Published on November 29, 2024 by Ira Dawar

The venture capital (VC) sector is undergoing a swift transformation as businesses seek creative ways to strengthen operations, enhance productivity, quicken decision-making, and improve performance. The sector is leveraging AI in venture capital widely for evaluating potential investments in start-ups.

Discounted cash flow, asset-based valuation, and comparable company analysis approaches, which have historically relied on market trends and financial data to assess an organisation’s value, are transforming rapidly because of the technological advancements in AI in private equity and venture capital.

Benefits of leveraging AI in VC start-up evaluation process

AI in venture capital technologies are contributing to the evolution of business valuation methods. Machine learning (ML) may help uncover intricate trends and patterns in financial data, allowing the precise analysis of huge volumes of data and accurate valuations. The adoption of these latest technologies may offer an advantage in the competitive VC world. These technologies are expected to streamline operations, enabling deeper insights and more robust portfolio governance. The use of venture capital AI tools represents a significant leap forward in this context, offering benefits that enhance the entire investment life cycle.

Enhanced decision-making through data analysis

Venture funds leverage AI in private equity to analyse vast data sets, which reveals insights previously unknown owing to data complexity. This analytical capacity enhances decision-making, reduces reliance on intuition, and enables more accurate predictions, mitigating risks in early-stage investments. Furthermore, AI solutions provide detailed assessments of company feasibility and predictive analytics on market trends for VC firms.

Increased productivity

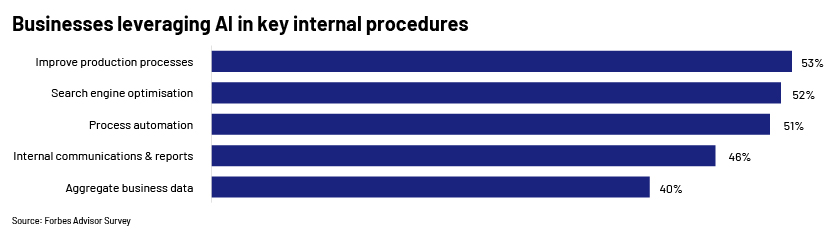

AI may streamline the tedious process of identifying deals by sifting through hundreds of companies and short listing the most attractive ones, offering VC firms more time to focus on strategic decision-making. Currently, around 46% of business owners use AI to improve their key internal processes (source: Forbes Advisor Survey).

However, 64% of businesses believe that AI may boost their productivity, highlighting business owners’ intent to deploy AI in their key internal procedures. This establishes their growing confidence in AI’s transformative potential to streamline various aspects of a business.

Unlocking insights from unstructured data

VC firms applying AI in venture capital can wield significant influence when analysing unstructured data. By examining text-heavy documents, emails and social media posts, they unearth valuable insights about competitive landscapes, start-up potential and market dynamics. By sorting and interpreting unstructured data, AI may unlock opportunities for VC firms to make informed decisions. AI may also help conduct sentiment analysis on news articles and social media content, thereby providing early signals on start-up viability, while deep diving into technical white papers and patent filings in search of innovation.

Market analysis and trend prediction

VC firms are using news, market data and other sources to identify industries ready for growth and disruption. Their efforts can be supplemented by AI algorithms, which can help process humongous amounts of data and identify market trends and new industries. AI systems may also sift through extensive start-up databases, assessing them on multiple facets such as market potential, expertise and technological advancements. This may assist VC firms in recognising promising investment opportunities and remaining competitive.

Portfolio management and performance monitoring

VC firms need to effectively monitor portfolios, and AI may come to their rescue, offering insights into performance indicators in real time, thereby enabling proactive and accurate decision-making. Performance indicators may be tracked via venture capital AI tools designed specifically for monitoring portfolio companies, alerting investors to potential risks and opportunities. These tools are instrumental in venture capital portfolio monitoring, ensuring that firms are well-informed about the health and progress of their investments.

Conclusion

AI is expected to revolutionise the VC industry, providing novel approaches to identify, evaluate and invest in promising start-ups. AI’s data processing and predictive analytics capabilities are enabling VC firms to make informed investment decisions. Despite the ethical challenges associated with the implementation of AI, it offers promising benefits to these firms. AI may also help in market analysis, trend prediction and portfolio management while allowing VC firms to stay ahead by identifying promising opportunities before rivals. With the continued evolution of AI, start-up investments are anticipated to see a revolution.

How Acuity Knowledge Partners can help

We offer services, such as market intelligence, deal sourcing and screening, to private equity and VC firms in a thriving market. Our customised solutions, coupled with industry expertise, help clients make informed data-driven investment decisions and position themselves as market leaders. We also offer bespoke data engineering, data science and AI services, which include alternative data analytics and visualisation.

Get in touch with our experts to understand how we tailor our data and technology services to suite private equity and VC requirement!

Sources

-

Why are VC firms investing in Artificial Intelligence (AI) companies?

-

Revolutionizing Venture Capital: The Power of AI and Relationship Intelligence

-

GGV Capital US backs Arteria AI’s digital makeover for financial document creation | TechCrunch

What's your view?

About the Author

Ira has over 7 years of experience in business consulting & advisory and market research. She has been with Acuity Knowledge Partners (Acuity) since 2021, supporting private equity players across multiple sectors, including financial services, business services, healthcare, retail, information technology & telecommunication. Holds expertise in delivering support to clients’ corporate strategy and marketing teams and assisting them in investment opportunity assessment through in-depth secondary research & data analysis. Ira holds a Master’s in Business Administration from NIRMA University, Ahmedabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox