Published on September 24, 2025 by Abhisek Sasmal

Despite having a robust banking system, the US financial sector has one segment that could experience tremendous pressure in the coming years – small US banks heavily invested in commercial real estate (CRE). Almost half of these banks' loan portfolios are linked to CRE, exposing them to CRE refinancing risks driven by rising interest rates, falling property values and decreasing demand for office space. Small banks, in contrast to their larger and more diversified peers, lack the level of capital buffer needed to absorb shocks, making them more vulnerable. Although the stress on these institutions’ balance sheets remains mostly concealed by loan restructuring and duration extensions, the underlying risks are increasing. In the event of rising defaults or further drops in collateral values due to refinancing stress, what appears to be a localised credit issue now could evolve into a systemic meltdown in the future. This "silent stress" does not suggest an immediate collapse but a gradual weakening of balance sheets across America's banking system.

US CRE market – cooling down

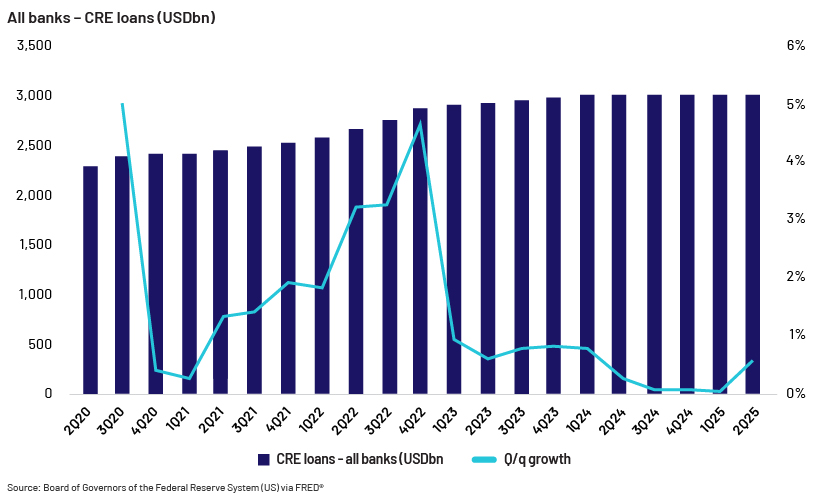

Total CRE loans have increased to USD3.0tn in 2025 from USD2.3tn in 2020, suggesting continued exposure across the US banking system. However, growth has decelerated considerably since 2023. Flat growth in recent quarters suggests that banks are now cautious about disbursing new CRE loans due to higher interest rates, falling office demand and regulatory ceilings on concentration risk.

Exposure and concentration: disproportionate stakes

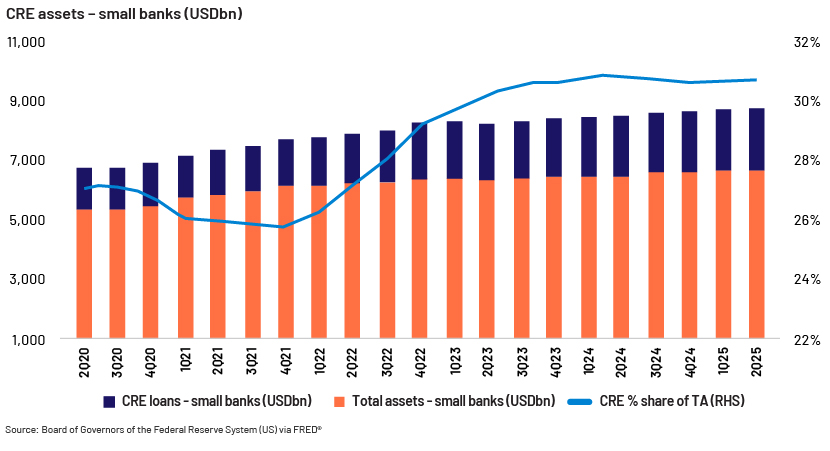

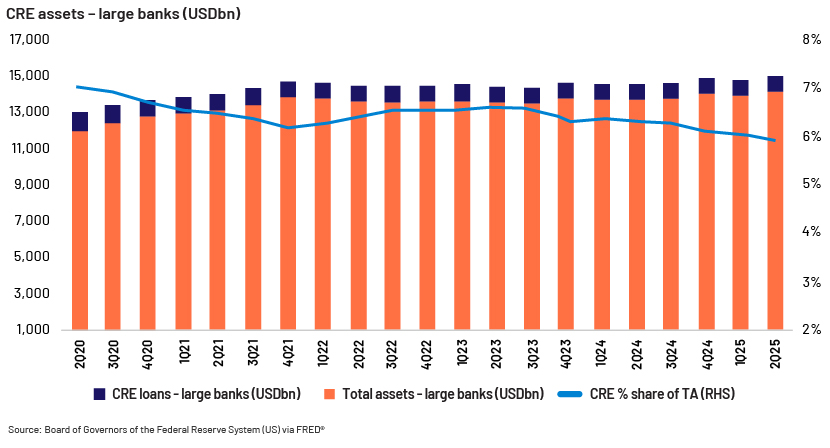

Small US banks are far more exposed to CRE than are larger banks. CRE loans constitute almost 31% of assets of small banks, compared to 6% of large banks. Although CRE loans generate higher margins for small banks, they also expose balance sheets to liquidity and market risks. Post-pandemic work profiles and behavioural changes have put pressure on the office CRE market, in turn pressuring small banks’ office-related portfolios (15% of the total CRE portfolio); a small increase in defaults could significantly erode banks’ equity. Small banks may struggle to absorb or hedge these shocks, making them a potential weak spot for US financial stability.

