Published on February 16, 2023 by Abhishek Jha

Taxes, homes and the economy

China has two major problems harming its economic ambitions in the 21st century – tax and real estate – the two factors considered to be the foundation of a successful economy. China has major tax problems and most of them stem from the fact that it is the world’s second-largest economy and is largely informal. China's large economy demands a level of government spending that can be funded only by a large and broad tax base.

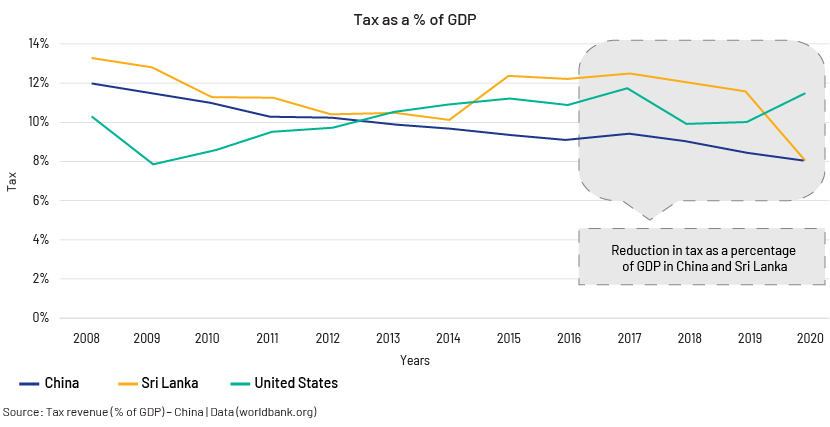

Taxation in the rest of the world

The US, China's closest peer in terms of size of economy, has federal tax revenue of around 17% of GDP, or around 25% of GDP if we include all local and state revenue. The UK’s tax revenue since 2000 has remained constant at 32.8% of GDP. China’s tax revenue is 9% of GDP (as of 2021). This creates a large budget deficit for China, exacerbated by the pandemic1.

China’s tax problem

China’s tax problem consists of three major issues, according to Nikkei Asia’s economic survey:

-

Tax collection is the responsibility of the local authorities

-

Local authorities are not given operational power

-

Local authorities are not incentivised to collect taxes from the population because their main source of income is property taxes

The World Bank’s Economic Update states that the central government – the Chinese Communist Party (CCP) – cannot collect taxes from most people; this is apparent from the low tax base of c.10% of the population.

The administrative setup in China

China operates through a central authority, and government authority is shared among provinces that are further divided into sub-provincial regions and cities within those regions. Local governments in most countries are funded by the federal government. China's local governments are different in that they generate most of their funds by taxing businesses and selling 20- to 70-year leases on their landholdings. In China, no private company or citizen can own urban land; renting it out for 70 years is, therefore, the next best thing.

Sixty percent of the funds these local governments generate from businesses needs to be returned to the central government. However, all revenue from land is theirs. China’s real estate market is a very large one, so this is a very significant revenue source.

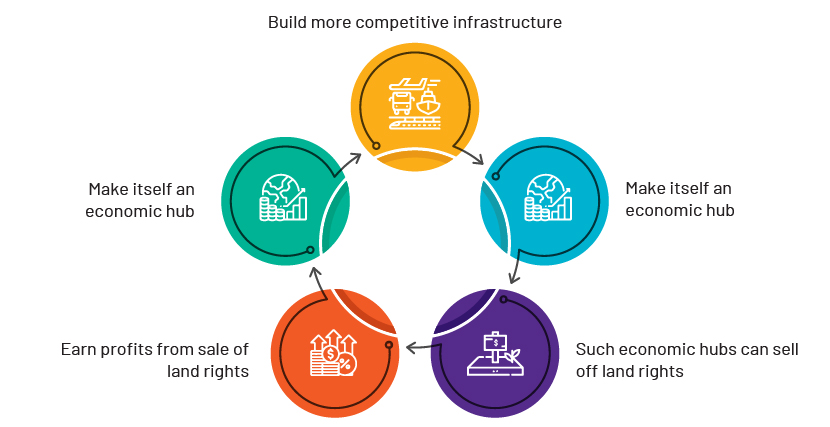

Land lease revenue works only if the land is worth developing. Land is worth developing only if there is infrastructure in place to support those who will live in these new developments. This leads to competition among provincial governments to do the following:

This chicken-and-egg situation results in two things:

-

It creates an infrastructure glut – ghost cities and railways that carry no passengers are not uncommon in China.

-

It necessitates substantial upfront investment by provincial governments. These governments are not allowed to issue bonds, and they do not start generating revenue from land until they sell off their landholdings. Therefore, they need to get creative.

They have come up with a local government financing platform3 to set up private companies and give these companies some of their state assets.

This could be cash shares and state enterprises or the land rights they are trying to sell off. The “private company” could then use all these assets as collateral to get a bank loan. The local government could use this cash to fund infrastructure projects, while banks could bundle these loans and sell them as bonds on the open market.

Local government financing platform bonds are deemed to be safe, according to Asia Times, because they have the indirect backing of the Chinese government, and the majority of Chinese investors believe the government would never default on its debts.

This also has the benefit of pushing government debt into the private sector, so national debt-to-GDP figures look better than they really should. Of course, the problem is that these are local governments, not the national government, and they have every chance of going bankrupt because they are limited in how they can raise revenue.

Problems with China’s administrative setup

So far, this system has not faced issues because the real estate market has continued to appreciate in value, so much so that even the most reckless borrowing practices can be offset with the funds generated from leasing land. However, this is now starting to come undone.

Businesses faced challenges amid the pandemic, and local government revenue declined as a result of limited business activity. Recent surveys indicate that the confidence of the Chinese in real estate is wavering on the back of the high-profile property development bankruptcies, including Evergrande’s. This means fewer investments in property and less being built.

China’s real estate and bond markets

Less being built means local governments are generating less revenue from renting out their landholdings. It also means that banks are no longer interested in accepting these landholdings as collateral to underwrite bonds for local government financing platforms.

China’s central government has started issuing tax returns to support citizens locked in their homes while simultaneously pushing for more infrastructure projects to offset the economic impact of the lockdowns.

This means less money coming in, more money going out and fewer options to raise money to bridge the financing gap in the meantime.

Property lease expiration and its impact

The 20- to 70-year leases eventually come to an end, and some of the shorter leases have now started to expire, posing a problem to the government in terms of what to do with the land. Traditionally, it would go back to the government, but this is not a popular solution among homebuyers.

A YICAI Global survey found that the Chinese believe land will never be reclaimed. For example, homes with 20 years left on their leases cost the same as homes with 70 years left on them, all things being equal. Why pay the same price for a home that can be lived in only for 20 years when you could pay for one that can be lived in for 70 years? The Chinese do this because they do not expect these leases to expire, and poor building standards in China mean that such buildings would not last that long anyway.

Conclusion

China’s tax problem could be solved by decoupling local government bodies from real estate development, increasing the tax base with stricter enforcement and investing in high-end manufacturing, all options China has not resorted to so far.

How Acuity Knowledge Partners can help

We have nearly 20 years of experience in supporting private equity firms across the real estate loan lifecycle. Our real estate services provide origination, processing, underwriting, closing and post-closing support across commercial, retail and consumer products, covering the range of basic to complex tasks. Leveraging a mix of people, process and technology, we provide tailor-made solutions to multiple clients – developers, mortgage firms, large banks and real estate investors.

References:

1.Organization for Economic Co-operation and Development

2.United Nation Reports (www.un.org)

3.World Bank

4.Asia Times: www.asiatimes.com

5.Reuters

6.Business Insider

7.Business Standard

8.YICAI Global

9.IMF

Tags:

What's your view?

About the Author

Abhishek has five years of experience in financial and investment research, with a focus on real estate assets. He has worked with Private Equity, Consulting and Valuation firms on a variety of research and analysis assignments across the deal pipeline spanning target screening, due diligence support, portfolio monitoring, market research, credit analysis, borrower research, loan servicing and ad-hoc research projects. He has gained exposure to supporting a wide spectrum of Private Market client engagements (with RE focus) at Acuity.

His previous experience includes working with a real estate consulting and valuation firm where he primarily focused on commercial real estate valuation, macro-economic studies, real estate sector..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox