Published on September 3, 2025 by Tejasav Suri

Introduction

The energy, utilities and resources (EU&R) sector has been dynamic in terms of global M&A. Firms with robust financial standings have demonstrated the greatest ability to capitalise on opportunities for dealmaking within an industrial environment undergoing significant transformation due to emerging geopolitical factors, governmental policies and continued focus on energy transition and security.

Companies operating in the sector as well as those in other sectors that have EU&R dependencies in their supply chains are increasingly adopting “friendshoring” strategies to ensure access to essential feedstock. The US, in particular, is emerging as a favourable destination for M&A, driven by economic incentives and robust infrastructure. These developments signal a global movement towards sustainability, adherence to regulations, optimising portfolios and strategic consolidation.

What's behind the surge in deal-making activity?

A number of firms are actively reinforcing their asset portfolios and refining capital strategies to navigate the significant volatility in the energy sector. At the same time, they are gearing up for increased investment demands, driven by the shift towards cleaner energy sources.

For companies focused on the energy transition, M&A can play a pivotal role in achieving scale and improving operational efficiency. In the current environment of high interest rates, these transactions can also serve as a critical source of new capital to support financial resilience. Assessing how such deals contribute to the sustainability of the overall portfolio is a key component of a sound capital allocation approach in the context of energy transition.

Securing adequate funding would be critical in advancing the energy transition. Identifying suitable sources of capital may prove difficult, but a group of global investors – such as sovereign wealth funds and private equity firms with a strong interest in infrastructure – could contribute significantly to financing these efforts.

Ensuring supply security is another primary focus for dealmakers. This priority, combined with the need for reconfiguration, is likely to drive companies to collaborate with partners outside their usual sectors to strengthen supply chains and secure energy resources. Examples include automotive OEMs entering innovative agreements to secure lithium supplies and major datacentre operators investing directly in greenfield energy sources.

The push for reconfiguration is also accelerating rapidly due to government regulations. These include tax incentives, government-backed capital pools, policy changes to boost investment and direct government involvement in specific projects. Among the most notable initiatives are Japan’s Green Transformation Act, the EU’s Green Deal Industrial Plan and the US Inflation Reduction Act (IRA). All these initiatives aim to boost investment in a number of low-carbon infrastructure projects, driving increased M&A activity across the sector.

The sector’s transformation has been influenced significantly by the “3D framework” – digitalisation, decarbonisation and decentralisation – that continues to drive innovation in areas such as energy-as-a-service models, battery storage and renewable energy.

Companies are fast-tracking synergy realisation in M&A deals

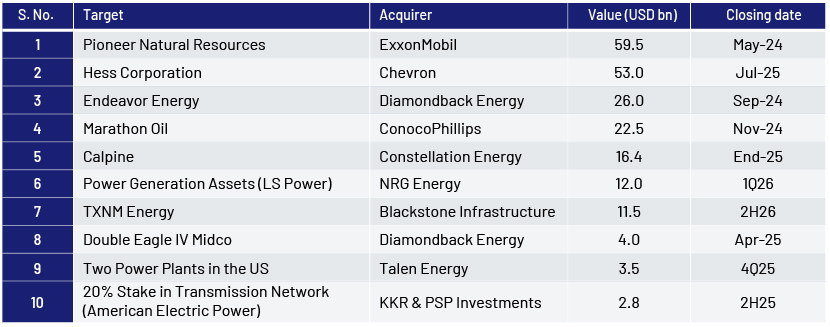

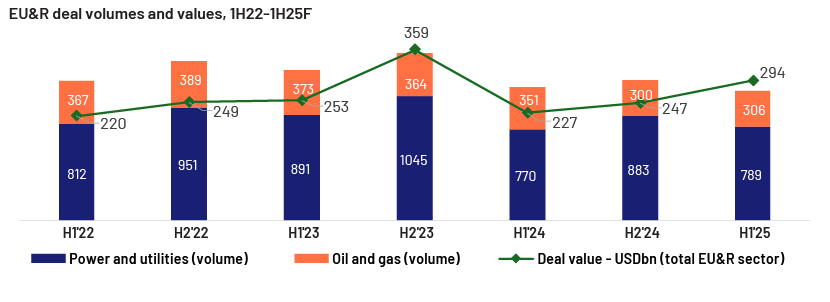

While many companies slowed their pursuit of energy transition deals in 2024, oil and gas firms accelerated consolidation efforts, anticipating sustained demand for hydrocarbons. The sector recorded over USD400bn in M&A activity – the highest in three years – driven by more than 10 megadeals. The most notable was the merger between Diamondback Energy and Endeavor Energy Resources, alongside several significant mid-size transactions such as Chord Energy’s acquisition of Enerplus. Overall, the year marked a clear pivot toward scale-driven deals that accounted for 86% of strategic M&A transactions exceeding USD1bn, reflecting a strong industry focus on building size and operational leverage.

Top-performing companies are shifting away from relying solely on formal sale processes typically managed by investment banks. Instead, they are adopting a continuous and proactive approach to M&A by regularly assessing potential targets through strategic scenario planning. Informal outreach – especially direct communication between CEOs and senior executives – is becoming a vital method for initiating deals. This forward-looking strategy enables companies to act swiftly and secure valuable assets before they become widely available.

As capital becomes more expensive and less accessible, companies are under greater pressure to ensure that every deal delivers strong returns. This has led to a significant upgrade in due diligence practices. Firms are now using advanced analytics and AI to conduct more thorough and efficient evaluations. These technologies help uncover early synergy opportunities by analysing supplier agreements, customer data and product lines. Additionally, AI tools assist in screening a wide range of potential targets based on financial and strategic criteria, enabling faster and more informed decision-making.

