Published on August 12, 2019 by Avinash Saxena

As is the case with most innovations, 5G is creating a lot of buzz in the market and media, and for the right reasons. Despite the challenges, it is nearly certain that 5G will find mass adoption in due course. While it would usher in major changes in wireless connectivity, it would also have far-reaching implications for businesses and individuals. One such field is financial services. While literature available on the topic strongly backs the potential for 5G use in financial services, with use cases ranging from connected payments to augmented reality (AR) apps, such changes are unlikely to take place immediately. So, let’s take one step at a time and explore the probable roadmap for the use of 5G in financial services.

What is 5G? 5G is one of the latest technology evolutions in cellular technology. Fifth-generation New Radio (5G NR) is a new air interface standard being developed by 3rd Generation Partnership Project (3GPP), a coalition of telecommunications organizations that creates technical standards for wireless technology.

Engineered to greatly increase the speed and responsiveness of wireless networks, 5G has a host of features such as the following that could significantly benefit businesses and customers alike:

-

Maximum theoretical speeds of up to 20Gbps – several times faster than the current networks’

-

Very low latency – as low as one millisecond

-

High reliability, with 99.999% network availability for mission-critical communications

-

Vastly improved capacity – able to support one million connected devices per square kilometer and allows mobile phone operators to create multiple virtual networks within a single physical 5G network (called network slicing), supporting specific clients or use cases

What does this mean for financial services?

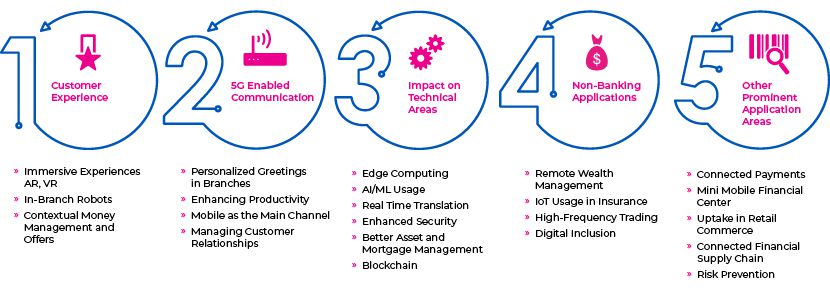

Source: Moody’s Analytics

With its enhanced network capabilities, 5G will open up new horizons for developers of finance-related applications, enabling them to bring to life projects previously shelved, as well as several new ones. The following are some of the prominent 5G use cases being looked at:

-

Customer experience – Customer experience is likely to undergo a major transformation with the delivery of 5G-enabled services to financial services customers. Given its increased bandwidth and ultra-low latency, 5G would make it possible to experience AR and virtual reality (VR) on smartphones, taking customer experience to the next level. Firms would be able to deploy in-branch 5G-enabled sophisticated robots capable of conversing with customers and assisting them with financial transactions. Smartphone data and mobility will make it easier to push marketing or advisory content to customers in specific moments of need.

-

Communication – Improvements in communication would boost the increasing use of mobile phones for financial transactions. Seamless video connectivity could help relationship managers quickly and conveniently address customer queries and requests. It would also improve productivity for firms by connecting all areas – such as branches, call centers, headquarters, and field agents – using reliable video-based services. Better IoT and beacon connectivity would also help firms deploy solutions that enable customers to easily navigate through their branches or offices and receive personalized greetings. For example, DenizBank in Turkey generates queue numbers for customers when they are within 50 meters of any of their 200 branch locations in Istanbul.

-

Technical changes – Financial institutions would need to make technical changes in their back-end processes by leveraging 5G capabilities to provide a better front-end experience for customers. 5G will enable edge computing – a boon for bandwidth- and latency-sensitive applications, as data will be processed closer to where it is generated rather than at some central location. High transmission speeds will support functions such as advanced AI algorithms, real-time translation, and IoT-based asset management. All this will also come with improved security, as it will be possible to perform multiple validations, such as behavioral and biometric ones, seamlessly and simultaneously. 5G could also be an enabler for blockchain-based services such as smart contracts and drive improved digital identities, simplified trade cycles and cross-border payments.

-

Non-banking financial services – Non-banking financial services will benefit from 5G, with relationship managers remotely managing customers’ wealth. AR will make it possible to walk customers through their investments and the wealth management lifecycle through immersive data presentations. IoT is already finding increased acceptance in the insurance industry, but 5G could enable its large-scale adoption. Similarly, the ultra-low latency of 5G connections will transform high-frequency and automated trading operations, which could be vital for capital market firms.

-

Payments – Payments could be embedded into virtually any device and contexts to reduce friction in the payment process. With reliable and ubiquitous connectivity, carrying physical wallets may actually become a thing of the past. Ecosystems of autonomous payment devices may be able to interact with other devices to automate day-to-day account management activities. The emerging digital-commerce market would also be boosted as 5G enables personalized shopping experiences and provides offers for customers on their mobile phones. Several brands, such as, Zara, Amazon, and Alibaba, have already added augmented reality modes to take their offering to the next level in terms of shopping experience. With 5G becoming mainstream, payments will also be made through AR/VR.

-

5G could also help firms create mini financial centers that offer all the services that a brick-and-mortar branch could but with increased mobility. These centers could easily move to locations where customers are, e.g., shopping centers, town centers, transport hubs, and entertainment venues. 5G will also help create mobile ATMs able to move across locations or even be mounted on vehicles. Overall, these measures will encourage digital and financial inclusion for the unbanked population. This could be significant, since it will have a ripple effect and create a well-connected end-to-end financial supply chain ecosystem. 5G could also help bring together a multitude of data from a variety of sources and process it faster for enhanced risk prevention and regulatory compliance.

Rollout – Although 5G has already been deployed, it is available only at a handful of locations and to selected customers. The coverage of these deployments is very low and mostly aimed at locations with high population densities (owing to its large capacity). Broadly speaking, 5G networks are undergoing the final set of advanced tests to ensure that they are ready to be launched. 5G will initially be made available through improvements in LTE, LTE Advanced, and LTE Pro technologies. However, this will soon be followed by a major step-up – the introduction of 5G NR (New Radio). Many networks will remain 4G long-term evolution (LTE) and gradually move toward “pure 5G”. Until then, 5G networks will likely be patchy. A widespread rollout may take at least three to five years.

Conclusion

The benefits of 5G will come with its set of challenges, related to technology and adoption. On the technology front, the coverage area of 5G networks is currently very low, radio frequencies cannot penetrate buildings, and constructing the network will be very expensive. On the adoption front, there are costs, and security- and complexity-related apprehensions, apart from the need for the mass adoption of devices capable of supporting 5G. Issues related to standardization and regulation also need to be sorted out before a mass rollout.

While the highlighted use cases are likely to transform the field of financial services, it is not going to happen overnight. Firms would need to take a multi-year approach to building 5G-based solutions and rolling them out on a large scale. Despite all the buzz surrounding 5G, it is unlikely to be a universal medium before the mid-2020s. It is estimated that even by 2023, only 20% of the world’s population will have access to 5G, with the US, South Korea, China, Canada, Australia and Japan being the first movers.

It seems safe to assume that 5G will not grow at breakneck speed. Financial institutions would, therefore, have enough time to build robust strategies and execution plans to roll out 5G-enabled services. It is not a race to the finishing line; firms should transition gradually from 4G-enabled services, just like they probably did while switching from 2G to 3G and then to 4G. This may involve a multi-app strategy. Additionally, they should be wary of the associated costs and security concerns. They should set realistic goals and target specific areas. They may also look to collaborate with network-service providers or other specialists to fine-tune their services.

Sources:

-

What is 5G New Radio (5G NR), 5g.co.uk

-

5G NR (new radio), tech target

-

5G: A transformation in progress, ZDNet,

-

How 5G could shape the future of banking, American Banker,

-

How 5G will shape your future, Credit Union Journal

What's your view?

Comments

15-Sep-2020 01:23:41 am

Like the way we think?

Next time we post something new, we'll send it to your inbox