in China. Increasing schoolwork further limits their socializing. Consumption then becomes a route to engage with peer groups with similar interests. Furthermore, recommendation by an acquaintance plays a vital part in their purchasing decisions. They would be more willing to buy a product recommended by a friend than by an advertisement.

Greater needs for differentiation and self-image

Generation Z want social acceptance and are under huge peer pressure. At an age of exploring “who I am,” owning the same items is not enough. The Internet and overwhelming social media trends boost young people’s desire to present themselves uniquely and even become key opinion leaders (KOL) to prove their worth. Compared with the collectivism of their predecessors, Generation Z are characterized by individualism.

Delight and indulgence with new purchase

Compared with Generation Y, Generation Z own luxury goods at an earlier age. They purchase for instant gratification. Many factors influence their instant needs: online shopping, home delivery, and easy consumer loans, among others. They are more likely to take a picture of clothes, food, or any social event and post it on social media.

Generation Z do not currently demonstrate brand loyalty

It will not be encouraging for brands to know that Generation Z are the most disloyal and capricious consumers. As per a 2018 Barclays report, a whopping 81% of Generation Z are willing to switch from their favorite brand if they find a similar-function or better-quality product. It is because this generation is particularly conscious of their spending, driven by the impact of the 2008 financial crisis and a high degree of financial literacy.

On the other hand, unlike their parents, they prefer to spend over saving, albeit wisely. Additional challenges persist for marketers in attracting Generation Z, who have a shorter attention span and make consumption decisions through hyper-informed online and offline channels.

Influencing Generation Z for favorable brand opinion

If you want to offer products or services to Generation Z, make a note of the following:

-

-

Before sales: Ensure your products/services are photogenic and easy to share online since Generation Z love to share on social media.

-

During sales: (i) Market through multiple channels. Generation Z are used to making decisions while switching seamlessly from physical stores to online shopping and vice versa. Besides developing an online channel, retailers should not abandon the well-designed in-store environment. Even on the Internet, channels could include, but are not limited to, official website, social media (especially Tencent QQ), and video sites (such as the popular Bilibili.com).

-

(ii) Market through eye-catching and time-saving formats. Research shows that the attention span of Generation Z is only 8 seconds, much shorter than Millennials’ 12 seconds. Born in an information era, Generation Z are used to seeking out relevant content faster and more precisely than any prior generation.

(iii) Interact with your customers and even invite them to create marketing content for you. This is the era of KOL: They are not stars, but common consumers willing to stand out and share their attitude about a product/service. For Generation Z, KOLs are becoming more influential than brand ambassadors.

-

After sales: Communicate with your customers and respond quickly to their opinion on your products/services. Generation Z would be more tolerant to a brand that values customer feedback. A brand in tune with customer preferences would be more popular than a conservative brand.

How Acuity Knowledge Partners understands Generation Z in China

Acuity Knowledge Partners, based on its global and local experiences, understands the evolution of Generation Z in China and the marketing needs of global players. Acuity Knowledge Partners strengths in this area include knowledge of marketing best practices in China and Generation Z demographic, as well as other theme-based research and trend analysis.

Sources:

-

https://baijiahao.baidu.com/s?id=1620989089819206305&wfr=spider&for=pc

-

https://www.warc.com/newsandopinion/news/chinas_gen_z_relies_on_social_media_for_shopping/39204

What's your view?

About the Author

Xiaoyu Zhang is Consulting Analyst serving Beijing office of Acuity Knowledge Partners. She is proficient in consulting analysis of retail, consumer goods and TMT industries covering macro trend, industry situation and company research. Her work is highly recognized by clients for high quality production and solid experience in manipulating a considerable amount of databases. She has outstanding interdisciplinary ability with a Bachelor of Arts (World History) of Peking University, China and a Master of Science (Marketing) of University of Manchester, UK.

Like the way we think?

Next time we post something new, we'll send it to your inbox