Published on November 22, 2018 by Nivesh Shankar

Investors and asset managers have constantly sought out the elusive position on the efficiency frontier, i.e., the point where returns are maximized for a given level of risk. With this in mind, portfolios with varying levels of allocations towards traditional instruments are frequently explored to help achieve investment objectives. However, as one delves into the investment universe seeking unconventional options like asset-backed securities, derivatives, and even the current favorites, crypto currencies, investors rarely cross over into the obscure world of alternate luxury investments.

Amid volatile equity and bond markets and a commodity slump, are asset managers willing to explore alternate investments and its potential to diversify risk (or even increase returns)?

Luxury Investments have always been restricted to a niche market. Here, investors freely diversify their portfolios by focusing on funds that derive their value from various collectibles, such as fine wines and whiskies, string instruments, vintage automobiles, comic books, and even Fine Art. Market growth is correlated to an increase in wealth and the tendency to spend on luxury products, and as this is a scarcity-driven market, the alternate space holds immense potential for growth.

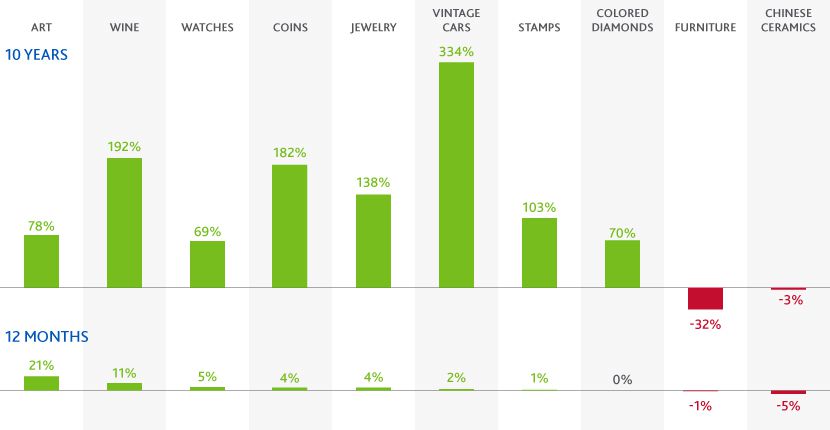

Performance of various luxury investments

Sources: Artmarketresearch.com (art, Chinese ceramics, watches, jewelry), Hagi (classic cars), Stanley Gibbons (stamps, coins), Wine Owners (wine), Fancy Color Research Foundation (colored diamonds). Data as of December 2017

Feeling artsy?

Since 2000, the global art market has grown at a staggering 13% p.a1. , witnessing total sales of $63.7bn in 20172 ; sales trends indicate that 2018 sales will be higher. However, players are expected to have the following abilities/access to tap into the investment potential of this market.

-

Ability to make informed decisions using in-depth knowledge of the market and art work

-

Ability to overcome expensive price tags

-

Access to a strong network of buyers and sells

Global art market share by value

Data as of December 2017

Source: The Art Market 2018, An Art Basel & UBS Report, Deloitte Luxembourg & ArtTactic Art & Finance Report 2017

Let’s face it, not everyone can own a masterpiece

Is there a product out there that can help investors overcome the hurdles faced in entering this market?

While investing in art is nothing new, access to this alternative class has been historically restricted to wealthy insiders and professional art dealers. High investment costs and lack of knowledge are some of the key barriers to entry within this space.

Art funds provide a relatively easy entry for investors attracted by a booming art market, but are unable to traverse the complexity and opacity of this space. These financial products help investors invest in art while avoiding the complications of buying and owning actual art work. They derive their underlying value from the acquisition and sale of art, which could be in the form of paintings, sculptures, photographs, etc. Akin to investing in a specific sector, some of these art funds provide offerings that are period specific. For example, Anthea — Contemporary Art Investment Fund SICAV FIS invests post-war and contemporary art, which includes sculptures, photographs, and paintings.3

With transactions only taking place in galleries, secondary markets or private sales usually require a strong network. Information, knowledge, experience, and access play a critical role, and usually only experts truly understand its dynamics.

How are art funds managed?

Art funds are usually managed by a mix of experienced art market professionals and investment advisors. This mix is crucial as it helps bridge the knowledge gap between the art market and the world of investment. Investment managers of art funds use various strategies and may use more than one strategy, to generate returns. While most funds adopt a “buy and hold” strategy, the funds differ in duration, restrictions, and investment focus and strategy, some which have been listed below.

