Published on August 1, 2024 by Asha Jagadishwaran and Kurian K Jacob

Introduction

Fund labelling is the process of categorising and identifying funds based on environmental, social and governance (ESG) considerations. It plays a key role in evaluating a fund’s impact on corporate ethics, governance and socio-economic factors and assists in creating and setting a framework for the fund’s commitments to sustainability.

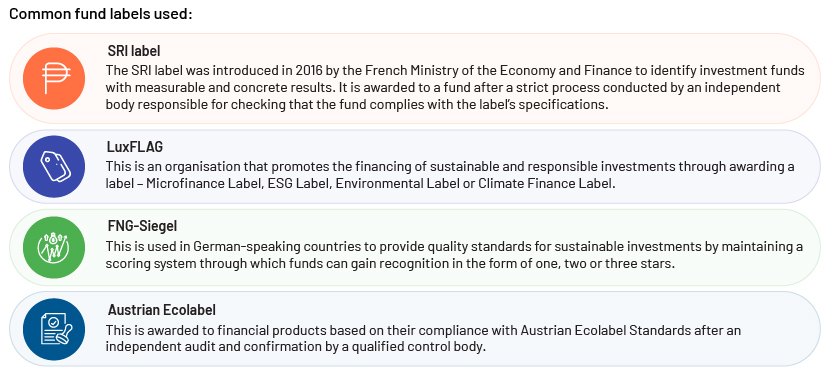

A quality label can act as a shield against greenwashing while minimising information costs. On the other hand, from the viewpoint of fund managers, it can be used to attract investors by helping them differentiate funds in the financial market. The SRI label, FNG-Siegel, LuxFLAG and Nordic Swan are some of the sustainable financial labels in use at present.

Fund names are an effective marketing tool. Funds’ ESG-related terms should be corroborated by fund labels so as not to mislead investors. A number of countries have adopted fund labels, and it is, therefore, not always easy for retail investors to fully understand what is on offer. For example, the Austrian Ecolabel rates companies, funds and consumer products.

Key parameters:

-

Transparency – ESG fund labels help prepare an independent view of the quality and transparency of sustainable financial management.

-

Additional credibility – ESG fund labels add credibility, transparency and a standard of quality to financial products.

-

Protection against greenwashing – ESG fund labels help protect against greenwashing, as funds are required to use specific wording to gain approval to sell products labelled as sustainable.

-

Building trust and confidence – ESG fund labels make investors aware of the fund’s objectives and strategies, helping building trust and confidence.

The relationship between the Sustainable Finance Disclosure Regulation (SFDR) and fund labelling is that the SFDR requires financial-market participants to disclose the sustainability characteristics of their products, such as funds and strategy, whereas in the case of fund labelling, funds are characterised based on sustainability attributes such as ESG. Labels are voluntary credentials whereas compliance with the SFDR is mandatory.

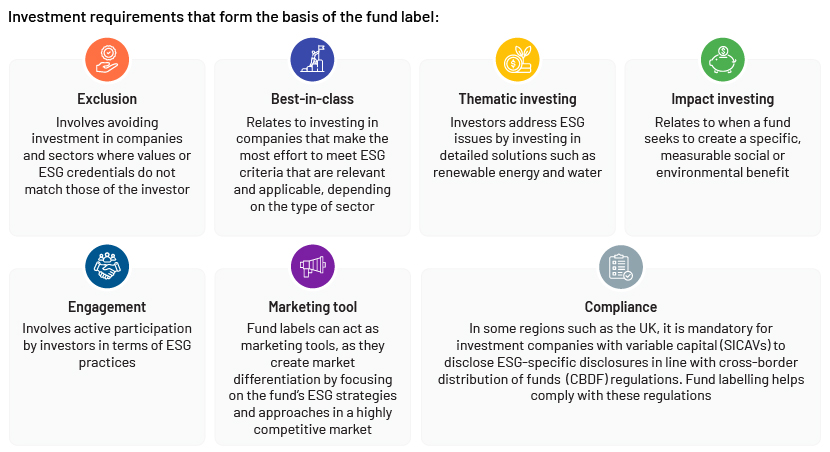

Fund labelling combines approaches such as exclusion, best-in-class, thematic investing, impact investing, engagement, marketing tools and compliance to meet fund objectives and environmental considerations. The exclusion approach helps avoid investment in certain sectors, while the best-in-class approach helps invest in companies that do the maximum to meet ESG criteria. Thematic and impact investing help address societal and environmental issues. All these elements combined help create a fund label that aligns an investor’s financial goals with ethical considerations.

How does compliance help in fund labelling?

Compliance plays a vital role in ensuring that fund labels follow the regulations and guidelines set by the respective regulator. For example, the UK’s Financial Conduct Authority (FCA) has released new Sustainability Disclosure Requirements (SDRs) that define labels based on sustainability goals. In line with the new requirements, a product must meet both general and specific criteria, including sustainability improvers, impact, focus and mixed goals. The FCA has also explicitly flagged the potential for enforcement action if companies misuse its labels or otherwise fail to meet the requirements. The FCA’s new labelling requirements present an opportunity for compliance, helping to ensure that the financial product continues to meet all the criteria. Compliance ensures that the fund managers disclose all the information required by the regulator for the purposes of fund labelling.

Conclusion

It is important that investors make the right decisions in terms of their investments. Labelling makes a fund transparent and credible, ensuring quality and sustainability. When investors are informed about how a fund meets ESG criteria, they are able to invest in such funds. The name of the fund can be an effective marketing instrument, not only catering to the needs of investors but also guaranteeing market stability, helping to reduce risks and ensuring that communication is fair, balanced and not misleading.

How Acuity Knowledge Partners can help

We are a respected player in the global financial services market, providing compliance expertise and a wide range of other services. We are experienced in reviewing marketing material (such as presentations, website content and brochures) and ensuring funds comply with a label’s specifications as prescribed by the regulator.

Marketing compliance

We help assess the gaps between current marketing practices and the new Marketing Rule and review marketing material and social media content when volumes are high.

We ensure that all the criteria relating to fund labels are met continuously and that fund managers disclose all the information required by the regulator for fund labelling.

ESG compliance

We deliver unparalleled ESG compliance and monitoring solutions. As a trusted partner, we take the complexity out of navigating ESG regulations, providing tailor-made solutions. We work closely with your organisation, ensuring verification of its internal ESG policies and that data validation is meticulous and ESG disclosure is authentic. We help conduct pre-investment screening and due diligence to help you make well-informed decisions that align with your investment and sustainability goals.

References:

Tags:

What's your view?

About the Authors

Asha Jagadishwaran has 14 years of work experience, with expertise in electronic communication surveillance. Prior to joining Acuity Knowledge Partners (Acuity), she worked with the Internal Compliance and Supply Chain team at Honeywell Technology Solutions. At Acuity, she is an integral part of the Corporate and Forensic Compliance team. She holds a master’s degree in Human Resource Management, specialising in Finance, from Tilak Maharashtra Vidyapeeth - Pune

Kurian K Jacob has overall 2+ years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners, he worked for KPMG as an Audit Associate and his expertise spans across distribution compliance, risk consultancy, project management, and financial reporting and assurance. At Acuity, he is a part of the Compliance Operations team and is responsible for compliance monitoring tasks for a client. He has completed Master’s in business administration from St Joseph’s Institute of Management and Bachelor of commerce from St Joseph’s College of Commerce

Like the way we think?

Next time we post something new, we'll send it to your inbox