Published on February 17, 2021 by Rajkumar Bodduna and Nishanth Neeli

For decades, investors have relied on a portfolio combination of 60% equities and 40% bonds to meet their retirement goals through managed risks. 60/40 portfolio was viewed as a strong hedge during downturns in stock markets as the fixed income portion helped reduce risk. Over the last few years though, investors have been rethinking their strategies, as the 60/40 allocation is no longer meeting their returns expectations.

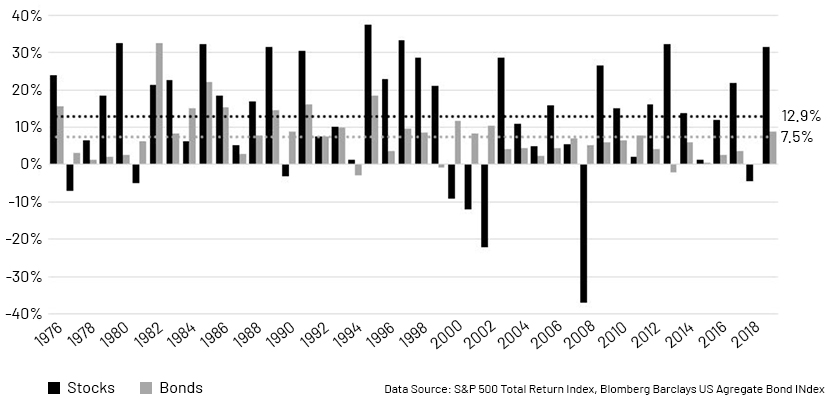

The chart below shows the historical performance of 60/40 portfolios over 1976–2018; the average 10-year yield was ~6.5%.

To understand investor concerns related to bonds, let us take a quick look at the rates of two major sources of bonds in the market – government debt and corporate debt.

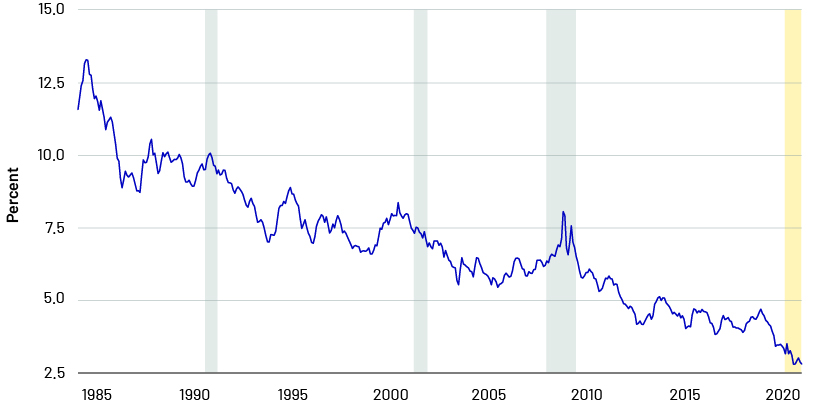

• 10-year Treasury note rates

The chart below shows the daily yield of 10-year Treasury notes starting 1962. The 10-year Treasury notes are viewed in the US as important indicators of market sentiment and can determine key economic factors such as mortgage rates. As of 3 December 2020, the current 10-year treasury yield was 0.92%.

• 30-year High Quality Market (HQM) corporate bond par yield

The following chart shows the yield curve for a set of high-quality corporate bonds rated A and above; with a 30-year yield of just over 3%, as of October 2020, these bonds represent the high-quality corporate bond market.

Current challenges to the 60/40 portfolio

60/40 is an investment strategy is considered as benchmark often compared with other investment portfolios. New asset classes are introduced in the market and there is growing demand to invest in alternate investments as they are promising reasonable returns. Asset class diversification is important to reduce the risk. If the portfolio diversified with different asset class, then there will be limited impact on portfolio by underperforming asset. Other factors that pose challenges to the 60/40 portfolio include the high valuation of equities, increased risk in bond funds and the impact of inflation.

-

If fixed income occupies a sizeable allocation, bonds must provide some level of returns – which has not been the case with bond returns over a period

-

Owing to the pandemic, high-yield bonds see increased default risk

-

Investors have to add new asset classes to their portfolios without adding more equity risk if they want to achieve the same returns that the 60/40 portfolio has provided historically.

-

Historically equity markets reached its all-time high and continued to set new limits over the years but bonds rate are decreasing. Everyone wants yield, but they're stuck in a zero yield environment.It is necessary to rethink the 40% allocation in the portfolio.

Emerging Alternative investments

With major asset classes such as equities, bonds and cash failing to match returns expectations, investors are now headed towards alternative assets. Some of the most popular among these are gold, real estate, private equity and hedge funds. These alternative investments are being used to generate greater alpha and diversify their portfolio.

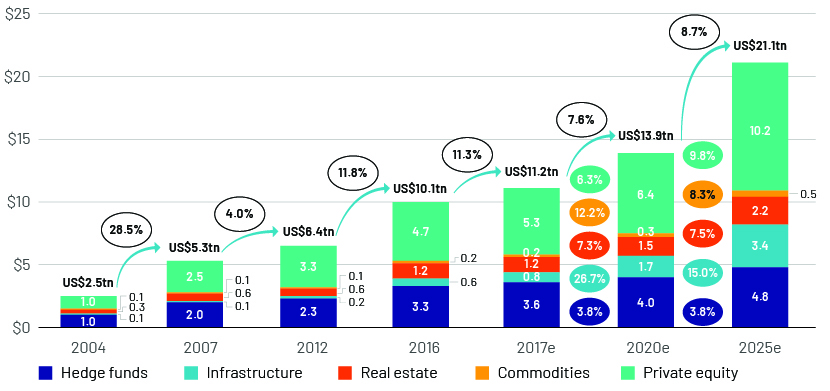

In the chart below, we look at some of these alternative assets and the rates at which investment in them has grown, from 2004 to 2025E.

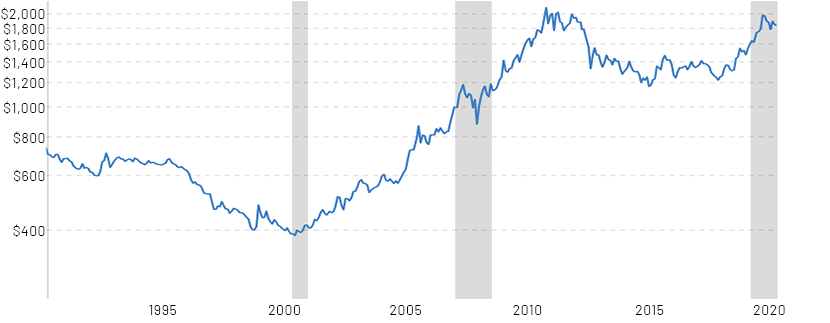

Gold has proven to be one of the safest alternatives for investors in recent years. While the commodity does not pay any interest or dividend, it has stood the test of time, beating inflation, monetary devaluation and macro risk. Over the past 20 years, investors have seen that adding a 5% share of gold to their portfolios leads to a 79% higher likelihood of an equal or better Sharpe ratio than a 60/40 asset mix.

Gold chart for past 30 years (price per ounce)

Among institutional investors and high-net-worth individuals, private equity is gaining ground as a preferred investment vehicle. Given that assets are privately held and allow long holders more time and control to implement value-creation strategies, this alternative investment option ensures higher returns.

Having said that, we note that while each asset class has proven results in terms of returns, a more important factor in investment decisions is asset allocation. To enhance profitability, the ratio of assets in a portfolio is a bigger determining factor than individual stock performance.

Bottom line

-

While the 60/40 mix has produced solid returns over the past few decades, market conditions have been changing in recent years. This has led an increasing number of investment strategists and advisors to suggest diverse portfolios that can deliver long-term growth with a reasonable level of risk.

-

The surge in alternative investment may be attributed to the following factors:

-

Track record of superior risk-adjusted returns

-

Ability to find alpha in private capital vs public capital

-

Significant growth in opportunities in emerging and frontier markets

-

Private capitals being able to fund businesses through their lifecycles, leading to a steady decline in the number of listed companies

-

Technology (especially block chain) facilitating private networks – investors and fund managers can conduct transactions and monitor their portfolios at reduced costs vs public markets

-

-

Given the volatility in capital markets, alternative assets have been an attractive bid to diversify and enhance returns. However, as markets continue to change and newer instruments (such as cryptocurrencies and uniform MBS (uMBS) emerge, fund managers would have to keep evaluating their investment strategies and questioning underlying assumptions.

Impact on investment compliance

-

When a new investment product/asset class enters the market, it also brings with it new regulations, governing bodies, and penalties.

-

Asset management companies, in turn, have to ensure that their structural/systemic flows can handle these new instruments. This includes the setting up of new data points and the creation of corresponding rules in their compliance systems.

-

As alternative investments grow, asset allocations are likely to see rapid changes. Given this, it is imperative that these companies ensure compliance with client guidelines and keep them up to date on developments in regulations.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading global provider of investment services, including equity research, index analysis and specialised solutions such as pre- and post-trade surveillance, interpretation and coding of client IMA and maintenance and reporting of regulatory restrictions. We understand our clients’ products and the regulations associated with them. Our experts keep track of evolving regulatory frameworks and assist our clients in complying with them.

Sources:

https://www.advisorperspectives.com/

https://www.businesstimes.com.sg/

https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

https://fred.stlouisfed.org/series/HQMCB30YRP

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

Tags:

What's your view?

About the Authors

Raj is an Investment Guidelines Professional with 2+ years of experience in Coding, Monitoring, Reporting, and Testing in Compliance Systems. He is adept at logical coding and monitoring of investment guidelines in Sentinel. He holds an MBA in Finance and Marketing.

Nishanth Neeli has over 7 years of experience in investment compliance with a prior working experience at Goldman Sachs. At Acuity Knowledge Partners he is responsible for process supervisory, coding and post trade management support of Investment Compliance Services. Nishanth has done his Masters in Actuarial Science from Bharatidasan University.

Like the way we think?

Next time we post something new, we'll send it to your inbox