Published on November 18, 2021 by Vivek Gupta

Key takeaways:

Twenty small and medium energy suppliers (out of c.50) in the UK with a cumulative customer base of over 2m have failed over the past two months. More than 15 are struggling to stay afloat, due to a near 3x increase in the wholesale power prices over the past two months

Most of these suppliers do not hedge their energy purchase costs and they cannot pass these additional costs to their end consumers due to the energy price cap1 and fixed one-year energy contracts with the customers

The UK energy regulator (Ofgem) appointed large energy suppliers to take on the customers of these failed energy suppliers. The industry expects only 10 firms to survive by end-2021

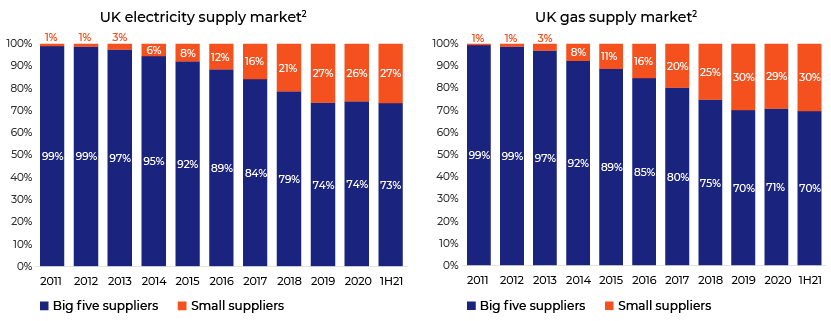

The crisis could prove to be an opportunity for the big energy suppliers to increase their market share, whose combined market share2 has declined to ~70% as of 1H21 (vs. 99% as of 2011)

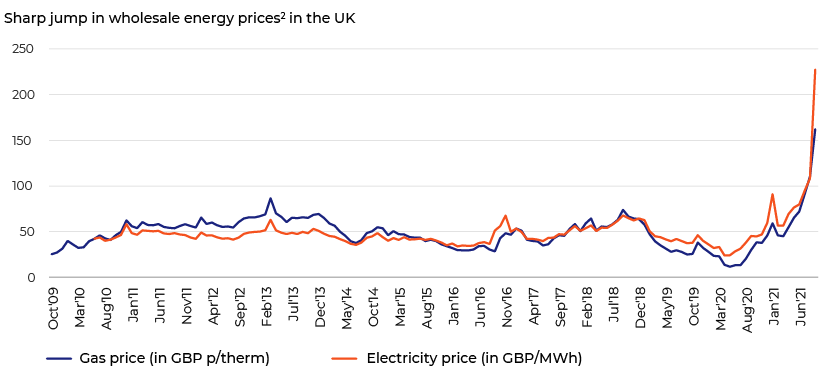

Wholesale power prices have increased sharply

Less gas storage capacity in the UK (9TWh3 vs storage capacity of 25TWh in Spain, 114TWh in France, 147TWh in Germany and 166TWh in Italy). Hence, the country is more vulnerable to short-term price fluctuations in the wholesale gas market

Storage levels in Europe are well below historical levels (storage utilisation is c.70% full vs the five-year average c.90%), after the prolonged cold weather at the start of the year drew down stocks, which also delayed the start of the traditional injection (refilling) season

Post-COVID economic ramp-up: Gas demand in China jumped c.10% YoY in 9M’21. To meet higher demand from China as well as from other Asian countries, higher Liquefied Natural Gas was transported to Asian countries, which means less LNG went to Europe (including the UK, which fulfils 20% of its gas imports from LNG)

High reliance on Gas in the UK: 85% of UK homes use central heating and the country generates c.40% of electricity from gas. However, with lower wind (due to adverse weather) and nuclear (driven by unplanned outages) power generation, 60% of electricity was generated from gas in 1H21; resulting in higher gas demand

Decline in imports from Norway: UK imports 40% of its gas from Norway; as such higher maintenance activity in the Norwegian continental shelf had an adverse impact on the UK’s gas import from Norway (down~10% YoY)

Unhedged Small/medium suppliers to be the worst impacted firms

The UK’s energy sector is relatively diversified, with small to medium players commanding ~25% of the market share. Majority of the small suppliers in the UK do not hedge their energy purchase costs (~80% of total expense). Furthermore, energy price cap1 and fixed one-year energy contracts with the customers limit energy suppliers ability to pass on cost increase limited ability to pass on higher costs. Hence, rising wholesale power prices erodes operating margins

At the current levels, these unhedged suppliers are expected to incur a loss of c.GBP700/year4 for serving one customer. Twenty such utilities have failed with a combined customer base of 2m over the past two months and over 15 suppliers are struggling to stay afloat. The Government has stated that it will not bail-out these firms

Big energy suppliers in the UK such as Centrica, E.ON, EDF and Scottish Power hedges most of their energy purchase costs. Hence, these firms will have limited impact from the current crisis. The UK’s business secretary has been warned by the industry that out of c.50 energy suppliers (before the crisis) in the UK, only c.10 could survive by end-2021. Most of these suppliers are private with limited access to Capital Markets. Hence, there failure will have limited repercussions in the credit market

Twenty energy suppliers2 in the UK have failed over the past two months

|

New appointed supplier |

Domestic customers |

Old supplier |

Timing of the exit |

|

Centrica (British Gas) |

511,700 |

||

|

50,000 |

Simplicity |

Jan. 27, 2021 |

|

|

82,000 |

PfP Energy |

Sept. 7, 2021 |

|

|

9,000 |

MoneyPlus Energy |

Sept. 7, 2021 |

|

|

350,000 |

People's Energy |

Sept. 14, 2021 |

|

|

5,900 |

Bluegreen |

Nov. 1, 2021 |

|

|

14,800 |

Zebra Power |

Nov. 2, 2021 |

|

|

EDF Energy |

580,000 |

||

|

360,000 |

Green Energy Network |

Jan. 27, 2021 |

|

|

220,000 |

Utility Point |

Sept. 14, 2021 |

|

|

E.ON Next |

239,000 |

||

|

6,000 |

Hub Energy |

Aug. 9, 2021 |

|

|

179,000 |

Igloo |

Sept. 30, 2021 |

|

|

48,000 |

Symbio |

Sept. 30, 2021 |

|

|

6,000 |

Enstroga |

Sept. 30, 2021 |

|

|

Octopus Energy |

580,000 |

Avro Energy |

Sept. 22, 2021 |

|

Shell Energy |

536,000 |

||

|

255,000 |

Green Supplier Limited |

Sept. 22, 2021 |

|

|

235,000 |

Pure Planet |

Oct. 13, 2021 |

|

|

9,000 |

Daligas |

Oct. 13, 2021 |

|

|

15,000 |

Colardo Energy |

Oct. 14, 2021 |

|

|

22,000 |

GoTo Energy |

Oct. 18, 2021 |

|

|

Yu Energy |

2,600 |

Ampoweruk Ltd |

Nov. 2, 2021 |

|

SmartestEnergy |

300 |

MA Energy |

Nov. 2, 2021 |

|

Utilita |

6,000 |

Omni Energy |

Nov. 2, 2021 |

|

Pozitive Energy |

41,000 |

CNG Energy |

Nov. 3, 2021 |

|

Total domestic customers |

2,496,600 |

Saving these energy suppliers could be a risky bet

At the current energy price cap and the elevated wholesale power prices, an energy supplier with 1m customer could end up incurring a loss of GBP350m over the next six months (until the next revision in the energy price cap, scheduled for Apr’22)

EBITDA margin (3%) is razor thin for the energy supply business. This loss of GBP350m could be equivalent to energy supplier’s 9 years of EBITDA

Hence, recovering the invested capital (if any) in these firms could be challenging for Asset Managers/ lenders of last resort

UK energy supplier could take c.9 years to cover up the losses from the current gas crisis in the UK

|

Expected loss from the current gas crisis in the UK |

P&L of an energy supplier with 1m customers |

|||

|

Total customer |

1m |

Revenue (based on current price cap) in GBPm |

1,270 |

|

|

Loss for serving one customer (per year)4 |

GBP700 |

EBITDA margin (for most energy suppliers) |

3% |

|

|

Loss until next energy cap revision |

GBP350m |

EBITDA in GBPm |

38 |

|

|

Total number of years to cover this loss |

9 years |

|||

Consolidation in the sector: Opportunity for Big five5 energy suppliers

The Big five energy suppliers’ (Centrica, E.ON, EDF, OVO and Scottish Power) market share2 dropped to 70% in 1H21 from c.99% in FY11 due to stiff competition (energy suppliers has increased by four times over the past ten years driven by low entry barriers) in the region

The industry expects only 10 firms to survive by end-2021 vs c.50 firms before the crisis. Hence, the crisis could prove to be an opportunity for the big energy suppliers to increase their foothold in the energy supply business in the UK

How Acuity Knowledge Partners can help

Acuity Knowledge Partners has partnered with some of the asset managers in Europe, UK North America who have invested in the UK Energy sector. We have helped our clients by providing time bound, scalable and idiosyncratic solutions at various level of complexities – such as sector reviews, credit rating recommendations, detailed financial models and new deal reviews. This is well supported by our sector expertise and proprietary solutions, ready to use templates across Utilities and other sectors.

Sources

1To protect these consumers from a spike in wholesale power prices, the UK energy regulator (Ofgem) imposed a price cap in the UK in 2019 for c.11m customers (which uses variable contracts rather than fixed contracts). The energy price cap puts a limit on the amount that the energy suppliers can charge for per of unit gas and electricity to domestic customers. The cap is reviewed every six months, and is adjusted based on wholesale power prices. The price cap was increased 12% from Oct’21 but was the cap was decided during the summer (before the current crisis).

2 Ofgem;

3 BBC;

4 FT

5 There were six big suppliers in the UK earlier. However, it reduced to five after E.ON merged Innogy’s Npower (part of big energy supplier) in FY20

EIA, Ofgem, S&P, ourworldindata, FT, CNN, BBC, Guardian, UBS

Tags:

What's your view?

About the Author

Vivek has over 7 years of experience into Credit Research (Investment Research). Over the years, he has supported IG and HY analysts on the buy side, sell side, and credit rating analysts. He has been associated with Acuity Knowledge Partners since June 2020. Vivek currently covers Utilities Sector and provides support to a large buy side client based in Europe covering IG and HY issuers in the EMEA region. Vivek holds an MBA (alumni of Indian Institute of Management-Indore) in Finance and a Bachelor’s degree in Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox