Published on April 17, 2024 by Ruvini Wijemanna

Elevated credit risk poses a threat to international trade transactions

An international trade transaction involves a minimum of two parties in two countries and is more complex and risky than a domestic trade transaction. Eighty percent of international trade transactions are on open terms; this poses a significant risk of non-payment to the seller, either due to insolvency or protracted default. The buyer being located in a different country, governed by a different set of rules and regulations, gives rise to country risk as well. Export credit insurance (ECI) mitigates risk of non-payment associated with international trade transactions through a special form of insurance cover.

Simply put, ECI protects an exporter against the risk of non-payment by an importer in that, in the event of default, the exporter is insured against the sum of receivables. It provides an extra cushion and ensures minimal disruption to business operations. “Debtor insurance”, “trade credit insurance” and “accounts receivable insurance” are used interchangeably to describe ECI, depending on the context. Parties that provide ECI cover are referred to as export credit agencies (ECAs), which could be privately or government-held commercial risk insurance companies or export and import (EXIM) banks.

In this blog, we explain in detail the risks covered under an ECI policy, how it works, the role of an ECA and how exporters and banks benefit from ECI.

Boosting your international trade portfolio with ECI

-

Reduces or eliminates risk of an actual loss of cash income from the export sale

The biggest challenge that exporters face is non-payment; in the actual event of default, the financial impact, especially on small and medium-size enterprises (SMEs), could be significant. ECI minimises the risk of losing revenue from foreign sales and ensures minimal disruption to the business cycle.

-

Increases your ability to compete in international markets

Considering the dynamic business environment and thin margins, especially with regard to consumer goods trade, all businesses want more competitive credit terms. Offering open-account credit terms and longer credit periods would be very appealing to foreign buyers and would decide the win or loss of a deal.

Additionally, open-term transactions are effected faster than letter-of-credit transactions, as banks are not involved in the process. They enable both the exporter and the importer to come to an agreement swiftly and proceed with the sales order. However, since no third party is involved and the transaction is not regulated, it means that the risk is higher. Exporters need to be protected against non-payment risk as they try to attract new customers. This is where ECI comes in. With open-term transactions, however, an exporter could increase orders from existing customers and gain more financial flexibility. This would increase export sales and market share.

-

Helps enter new markets

Exporters are usually reluctant to enter new markets, which may be less regulated or have high political risk. ECI assures payment in the event of default, connects parties to establish a new trade relationship and promotes global trade.

-

Improves cash management and access to financeWhen foreign account receivables are insured, lenders are willing to lend money on favourable terms. This increases the exporter’s borrowing capacity, supporting the improved cash management position.

Mounting corporate insolvencies and payment defaults increase demand for ECI

A number of companies – from large multinationals to SMEs – have faced challenges and drastic changes in the business environments they operate in, in recent years. Uncertainty has risen from market pressure due to customer behaviour changing after the pandemic, economic and political pressure, increases in inflation and the cost of living, tighter budgets and higher taxes.

Geopolitical instability in Europe and the Middle East, the war in Ukraine and the Israel-Gaza conflict have further increased the difficulty and volatility, influencing business outlooks and hindering recovery and growth. A major consequence of this challenging business environment is the surge in insolvencies around the world.

