Published on February 26, 2018 by Hitesh Acharya

Concerns remain about why European banks’ profitability is lower than global peers’. Low bank profitability is both the cause and the consequence of a weak economic environment. A 2016 IMF study of 170 lenders in Europe revealed that over 50% of them generated a weak return on equity (ROE; i.e., <8%), while lenders representing only 15% of the asset base generated a healthy return (i.e., >10%). This low profitability was also reflected in their collective price-to-book ratio of below 1x in Q4 2017.

We discuss below the cyclical macroeconomic conditions and structural reasons that give rise to such low profitability

-

Relatively narrow spreads: Factors such as low interest rates, expensive long-term borrowings during the financial crisis, competition from non-banking players, and central bank policies have contributed to European banks’ net interest margins remaining low, averaging c. 1.6% of assets in 2016 versus c. 3% in the US. While Europe’s banks have been hesitant to cut rates on deposits to below zero, they are also unable to hike lending rates beyond a certain point – either due to a cap imposed by the central bank or due to intense competition.

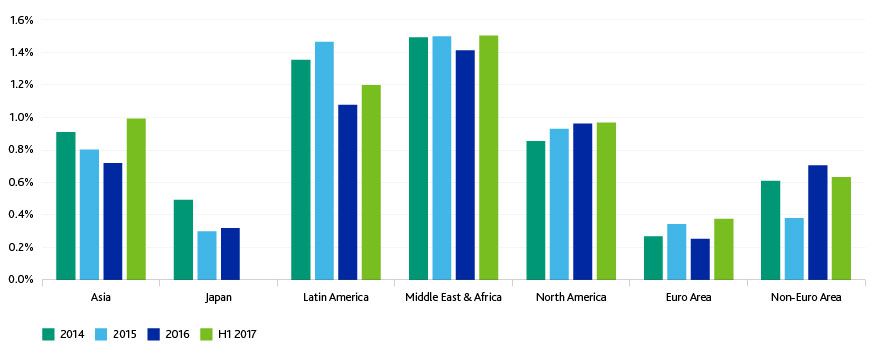

The following is a comparison of global net income-to-tangible assets ratios:

-

-

Regulations and fines: Changes under Basel norms may result in an aggregate capital shortfall of EUR40bn as banks’ internal risk rating models are replaced with standardized risk weights and/or a minimum floor level. This may be moderated by an extended phase-in period (until 2027). Changes in regulatory standards for the prudential treatment of sovereign exposures may result in additional costs. Moreover, it remains to be seen whether these reforms translate into lower wholesale funding costs due to improved creditworthiness.

-

Regulatory actions due to banks’ transgressions have also resulted in a sizable hit to the profitability of some major banks. ‘Misconduct risk’ generates the bulk of operational risk (c. EUR71bn) expected by Europe’s top banks. Regulatory misconduct costs amounted to c. EUR122bn over 2011-2015.

-

-

Overbanking: Overbanking is a drag on profitability, as it means (a) an excess of assets relative to the size of the economy, (b) too many banks competing for the same market segments and (c) too many bank branches relative to assets.

-

For example, Italy and Germany have too many banks and bank branches for all of them to have a high ROE, while institutions in Denmark, the Netherlands and Spain have reduced the number of branches significantly. Such steps could represent savings of about USD23bn.

-

-

Non-performing loans (NPLs): Asset quality remains a major drag on European banks’ profitability due to accrual of unpaid interest, provisions, impairments, high foreclosures and booking losses on sale of assets. NPLs increased to 4.5% of total loans in June 2017 from c. 1.5% in 2006.

Successful resolution of NPL sales by banks in Italy, Spain and Portugal indicates a need for high loan loss reserves to cover aging problem loans. This comes at a high cost and requires comfortable headroom in terms of capital resources or market access. Europe’s NPL book of a few trillion euros may take years to offload, especially in the context of a subdued economic climate, which may diminish the price realized through asset disposal.

-

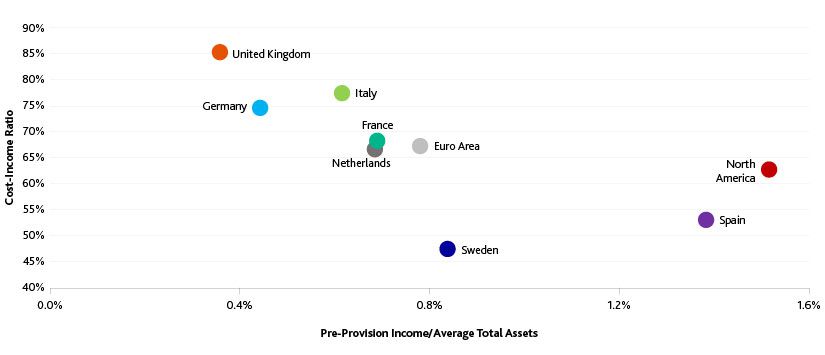

Cost-to-income ratios: European banks’ cost-to-income ratios have averaged a high 67% from 2012-2016 as efforts to reduce costs have been offset by higher spending in areas such as regulatory compliance and technology upgrades.

-

Many European banks have yet to capitalize on opportunities offered by financial innovation and technological advancement such as automation and offshoring. The following chart shows cost-to-income ratios versus pre-provision income to average total assets as of 2016:

Developing non-interest income streams is not easy, due to high competition and weak economic conditions. For example, while US and Canadian banks’ market share in the global investment banking domain increased to 62% in 2015 from 58% in 2010, European banks’ share dipped to 30% from 35%.

The solutions offered by Acuity Knowledge Partners’ Commercial Lending arm enable banks to elevate their business practices and successfully overcome constraints to profitability.

Sources:

European Banking Authority

International Monetary Fund

Eurostat

Nasdaq

Moody’s Investors Service

What's your view?

About the Author

Hitesh has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of analyses, including credit appraisal, leveraged lending, stressed assets, industry reports, cash flow modelling, and client pitch presentations. At Acuity Knowledge Partners, he has led sector and product-specialist pilot teams in Commercial Lending, focusing on diverse sectors such as real estate, manufacturing, aerospace and defense, transport and logistics, and business services.

Hitesh holds a Masters in Management Studies from K.J. Somaiya Institute of Management Studies and Research, University of..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox