Published on March 19, 2021 by Anant Tripathi

Industry shift from offices to homes

Today, the term “new normal” does not feel new anymore. Lockdowns feel commonplace, social distancing is the watchword and work-from-home (WFH) seems to be how we continue to keep the wheels turning for the economy. And this brings us to the key challenge that industries are facing even a year into the pandemic – the displacement of over three billion people from the office to the home, representing the world’s single-largest rearrangement in corporate history to date!

What looks to be an easy change came about as the result of a series of steps developed by corporate IT departments worldwide. While initial attempts were centered around hardware, network integration and remote availability, the focus has gradually shifted towards productivity and process and business stability

In many companies – operating in sectors as varied as finance and telecommunication – mundane tasks can represent 10-30% of the daily working time of an employee. This is where emerging technologies such as intelligent automation and robotic process automation (RPA) become crucial, as they provide productive ways to work remotely. RPA involves the use of software robots to automate monotonous, non-value-added tasks to the extent possible.

Data security

Data safety and privacy are crucial to organizations in any sector. In a remote-working scenario, data spills are a key risk, and their high likelihood has led many employers to discourage or disallow this mode of work.

That said, the integration of cybersecurity features with smart automation can allow organisations to create and maintain a safe ecosystem to successfully tackle cyber threats. Software robots can automate jobs such as vulnerability testing, access management, event analysis and monitoring.

Network fluctuations and volatility

One of the major issues in remote working has been network stability. IT infrastructure in offices is strong and provides seamless connectivity. Therefore, while making the shift to remote working, employees may assume that network connectivity is reliable but may face issues later.

Using software robots, employees can develop, deploy and schedule automations within the virtual desktop. These can run without manual intervention; robots can also be programmed to trigger event-based automations.

Team management

In a remote-working environment, employees may find it difficult to work in the absence of the procedures and supervision they were accustomed to in their offices. On top of having to adapt to working from home, they could also be on their own managing difficult tasks without the direct support of co-workers and supervisors.

Robotic process automation can be of incredible value in such situations. Junior team members with less training can quickly learn to operate programmes that can handle tedious repetitive tasks, provide contextual guidance in real time, help workers follow systematic business processes that they are not familiar with and help guarantee compliance with firm policies. Using RPA, we can take these even further – from reactive employees to proactive ones.

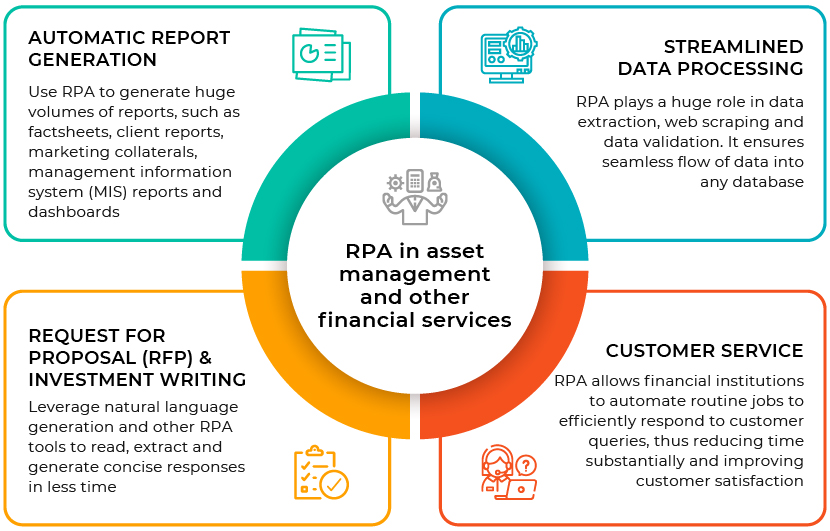

Industry application and benefits of RPA

Over the last few years, financial institutions and asset management firms are reported to have spent more than USD321bn annually on compliance operations as well as the payment of fines. Companies are estimated to cough up nearly USD270bn per annum just on compliance – translating to around 10% of their operating cost. RPA can help financial institutions manage risk and meet compliance mandates. Shareholder in the financial industry also acknowledge the algorithm-based nature of RPA and the benefits this can provide, such as the ability of software robots to maintain audit trails.

What automations can and cannot do

Today, financial institutions use a variety of off-the-shelf software to further their marketing and reporting efforts. Tools exist that can manage content such as PowerPoint slides and document records for RFP. Reporting tools and digital marketing tools are equally prevalent. But are these enough?

Organisations often struggle with getting the most out of such tools. An inherent understanding of what the tool can and cannot do is critical, and firms sometimes try to solve operational problems looking at the potential of a tool rather than how to effectively maximise the value they can derive from it. Evidence of this is seen in how firms regard artificial intelligence as some sentient intelligence capable of doing everything at the push of a button.

At Acuity Knowledge Partners (Acuity), we provide a service that is a combination of process, people and technology. Our technical and functional experts work with clients to help successfully reduce manual intervention and increase efficiency using tools. What makes our service particularly valuable is that we integrate our domain and technology expertise to provide a holistic solution – much more effective than standalone software.

If you are looking to improve your RFP record library, your commentary (with natural language generation [NLG]), or your factsheets and slide library management – Acuity can help! We leverage existing best practices to develop an environment that is independent of manual intervention, ensuring that functional experts are put to actual business requirement. This elevates existing in-house automations, allowing easy refinement or updates whenever required.

We believe such an approach will be a game changer in the coming years as the asset management industry embraces technology transformation, moving it from a good-to-have to a must-have solution. This is especially significant, because at this critical juncture – amid the COVID-19 pandemic – asset managers and fund marketers have to look at ways to get the most of their technology spends.

If you are interested in a pilot programme, email us at Contact@acuitykp.com

References

https://marutitech.com/rpa-in-banking-and-finance/

https://thewire.in/economy/indian-economy-covid-19-lockdown-policy

What's your view?

About the Author

Anant is an innovative process-oriented operations manager with 11+ years of experience. Currently, he supports functional teams in identifying, and implementing process improvement and process re-engineering opportunities. He provides technical and analytical support for process improvement initiatives, develop process analysis and re-engineering to improve efficiency and quality. He has excellent knowledge in Advance Excel, Seismic, SQL and automation technologies like RPA, VBA and Python; and holds an Executive Post Graduate Diploma in Management (Finance) and Bachelors of Engineering degree in Computer Science

Like the way we think?

Next time we post something new, we'll send it to your inbox