Published on October 5, 2020 by Piyush Thakur

An overview of the private equity/venture capital growth story

Private equity (PE)/venture capital (VC) firms, known for adopting innovative investment strategies, have witnessed strong growth in the past decade. However, the COVID-19 pandemic has disrupted their growth story, having significantly eroded the valuations of portfolio companies and led to a decline in transaction volumes. At the same time, PE/VC firms are also facing challenges in their portfolio valuation and opportunity assessment processes due to the prevailing uncertainty, high volatility and low investor confidence.

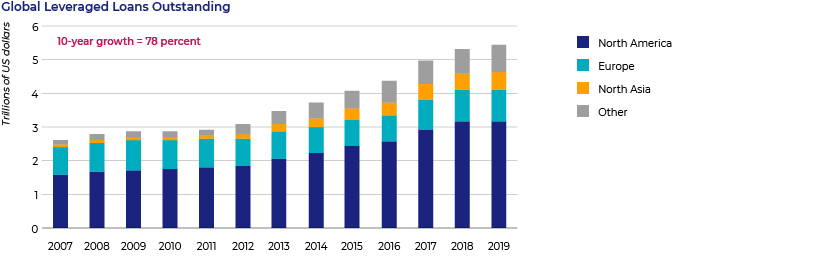

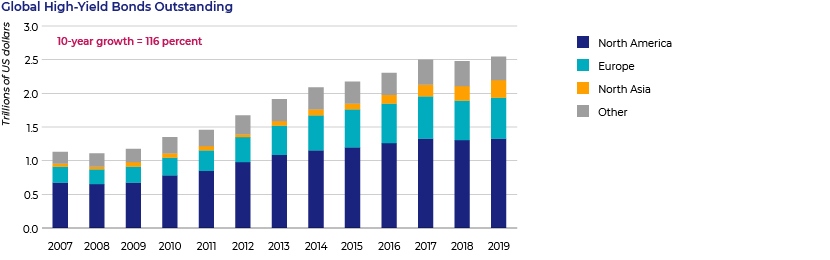

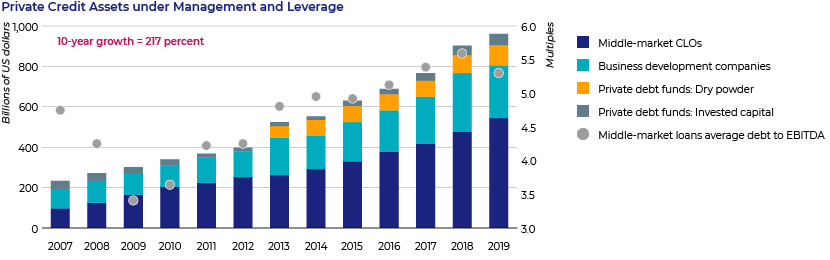

Source: IMF Global Financial Stability Report 2020

Rise in PE/VC is increasing focus on accuracy of valuations

Demand for accurate valuations is increasing – from investors (limited partners) for committing to new funds or for monitoring existing investments, and from regulatory authorities and auditors. Transparent and reliable valuation reporting has, therefore, become important in the current environment.

In March 2020, International Private Equity and Venture Capital Valuation (IPEV) Guidelines set measures to calculate the fair value of investments, emphasising the need for extra and frequent analyses.

A number of factors, both internal and external (company, sector and countryperformance) impact the valuation process. The pandemic has disrupted all these factors and created new challenges for the valuation of unlisted portfolio companies/opportunities. However, its effect has varied across sectors – for example, the retail, luxury goods, hotel and food, tourism and travel, and oil and gas sectors have been hit the hardest, while healthcare and online platforms are performing well.

Considering the factors involved, adjustments need to be made when performing a valuation to reflect the impact of the pandemic. Unlisted investments can be valued using a market approach or an income approach.

How to manage valuation challenges when using one of these approaches:

-

Market approach: A relative valuation or market approach is used to value an asset based on similar/comparable assets that are trading (or have traded) in the market. Valuation multiples (EV/EBITDA, EV/EBIT, P/E or industry-specific multiples) are used to derive a valuation.

-

Trading comparable method: In the current uncertain environment amid increased stock-market volatility and forecasting risk, and a reduction in revenue and EBITDA levels, the following adjustments may be made to derive a fair value:

-

Solutions: In most cases, the last reported financials are used for valuation. These, therefore, do not capture the impact of the pandemic on profitability. In this event, we could use forward multiples based on forecast financials, factoring in the new economic environment

-

A control premium over and above market value could be applied in the event of a majority stake

-

-

Precedent transaction comparable method: “It may no longer be appropriate for recent transaction prices, especially those from before the expansion of the pandemic to receive significant, if any, weight in determining fair value” – IPEV Guidelines, March 2020

-

Solutions: Adjustments in terms of projected financials, capitalstructure, and future cash flow of the target company can be made during the valuation process

-

Since the number of transactions in the market has dropped significantly, pre-COVID-19 transaction multiples would need to be adjusted accordingly

-

-

Income approach: This uses the discounted cash flow (DCF) method to derive a fair value. This appears to be the most appropriate method at present, as we can incorporate the impact of uncertainty, although quantifying the impact of the pandemic on future cash flow is a challenge.

-

Solutions: Avoid a double dip – adjusting for increased discount rates due to a higher risk premium and for a higher cost of debt – in the current environment. A carefully balanced lower profitability forecast could be used

-

Adjusting for target company-specific risk, e.g., geographical presence, product segmentation, and leverage profile

-

Regular update of key drivers used for financial projections, based on recent economic developments and government policies

-

-

Key takeaways:

There are no changes to the valuation principles in this scenario, but the valuation framework needs to be adjusted to arrive at a fair value:

-

It is advisable to use the results of one method in conjunction with one or more methods discussed above

-

Any change in assumption/drivers of projected financials should be backed by documentation

-

Prepare different scenarios to arrive at a valuation range – pre-COVID-19, stressed case, base case and upside case – as the magnitude of the impact and time to recovery may differ by, for example, industry and geography

-

Frequently update business drivers in the financial model based on industry/government policies (such as fiscal stimulus, industry-specific financial packagesand changes in central-bank lending rate policies)

How Acuity Knowledge Partners can help

We have deep domain knowledge and extensive financial modelling and valuation capabilities that we can use to help our onshore clients derive the fair value of an existing/potential target company. We also support our clients on quarterly valuation of their portfolio companies using the valuation techniques discussed above. The key services we offer include in-depth analysis of the IRR and MoIC, scenario building, building and testing hypotheses, recovery and waterfall analysis and comprehensive financial modelling.

Our years of experience across the investment lifecycle and valuation techniques have helped us develop best practices and consider all scenarios.

For more details, please visit our PE valuation page

Sources:

1 IMF Global Financial Stability Report 2020

What's your view?

About the Author

Piyush has been with Acuity since 2006 and has experience working on a variety of research and analysis assignments serving Private Equity clients, and has rich exposure to multiple investment philosophies including control investing, distressed-debt, direct lending, credits and loans, real estate, oil & gas among others.

He has extensive experience working on assignments covering the entire life cycle of a private equity investment including target screening, comprehensive financial models, LBO models, waterfall & recovery analysis, sensitivity and scenario building, valuation, portfolio monitoring and similar assignments for clients

Piyush is a qualified Chartered Accountant from ICAI, India and a..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox