Published on September 16, 2020 by Nitin Sonawane and Priyadarshini Elumalai

A robust and comprehensive database is a basic requirement for a financial firm’s system infrastructure to be able to produce accurate data when needed, and a data infrastructure needs to be reliable and accessible. Data innovators constantly seek to obtain accurate data and develop processes to utilise data at an optimum level. Data infrastructure is, therefore, a fundamental pillar of a competent and efficient trade lifecycle, including but not limited to investment compliance.

Data infrastructure and its importance in effective investment compliance:

Data infrastructure is significant in the financial services industry, due to the inherent monetary risk and the need to protect participants’ financial data. Participants include retail banks and building societies; investment banks; pension funds; insurance companies; fund managers; stockbrokers; wealth managers, platforms and financial advisers; custodians; and third-party administrators (TPAs).

The constant development of complex products and increased regulatory governance of financial institutions have required that companies recalibrate and streamline data feeds and usage to achieve optimum control and efficiency with minimum or no spillage.

An investment compliance function ensures adherence to rules and regulations and investment norms, and it is, therefore, imperative that such functions have a robust data infrastructure in place for effective and comprehensive control.

The way companies source and consume data varies. Many use data from market vendors such as Bloomberg and Reuters without making many changes and with universal identifiers, while others transform and customise the data according to their need. Neither scenario guarantees a perfect environment, as the data is tailored to fit a particular purpose.

Data infrastructure is the most critical element of an investment compliance function. Investment managers manage a large number of assets, based on their investment strategies and policies. It is, therefore, essential that they have all the relevant data points for the investable instruments to ensure

-

Governance and control to invest in permitted instruments

-

Adherence to rules and investment restrictions, as agreed with clients

-

Compliance with regulations for investor capital protection

-

Return and revenue generation

The investment compliance function plays a vital role by assisting the investment managers to keep their portfolios in compliance with the rules and regulations via rule creation, monitoring and reporting.

Problems with not having a proper data setup:

1. Incorrect classification of companies’ UPIs:

Data issues related to securities due to incorrectly capturing the ultimate parent issuer (UPI) of the securities. For example, Chinese securities incorrectly reflect their UPI as the “People’s Republic of China”. In addition, false alerts are raised when restricted/permitted securities use their UPI.

2. Internal ratings for securities:

Data issues can also result from the type of data fields maintained by a company’s data team (TSCF-Custom Fields). For example, they may miss updating, incorrectly update, or delay updating the internal ratings of a security on a compliance engine, which can raise alerts during monitoring.

3. Dependence on external systems:

Data issues can also be related to cash; for example, Bloomberg research depends on external systems such as Hi-Port, and delays in updating data or the operations team posting incorrect cash entries could affect the data/create problems in monitoring alerts.

4. Data misinterpretation:

Data issues can also arise when the data related to a security is misinterpreted in the compliance engine, for example, when transactions/trades related to FX spot contracts are also flagged as FX forward contracts in Bloomberg.

5. Dependence on client database:

Data issues can also result from having no access to data maintained by the client. For example, custodian reports (required to cross-check breaches), confirmation of pending markets and counterparty checks require data from the client’s database.

6. Other issues:

-

Issues can also arise when the rule in the compliance engine is coded to consider uploaded NAV/custom NAV that needs to be input manually

-

A trade entry keyed in twice by a trader with the same quantity can also cause issues, for example, if sell trades are keyed in twice and the position held turns negative in quantity and a short-sale alert is raised

-

Concentration rules may be raised even if there are no active transactions due to delays in refreshing the benchmark

-

Data relating to private securities cannot be obtained in a straightforward manner, due to their complex nature; this results in numerous issues in monitoring alerts relating to their security type

For effective investment compliance, an investment bank should have data infrastructure that

-

Is designed and developed to deal with all types of instruments

-

Considers the risk and compliance issues involved in dealing with and maintaining the data

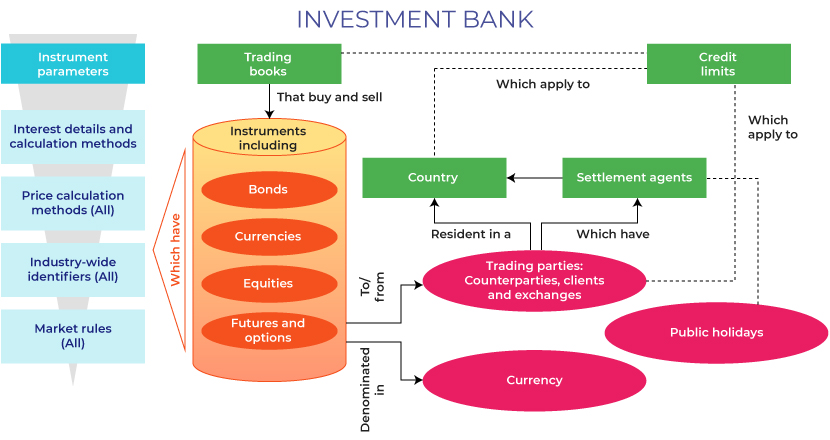

The following diagram explains instruments and their data points that need to be considered when designing integrated systems for investment managers:

Source: www.cisi.org

The importance of instrument data infrastructure in an effective compliance system:

When designing a compliance system, a number of functional requirements and infrastructure elements are configured to interact with each other to monitor different instrument types that funds manage; this helps in monitoring risk (credit/market risk) and adhering to rules and regulations.

Data infrastructure also helps with the investment compliance activities mentioned below:

1. Attributes:

Attributes are instrument characteristics – e.g., security type, country of incorporation, sector/industry, exchange and identifiers – that are important in order management and compliance systems. Attributes help create rules based on permissible and non-permissible guideline restrictions.

2. Analytics:

Valuation helps to create analytics for compliance systems and rules based on percentage guidelines/restrictions, e.g. benchmark weightage, market capitalisation, counterparty exposure and hedging rules.

3. Risk analytics and external values:

The compliance team checks or creates and modifies rules using internal values integrated from other system outputs, e.g., credit rating analytics, OTC derivatives and counterparty exposure. This helps expand the efficiency and depth of compliance activities by automatically incorporating risk analytics.

4. Pricing and valuation:

Valuing an investor’s holdings as per the type of securities held is top priority when designing data infrastructure; therefore, pricing and valuation methodology is crucial for valuing investments and adhering to investment guidelines. As per the regulatory framework, all investment companies need to adopt a pricing and valuation policy that considers the best interests of investors.

Conclusion:

Data infrastructure is significant for investment managers and compliance functions, and they need to adopt best practices for rule and regulation monitoring. Every financial organisation would, therefore, need to assess their technology and ensure data quality – that it is from a reliable data source and is able to meet investment objectives effectively, while protecting clients.

Acuity Knowledge Partners’ solution:

We tailor-make dynamic functions with a robust, responsive and proficient control framework and process delivery. Our tool-agnostic team is experienced in providing support on investment compliance, trade surveillance, and corporate, forensic and crime compliance. We are also experienced in providing unique solutions with the help of our state-of-the-art technology.

Our pool of subject-matter experts handles process delivery, training, projects and automation to mitigate costs. Our established compliance capabilities help clients identify problems and opportunities to navigate through challenging business environments.

Sources:

https://www.bloomberg.com/asia

https://www.cisi.org/cisiweb2/cisi-website/homepages/cisi-financial-services-professional-body-india

Tags:

What's your view?

About the Authors

Nitin is an Investment Guidelines Professional with over 12+ years of experience in Coding, Monitoring, Reporting, and Testing in Compliance Systems. He is adept at logical coding and monitoring of investment guidelines in Sentinel and SimCorp for Equity, Derivatives, Mutual Fund and Fixed Income. At Acuity Knowledge Partners, he works for leading global financial services clients for implementing Investment Guidelines on Sentinel System replacing various in-house legacy systems. Previously Nitin worked for AXA Business Services and served AXA Rosenberg, AXA Investment Managers Paris on various projects for implementing Guidelines Management Systems. He holds an MBA..Show More

Priyadarshini has 4.5 years of experience in Investment Compliance and Collateralized loan obligations, having worked with State Street Corporation prior joining Acuity. At Acuity Knowledge Partners she is part of the Investment Compliance team and specializes in post and pre trade monitoring. Priya holds a Masters of Business Administration degree from Pondicherry University.

Like the way we think?

Next time we post something new, we'll send it to your inbox