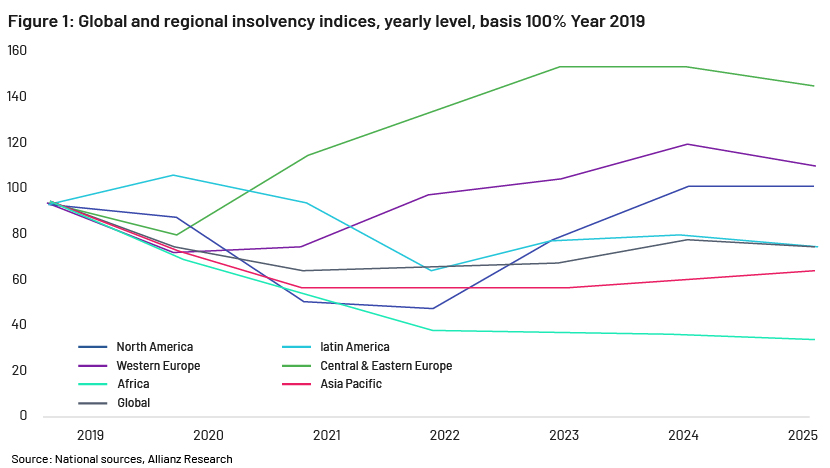

Global business insolvencies are set to rise by 6% in 2023 and 10% in 2024, according to Allianz Research’s Global Insolvency Outlook 2023-25 report. Insolvency experts anticipate a gloomy outlook for corporates’ payment-related behaviour in 2024. The most vulnerable sectors identified are hospitality, transport and wholesale/retail.

Bankruptcy filings, including all chapters in the US, increased by 17% to 36,607 in January 2024 from 31,176 in January 2023, according to the American Bankruptcy Institute. Commercial chapter 11 filings increased by 22% in January 2024, driven mainly by higher interest rates and tougher lending conditions.

Surging insolvencies have necessitated extra protection, increasing demand for ECI to cover risk of non-payment in export trade transactions. The global trade credit insurance market was valued at USD9.56bn in 2022 and is expected to grow at a CAGR of 11.1% from 2023 to 2030, according to Grand View Research., driven by heightened geopolitical tension, rising insolvencies, payment delays and difficult business environments.

Increased complexity in supply-chain transactions has heightened counterparty risk and the need for trade credit insurance protection. New regional/bilateral agreements will likely see a reallocation of trade resources, increasing trade creation and boosting demand for ECI.

Prepare the ECI umbrella before it rains

ECI cover should start at the time a sales order is received. The following diagram outlines the process – from obtaining ECI cover to logging an ECI claim.

ECI can be classified into three categories:

-

Short-term insurance. Usually focuses on short-term credit sales with tenures of less than one year and covers merchandise trade and commodities. It could cover all turnover or a single buyer.

-

Medium-term insurance. Usually provides protection against non-payment for export transactions with tenures of one to five years and covers capital-goods exports.

-

Long-term insurance. Covers long-term cross-border credit transactions with tenures of 5-20 years, generally facilitating projects in power generation, large-scale infrastructure and transport.

Risk coverage – protecting foreign receivables against unforeseen events

An ECI policy covers two types of risk:

-

Commercial risk

-

Political risk

Commercial risk

This has three categories: insolvency risk, protracted default risk and non-acceptance risk.

-

Insolvency risk

A buyer may be unable to meet commitments due to insolvency. In this scenario, trade suppliers are the least priority, posing a significant risk to export receivables and affecting business operations significantly.

-

Protracted default risk

Also referred to as slow payment or where the buyer intentionally defaults on payment.

-

Non-acceptance risk

The buyer may not show up to accept the goods delivered at the agreed destination. This is another form of counterparty risk.

Political risk

This covers non-payment due to country risk-related incidents such as war, riots, terrorism and trade embargos. Even creditworthy buyers could default on payment due to circumstances beyond their control. For example, during times of war, a buyer may have the funds but be unable to reach a bank, or there could be government restrictions on foreign-currency payments. These situations could result in delays in or defaults on payment.

Protects exporters and ensures safer lending for banks

ECI is a catalyst between cross-border investment and economic growth, bridging trade finance and the real economy. Although businesses are well aware of the concept of insurance and the importance of mitigating risk, accounts receivable are often the largest uninsured asset on a company’s balance sheet. This could be due to a lack of awareness among the exporter community or due to overlooking the risk of non-payment and its impact on business.

ECI helps exporters and banks mitigate and manage credit risk while improving financing.

ECI compensates for loss, safeguards continuity and promotes open trade between countries and is, therefore, an ideal way to protect foreign receivables.

It is not only the weak performers who default on obligations; even creditworthy buyers could, due to circumstances beyond their control, such as trade embargos or war. In the event a buyer defaults due to commercial or political risk, the ECA would pay the exporter up to the agreed percentage of cover, usually 70-90%. This would minimise the impact on business and ensure that the exporter continues to operate without significant loss. SMEs would benefit more, as a default on even one or two shipments could have an adverse impact on the business and result in closure.

Providing open terms and longer credit periods would improve an exporter’s competitiveness, helping to increase sales to existing byers and acquire new ones.

ECI helps exporters stabilise cashflow even during difficult times. As export sales are indemnified against non-payment risk, this minimises volatility in cashflow due to unexpected delays in payment.

Exporters engage in a number of tasks – from looking for sales and arranging logistics to handling operations. Time is a limited resource, and managing credit may not be a core task. ECI eases the burden of credit management, so exporters can focus on their core business.

ECAs monitor buyers’ payment behaviour constantly and hold comprehensive information on a buyer, including early warning signals of insolvency/default on payment. If the exporter is insured, their credit profile will be monitored diligently, and they will receive early warnings of possible delays in payment and expert advice on how to avoid very-high-risk transactions.

Furthermore, as ECI provides a cover against non-payment risk, exporters can enter new markets with confidence and penetrate current markets with better credit-risk management. Entering new markets is always risky, as it involves a number of uncertainties including heightened political risk and counterparty risk that exporters are usually hesitant to take. Building a relationship with a new buyer in a known market also includes commercial risk; this could be mitigated through ECI.

When export receivables are insured under an ECI policy, banks are more comfortable in offering credit to exporters. In some countries, banks ask exporters to obtain ECI cover before they lend against foreign receivables. ECI can also help a company improve its financial standing by allowing it to use insured accounts receivable as collateral. It helps exporters obtain pre- and post-shipment financing, supporting management of the cashflow cycle. ECI acts as collateral and increases the exporter’s borrowing base. Improved access to bank finance would improve the liquidity position.

On the other hand, banks offer higher advance rates for insured receivables under factoring or post-shipment finance. In both instances, ECI turns the same collateral into a larger borrowing base, resulting in better cashflow.

When it comes to project financing, a bank’s exposure to credit risk is extended, usually for more than five years, increasing uncertainty and involving greater political risk. In this context, long-term ECI policies are handy, as they cover risk of non-payment for projects phase by phase.

ECAs issue pre-shipment and post-shipment credit guarantees to banks, covering a bank’s risk of non-payment by exporters. Banks could pool their credit exposure under export financing and obtain a guarantee facility; then, if an exporter defaults on repayments, the ECA would pay the bank on behalf of the exporter. ECAs issue such export credit guarantees for the sole purpose of promoting international trade and supporting local exporters.

Conclusion

ECI is an important tool in international trade, helping both exporters and banks mitigate credit risk, stabilise cashflow, manage credit better and gain improved access to finance while acting as collateral. Amid increasing geopolitical risk, economic uncertainty and insolvencies, ECI would play a major role in promoting international trade.

How Acuity Knowledge Partners can help

Our innovative concepts and expertise in trade financing and structured export financing help us support commercial banks, EXIM banks and ECAs with credit analysis, risk assessment, early-warning-signal monitoring, credit reviews and covenant monitoring, helping them mitigate credit risk and manage their credit portfolios effectively.

Sources:

-

https://berneunion.org

-

https://grandviewresearch.com/industry-analysis/trade-credit-insurance-market-report

-

https://atradius.ie/reports/economic-research-economic-outlook-december-2023.html

-

https://www.cityam.com/corporate-insolvencies-in-2023-dramatically-hit-level-not-seen-since-2009/

Tags:

What's your view?

About the Author

Ruvini is a Delivery Lead with the Commercial Lending Division at Acuity Knowledge Partners. She is currently part of the Real Estate & Infrastructure team, undertaking covenant monitoring, risk raters, insurance monitoring, financial spreading, early warning indicator monitoring and other credit workflows for a leading European bank. Prior to joining Acuity Knowledge Partners, she has worked in an export credit agency handling export credit underwriting and risk management and she has served an international bank attached to fund management division. She holds a Bachelor’s degree in Business Administration (Finance Special) from the University of Colombo and a passed finalist..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox