Published on July 17, 2025 by Chaitanya Gaur

The Indian equity market has seen a notable rise in recent years, fuelled by a confluence of robust economic expansion, favourable regulations and growing investor interest. However, there are concerns about the possibility of a market bubble, even amid this extraordinary rally.

In this blog, we explore the status of Indian equities; look at the function of institutional investors, both domestic and international (DIIs and FIIs); and evaluate the possible consequences and risks of a market correction.

Unrealistic expectations

Brokerages and analysts have been emphasising that greed or unrealistic expectations are what have been driving up Indian equities for a while. Price-earnings ratios, revenue, profitability and other conventional criteria all show that prices are on the verge of collapse and could break at any time.

It appears that there is no stopping despite the evidence. Retail investors seem to be ignoring experts’ caution and jumping on the bandwagon. For instance, a Delhi-based bicycle dealer's IPO was over-subscribed nearly 400 times. The company expected a meagre USD1.4m but received bids totalling USD560.6m.

While the total raised from IPOs increased by 24% (to USD7.9bn in FY24 from c.USD6.4bn in FY23), the number of IPOs jumped by 66%, to 272 in FY24 from 164 in FY23.

Indian exchanges were global leaders in IPO listings, according to the 2024 EY Global IPO Trends report. India's share increased steadily to 17% in 2023 from 6% in 2021 and 11% in 2022. Reflecting the buoyant market conditions, qualified institutional placements emerged as a critical equity fundraising mechanism for corporates in FY24. Resource mobilisation through rights offerings more than doubled to USD1.7bn in FY24 from USD788m in FY23.

While this looks attractive and shows confidence, experts feel it could be a result of overconfidence.

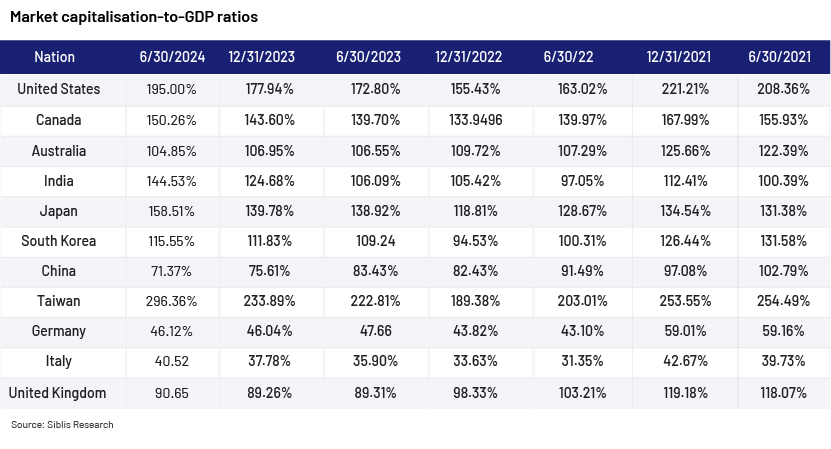

Although the prognosis for India's financial sector looks good, the Economic Survey 2023-24 also warned against overconfidence and speculation, noting that certain areas require targeted attention. Since financial assets represent claims on actual commodities and services, the market capitalisation-to-GDP ratio is not always an indicator of economic complexity or progress. It noted that extremely high equity-market claims on the real economy are a sign of market instability rather than market resilience.

Mutual funds and market inflation

Mutual funds, particularly passive and active funds, play a pivotal role in shaping capital markets. These funds influence market dynamics in different ways, but both can contribute to market inflation, especially when fuelled by consistent Systematic Investment Plan (SIP) inflows.

The following are details of trends in recent years:

| FY | SIP inflow (in USDbn) | Total mutual fund inflows (in USDbn) | Total AuM (in USDbn) | Active funds AuM (in USDbn) | Passive funds AuM (in USDbn) |

|---|---|---|---|---|---|

| 2018-19 | 10.8 | 12.8 | 286.1 | 269.5 | 16.6 |

| 2019-20 | 11.7 | 10.2 | 260.1 | 240.9 | 19.2 |

| 2020-21 | 11.2 | 25.1 | 367.2 | 329.7 | 37.5 |

| 2021-22 | 14.6 | 28.8 | 438.9 | 377.9 | 61.0 |

| 2022-23 | 18.2 | 8.9 | 460.6 | 379.1 | 81.5 |

| 2023-24 | 23.3 | 37.5 | 623.9 | 514.7 | 109.2 |

| CAGR | 13.6% | 19.6% | 13.9% | 11.4% | 36.9% |

Despite growing at a slower pace than passive funds, active funds have seen a consistent increase in their AuM. The data reflects an 11.39% CAGR in active funds, suggesting that while active managers continue to play a significant role, they face challenges in a market increasingly influenced by passive strategies. This could lead to a feedback loop where active funds contribute to inflationary pressures as they attempt to keep pace with market indices dominated by passive fund inflows

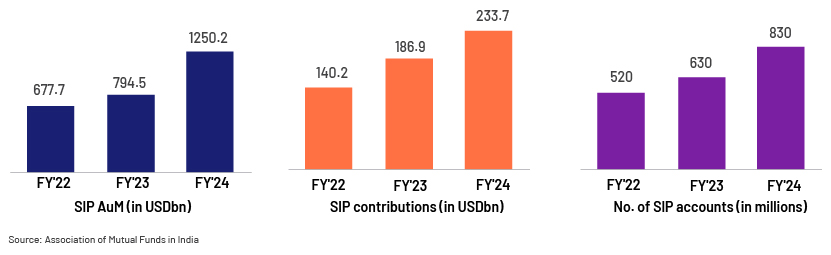

SIPs have become very popular in the past 10 years, and millions of investors have committed to making monthly deposits in equity mutual funds. These consistent inflows have grown to become a significant source of market liquidity.

The flow of money via SIPs has created persistent buying demand for stocks, helping market indices grow consistently.

On the other hand, capital markets are currently experiencing an "inflationary effect" as a result of this continued injection of capital.

Regardless of market assessments, ongoing purchasing has raised stock prices, often above their underlying values. This behaviour is most noticeable when there is a market correction or an economic downturn since the steady stream of SIPs inflates prices upward and reduces the severity of the correction.

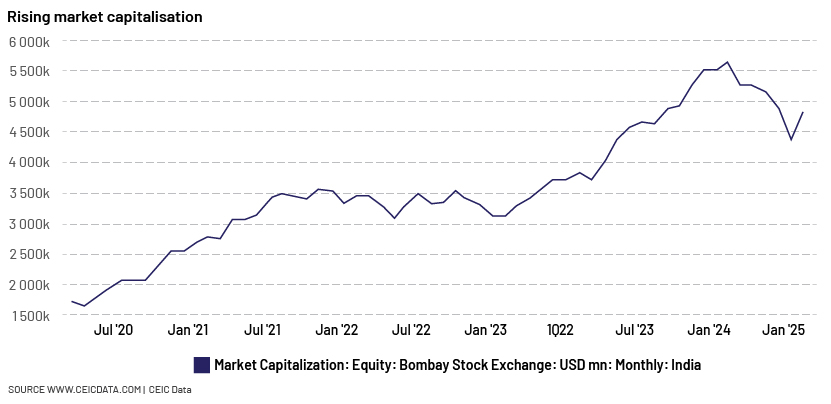

Market capitalisation tells an interesting tale.

The addition of USD1tn initially took 46 months, with India's market capitalisation increasing to USD3tn in May 2021 from USD2tn in July 2017. The next trillion was added over the course of 30 months, reaching USD4tn by December 2023. By May 2024, the amount had increased to USD5tn (in just six months). India's market capitalisation was at a tidy USD5.5tn as of 30 August, having gained an additional USD0.5tn in the previous three months.

Experts are, therefore, always issuing warnings. Investor Deepak Shenoy, who has warned about the risks and the possible decline in the face of disaster, summed up the feeling on X by posting that "It is time to be conscious that you are all riding a tiger." Calling it a “crazy” market, he stated that things will stay this way until they do not. "At the moment, it is impossible to anticipate how stocks will move. This market is crazy, and it always will be until something changes. Not constantly alerting folks when it is getting too hot is the point. This was said in December of 2024, and since then, we have increased by at least 30%. It might drop in ten months, or it might drop tomorrow. It is best to advise folks to stay rather than leave.”

India's market capitalisation-to-GDP ratio, far greater than those of other developing-market economies such as China and Brazil, has risen sharply over the years – to c.145% in June 2024 from c.100% in June 2021. A note of caution is that the ratio does not always indicate economic complexity or progress.

Current dynamics

Recent events, particularly the revival of trade disputes marked by the reintroduction of tariffs by the US, have led to increased market volatility.

Tariffs, which have reached as high as 26% on certain Indian products, have raised alarm in sectors heavily reliant on exports to the US, including gems and jewellery, textiles and specific manufactured goods.

The market responded with notable declines in the Nifty 50 and BSE Sensex Indices. Persistent geopolitical tensions are adding to investor unease, resulting in variations in capital flows.

On 7 April 2025, the BSE Sensex plunged over 4,000 points (5.3%) to hit a low of 71,725, while the Nifty 50 tumbled nearly 1,150 points (5%) to 21,744 in early trading. The broader market saw even steeper declines, with the BSE MidCap and SmallCap Indices crashing up to 10% in pre-opening deals.

Although India's domestic fundamentals provide some protection, the global trade landscape's interconnectedness means that these external influences cannot be overlooked. Investors are vigilant about these changes, as they could significantly affect market sentiment and overall economic stability.

Nevertheless, it is crucial to recognise that the Indian market has demonstrated resilience in recovering from such disturbances, and certain sectors, such as pharmaceuticals, have benefited from tariff exemptions, which have contributed positively to the market.

In relation to the Israel-Hamas conflict, bilateral trade in services between India and Israel is estimated at c.USD1.3bn. However, the repercussions are likely to remain limited unless there is substantial escalation in the conflict. The total impact on trade between India and Israel, encompassing both goods and services, would depend on the length and severity of the conflict.

Concerns surrounding energy security and geopolitical tensions in oil-producing areas significantly affect global energy markets and oil prices, with a direct impact on India's energy security and economic stability. Any interruption in oil supply or increase in oil prices due to geopolitical tensions would impact sectors in India’s stock market that are sensitive to fluctuations in oil prices.

Conclusion

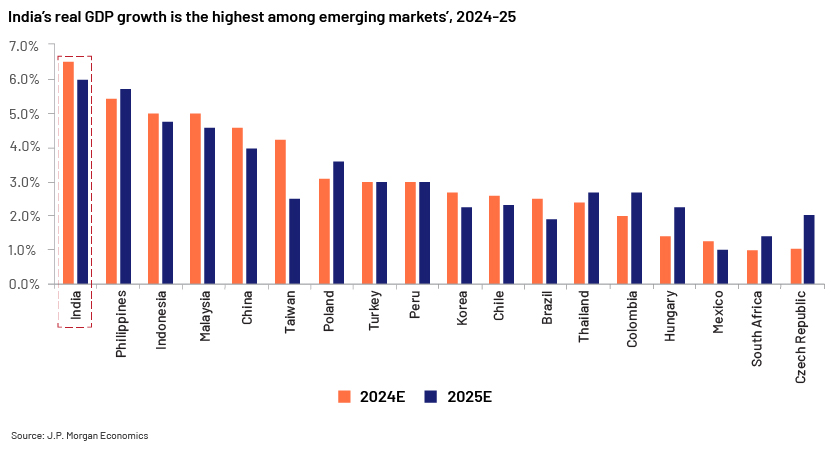

India's remarkable economic growth trajectory, coupled with favourable government policies and increasing investor interest, has propelled its equity market to new heights. However, elevated valuations and potential risks associated with a market bubble warrant a cautious approach.

While India's long-term prospects remain promising, it is essential that investors remain vigilant and assess the underlying fundamentals of individual companies before making investment decisions. By understanding the potential risks and implications of a market correction, they could navigate market volatility and capitalise on opportunities that may arise.

How Acuity Knowledge Partners can help

We are a leading provider of research, analytics and technology solutions to over 650 financial institutions across the world, including asset managers, corporate and investment banks and private equity (PE) and venture capital (VC) firms. Our services and solutions are supported by a global network of more than 6,000 analysts and industry experts. We assist PE and VC clients across their investment value chain – from industry research, deal screening and due diligence to deal acquisition and portfolio monitoring, enabling them to fast-track their investment decisions.

Sources:

-

https://www.jpmorgan.com/insights/global-research/markets/india-stock-market-outlook

-

https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

-

Market Cap to GDP Ratios by Country (2025) | Siblis Research

-

How Global Tensions Influence the Performance of the Indian Stock Market

-

Bloodbath in Indian Markets: Sensex crashes by over 4,000 points amid global trade war fears

What's your view?

About the Author

Chaitanya is an investment banking analyst with nearly 14 months of experience focused on the US tech sector. He supports both quantitative and qualitative research initiatives for a leading investment banking firm.

He holds an MBA in Finance from Jawaharlal Nehru University

Like the way we think?

Next time we post something new, we'll send it to your inbox