Published on December 9, 2022 by Kalana Perera

Demystifying fintech

"Fintech" refers to financial technology. It is a catch-all term for any technology or software advancement in the market for financial products and services. The business world also includes a number of organisations that deploy technology to provide financial services to end consumers. Such businesses are typically startups founded to challenge well-established financial systems and institutions that are less tech-savvy or rely less on specialised software.

“Fintech is revolutionary and armed with digital weapons that will tear down barriers and traditional financial institutions,” according to the World Economic Forum Annual Meeting 2017.

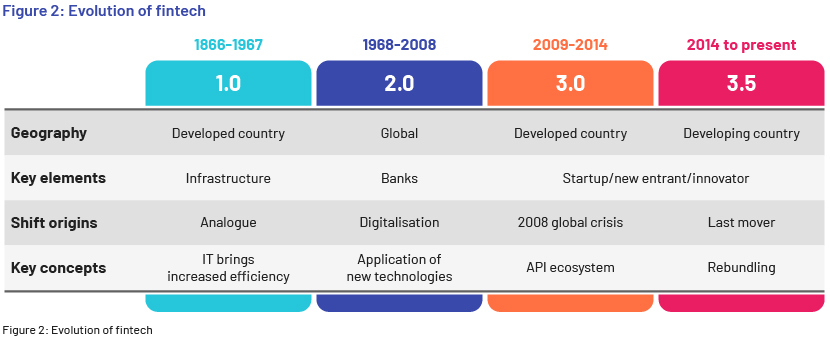

Fintech has been around during three different period. We illustrate its evolution below.

Fintech 1.0 was developed in four areas – to increase back-office efficiency, make payment methods more sophisticated, enhance security, and enable new channel growth and channel integration. It used IT to make financial processes more efficient and sophisticated.

Large-scale infrastructure and systems were needed to offer such comprehensive financial services. The development of IT made it possible to offer financial services previously offered only by financial institutions and reduced obstacles to entry to the financial services sector. This phenomenon is known as "unbundling" and those who effected the change are referred to as "disrupters". The emergence of fintech business initiatives or fintech startups that aimed to unbundle the financial services sector was Fintech 2.0.

The latest stages of Fintech 3.0 and 3.5 are referred to as “the era of startups”. Traditional banks stared to feel the competitive pressure from these fintech startups. The competition is due to fintech firms providing services that traditional financial institutions offer, offer partially or do not offer; subsequently increasing the number of end users in the market.

Fintech in banking has had an impact on many applications and fundamentally altered how users access their finances. For instance, fintech firms created the concept of digital wallets such as PayPal, and everything from investing and insurance companies to mobile payment apps such as Square are influenced by fintech. Fintech firms such as Affirm aim to eliminate the role of banks and credit card issuers in online shopping by providing consumers with a mechanism to obtain quick, short-term loans for purchases.

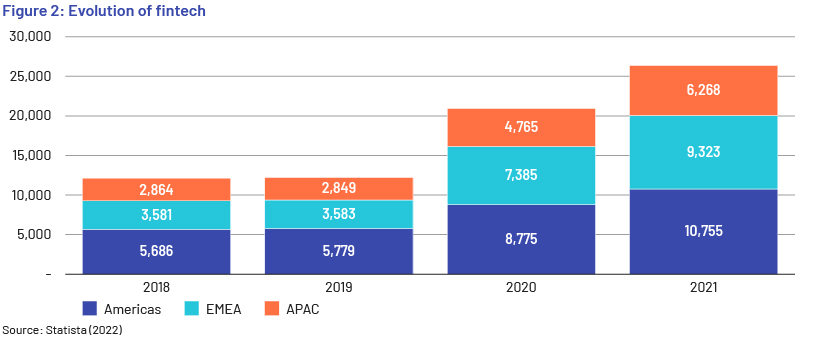

The number of fintech startups has increased significantly in recent years. There were 10,755 fintech companies in the Americas by November 2021, the highest globally, followed by 9,323 startups in EMEA and 6,268 startups in Asia Pacific.

Headwinds in the banking sector – the springboard for the fintech revolution

The traditional banking system was upended, introducing a new era of alternative finance. This was the result of many factors, such as the large number of regulations, high operating costs, little collaboration with innovators and an unwillingness to divert from the traditional banking system.

Strictly regulated and subject to numerous laws and compliance standards

Traditional banks are strictly regulated and supervised to ensure customer transactions are protected. However, such strict governance led to rigidity, causing customers to seek alternative financial service providers governed by fewer regulations and laws.

For instance, Indian banks are required to maintain statutory liquidity ratios, cash reserve ratios and capital-to-asset ratios. Banks in Europe and North America are required to follows rules such as PSD2 and MiFID. In general, there are an increasing number of regulations that banks and credit unions need to abide by, ranging from Basel's risk-weighted capital requirements to the Dodd-Frank Act and from the Financial Account Standards Board's Current Expected Credit Loss (CECL) to the Allowance for Loan and Lease Losses (ALLL). Therefore, banks often adopt a rigid approach.

High operating costs

Traditional banks were the main service providers in the financial markets in the past and each operated many branches. Therefore, their operating costs were high, and these were reflected in the services they provided.

For example, in traditional banking systems, POS machines were a prerequisite for merchants wanting to have card payment facilities. Merchants had to invest in such devices and these costs were reflected in customer fees. Fintech startups, on the other hand, have introduced facilities such as mobile POS applications, reducing the high cost of buying and maintaining hardware such as POS machines.

Lack of collaboration with innovators

Since most traditional banks are publicly held banks, they tend to be risk-averse, failing to understand changing customer needs beyond their traditional approach. Their low investment in creating value through adopting new and innovative ideas and technology made fintech startups more attractive.

Unwillingness to divert from the traditional banking system

Traditional bankers generally do not recognise the dynamic environment and changing customer needs. They are reluctant to change or upgrade their traditional banking infrastructure, probably built over decades. Customers, therefore, tend to prefer the more convenient options that fintech startups offer.

The link between fintech and banking

A bank’s core functions involve disbursing loans to and taking deposits from eligible individuals. Customers of traditional banks and financial institutions have had access to a variety of products and services in the financial services sector in recent years. Banks have been able to modify and relaunch some of these products and services using technology.

Fintech firms offer both individuals and businesses the option of lending and borrowing money online. They provide a win-win situation for all parties – lenders, borrowers and facilitators.

The following are some of the services they provide.

Digital payment solutions

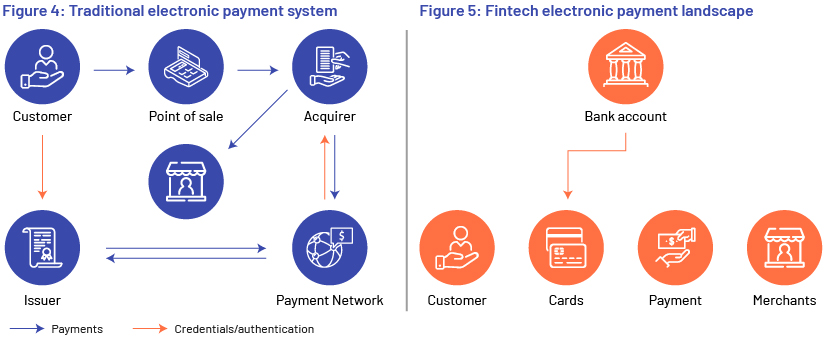

The payments business is the most profitable banking business and was revolutionized the fastest following the technology boom. The availability of cutting-edge mobile devices, easy access to a number of data networks and the wide range of innovative products and applications launched by fintechs were the main drivers of the disruption in the payments business. These applications and technologies help consumers engage directly with vendors and eliminate third-party channels, saving costs and providing a positive customer experience. Online payment gateways and mobile wallet services were introduced. Among the most well-known e-wallets are PayPal and Apple Pay. These wallets allow for P2P payments, top-up and utility bill payments, international transfers, ticket booking, and facilitate a number of other transactions. Many traditional banks are now acknowledging the significance of e-wallets and the benefits of incorporating such technological improvements.

The buyers are typically large e-commerce companies looking to improve the payment experience for customers who previously used banks as the third party for payment services.

Thus, fintech startups are enhancing settlement services in terms of speed, comfort, effectiveness and digital accessibility. They are influencing consumer behaviour, raising expectations for better, faster and more creative payment solutions, and increasing risk to customer relationships with banks.

Personal finance management

Fintech developments have made personal financial management simple for everyone. Consumers can now effectively manage their funds and obtain insight on their spending habits with fintech solutions.

Ease of obtaining loans for SMEs

Fintech has been a turning point for entrepreneurs and small-company owners, as most small businesses find it challenging to obtain a loan from a traditional financial institution.

Fintech makes it possible for SMEs to process payments and obtain loans. Fintech has had a significant influence in reforming and developing small enterprises, which were previously considered to be high-risk.

Impact of fintech on the banking sector

Positive impacts

Banks have considerable funds, enabling them to compete by creating similar goods, notwithstanding the dynamic potential of fintech that could affect banks' value propositions. Competition among banks and fintech businesses benefits the economy and provides clients with access to a wider range of services. Fintech is not disrupting the banking sector totally, but introducing healthy competition.