Source: The Art Fund Association LLC

Understanding the returns, risks and benefits

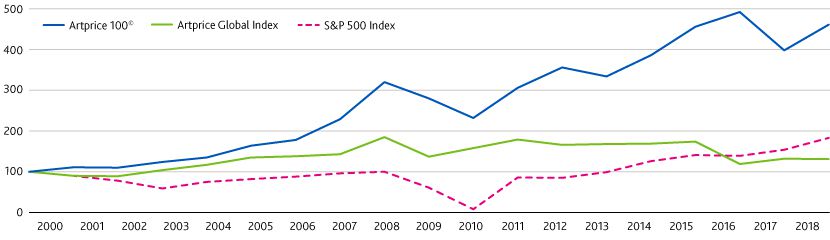

Investments in art have been shown to generate competitive returns compared with traditional investment options. At the same time, they also remain uncorrelated to equity and bond markets. This characteristic makes art an asset that not only helps generate returns but also acts as a risk diversifier when added to a portfolio.

Source: Artprice

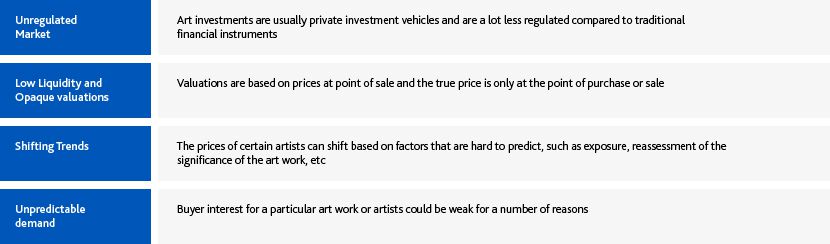

Since the art trade is an imperfect market, investing in this space carries its unique set of risks that investors have to assume in order to earn their risk premia. Some of the key risks associated with the art market have been mentioned below.

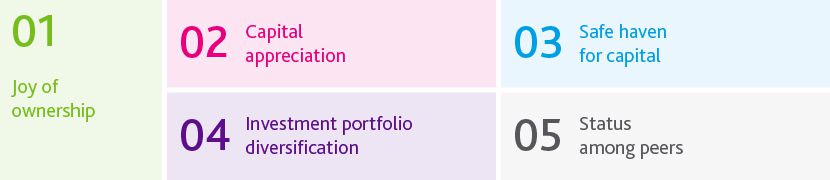

Why buy?

-

Art is seen as a defensive asset with returns being generated even during periods of financial market volatility

-

It provides protection against inflation with properties similar to commodities, e.g., gold

-

Early adopters can benefit from factors like scarcity, as this is a growing asset class with limited supply

Source: The Wealth Report Attitudes Survey 2018, Knight Frank

What to expect in the future?

As the understanding of art as an asset class improves, awareness of the financial value and risks associated with this asset class also continues to increase. Additionally, the structure of art funds has also evolved to help meet investor demand while simultaneously aiming for a more inclusive investor base. Whether it is a collateralized debt obligation based on art loans or publicly traded shares of securitized art, the industry will continue to introduce products that address and overcome the current shortcomings of this space. With the advent of cryptocurrency and stronger regulations, online platforms that help connect artists to buyers and improving transactional transparency could change the face of this product, as art emerges as a worthwhile asset class in helping investors find that elusive spot on the efficiency frontier curve.

Art funds and marketing materials Art is still in its nascent stage as an asset class and is usually promoted directly to wealthy individuals or investors active in the art network. Besides, owing to restrictions on the marketing and advertising of privately offered investment vehicles, the art fund industry has to act largely outside the eyes of the general public. Marketing materials differ from the traditional material, as it usually includes a general information brochure to help educate investors. Fund and portfolio details are also provided, along with details about the art collection replacing the typical holdings. At Acuity Knowledge Partners (Fund Marketing Services), we offer a range of services to assist clients with their fund marketing efforts. We have worked extensively with marketing material for traditional instruments, such as mutual funds and Exchange traded funds, and leverage this experience to assist our clients with marketing material for off-beat products such as art funds. Our in-house subject matter experts work along with our DTP specialists to ensure that data and content are presented in a visually appealing manner for an easy reading experience while highlighting key features of the fund and adhering to compliance and branding requirements.

Sources

2. EFAF Art Market Report 2017

3. http://www.anthea.art/fund/2/3/4

What's your view?

About the Author

Nivesh is a Finance and Economics postgraduate with over 7 years of total work experience. He has experience in the capital markets domain, with exposure to investment banking, commentary writing, performance reporting, client reporting, and preparing RFPs/DDQs for mutual funds and ETFs. Nivesh is currently Delivery Manager at Acuity Knowledge Partners, preparing, maintaining, and updating fund marketing material and client reports, such as factsheets, presentations, and brochures. Prior to this, he was Analyst at an investment banking firm, where he was responsible for equity/sector research and company valuations.

Like the way we think?

Next time we post something new, we'll send it to your inbox