Published on January 10, 2020 by Ashwin Jose

Maersk, the largest container ship and supply vessel operator in the world by capacity, says that the cost of its complying with IMO 2020 could be as high as USD2bn for 2020, based on the current spread between low-sulphur fuel oil (LSFO) and high-sulphur fuel oil (HSFO). IMO 2020 refers to the United Nations’ shipping agency the International Maritime Organization’s (IMO’s) regulation that bans ships from using fuels with a sulphur content above 0.5%, compared with 3.5% previously, to control pollution. According to Alphaliner, the worldwide reference in liner shipping, Maersk announced a USD116/20-foot equivalent unit (TEU) LSFO surcharge for trade to the Far East/North Europe effective 1 December 2019 to offset the higher expense on use of LSFO, while the Shanghai Containerized Freight Index (SCFI) rates for trade to Europe saw an 11.6% increase week-on-week in early December 2019.

Key beneficiaries and losers

Complex refineries, capable of producing LSFO, benefit the most from IMO 2020 due to higher utilisation and refinery margins on the back of higher LSFO demand.

Tankers in general have seen higher earnings, driven by strong demand. Shipping yards, where vessels are docked for fitting exhaust gas cleaning systems (or scrubbers) have also been busy filling orders for new builds as old vessels that are less energy efficient are scrapped.

The charter market has also been very active recently to bridge the gap in supply due to scrubber retrofits.

Contractually, the trader needs to pay the additional cost of complying with this regulation (in the form of an LSFO surcharge, as set by the shipping company). In some instances, however, the shipping company may absorb this cost in the form of lower freight rates to offset the LSFO surcharge, depending on market conditions.

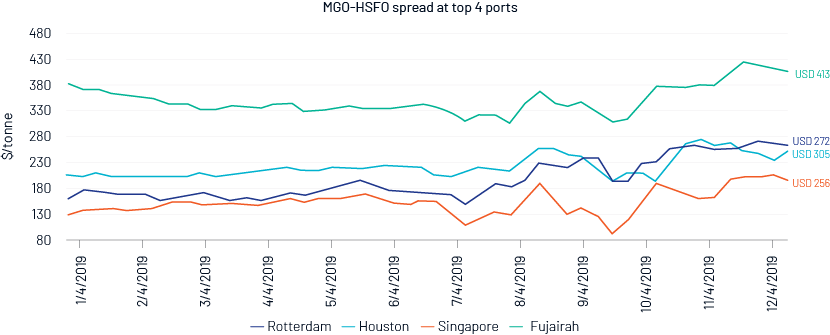

Significant price volatility

Around 4% of global oil demand is met by marine transportation (according to the US Energy Information Administration, March 2019), and a major shift in demand would, therefore, be disruptive, at least for a short while. The spread in marine gas oil (MGO, the widely available low-sulphur fuel) indicates significant volatility in the pricing of LSFO and HSFO on a change in demand dynamics. A prolonged wider spread between LSFO and HSFO would favour ships fitted with scrubbers and help to reduce payoff periods from scrubber investments. In such cases, a rate increase would pass through directly to the profit of shipping companies.

Compliance with IMO 2020, effective 1 January 2020, adds significantly to the cost of trade at a time when the global economy is trying to recover from the slowdown in trade due to the trade war. Shipping companies were, however, prepared for this regulation, with c.15% of all vessels retrofitted with scrubbers as of October 2019 and the remainder using low-sulphur fuel and liquefied natural gas (LNG). We believe shipping companies will consider LSFO-HSFO spreads over the next few months before investing heavily in scrubbers. A combination of vessels fitted with scrubbers and vessels using LSFO is generally the strategy preferred by all the major shipping companies, due to the uncertainty surrounding LSFO prices. While the supply-demand mismatch should drive the volatility in LSFO prices in the near term, we believe the long-term trend will follow crude oil prices closely.

Acuity Knowledge Partners supports global investors in terms of helping them internalise more of their investment research process by building dedicated teams of research analysts at our delivery centres in South Asia, Beijing and Costa Rica. Our analysts (MBAs, chartered accountants, CFAs) work as an extension of the client team and provide support on various types of client-specified research assignments, including financial modelling and valuation, conducting background research, gathering primary and secondary data, preparing for company visits, and providing earnings-season support and a host of other value-added research. Each research output we produce is customised for the client and reflects the client’s proprietary and differentiated research process. This gives the client a unique, sustainable edge.

Sources:

http://www.imo.org/en/MediaCentre/PressBriefings/Pages/27-sulphur-2020-roundtable-.aspx

https://www.eia.gov/outlooks/studies/imo/

https://shipandbunker.com/prices

Tags:

What's your view?

About the Author

Ashwin has about 6 years of experience in buy side/sell side equity research and is currently working on the transportation sector at Acuity. He holds an MBA in Finance and is a commerce graduate.”

Like the way we think?

Next time we post something new, we'll send it to your inbox