Negative impacts

What banks do to compete with fintechsThe value of bank products has reduced, explained by the "four horsemen of the e-pocalypse” – disintermediation, invisibility, unbundling and commoditisation. These factors are disrupting banks, according to Forbes writer Martin Haering. Since customers can obtain multiple services from one provider through fintech startups, the unbundling strategy of traditional banks have made bank products less distinctive. Commoditisation refers to banks no longer being able to distinguish themselves as banks because they are being compared to other financial institutions. Invisibility implies that banks are beginning to lose brand recognition as customers can now obtain financial services from other providers. Disintermediation refers to the process through which banks gradually lose access to clients as a result of their increased ability to use other providers' financial services.

What banks do to compete with fintechs

While fintech startups have recognised the need for more customer focus and are developing solutions to meet this, established banks are still underperforming and making only slight advancements. Banks need to realise that merely facilitating trade is not enough if they are to succeed in the current environment. They must modernise their operations to remain relevant to tech-savvy customers whose needs are constantly changing.

Collaboration and partnership

Direct collaboration across the fintech ecosystem may replace the competition between banks and startups. There are opportunities for collaboration and partnership that would take advantage of each other's strengths, whether in terms of startups’ product development and design or banks’ distribution and infrastructure capabilities. In instances where they cannot gain from working alone, banks should partner with fintechs until they are able to manage on their own. Banks should identify the market segments with the most growth potential and the lowest consumer value proposition and choose the best fintech partner to close this service gap while remaining competitive.

Banks, more than other financial service providers, are entering into collaborative ventures with fintech startups, according to PwC’s 2016 Global Fintech Survey. Banks are the most active in creating venture funds to finance fintech businesses. Such collaborations can result in advantages to all parties, such as safe and secured transacting, a wide range of products and services, discounts and offers for customers, regular support and government incentives.

Banks also benefit from innovative products and services, and increased efficiency, visibility and risk management. A good example is the partnership between fintech firm Tradeshift and HSBC. To help businesses that wanted to digitise and automate their processes, HSBC and Tradeshift came up with a creative solution to help banks manage their working capital requirements and manage their global supply chains from any device, using one simple digital platform. This improves risk management, visibility and general efficiency. Another major collaboration is that between Deutsche Bank and Traxpay. Supply-chain financing was a potential investment for Deutsche Bank. The objective was to establish a partnership that would allow them to incorporate supply-chain technology and solutions into the bank's own product line. To provide its corporate clients with discounting and reverse factoring options, the bank and Traxpay, a German fintech business, collaborated. The bank now leads supply-chain financing on a global scale.

Integrate fintech startup ideas

Both banks and fintech companies have unique selling points. Banks can influence consumer demand and should take advantage of their extensive customer base and customer loyalty. Additionally, they have a solid financial foundation that enables them to invest in emerging trends and concepts that startups and fintechs may not be able to comprehend. Therefore, banks should try to incorporate innovative ideas and concepts from fintech into their banking models.

How Acuity Knowledge Partners can help

We are the world’s leading provider of research and analytics support to the financial services sector, with over 4,800 analysts supporting 490 financial services clients, including 35 global and regional corporate and commercial banks. With 20 years of credit experience and 1,000+ credit experts, Acuity’s lending team supports across the lending value chain, including origination, underwriting, credit monitoring and loan operations. Our services are supported by our proprietary suite of solutions – Business Excellence and Automation Tools (BEAT) – that combine our domain expertise with contextual technology. We enhance our automation capabilities with machine learning and NLG, enabling faster turnaround without compromising on accuracy. We help improve client service and drive revenue while reducing costs and retaining talent.

Sources:

-

https://www.statista.com/statistics/893954/number-fintech-startups-by-region/

-

https://www.digipay.guru/blog/the-impact-of-fintech-on-banks-and-financial

-

https://www.cfainstitute.org/en/research/foundation/2017/fintech-and-regtech-in-a-nutshell

-

https://subaio.com/5-fintech-and-bank-partnerships-that-are-generating-revenue/

What's your view?

About the Author

Kalana is an Associate attached to the Lending Services. Currently, he supports the Acquisition Finance (AF) team and is responsible for carrying out risk raters, financial spreading, covenant migration, validation and monitoring, cover validations, and other credit workflows for the AF team of a leading European-based bank.

Kalana holds a BBA (Hons) in Finance Degree with First Class Honors from the Department of Finance of the University of Colombo and he was the Team Leader representing the University in CFA Research Challenge 21/22, which was selected as Local Finalists. He has 5+ years of work experience and prior to joining Acuity, he worked as an Executive – Tax..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox