Published on January 22, 2021 by Anamika Deshwal

Fifth-generation (5G) cellular technology is gaining popularity due to the advantages it offers over previous-generation cellular technologies. It has the potential to be a disruptive technology, offering greater speed than 4G long-term evolution (LTE). With such throughput, 5G is expected to play a major role in enabling technologies such as virtual reality (VR), artificial intelligence (AI), and the internet of things (IoT).

Almost all industries will be impacted by 5G, and fintech will be no exception. The fintech industry is moving rapidly towards digitalisation, currently facilitating online transactions, contactless payments, online account opening and online mortgages. Banks across the world are also trying to digitalise their services and are launching new innovative products to make banking easy for customers. 5G is expected to accelerate the process of digitalisation, as the 5G network would be able to handle larger numbers of transactions than the current networks.

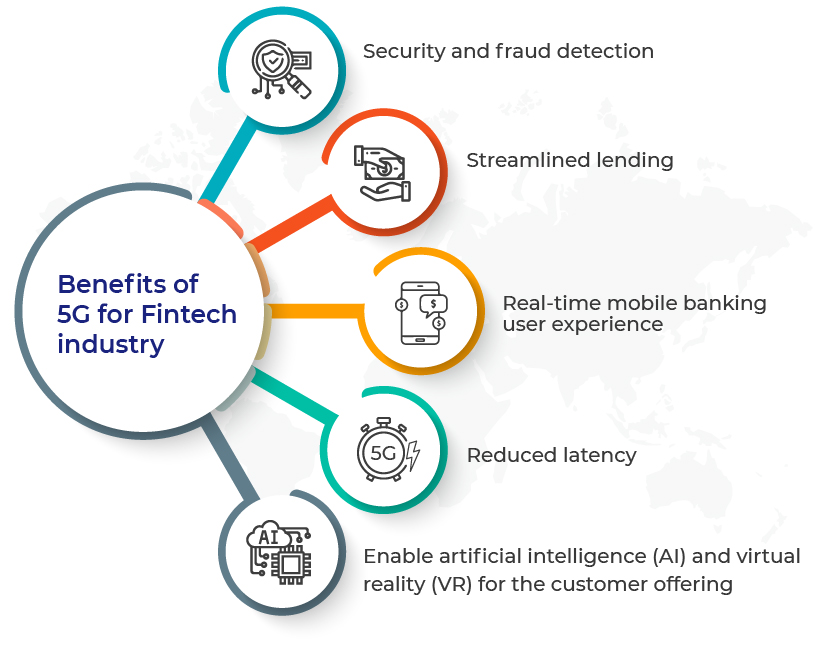

Benefits of 5G for the fintech industry

-

-

Introduce a real-time user experience to mobile devices

-

Around 1.7bn globally still do not have access to a bank account, according to the World Bank. 5G and access to mobile phones could soon resolve this issue. The introduction of 5G will offer high-speed internet in rural areas and provide fintech firms with large target populations. 5G would help fintech firms penetrate these areas and transform digital banking by introducing a high-speed real-time user experience to mobile devices, enabling instant payments and other transactions.

-

-

Enable better lending decisions and optimise lending rates

-

Fintech firms would be able to leverage the speed and capacity of 5G to develop new products and processes, helping them improve the speed and accuracy of lending decisions. It would also help them optimise lending rates to match each applicant’s profile. In addition to empowering fintech firms, 5G would bring customers closer to their financial consultants virtually, helping them make informed financing decisions digitally.

-

-

Accelerate push towards digitalisation

-

The pandemic has altered consumer behaviour towards digital banking, strongly driving the need for cashless payments. This has led to fintech firms focusing on building a touchless, safe, flexible and easy-to-use customer experience. 5G will be a game changer, making these features available everywhere, and mainly in rural areas.

In addition to the many fintech firms coming up with new products amid the current crisis, banks have also realised that digital transformation is the need of the hour. Fintech firms are likely to become more innovative with their apps and products with the introduction of 5G, as they would be able to store significant amounts of data on the cloud and incorporate augmented reality (AR), enabling faster and seamless usage.

-

-

Reduce latency and enhance the mobile banking experience

-

Latency in 5G will be reduced to less than one millisecond, making digital banking more attractive to users and boosting the mobile payments market. With the introduction of 5G, current banking operations are likely to be extended to new channels such as wearables and IoT devices.

-

-

Reduce emphasis on “brick-and-mortar” banking

-

With most fintech firms moving towards digital banking and coming up with innovative and attractive products, brick-and-mortar banking services will likely be limited in the coming years.

-

-

Introduce advanced fraud prevention

-

Some individuals are still reluctant to make online payments due to slip-ups in fraud prevention. However, with the introduction of 5G, performance-related glitches in payments made through wearables and IoT-connected devices will be eliminated, as 5G will enable more data to travel across networks in real time. This would increase adoption of digital wallets.

-

-

Improve security

-

5G will enable fintech firms to update and make improvements to apps in real time, without inconveniencing the customer. The high speed and receptivity of 5G would make facial recognition possible, for promptly checking databases on the cloud – something not possible with 4G. 5G will also endorse the increased use of multimodal biometric security procedures to authenticate a mobile user’s identity.

-

-

Enable technology giants to enter the fintech industry

-

Tech giants such as Apple, Samsung, Facebook and Google are coming up with innovative financial and banking products – the Apple Pay, Google Pay, Samsung Pay and WeChat online payment services are making customers abandon their physical wallets. 5G should help these giants attract more customers to their services.

Conclusion

5G will be a catalyst for the personalised digital banking experience, increasing productivity with connected devices. It would lead to even more advanced innovations in the fintech industry, boosting adoption of the digital payment option and prompting more consumers to reconsider how they make payments.

The adoption of 5G in the fintech industry would also prompt banks to review their adoption of technology and understand industry best practices, and look at reliable partners and markets for such adoption. This would provide a niche market for consulting, technology and research firms seeking to play a part in the evolving 5G landscape.

How Acuity Knowledge Partners can help:

We keep abreast of developments and enhancements in the fintech space. We offer a wide range of tailored solutions and capabilities including market assessment, competitive landscape and positioning, competitive benchmarking, competitor tracking, opportunity assessment and market-entry strategy. Our services deploy technology, research and data expertise, ensuring that the research we provide is technology-backed, is based on exhaustive data points and is driven by the best insights. We currently support the world’s top banking firms and payment providers with our banking and fintech team that offers coverage across geographies.

Sources:

What's your view?

About the Author

Anamika Deshwal is a part of Acuity Knowledge Partners – PE & Consulting team, wherein she has worked on projects for numerous clients across sectors including technology, financial services and payments. Her functional expertise includes strategic research, company profiling, competitor analysis & benchmarking, besides GTM market studies. Anamika holds a PGDM in Business Analytics from IMT Ghaziabad and BE in Electronics and Communication from Chitkara University, Himachal Pradesh.

Like the way we think?

Next time we post something new, we'll send it to your inbox