Published on November 15, 2021 by Sandani Saparamadu

We live in an era where technology is at the core of every task. Thanks to the evolution of technology, it is now possible for a building to perform the same tasks as before but with much more efficiency and cost saving and less energy consumption.

Occupants are now demanding buildings that are versatile and able to cater to changes in their behaviour and sustainability-conscious lifestyles. They are looking beyond the four walls and are concerned about the ecological footprint their buildings leave.

As an antidote to the austere nature of conventional buildings, we have entered the age of smart buildings.

What are smart buildings?

A smart building is one that uses IoT to automatically control the operations of the building, including heating, lighting, air conditioning and security. Occupants can tune their place of work/living to suit their frame of mind, just like tuning their home entertainment system. The question is how a building can do that. A smart building uses sensors, receptors and microchips that enable it to collect data and adapt accordingly. Conventional buildings are responsible for 40% of Europe’s energy consumption and are an area that can be tapped into to reduce energy consumption. The benefits of smart buildings go beyond energy savings to other environmental, societal and economic benefits.

Smart buildings, at the most fundamental level, provide valuable services that make occupants productive and comfortable at the lowest cost with the least environmental impact throughout the building’s lifecycle.

Reaching this vision requires IoT to be enabled from the commencement of the design phase through to the end of the building's useful life.

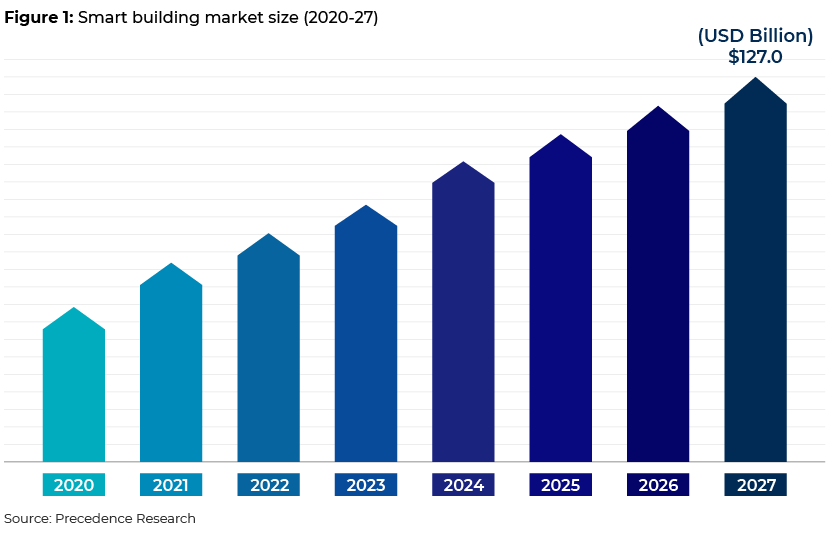

The smart building global market surpassed USD49.35bn in 2020 and is expected to be worth c.USD127.09bn by 2027, growing at a CAGR of 12.5%.

Key drivers of growth of smart buildings

Growing demand for energy sources has raised global concern relating the sustainability of the sources.

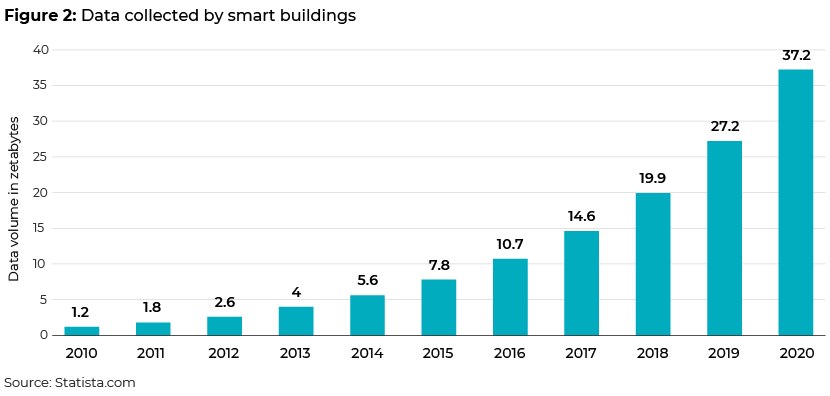

World energy consumption exceeded 12,000 Mtoe, as of 2020, with Asia accounting for the most. There is significant opportunity to limit energy depletion by resorting to smart buildings. Occupants should have the ability to identify and evaluate the use of energy and space, and maintenance requirements in order to optimise these metrics. Smart buildings were reported to have collected c.10.7 zeta bytes worth of data back in 2015 to optimise services offered to their occupants.

IoT, the essence of smart buildings, is in demand from big corporates and tech-savvy occupants. Smart buildings have advanced temperature and illumination controls that can enhance indoor comfort levels. Enhancing indoor air quality can improve worker productivity by 8-11%, and enhancing lighting conditions can improve productivity by 23%, according to the World Green Building Council (GBC).

Innovative financing for smart buildings

The focus on clean energy has presented an opportunity to resort to smart buildings. This would not be an inexpensive task. For example, USD100bn would need to be spent annually until 2030 to achieve the European Union’s ambitious climate goals. It is a challenge to source the volume of funding required to upgrade conventional structures to smart buildings and to construct smart buildings from the ground up without effective and scalable financing. The following financing mechanisms have proven to be efficient for smart building investments.

-

Energy-efficient mortgages (EEMs)

This is a novel product introduced by the banking sector to redirect funds to support the development of smart buildings. The logic of operation of EEMs is that banks offer the possibility of lower principal repayments, flexible interest rates and additional funds at the point of refinance on the understanding that the mortgaged property will show a substantial improvement in energy consumption. Major European banks such as BNP Paribas, ING Bank, Nordea Bank and Société Générale have joined hands with the World GBC to implement EEMs as a pilot scheme, indicating that EEMs is the way forward across Europe. On a positive note, EEMs are cheaper than general mortgage loans for the borrower. EEMs offered by Barclays are known to carry a rate 0.1% lower than standard rates.

The operation of a standardised EEM is backed by two objectives:

(1) Reduction in risk to the bank's risk-weighted assets – improvement in the energy performance of a property has a positive impact on the value of the property.

(2) Reduction in the bank’s credit risk – borrowers are less likely to default, as the household has more disposable income due to lower energy costs. The default risk is 32% lower in energy-efficient homes, according to data gathered by IMT Washington.

Standardised EEMs come in three forms:

(1) Federal Housing Authority (FHA) mortgages – minimum down-payments are linked to 3.5% of the total market value of the property. The FHA grants permission to add the cost of renovations conducted to maximise energy efficiency if the cost of improvements is less than the monetary benefits accumulated due to these renovations.

(2) Veteran Administration (VA) mortgages – offered to veterans and service personnel.

(3) Conventional mortgages – these allow the lender to increase the borrower’s loan amount by a dollar amount equal to estimated energy savings.

-

Property Assessed Clean Energy (PACE) programmes

PACE is a novel mechanism of financing energy-efficient additions to a commercial or residential property. The distinctive feature of these programmes is that the debt is linked to the property rather than to the borrower. PACE programmes allow the owner to finance upfront energy or other eligible improvements in return for voluntary payments to the government via the tax bill. The government in turn remits the debt repayment belonging to the lender. More than 200,000 residential property owners had borrowed a total of USD5bn and more than 35 states had funded projects worth more than USD800m under PACE programmes as of 2019.

How Acuity Knowledge Partners can help

We help commercial real estate lenders manage and monitor loan portfolios. We provide extensive knowledge on valuation and research that can be leveraged to identify lucrative deals. Our analysts conduct comprehensive risk rating, covenant monitoring, customised credit reviews and other activities that provide early warning signals in line with a client’s unique needs.

References:

https://www.energy.gov/eere/slsc/property-assessed-clean-energy-programs

https://www.precedenceresearch.com/smart-building-market

https://www.statista.com/statistics/631151/worldwide-data-collected-by-smart-buildings/

https://yearbook.enerdata.net/total-energy/world-consumption-statistics.html

Research Report: Home Energy Efficiency and Mortgage Risks, by the Institute for Market Transformation

https://energysavingtrust.org.uk/green-finance-can-it-support-home-energy-efficiency/

What's your view?

About the Author

Sandani is an associate attached to the commercial lending division. She is currently part of the Real Estate Finance team undertaking covenant monitoring and covenant validations for a leading European bank.

She is a CIMA passed finalist, holding a bachelor’s degree in finance from University of Colombo. She is currently pursuing a MBA (Finance) from University of Bedfordshire.

Like the way we think?

Next time we post something new, we'll send it to your inbox