Refinancing risk: a ticking time bomb

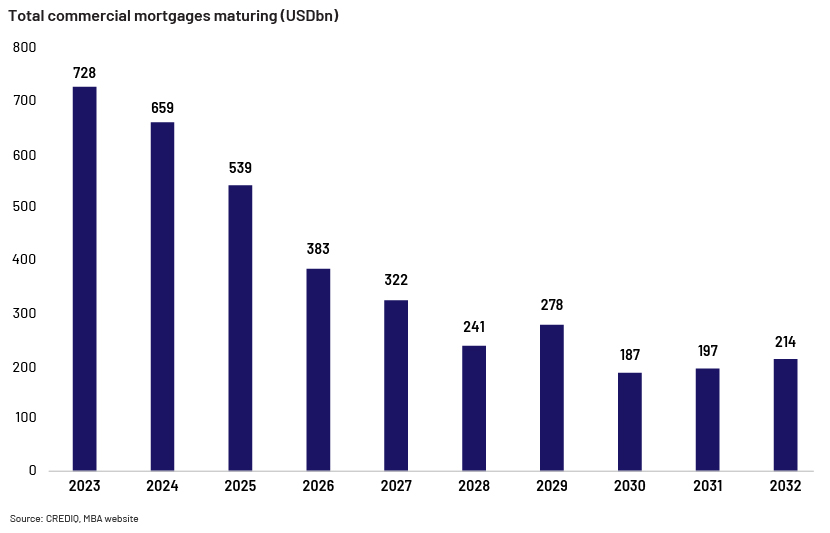

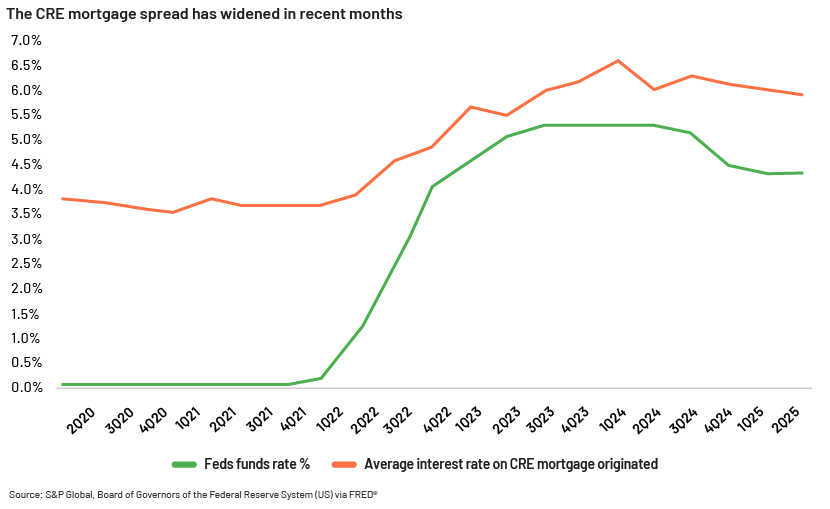

Post-pandemic behaviour and recent rate hikes by the Federal Reserve have increased pressure on CRE borrowers who need to refinance their loans. CRE mortgage interest rates have doubled since 2021, making refinancing expensive, while falling office (approximately 15% of the CRE sector) valuations have weakened collateral values. Over USD900bn of commercial mortgages are expected to mature from 2025 to 2026, highlighting the scale of CRE refinancing challenges that are unlikely to be resolved soon.

Delinquency trends and capital fragility of small banks in the US

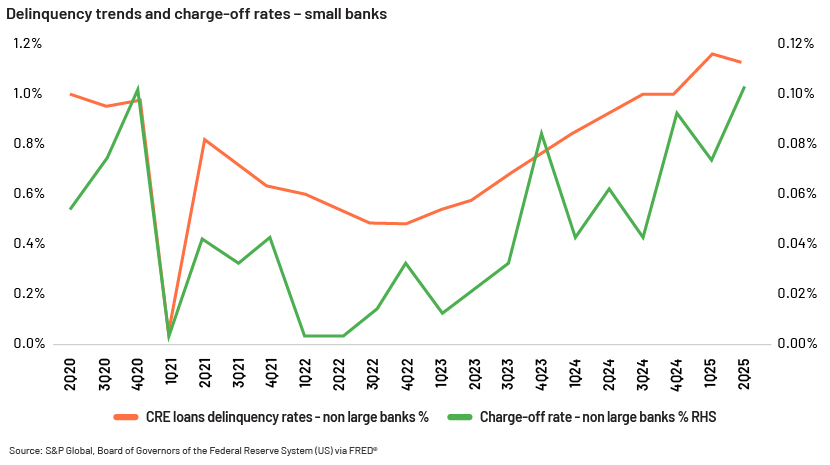

Small banks’ CRE delinquencies increased to approximately 1.1% in 2Q25 from approximately 0.5% in 2022. This upward trend is consistent with the current CRE/office refinancing pressures and declining collateral values. Net charge-offs remained subdued in 2022 but started to increase in 2Q23 and reached approximately 0.10% in 2Q25.

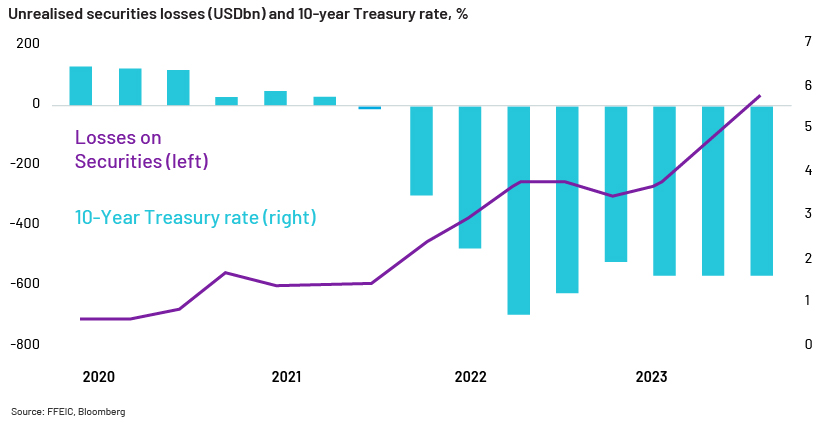

Bank portfolios of long-duration securities come under pressure amid rising interest rates. Small banks are disproportionately exposed to this risk due to their larger relative holdings of MBS/long bond securities. The increase in the 10-year Treasury bond yield from almost 1% in 2021 to 5% in 2024 eroded almost USD600-700bn in bond values in banks’ securities portfolios.

When analysing banks’ risk in the CRE market, one metric we should always keep an eye on is the CRE loans-to-CET1 ratio. This ratio shows the extent of CRE exposure a bank has in relation to its core equity. Regulators closely monitor each bank’s portfolio and usually set a threshold at 300%. This means that if a bank’s CRE loans exceed 3x its equity, it raises a red flag to the regulators. Going beyond this limit may also result in stricter requirements, such as raising capital, reducing CRE lending or reducing the balance sheet.

“Small regional US banks with USD0-10bn in assets are projected to have an aggregate CRE loans-to-CET1 ratio of 366.4% in 2025, slightly down from 377.3% in 2024. In comparison, banks with USD10-100bn in assets are expected to have a ratio of 313.7%, while those with over USD100bn in assets have a much lower ratio of 86.4%”, according to Visible Alpha consensus data.

Conclusion

Small US banks have already been experiencing the warning signs in CRE, driven by CRE refinancing pressures on heavily exposed portfolios, increasing unrealised losses on securities holdings and limited capital buffers. Rising delinquencies and high CRE loans-to-CET1 ratios show which lenders are most vulnerable, and many are already approaching regulatory limits. Banks that are overly dependent on CRE could face pressure from regulators in terms of caps on lending and valuation in terms of market-price decline. Reducing the scope for loan growth could negatively impact these small banks' future valuations. Moreover, if this stress spills over to larger banks, it could cause a meltdown in the US banking system.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners help identify early macroeconomic trends in various geographies and analyse their impact on specific sectors. Our team of subject-matter experts, with expertise in multiple sectors, helps clients analyse complex macroeconomic trends and their quantitative impact on earnings.

References:

-

https://www.federalreserve.gov/publications/financial-stability-report.htm

-

https://www.occ.gov/news-issuances/bulletins/2024/bulletin-2024-29.html?utm_source=chatgpt.com

-

https://www.fdic.gov/quarterly-banking-profile?utm_source=chatgpt.com

What's your view?

About the Author

Abhisek Sasmal has over 15 years of work experience in equity and macro research, financial and credit risk modelling. Currently he is supporting a European buy side client mainly on the diversified financial sector. He has been with Acuity for last 14 years supporting Global Fund Managers and sell side analysts in their research on Global BFSI. He is an MBA in finance and CFA charter holder. Before joining Acuity Knowledge Partners, he used to work with some leading domestic sell side firms in India on diversified sectors.

Like the way we think?

Next time we post something new, we'll send it to your inbox