Integration planning is no longer reserved for post-deal execution. Leading companies are now initiating this process well before a deal is finalised. Cross-functional teams – including IT, supply chain and operations – are brought in early to develop a clear roadmap for integration. This includes identifying quick wins, mitigating risks and aligning operational models. In complex sectors such as shale oil and gas, this early planning ensures that asset-level strategies and decision-making structures are in place to support a smooth and effective transition.

Prominent deals in the global power and utilities sector

Strategies used by top-performing oil and gas companies to create greater value

Leading oil and gas companies with the highest total shareholder returns strategically pursue selective M&A opportunities to drive growth, followed by disciplined portfolio management through the divestiture of non-core assets. To safeguard their balance sheets, they rely mainly on equity financing for major transactions and complement these with smaller, asset-level deals to fine-tune their portfolios. This balanced approach has enabled them to achieve robust five-year annualised total shareholder returns (SR), fuelled primarily by earnings growth, even in a flat oil price environment.

In contrast, companies with weaker TSR performance often financed large acquisitions with cash or debt, placing strain on their balance sheets. Their reactive stance on divestitures further compounded the issue, leading to rising net debt levels, ultimately becoming a key factor in their underperformance.

What distinguishes the top performers in the power and utilities subsector

In the power and utilities (P&U) subsector, companies with the highest total shareholder returns tend to engage in fewer overall transactions – executing roughly half as many acquisitions and 60% fewer divestitures compared to their lower-performing peers. Their selective approach to M&A enables them to scale efficiently without compromising financial stability, while their proactive divestiture strategy helps recycle capital and refine their asset base. This disciplined execution has led to strong five-year annualised TSRs, driven primarily by expanding price-to-earnings multiples and reduced net debt, supported by well-timed divestments and responsibly structured M&A deals.

Conversely, underperforming firms have often taken a more reactive stance on asset sales and relied heavily on cash or debt to fund acquisitions. As a result, they have faced rising costs and been forced to issue equity to manage leverage – factors that contributed significantly to their weaker TSR performance.

Momentum going forward

The P&U subsector is set for a transformative year in 2025, driven by increasing demand for energy, technological innovations and geopolitical factors. One major factor influencing M&A is increasing need for datacentres, fuelled by the rapid growth of AI, cloud computing and digital infrastructure. This surge is pushing energy markets to adapt.

Three key forces are expected to continue shaping M&A activity in the P&U subsector in the latter half of 2025: rising electricity demand driven by datacentre expansion, shifts in federal energy policy and a heightened focus on strengthening grid reliability and system resilience.

Unlike other energy users, hyperscale datacentres prioritise energy reliability and quick access over cost. This increased power demand is expected to boost investments in traditional power sources such as advanced nuclear technology, as well as in new renewable solutions such as carbon capture, utilisation and storage (CCUS), combined with thermal generation. Growing interest in small modular reactors also highlights the global focus on sustainable, large-scale energy solutions, although these projects may take longer to develop.

As the sector adjusts to growing energy demands and evolving political dynamics, 2025 is set to be a pivotal year for P&U M&A, characterised by a careful balance between investments in traditional and renewable energy sources.

How Acuity Knowledge Partners can help

We support EU&R sector clients by working as an extension to their teams, on both high-value and regular tasks, including building and implementing business, growth and deal strategies. Our team of experienced industry professionals also provide our clients with the necessary information and analysis on core and emerging areas such as LNG supply and trade, new-energy markets, contract analysis, tender tracking, fuel distribution, storage business, renewable projects, carbon neutrality, biofuels and carbon credits.

Sources:

-

https://www.pwc.com/gx/en/services/deals/trends/energy-utilities-resources.html

-

https://www.financierworldwide.com/deal-trends-in-energy-utilities-and-natural-resources

-

https://www.bcg.com/publications/2024/driving-forces-behind-the-energy-ma-boom

-

https://www.reuters.com/default/more-us-energy-deals-likely-2024-wave-consolidation-2024

-

https://www.rystadenergy.com/news/global-upstream-opportunities

-

https://www.offshore-technology.com/deals-dashboards/global-ma-activity-oil-gas-industry/?cf-view

-

https://www.offshore-technology.com/news/top-oil-and-gas-sector-deals-in-2024/?cf-view

-

https://www.harriswilliams.com/our-insights/2025-industry-outlook-trends-energy-power-infrastructure

-

https://finance.yahoo.com/news/energy-m-top-5-deals-170900363.html

-

https://www.pwc.com/gx/en/services/deals/trends/energy-utilities-resources.html

-

https://www.bain.com/globalassets/noindex/2025/bain_report_global_m_and_a_report_2025.pdf

What's your view?

About the Author

With 3+ years of experience in Investment Banking Research & Analytics, at Acuity Knowledge Partners, Tejasav manages diversified sectors of client coverage team for a regional investment bank, focusing Africa and the UK region. He has deep proficiency in the full suite of IB products, including industry research, competitive landscaping, macroeconomic analysis, strategic commentary, M&A transaction analysis, and financial modeling. Previously, he worked at SMERGERS, providing investment banking solutions to SMEs globally. He holds a B.Sc. in Finance from Narsee Monjee Institute of Management Studies (NMIMS) and is a CFA Level 3 candidate, having cleared Levels 1 and 2 consecutively with a 90+ percentile in each.

Like the way we think?

Next time we post something new, we'll send it to your inbox