Published on July 7, 2025 by Rabin Thakur

Our collaborations with private market asset managers of different sizes and with diverse strategies have unearthed an interesting observation – data management around environmental, social and governance (ESG) aspects is highly fragmented. Such fragmentation poses numerous challenges such as inability to benchmark investments and analyse their impact on portfolios, non-compliance with regulatory needs and inability to meet limited partners’ requirements.

As a result, the standardisation of ESG data becomes paramount. Popular frameworks and templates that particularly address the needs of private markets include ESG Data Convergence Initiative (EDCI), ESG Integrated Disclosure Project (IDP), European Leveraged Finance Association (ELFA), Principal Adverse Impact (PAI) and Sustainable Finance Disclosure Regulation (SFDR).

What is ESG covenant package?

ESG covenant package is a framework designed by infrastructure lenders including Aberdeen, Allianz Global Investors, Aviva Investors, BlackRock, IFM Investors, LGIM Real Assets and Macquaire Asset Management. It seeks to ensure consistency in borrowers’ ESG data reporting to their lenders. Besides, the framework intends to help borrowers report consistently amid dynamic regulatory requirements, especially in the United Kingdom (UK) and the European Union (EU).

Components of ESG covenant package

The covenant package primarily focuses on helping borrowers meet the reporting obligations prevalent in the UK and the EU. Additionally, it lays down certain ground requirements around ESG that need to be dealt with before a financial closure. The covenants in the package are non-binding – they are only recommendatory in nature.

Environmental and social monitoring report

ESG covenant package, chiefly addressing the reporting requirements of borrowers, consists of an environmental and social monitoring report. Occasionally, borrowers need to create ad hoc reports. Environmental and social action plans are also included in reporting.

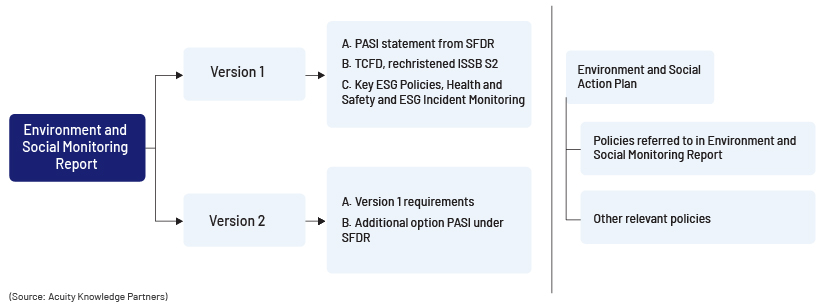

Figure 1. Components of environmental and social monitoring report and action plan

As shown in Figure 1 above, the report consists of two versions. Version 1 includes the mandatory Principal Adverse Sustainability Indicators (PASI) reporting in accordance with the Regulatory Technical Standards (RTS) under the SFDR. A Taskforce for Climate-related Disclosures (TCFD)-based report was also part of this version. However, International Sustainability Standards Board (ISSB) S2, which has replaced TCFD, is now a part of Version 1 reporting in the covenant package. Lastly, key ESG policies, along with ESG incidents and health and safety parameters, must be reported.

Version 2 includes all the components of Version 1 plus reporting on option KPIs under the PASI disclosure mentioned in Tables 2 and 3 of the RTS under the SFDR. In addition, an environment and social action plan, which should ideally include descriptions and applicability of the policies mentioned in Version 1, should be reported.

How are lenders using ESG covenant package?

Aberdeen is one of the first lenders to use debt ESG covenant package (in a July 2022 deal). To refinance Italian gas network Societa Gasdotti Italia’s loan, Aberdeen applied the ESG covenant package, which stipulated that if a borrower failed to report on select ESG KPIs on an annual basis, it would be considered a default, as mentioned in the loan documents.

In another transaction, involving an infrastructure asset manager investing in a natural gas plant, the loan terms included periodic reporting of carbon emissions by the borrower. In addition, the borrower was obliged to develop and implement a health and safety programme for its operations.

Additional ESG drivers in private debt

ESG integration in private debt is growing at a faster rate than ever. A recent survey by a United Nations Principles of Responsible Investment (UNPRI) group suggested 82% of the private debt respondents were collecting ESG data for decision-making.

The UNPRI has developed a ‘responsible investment framework’ for private debt investors, which helps them integrate ESG factors into their investment decision-making. It also guides them in actively assessing ESG risks and opportunities and ensuring transparency in their operations.

Green Loan Principles (GLP) – another popular framework – has been developed to integrate green principles in the lending market. GLP sets out clear guidance on the use of loan proceeds to develop products and solutions with environmental benefits. Similarly, Social Loan Principles provides an investment framework to create a positive impact on communities and society at large. These principles and frameworks are developed and promoted by Asia Pacific Loan Market Association (APLMA), Loan Market Association (LMA) and Loan Syndication and Trading Association (LSTA).

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading provider of bespoke solutions to the private debt market. We serve as a one-stop shop for ESG and sustainability solutions, supporting clients through research and analysis, due diligence, data collection and reporting, portfolio monitoring and integration of technology-based processes for automating manual efforts.

Sources

-

Private Debt Investor – Where does ESG fit in the future of private debt

-

Private Debt Investor – Where does ESG fit in the future of private debt

Tags:

What's your view?

About the Author

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Like the way we think?

Next time we post something new, we'll send it to your inbox