Published on May 30, 2019 by Mrutyunjay Panigrahi

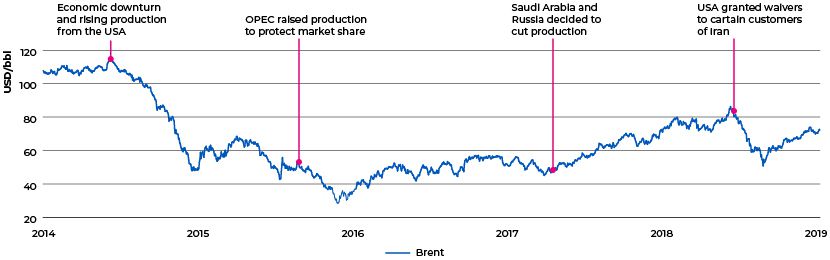

Crude oil prices have remained volatile since their slump in 2014. The average Brent price was USD71.6/barrel (bbl) in 2018, USD16.9 higher than the average in 2017. However, the second half of 2018 saw high volatility, with the Brent price reaching a high of USD86.3/bbl in October and a low of USD50.8/bbl in December. The sharp price movements reflected increased uncertainty and shifts in market fundamentals, the behavior of key players, and overall market sentiment. While heightened trade tensions between the US and China and the slowdown in the global economy are affecting demand, unprecedented growth in US crude production, the re-imposition of sanctions on Iran, and market balancing by OPEC members are impacting supply.

While larger producers have maintained healthy balance sheets through capital discipline amid volatility in prices, several smaller producers are struggling, with well development falling short of the optimistic forecasts presented to investors.

Why consolidation is necessary for survival

Despite more than three years of capital discipline, many companies have failed to provide tangible rewards to their shareholders. While oil prices have recovered from the lows of 2016, the recovery could not save companies from bankruptcy in 2018. In all, 43 oil and gas companies, mostly exploration and production (E&P) companies, filed for bankruptcy in the US in 2018. Some of the notable E&P names are Exco Resources Inc., Fieldwood Energy LLC and R.E. Gas Development LLC.

Benefits of consolidation

-

Balance sheets can be strengthened quickly, particularly if the deals are paid for using equity

-

Diversifying transactions can reduce the risk of exposure to worrisome pricing differentials

-

Increasing the size of the organization can boost operations through economies of scale

-

Can give the resulting entity higher bargaining power

-

Can result in synergies in terms of technological expertise, revenue and costs

Emerging challenges for the oil and gas sector

-

Growing environmental concerns: The sector is under significant pressure due to its contribution to greenhouse gas emissions and global warming. Several developed countries are already planning to replace fossil fuels with renewable fuels.

-

Geopolitical tensions: Some of the leading oil and gas producing countries are vulnerable to political crises and US sanctions. Volatility in production by OPEC countries such as Iran, Libya, Nigeria, and Venezuela has led to sharp rises/drops in crude oil prices in the recent past.

-

Shift in demand-supply fundamentals: Unprecedented growth in US oil and gas production, which reached an all-time high of 10,962 million barrels of oil equivalent per day (MMboe/d) in 2018, resulted in a significant drop in US imports. With the loss of the US as an anchor market, the world’s major oil suppliers are trying to find new buyers.

-

Minimizing costs to remain competitive: Given the high volatility in crude oil prices, oil and gas producers would need to reduce production costs. National oil companies (NOCs) and international oil companies (IOCs) are increasingly implementing ambitious cost-optimization programs. For example, Exxon plans to reduce its cost of pumping oil in the Permian Basin to about USD15/bbl, a level seen only in the giant oilfields of the Middle East.

Corporate M&A – a major driver of upstream M&A

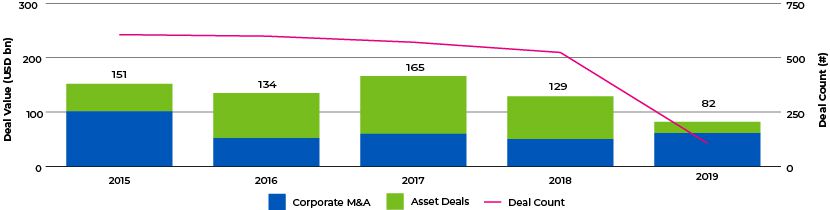

The industry dynamics discussed in the preceding section and volatility in oil prices are driving M&A in the upstream segment. The value of global M&A deals in 2018 was ca.USD129bn compared with ca.USD165bn a year ago, with 6 of the top 10 deals being corporate acquisitions. The current year has started well, with ca.USD82bn worth of deals as of May 17, 2019, due partly to the USD57bn acquisition of Anadarko by Occidental Petroleum.

Global upstream M&A activity

Note: Corporate M&A includes deals where the target company is a corporate entity, as defined by Drillinginfo; the remaining deals are classified as asset deals

Given the sluggish asset market, corporate deals are likely to account for a higher share of total deals. Distressed companies could be primary targets for opportunistic buyers.

Large and financially strong companies (international oil companies, or IOCs, and majors) are likely to find themselves at an advantage as buyers, as capital markets are reluctant to fund deals in the oil and gas sector due to high volatility in oil and gas prices. We expect the US to be at the center of this consolidation, largely due to the diversity of its corporate landscape.

Acuity Knowledge Partners combines in-depth investment banking expertise with strong research domain in oil and gas sector to present integrated solutions to the global oil and gas M&A market. We help global investment banks scale up their coverage, while reducing overall costs and time-to-market. We have able to accomplish this by setting up dedicated teams of analysts for each client. This exclusivity not only provides clients with a unique proposition, but also gives them a sustainable edge.

Sources:

1. Drillinginfo and S&P’s Capital IQ, May 17, 2019

2. Haynes and Boone Oil Patch Bankruptcy Monitor, May 2019

3. News articles

Tags:

What's your view?

About the Author

Mrutyunjay Panigrahi is part of the Investment Banking division at Acuity Knowledge Partners, attached to the Energy & Natural Resources sector. He has spent more than 10 years at Acuity Knowledge Partners and currently leads a team catering to a leading global investment bank. He holds an MBA in Finance from Utkal University.

Like the way we think?

Next time we post something new, we'll send it to your inbox