Published on April 29, 2020 by Jarmanjeet Singh

The unprecedented liquidity crisis created by this pandemic has set the stage for a debt meltdown as the corporate sector scrambles for cash. Fundamental uncertainties have put companies with high leverage and near-term debt maturity in a debt dilemma. Plunging revenues due to emergency measures such as lockdowns and social distancing has strained cash flows.

Key highlights

-

The COVID-19 pandemic hit the financial markets when global debt was at its peak; corporate borrowings are at an all-time high, triggered by the low interest rate environment in the past decade

-

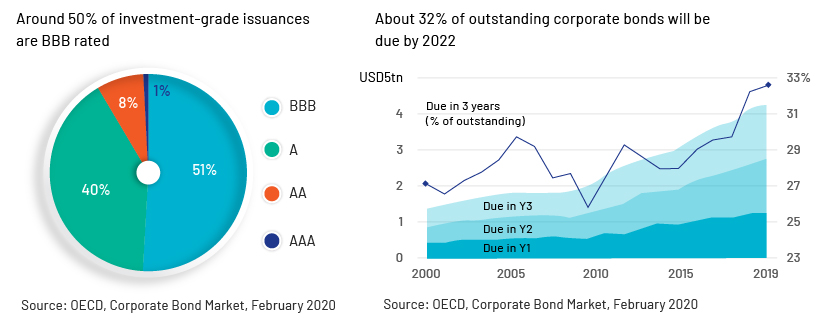

Nearly 50% of borrowings are in the BBB rating category (the lowest in the investment-grade class), at risk of being downgraded to junk in the event the pandemic is prolonged

-

Deteriorating earnings with weakening cash flows are pushing such companies to the edge, eventually to near collapse

-

Even with government support, businesses are at risk of default, with debt restructuring the next plausible solution

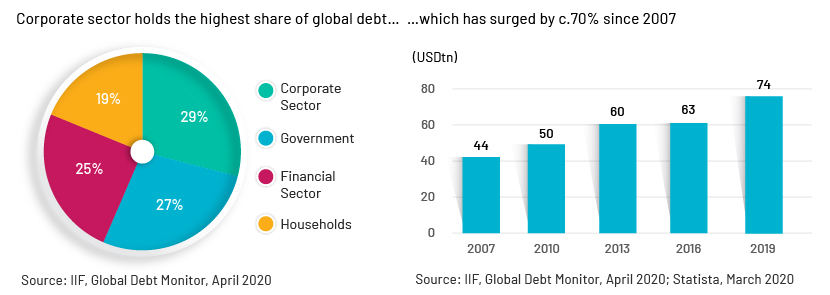

Global debt is 40% higher than at the start of the 2008 global financial crisis; corporate debt is 70% higher

The global debt-to-GDP ratio reached an all-time high of c.322% in 2019 with total debt reaching USD255tn.

-

Emerging-market debt exceeded USD71tn (220% of GDP), while debt in mature markets topped USD184tn (383% of GDP) in 2019

Corporate debt (excluding debt issued by the financial sector), has surged over 70% since 2007 to near 92% of GDP (USD74tn)

Unconventional monetary measures taken to create a low interest rate environment since the global financial crisis to stimulate economic growth have led to considerable growth in corporate borrowing.

-

Major economies such as the US, China, Japan, the UK, France, Spain, Italy, and Germany had corporate debt totalling USD51tn in 2019, a significant 50% increase over the USD34tn in debt outstanding as of 2009. According to the IMF, c.40% (USD19tn) of corporate debt of these major economies would be at risk in the event of a material economic slowdown

-

US corporate debt as of November 2019 reached c.USD10tn (c.47% of the US economy)

-

Two-thirds of growth in total corporate debt came from developing countries; China being the biggest driver

“Low global interest rates provide only a precarious protection against financial crises” – Ayhan Kose, Director of the World Bank’s Prospects Group

Corporate bonds reached an all-time high of USD13.5tn in 2019; at risk of being downgraded

Supported by a low interest rate environment, the mechanics of the credit rating system have allowed companies to increase their leverage ratios and still maintain a BBB rating, which has come to dominate the investment-grade category. Over the past three years, BBB rated bonds (the lowest in the investment-grade category) have made up 52% of all new investment-grade bond issuance. If forecasts of the COVID-19 impact become more pessimistic, there would clearly be a risk of abrupt and widespread downgrades from the sizeable BBB category to junk status.

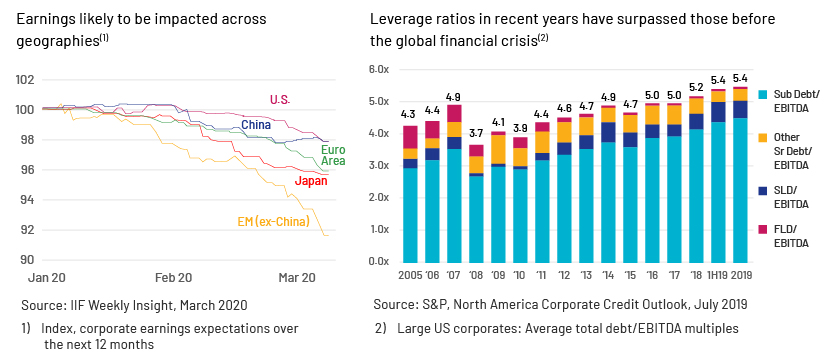

Weak mid-term prospects put extra pressure on already highly leveraged balance sheets

Earnings prospects are deteriorating, as evidenced by companies and analysts across sectors downgrading their guidance and forecasts. This puts extra pressure on sectors with weak and volatile earnings profiles. Debt to EBITDA could surge sharply, pushing credit spreads higher (since mid-February, high-yield spreads are up 300bps to over 650bps). Firms with limited cash buffers would be highly sensitive to a prolonged disruption, as any refinancing and access to interim financing would prove to be extremely challenging, especially to companies with high debt.

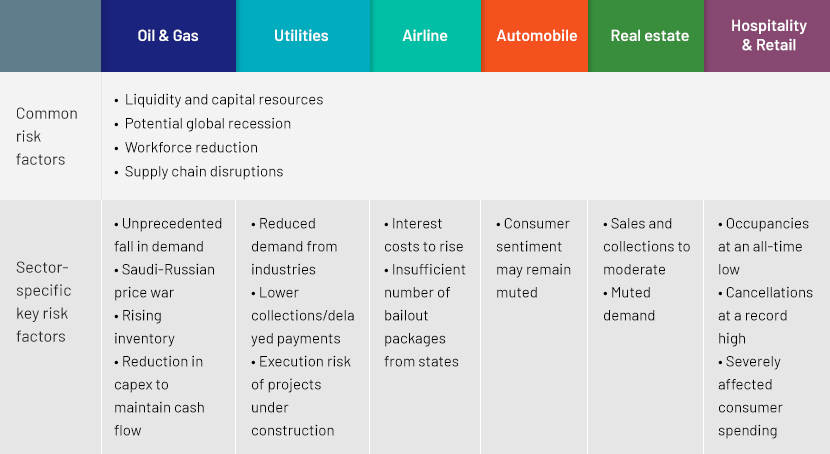

Selected sectors exposed to high credit risk

State measures will continue to evolve to minimise the impact on financial markets

The US federal government announced a USD2tn stimulus bill that included USD500bn to back loans for companies and USD350bn for small businesses. The UK government announced a GBP330bn bailout fund (c.15% of GDP) to offer state-backed loans to support UK businesses. Governments worldwide are implementing record stimulus packages to support their citizens and businesses. Most interventions so far have targeted financial markets and businesses, however given the extent of leverage and expected prolonged disruption, this may not suffice.

Increased risk of default expected to lead to a spike in the debt restructuring market

The pandemic has triggered global economic uncertainty and will have a long-lasting effect on companies’ cash flows, ultimately impacting their debt repayment capacity, i.e., they will not have enough earnings to cover interest payments or repay debt in the near term.

Companies across sectors are now forced to reforecast cash flows and conduct stress tests to assess whether future cash flows will be able to keep them within the defined limits of financial covenants. Any threat of breaching financial covenants would increase the risk of default and downgrade by rating agencies, putting companies in dire need of restructuring their balance sheets and proactively involving their lenders and shareholders in the process.

Advisers and investors are gearing up amid the chaos, with restructuring experts playing a vital role as companies struggle to fulfil their obligations and seek to negotiate new terms with lenders, vendors and other parties.

Mohsin Meghji, a managing partner at M-III Partners said, “Significant debt restructuring activity, which was previously more confined to industries in secular decline, such as brick-and-mortar retailers, is now becoming more widespread.” Investment banks and advisory firms that specialise in recession tactics, default, and distress are in demand as more companies find their balance sheets to be in trouble and seek help to weather the crisis.

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business around the world. Businesses will need to be agile to adapt to this new normal of business as they rethink their strategy for 2020.

Acuity Knowledge Partners has years of experience in working with investment banks and advisory firms specialising in restructuring and extraordinary situations. Our specialised teams of restructuring experts are equipped to support all aspects of restructuring and debt advisory, including liquidity management, creditor advisory, distressed assets support and other turnaround activities, meeting the front-office needs of our clients such as global bulge-bracket banks, mid-market banks, regional banks, and boutique advisory firms.

For more details on our restructuring and debt advisory click here.

Sources:

The Institute of International Finance (IIF)

IMF

OECD

Bloomberg

S&P

Press releases

Tags:

What's your view?

About the Author

Jarmanjeet Singh has over 14 years of experience supporting various investment banking clients at Acuity Knowledge Partners. In his current role, he is responsible for managing mid-market IB and boutique advisory clients. He leads teams that work very closely with the senior bankers on live mandates including debt advisory, capital raising and M&A activities. In his prior role at Acuity Knowledge Partners, he worked with the US based bulge bracket investment bank where he led sector teams of EMEA region. Jarmanjeet holds a Master’s degree in Business Administration in Finance from Symbiosis and a Bachelor’s Degree in Commerce (Hons.) from Delhi University

Like the way we think?

Next time we post something new, we'll send it to your inbox