Published on July 14, 2020 by Arjun Prasad

-

Non-bank entities have significant exposure to leveraged lending/loans (LL; 57%) and collateralised loan obligation (CLO; 72%) markets

-

Slowing economies due to pandemic-related stress have resulted in large downgrades and could lead to sharp selling

-

Asset managers (AMs) should remain vigilant about their LL and CLO exposure and look to exploit the opportunities these downgrades present

-

Acuity Knowledge Partners can support managers by continuing to check exposure through constituent analysis, issuer reviews, detailed capital structure, covenant reviews and other services

The hunt for yield has supported market expansion

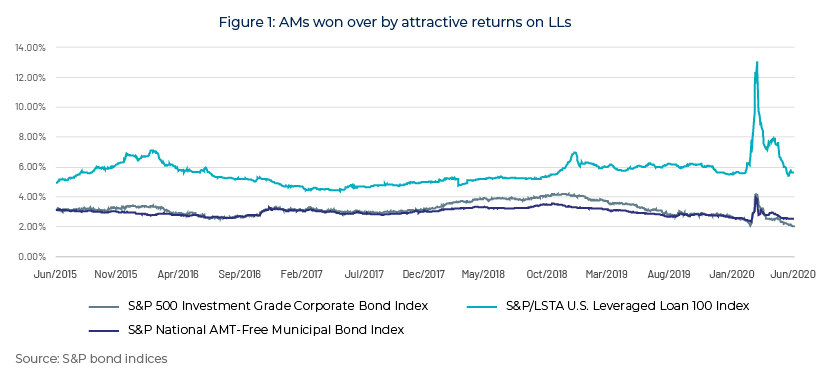

The LL market expanded 2.2x to USD1.1tn in the decade to February 2020, driven mainly by the hunt for higher yield and ample market liquidity. Seventy percent of issued LLs were held by rule-based CLO managers. Lower yields on traditional assets resulted in AMs shifting their focus to alternative investments such as LLs and CLOs that offered more attractive yields.

Slowing economic cycle: Cracks appearing in the LL and CLO markets

-

Weak underwriting standards: LL markets have witnessed a rise in covenant-lite (cov-lite) loans (discussed in an earlier blog) and significant add-backs to EBITDA

-

Cov-lite loans have shifted execution risk to lenders, with clauses relating to restricted payments, negative pledges and restrictions on additional debt issuance removed for the issuer

-

The sharp increase in advantages for issuers, such as EBITDA add-backs, has made some of the issuers riskier. For example, many issuers missed leverage (debt/EBITDA) targets by c.200bps over FY17-19

-

-

Changing capital structure: LLs have replaced subordinated loans in the capital structure (the share of subordinated loans had dropped recently to as low as 0% of the capital structure in some cases, from 25% historically). The lower cushion available, along with the cov-lite nature of the loans, resulted in first-lien LL recovery rates declining to 61% in January 2020 from the historical average of 77%.

-

Credit rating arbitrage: CLOs transfer the rating of sub-investment-grade collateral to investment grade when packaged together. As such, 85% of “AAA” rated CLOs have c.70% of assets from the “B” rated pool, as per the July 2019 report of the Office of Financial Research.

-

Default risk for lower tranches: Downgrades of “B” rated assets would compel CLO managers to liquidate “CCC” rated securities (so as to pass the overcollateralisation test), resulting in significant losses for junior and equity tranches (mainly held by hedge funds). Some CLO managers such as Alcentra, Barings and Bardin Hill breached their overcollateralisation tests in May 2020. However, these breaches represented 3% of European CLOs and focused on mostly junior debt tranches.

-

Concentration risk in CLOs arises from the following:

-

Issuers: In the US, 90% of CLOs have exposure to at least one of the top 50 borrowers, while in Europe, c.80% of CLOs have exposure to at least one of the top five borrowers

-

Sectors such as consumer goods, high-tech, healthcare, and media and entertainment constitute c.45% of US-based issuers of “B” rated securities

-

Acuity Knowledge Partners’ unique experience

The economic slowdown triggered by the COVID-19 pandemic has exposed this fragility in the credit markets, which has witnessed widening spreads and low liquidity since March 2020 (the S&P/LSTA Leveraged Loan Index dipped to 76.23 on 23 March from 96.72 at the start of the year). However, sector-specific actions by policymakers and covenant relief activity (c.80 deals since the start of the year) supported the S&P LL Index’s rebound to 86.69 on 21 April 2020. We expect the recovery to continue, although it will likely take longer than it took following the 2008 crisis. We also expect deep discounts in the credit market as CLO managers under stress continue to reduce their “CCC” exposure (they have reduced it by 1.23% since early May 2020 at a cost of 21bps at par).

We believe that in the current scenario, investors can derive higher alpha (which has largely been non-existent in the past decade due to the bull market) by identifying quality LLs on discounted terms and with limited downside risk. We have extensive experience in supporting some of the largest CLO managers globally through our customised leveraged lending solutions.

Sources:

1. OFR FRAC Working Group: Leveraged Lending & CLOs

3. Bloomberg: First European CLOs Fail Key Test Amid Strain of Pandemic Impact

4. S&P Global: Covenant relief activity soars on LL; <a "https:\www.spglobal.com\marketintelligence\en\news-insights\latest-news-headlines\leveraged-loan-news\fed-rally-default-fears-bring-bifurcation-back-to-leveraged-loans" target="_blank" rel="noopener noreferrer">Rebound in credit market; EBITDA add-back analysis finds projections often fall short

5. Reuters

6. Under stress: Assessing CLO Manager Performance During COVID-19

7. UBS: Defining credit dislocation

Tags:

What's your view?

About the Author

Arjun has over five years of experience in fixed income research, supporting Europe- and US-based CLO managers by identifying suitable investment opportunities after screening and analysing the credit quality of high-yield European and US issuers. His analysis has helped clients to successfully roll out multiple warehouses. He holds an MBA (Finance) and a Bachelor of Engineering degree.

Like the way we think?

Next time we post something new, we'll send it to your inbox