Published on December 21, 2023 by Rabin Thakur

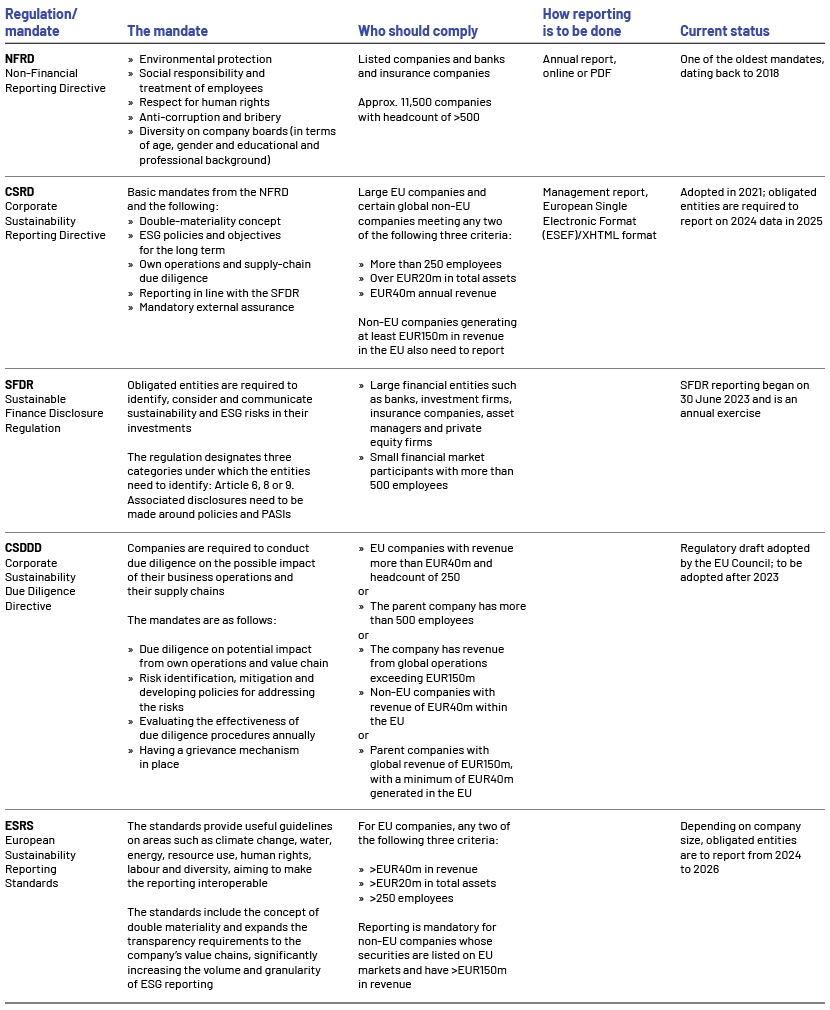

The EU’s sustainability landscape has seen a series of new regulations and rules proposed and implemented in recent years. These impact not only European business entities, but also those headquartered outside Europe with significant business interest in the region.

This is what we are hearing the most from our clients. The private equity and credit markets were just getting used to the transparency and reporting requirements of the European regulation, Sustainable Finance Disclosure Regulation (SFDR), with mandatory requirements and directives for enhancing the sustainability mandate increasing in recent years.

To add to the complexity, the directives are usually identified by their acronyms. We have compiled the following table to help simplify them.

How Acuity Knowledge Partners can help

We are the leading service provider of ESG services to the private markets. Our capabilities are developed around ESG data collection, aggregation, analysis and reporting, and we have hands-on experience in supporting clients throughout the regulatory reporting journey. We have supported clients on either side of the maturity continuum to set up ESG reporting processes.

Sources:

-

Non-financial Reporting Directive: Briefing – Implementation Appraisal

-

Everything you need to know about CSRD Reporting: Schneider Electric Perspective Blogs

-

How the EU’s new Corporate Sustainability Reporting Directive will impact your business: Marsh

-

EY: European Sustainability Reporting Standards adopted by EC

Tags:

What's your view?

About the Author

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Like the way we think?

Next time we post something new, we'll send it to your inbox