Published on April 2, 2020 by Harsha Krishnakumar

As demand for data-driven insights steadily increases, more and more asset managers are rapidly embracing artificial intelligence (AI) and machine learning. Providing data in tabular format, with charts and graphs, and performance and risk numbers may have worked well in the past, but the needs of today’s investors are evolving as is their consumption of information. This mandates more personalisation and contextual reporting than ever before.

“By 2022, content creators will produce more than 30% of their digital content with the aid of AI content-generation techniques” – Gartner, 2019

This is where NLG comes in. NLG empowers managers by elevating the ubiquitous factsheet (or client report) to the next level. It does this first by including a narrative to unravel the quantitative content and second by creating options for end users This could be as part of web-based dynamic reporting for funds or creating customised reports generated at a non-standard frequency, based on client requirements.

A powerful weapon in your fund marketing arsenal

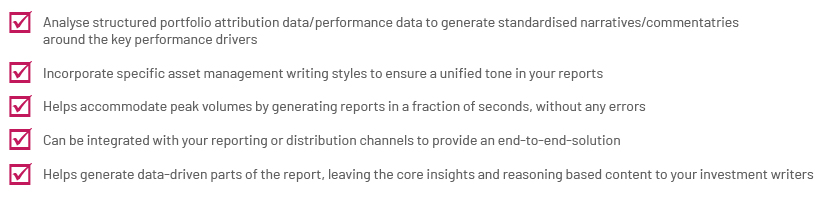

NLG is used even in the traditionally manual content marketing strategy. Functions that can be adopted within this framework include the following:

NLG’s strength is that it eliminates errors in data analysis, addressing quality issues and reducing time spent on review – fairly routine with human-generated commentaries. Another advantage stems from NLG’s ability to convert logic into a rules-producing, template-based approach that can easily be scaled up for grammatically complex write-ups and generated in a few minutes.

Consider a management dashboard that highlights only numbers and charts. NLG can help time-constrained executives interpret these numbers in a few sentences and express them in terms of, for example, fund growth and cash flow.

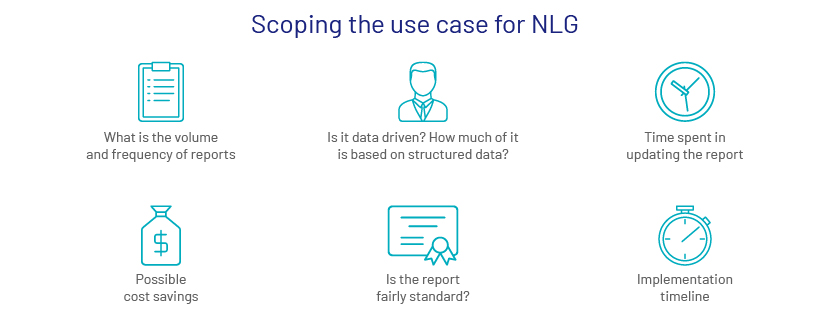

What to keep in mind when evaluating NLG

Before transitioning to NLG, we recommend that companies evaluate a use case and then create a prototype. Some key questions to be addressed before implementing an NLG solution are provided below.

A common myth associated with NLG implementation is that it will replace your investment report writers. NLG’s efficiency would only increase a team’s capabilities, as it enables marketing teams to expand the range of content and the amount of material created. Canned reports can be distributed to a wider audience, while writers can be used to enhance the NLG narrative by including more thought-provoking and strategic content. With all asset managers increasingly focusing on thought leadership to differentiate themselves in a competitive market, NLG would only enhance the capabilities of content writing teams.

However, a standalone software model has several drawbacks, such as the following:

-

Lack of subject-matter expertise to fully understand the logic, and inability to conduct quality-control checks to prevent errors

-

Takes longer to resolve issues, leading to clients having to spend time to educate the team on how to resolve them

-

Not as flexible as a managed services platform – consisting of technology and people – in project-managing end-to-end delivery

-

Rebranding and template changes are easier to effect on a managed services platform

Acuity’s solution for asset managers

Our managed services platform provides investment report writers and technology specialists with bundled service options to deploy a robust NLG solution. These include the following:

We recommend building a testable prototype before deploying the model live, as it would clarify potential questions.

Acuity’s NLG framework (LIPI) can meet your language and style needs at 30% lower cost than off-the-shelf solutions. What makes it more valuable is that it integrates our domain and technology expertise to provide a more holistic solution than offered by standalone software. LIPI offers a one-stop solution for quality, speed and bandwidth. In addition, it has multilingual capabilities and uses advanced technology to translate content into different languages.

We believe NLG will be a game changer in the coming years as the asset management industry embraces it as an integral element of technology transformation and it moves from a want-to-have to a must-have tool. At this critical juncture, every asset manager and fund marketer would, therefore, need to ask themselves how they can leverage NLG effectively in their business.

If you are interested in a free pilot programme of LIPI, please contact us at: Contact@acuitykp.com

What's your view?

About the Author

Harsha Krishnakumar has over 10 years of experience in RFP creation/writing and personal coaching. In his current role at Acuity Knowledge Partners, he provides support in business development and content strategy for fund marketing services. Prior to this, he was part of the Sales Enablement team at JPMorgan. He holds a Master of Business Administration from ICFAI Business School and a Bachelor of Engineering from Bangalore Institute of Technology.

Like the way we think?

Next time we post something new, we'll send it to your inbox